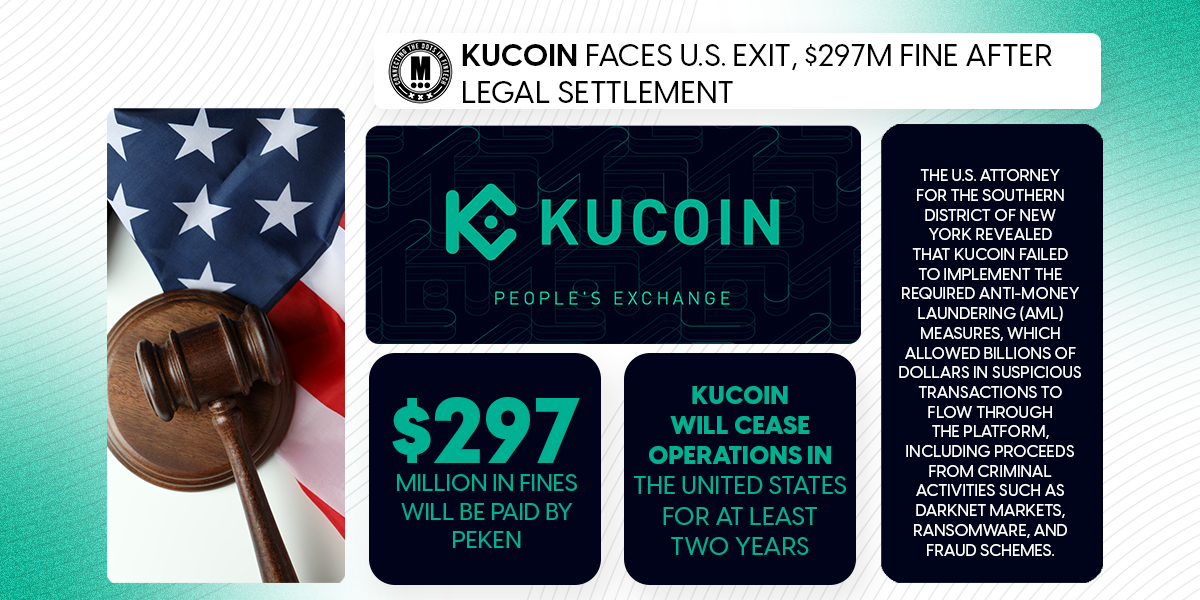

KuCoin Faces U.S. Exit, $297M Fine After Legal Settlement

Hey FinTech Fanatic!

KuCoin's operator, Peken Global Limited, will exit the U.S. market for at least two years after pleading guilty to operating an unlicensed money transmitting business. The settlement includes a $297 million penalty, and founders Chun (Michael) Gan and Ke (Eric) Tang will step down from their positions at the company.

According to the U.S. Attorney for the Southern District of New York, KuCoin's lack of required anti-money laundering (AML) measures allowed billions in suspicious transactions through the platform, including proceeds from darknet markets, ransomware, and fraud schemes. The company has reportedly strengthened its compliance framework and platform security over the past two years.

KuCoin will continue operating in other global markets while focusing on compliance practices and regulatory engagement, with plans to explore U.S. market reentry once necessary licenses are secured.

Stay tuned for more updates below 👇. Talk soon!

Cheers,

P.S. Ready to Validate and Scale Your FinTech Business? The FintTech landscape is fast-paced—don't let your idea lose momentum. Connect with an expert who has helped FinTech startups achieve faster growth and smarter scaling. Whether you're launching or expanding, the right guidance makes all the difference.

👇Get started today—schedule a free consultation and see what's possible for your FinTech

Navigate Europe’s evolving FinTech landscape. Get the latest insights delivered weekly—subscribe today.

#FINTECHREPORT

📊 Unpacking the Commercial Payments Landscape. This report aims to help acquirers and issuers to better understand the potential that commercial payments can present to their business. Read the full report

FINTECH NEWS

🇬🇧 Vyne shuts down UK operations. Vyne says it will "cease all operations" on 22 April. It was acquired by Dubai-headquartered Tarabut in September, to bring the UK firm's A2A payment capabilities to the Middle East, starting with Bahrain, and expanding to Saudi Arabia and the UAE as Open Banking regulations evolve.

🇺🇸 SoFi CEO: ‘We’re Not Just a Lender Anymore’. CEO said on a conference call with analysts that the company’s current membership roster of more than 10 million individuals is up 34% year over year and a multiple of 10x through the past five years.

