Kraken & Gemini Take Steps Toward IPOs

Hey FinTech Fanatic!

Despite past regulatory hurdles, major crypto firms are now moving toward public markets. Kraken and Gemini are both preparing for IPOs, a sign of renewed confidence in the sector as the political climate in the U.S. shifts in favor of digital assets.

Kraken is targeting an IPO in early 2026, though it could be already this year. In the last few years, the crypto exchange has emphasized transparency, releasing financial highlights and maintaining its commitment to proof-of-reserves disclosures.

Revenue more than doubled to $1.5 billion in 2024, with adjusted earnings of $380 million. “We’ll pursue public markets as it makes sense for our clients, our partners, and shareholders”, Kraken stated.

Gemini, meanwhile, has filed confidentially for an IPO, working with Goldman Sachs and Citigroup. According to Bloomberg, the company is exploring a public listing as soon as this year, though no final decision has been made.

Gemini founders Cameron and Tyler Winklevoss were among the industry leaders at a recent White House Digital Assets Summit, highlighting the increasing dialogue between crypto firms and policymakers.

With Circle, BitGo, and other crypto firms also eyeing IPOs, the race to the public market is heating up. The question now is: Will Kraken or Gemini be the first to ring the bell? 🔔

Read more global FinTech updates below👇 and I'll be back tomorrow!

Cheers,

FEATURED NEWS

🇺🇸 Greek FinTech Viva Wallet seeks end to long-running JP Morgan legal battle. The CEO of Greek neobank Viva.com has filed an injunction against JPMorgan in an attempt to block the banking giant from pursuing any further lawsuits or takeover attempts. Last year, both parties launched legal proceedings against each other.

FINTECH NEWS

🇺🇸 Astrada emerges from stealth to unveil a unified API for transaction data that offers the infrastructure, compliance, and workflows that software companies need to offer bring-your-own-card functionality. Using its API, software companies enable businesses to enroll Visa or Mastercard cards and track spending in real time.

🇦🇷 Argentine FinTech Alprestamo aims for regional consolidation and product diversification by 2025. With operations in Argentina, Uruguay, Mexico, Colombia, Peru, and Chile, the FinTech allows users to compare options for bank credit, credit cards, insurance, and other services, helping them choose the most convenient offer.

🇺🇸 FIS launches Treasury GPT, a pioneering AI-based product support tool for the treasury industry. The tool uses Microsoft Azure OpenAI Service for enhanced data and risk management, and quickly generates responses on queries about product usability, client configuration, policies and best practices for use of the solution.

🇺🇸 Curve halves losses as it pauses US operations and prioritises fundraising. Curve’s auditors agreed with the directors’ assessment that the company will continue to operate for the foreseeable future. However, directors do note that further fundraising will be required to sustain normal business operations.

🇬🇧 Revolut UK CEO stresses Revolut's ambition to shift from “disruptor” to primary bank. The UK CEO of Revolut spoke about Revolut's focus on being the main bank account of its customers while also shedding light on its preparations to become a fully licensed UK bank.

PAYMENTS NEWS

➡️ Athia, DEUNA’s Aware AI, Presents Payment Optimization: Maximizing Bottom-Line Impact in Real Time.

Athia Reinventing Payment Strategy with AI

🇪🇪 How to avoid chargebacks on PayPal: A merchant’s guide by Solidgate. PayPal's unpredictable chargeback process can escalate quickly, pushing even low-risk merchants over thresholds. This guide explains how PayPal chargebacks work, why they happen, and how to prevent them.

🇺🇸 80% of pay-by-bank users report better data security and lower cart abandonment. These benefits are especially important for retail, grocery, betting, ridesharing, telecommunications and utilities sectors, where user experience and security are top priorities. Despite the benefits, cost concerns remain a barrier to the wider adoption of pay by bank.

