Lake Views, Tight Jerseys, and Todays FinTech News

Hey FinTech Fanatic!

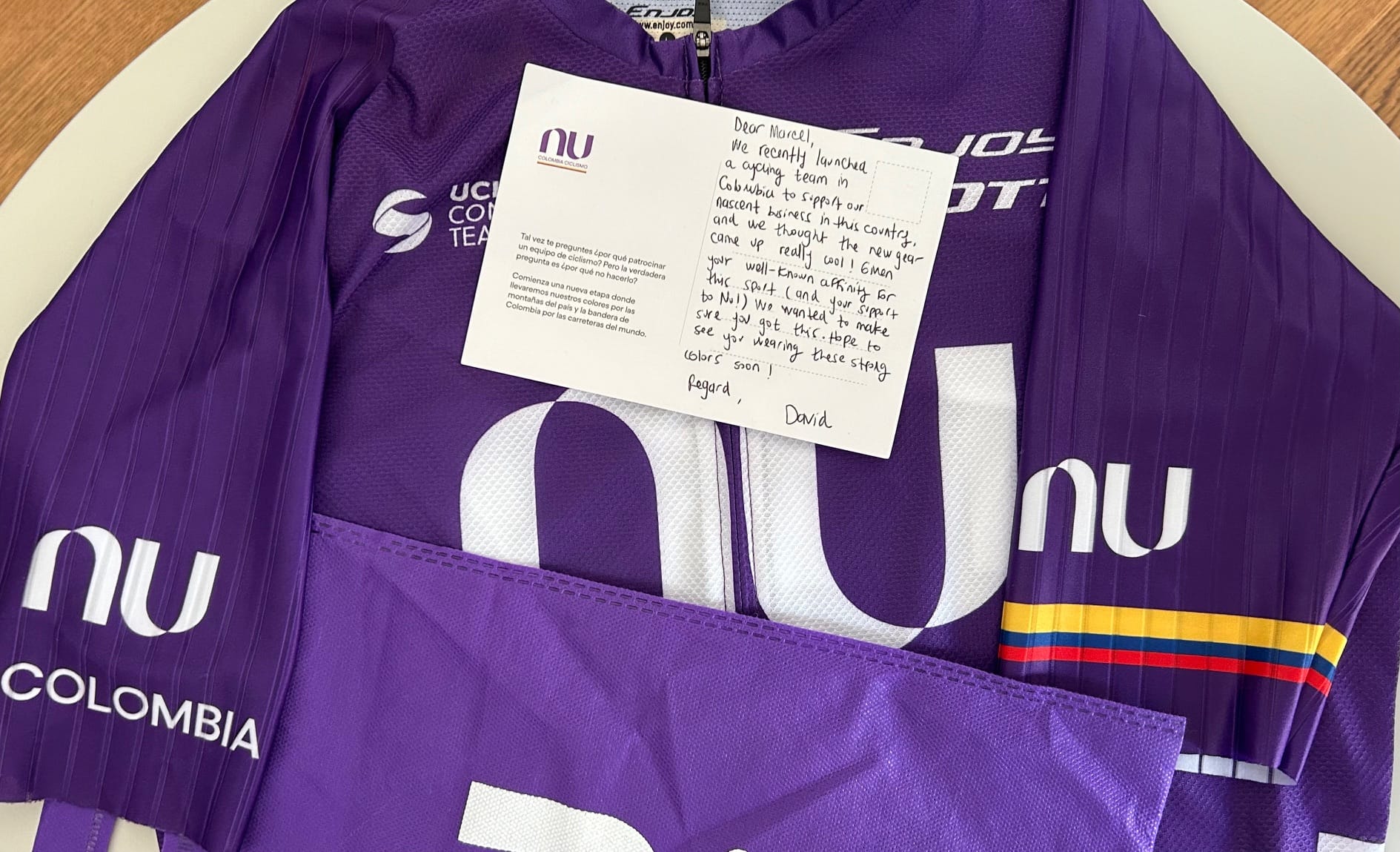

I'm currently in Italy for a few days, soaking up some quality time with my partner for her birthday. I'm about to have a ride around Lake Como on my bike, and I’m stoked to wear the new jersey David Velez from Nubank hooked me up with👇

I might have to play a game of ‘hold your breath’ to keep it zipped up, which is not ideal on these crazy-steep roads (yep, wish me luck 😂), but I'll be proudly wearing those strong 💜 colors David!

And hey, just because we're out here enjoying the views doesn't mean I'm skipping out on the FinTech buzz.

So, before I hit the road, let's dive into what's shaking in the world of financial tech. Enjoy the read, and I'll catch up with you on Monday with more tales and updates.

Have a fantastic weekend!

Cheers,

P.s. If you like this newsletter and/or my other content, you can support me by becoming a member. I'll be forever grateful.

Now let's dive into the news of today:

PODCAST

🎤 In this FinTech Leaders episode, Miguel Armaza sits down with Jack Zhang, CEO/Co-Founder of Airwallex, a global FinTech giant that moves $7B a month in transaction volume and serves 100k+ clients. Listen to the full podcast episode here.