🇪🇸 SoftBank-backed TravelPerk doubles valuation to $2.7 billion. The fresh cash would be used to accelerate growth, fuel expansion in the U.S. market and investment in product, tech, and artificial intelligence. The startup acquired Yokoy in a deal that will see it expand its reach into financial services.

PAYMENTS NEWS

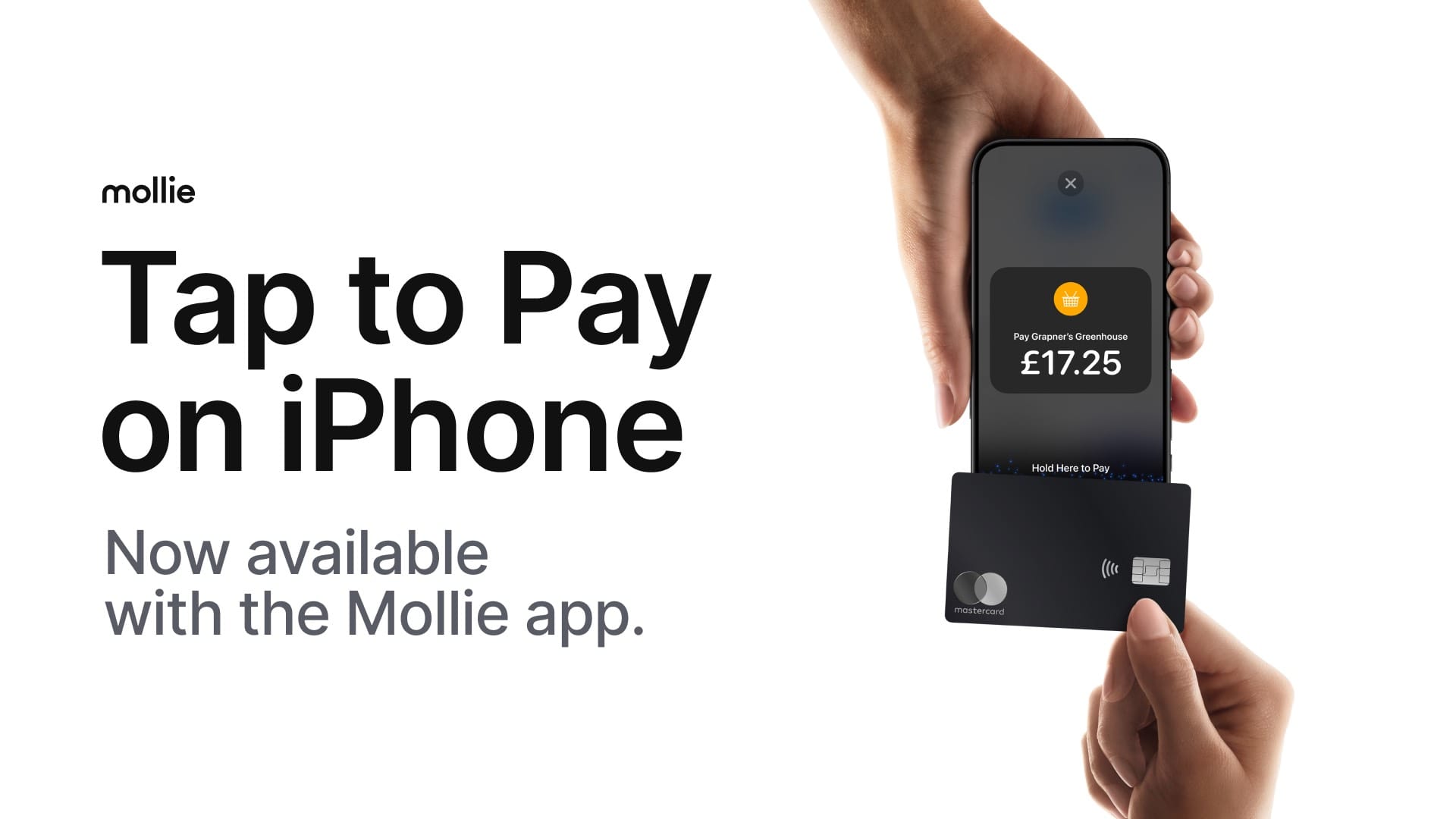

🇬🇧 Mollie enables Tap to Pay on iPhone for businesses in the UK. This allows businesses of all sizes to use the Mollie app on iPhone to accept contactless payments without the need to purchase or manage additional hardware. Continue reading

🇺🇸 Elon Musk's social media platform X announced the launch of a digital wallet and peer-to-peer payments services provided by Visa. X struck a deal with Visa to be the first partner for what it is calling the X Money Account, CEO Linda Yaccarino announced in a post on the platform.

🇧🇷 Bybit launches Bybit Pay. The solution is live in Brazil and integrates with the Brazilian Pix instant payment system. It allows users to connect their crypto wallets for transactions across websites, mobile applications, and point-of-sale systems, offering an interface for deposits, withdrawals, and payments.

🇿🇦 Noda delivers no-code payment pages. The tool enables gaming streamers and creators to design personalised payment pages in minutes using AI technology. It also eliminates the need for websites or complex integrations, enabling creators to focus on engaging with their audience and growing their brand.

🇯🇵 IDEX Biometrics teams up with LIFE CARD. This partnership marks the introduction of biometric payment cards. It marks a significant step in the evolution of payment technology in Japan, offering consumers a glimpse into the future of secure, biometric-enabled payment systems.

OPEN BANKING NEWS

🇯🇴 FinTech Galaxy approved to test Open Banking in Jordan. This approval allows the company to test and deploy Open Banking services within a controlled real-market environment. The company plans to integrate its services with most banks and financial institutions in Jordan.

🇦🇺 Ozone API partners with ProductCloud. The new partnership will help Australian companies simply comply with the Consumer Data Right legislation, providing a technology platform which removes complexity and enables them to rapidly deliver open APIs aligned to the latest version of Consumer Data Standard.

REGTECH NEWS

🇦🇺 Australia tells BNPL providers to apply for credit licences. Firms need to apply for a credit licence, have the application for lodgement accepted by Asic, and become a member of the Australian Financial Complaints Authority by 10 June. Continue reading

🇺🇸 KuCoin to exit US amid resolution of lawsuit. The cryptocurrency will exit for at least two years after its operator, Seychelles-based Peken Global Limited, pleaded guilty to one count of operating an unlicensed money transmitting business. Peken will also pay monetary penalties totaling more than $297 million.

🇬🇧 ComplyStream exits stealth to redefine financial crime operations. The platform tackles the complexities that follow an alert. It goes beyond detection to address the fragmented, manual processes that leave compliance teams overwhelmed and stretched thin.

🇫🇷 French investigators open money laundering probe against crypto platform Binance. Prosecutors claim the platform failed to report suspicious activities and operated without necessary approvals in France and other EU countries. Complaints from users who said they lost money due to misleading communication and unlicensed trading practices fueled the probe.

DIGITAL BANKING NEWS

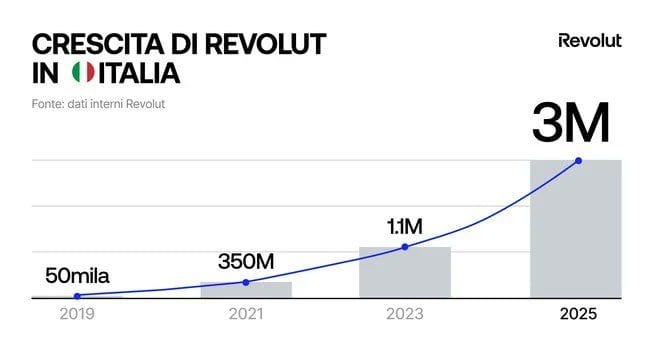

🇮🇹 Revolut’s growing range of offerings in Italy has helped it surpass 𝟯 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 customers, with an average monthly growth rate of 160,000 users. The company now aims to reach 𝟰 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 customers by the end of 2025 🤯

🇬🇧 Revolut is moving into commercial real estate lending. The London-headquartered neobank enlisted Duncan Batty, who previously led the real estate finance platform at M&G Investments, to oversee the new business. Batty will be responsible for building the commercial real estate lending unit from scratch.

🇮🇳 Cred joins RBI's digital currency project. Tiger Global and Peak XV backed Indian firm Cred to roll out access to India's central bank digital currency. Cred will roll out access for its e-rupee wallet to a select set of users and the issuance of e-rupee tokens into the wallets will be facilitated by YES Bank.

🇮🇪 Bank of Ireland to invest £100 million in technology. The investment will give retail and SME customers speedier payments, enhanced functionality on the mobile banking app to improve self-service options, and the introduction of new products including more sustainable lending options.