#FINTECHREPORT

🇧🇷 Brazil: A Financial Inclusion Success Story that has only just gotten started.

INSIGHTS

➡️ Revolut, Checkout. com, Starling and majority of best-funded UK tech companies have wider gender pay gaps than national average.

FINTECH NEWS

🇬🇧 GoCardless extends strategic partnership with Sage, boosting global reach and unlocking new growth opportunities. This enhanced partnership means that millions of Sage's SMB customers around the world are now able to leverage GoCardless’ Direct Debit and open banking payment capabilities, helping to streamline the payment collection process.

🇮🇹 Viva. com and Bancomat form partnership. Principal membership with BANCOMAT optimizes the efficiency and costs of Viva’s payments value chain. Connecting to local payment methods and schemes is a strategic pillar that underlines Viva. com’s European expansion, empowering the technology bank to deliver truly localised financial services.

🇺🇸 Navy Federal Credit Union announces 7-year strategic partnership with Backbase. Navy Federal Credit Union has strategically embarked on an ambitious multi-year transformation journey by continuing to standardize on Backbase as their engagement layer of choice. Read more

🇺🇸 KeyBank scouts for FinTech partners to enhance technology for commercial clients, with a focus on FinTech management quality, says Ken Gavrity, president of Key Commercial Bank. While the bank hasn't secured any partnerships this year, it typically establishes one to two annually.

OPEN BANKING NEWS

🇬🇧 FICO partners with Atto to build predictive models with Real-Time transactional data. This partnership will enable UK lenders to easily integrate Open Banking data into the credit scoring process. Atto and FICO are combining their expertise to deliver transaction-based scores that rank-order consumers’ risk by analysing up-to-date consumer-permissioned current account and tradeline transaction data.

DIGITAL BANKING NEWS

🇬🇧 UK digital bank SmartSave reaches £2bn deposits milestone. Having launched in 2019, SmartSave has seen marked growth in the past two years, reaching £1bn in direct deposits in March 2023 and providing consumers and investors with the opportunity to reverse the real-term depreciation of their capital due to record inflation in recent years.

🇺🇸 US Capital Global announces that Zyng, a Canadian FinTech company developing and integrating ATM smart kiosk software as well as neobanking software for a pre-paid card platform, has engaged the group as its strategic financial advisor for a potential $10 million financing initiative consisting of debt and equity.

🇩🇪 N26 launches Joint Accounts in 21 new markets to enable customers to manage finances as a couple. Joint Accounts allow N26 customers to manage both their personal finances as well as finances shared with a partner – all in the N26 app, and at no extra cost. This reduces complexity and makes it easier than ever to budget, track expenses, and achieve financial goals together.

BLOCKCHAIN/CRYPTO NEWS

🇭🇰 Hong Kong's financial regulator is poised to give the green light to the first batch of bitcoin spot ETFs. The move would make Hong Kong the first domicile in the Asia-Pacific region to approve a crypto-backed, exchange-based investment fund. It would also put the island in prime position in the race to become the digital assets hub for the region.

DONEDEAL FUNDING NEWS

🇺🇸 FloQast raises $100m. With this latest investment, FloQast achieves a post-money valuation of $1.6 billion, underscoring its position as a leader in the accounting and finance technology sector. The company further emerges as a solution for countless organizations striving to transform finance and accounting operations for better insights to inform business strategy.

🇬🇧 Pactio, a UK-based FinTech focused on the private equity (PE) market has completed an £11m series A funding round. The London-based startup was formed in 2021 and provides deal track and risk management software to private capital investors. Read the full article here

🇮🇩 The Indonesian FinTech AwanTunai has gotten the support from OP Finnfund Global Impact Fund I in the form of 5 million US Dollars in equity. AwanTunai aims to provide affordable financing and services. They have a special focus on, as they say it, the millions of underserved micro businesses that employ 90% of the country’s workforce.

M&A

🇫🇮 Alisa Bank and PURO Finance have agreed on a combination. Together, the companies are able to provide SMEs with a service model that combines cutting-edge and smooth digital banking services, flexible customer service as well as efficient and diverse finance solutions closely integrated with the systems of financial administration service providers.

MOVERS & SHAKERS

🇺🇸 Rick Castello joins PayRetailers as Head of Sales North America. Rick brings a wealth of knowledge and over 20 years of expertise to PayRetailers. He will be responsible for driving the company's sales strategy and supporting large enterprises in their expansion efforts in Latin America (LatAm).

🇸🇬 Pomelo names Steve Vickers CEO. Vickers has over 25 years of executive experience growing a number of highly successful venture backed businesses and has a deep understanding of cross-border B2B payments in Southeast Asia. Read on

🇺🇸 Mastercard shuffles leadership. Jorn Lambert will be leading Core Payments as Chief Product Officer, Raj Seshadri will lead Commercial & New Payment Flows as Chief Commercial Payments Officer, and Craig Vosburg will lead Services as Chief Services Officer. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()