🌍 HSBC to exit parts of investment banking business in UK, US and Europe, as part of Chief Executive Georges Elhedery’s plan to overhaul its operations. Europe’s lender will close its mergers and acquisitions advisory and its equity capital markets businesses outside Asia and the Middle East.

🇬🇧 Natwest Group is investing in AI to identify and support vulnerable customers. Their new platform, Serene, leverages AI and behavioral science to provide real-time customer insights. It detects early signs of financial distress and predicts risks, enabling the delivery of personalized and timely support at scale.

🇸🇬 Moomoo and Arta target Singapore’s wealthy with feature-rich apps. Their business models involve using artificial intelligence to provide the same services as private banks and charging lower fees, while having a small number of staff to provide the “human touch” when needed.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Ondo Finance brings 24/7 access to Tokenized U.S. Treasuries on the XRP Ledger. Through this collaboration, institutional investors will gain access to Ondo Short-Term U.S. Government Treasuries, backed by the BlackRock USD Institutional Digital Liquidity Fund, which can be instantaneously minted and redeemed 24/7 using Ripple USD, an enterprise-grade, USD-denominated stablecoin.

🇯🇵 Metaplanet plans to raise $745 million via stock warrants to buy more bitcoin. The firm said that plans to issue 21 million shares of 0% discount warrants. These financial instruments give the holder the right, but not the obligation, to buy the underlying stock at a predetermined price before the warrant expires.

PARTNERSHIPS

🇺🇸 Wells Fargo and Derivative Path bring global payments to regional banks. The partnership marks a major evolution in capabilities for these smaller banks, enabling them to overcome traditional market barriers to provide competitive, secure, and transparent FX payment services, akin to those offered by the largest financial institutions.

DONEDEAL FUNDING NEWS

🇺🇸 Method raises $41.5m Series B. The start-up plans to “accelerate its delivery of end-to-end loan refinance automation and expand into use cases unlocked by deeper card network integrations”, according to a statement. Continue reading

🇧🇷 Paytrack raises $40M Series B led by Riverwood Capital. The platform plans to use the funds to accelerate product innovation, integrate new payment solutions, and expand into international markets. It simplifies travel and expense management for businesses by integrating payment solutions, automating workflows, and centralizing expense tracking on a single platform.

🇨🇭 WiseLayer raises $7.2M for finance agents. The company has integrations with over 300 major ERP, billing, procure-to-pay (P2P), and human resources information system (HRIS) platforms to enable its agents to automate various finance and accounting tasks.

M&A

🇳🇱 Euronext to acquire Nasdaq’s Nordic power futures business. The acquisition aligns with Euronext’s “Innovate for Growth 2027” strategy, which aims to strengthen its role in the power sector and expand its market infrastructure. Read more

🇵🇰 Pakistan’s ABHI acquires FINCA microfinance bank. “This acquisition represents a significant leap forward, allowing us to reach communities that have historically been excluded from the financial system. Together with TPL and FINCA, we are determined to transform financial access across Pakistan,” said Chair of the FINCA Pakistan board of directors.

MOVERS AND SHAKERS

🇮🇳 Paytm Payments MD and CEO Nakul Jain quit. He will step down from his position at the close of business on March 31, 2025, or sooner if both sides agree. Jain plans to pursue an entrepreneurial venture, prompting his departure after joining Paytm in April 2022.

🇨🇭 Temenos appoints Sairam Rangachari as CPO. Sairam will focus on enhancing the rich functionality and flexibility of Temenos’ best-of-suite core banking platform while driving innovation with AI and modular solutions to address the evolving needs of financial institutions.

🇬🇧 Moneyhub appoints Alastair McGill as CEO. Alastair brings with him a wealth of experience in driving growth within technology businesses and a deep passion for fostering positive workplace culture and people empowerment. Continue reading

🇫🇮 Former Holvi leader joins $30M instant payment startup Ivy as Managing Director. Sascha Bross will be responsible for the regulated business in Finland. The Helsinki-based subsidiary operates as a fully licensed payment institution throughout the European Economic Area and the EU.

🇬🇧 Triodos Bank UK appoints Mark Clayton as CEO. His appointment is subject to formal approval by the regulators and it is anticipated he will start in early summer. He will succeed Dr Bevis Watts, who announced last October that he would step down after nearly 10 years at the helm.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()