🇸🇦 Visa launches Tap to Add card in Saudi Arabia and Egypt. This enables cardholders to seamlessly add their cards to digital wallets by simply tapping them on their mobile device. Upon tapping, a unique one-time code validated by Visa's Chip Authenticate service, ensuring secure provisioning of card credentials and offering a significantly faster and more secure alternative to traditional methods.

🇬🇧 Mastercard and Visa linked to illegal gambling sites accused of scamming UK customers. An investigation has found that the payment giants are failing to stop their networks being used to make transactions on unlicensed sites despite a previous pledge to do so.

🇪🇬 Careem Pay launches money transfers to Egypt. The payments platform within the Careem app, expands its remittance service to the country, allowing UAE residents to send money directly to bank accounts in Egypt quickly and at competitive rates.

🇦🇷 Prepaid card transactions in Argentina grew by 39% during 2024. According to the fourth edition of GP Insight on the FinTech ecosystem in the country, prepaid cards have solidified as a growing payment method, with a significant increase in transaction volume and the number of transactions.

🇸🇪 Sweden's Riksbank works on offline payments in contingency planning for war outbreak. The possibility to pay offline in Sweden when the Internet is down is currently limited and does not work at all for contactless and mobile wallet payments. Learn more

🇧🇬 Bulgarian national payment operator BORICA implements Tips connectivity module from Montran. This solution enables banks to access TIPS, the ECB's instant payments service, integrating with Bulgaria's BISERA, and also includes advanced liquidity monitoring and controls.

🇲🇽 Kushki expands into Mexico and Colombia through a partnership with JP Morgan Payments. The collaboration aims to leverage JP Morgan’s network and expertise in payment processing while integrating Kushki’s acquiring services to enhance payment efficiency for businesses.

🇨🇴 Nu Colombia has partnered with Redeban, enabling over 2.5 million users to send and receive instant and free money transfers to and from any bank or digital wallet connected to the network in the country. This includes Bancolombia, Davivienda, Nequi, and Daviplata.

REGTECH NEWS

🇺🇸 Confide rebrands to Confide Platform, delivering a complete GRC workflow and case management system. It also provides tailored solutions for startup and enterprise compliance. CEO Pav Gill aims to simplify compliance, enabling businesses to manage risk with an intuitive, all-in-one platform. Read on

DIGITAL BANKING NEWS

🇬🇧 Atom Bank wants to inspire staff back to the office by announcing plans to relocate the headquarters to Newcastle. Chief Executive Mark Mullen has confirmed plans to move its head office from The Rivergreen Centre in Durham to The Pattern Shop in Newcastle.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Winklevoss Twins’ Gemini files confidentially for IPO. The crypto exchange and custodian is working with Goldman Sachs Group Inc. and Citigroup Inc. on the offering. The firm is considering going public as soon as this year.

🇺🇸 Crypto Exchange Kraken preparing for IPO in 2026. The exchange is seeking to go public as soon as the first quarter of next year, amid a friendlier regulatory climate in the U.S. Click here for more info

🇬🇧 Kraken secures UK EMI authorization; creates foundation for next phase of U.K. growth ambitions. The license strengthens its market position by enabling electronic money issuance, allowing faster deposits and withdrawals for clients.

🇺🇸 Coinbase CEO Armstrong says he'll hire 1,000 in U.S. as the crypto tide turns. Brian Armstrong said his U.S. exchange is planning to hire a thousand people because of the policy progress the industry seems to be making at the beginning of President Donald Trump's second term.

🇪🇸 BBVA gets regulatory nod to offer Bitcoin and Ether trading in Spain. The bank’s crypto offerings will enable users to buy, sell, and manage digital assets through its mobile app. The bank said it will use its own cryptographic key custody platform to maintain full control over customer holdings without third-party involvement.

🇺🇸 Robinhood fined $29.75M by FINRA for compliance failures. The regulatory authority found that Robinhood did not properly manage its system for processing trades, even though there were clear signs of delays due to a surge in trading activity.

🇫🇷 Deutsche Digital Assets expands into France. The move reinforces the company’s commitment to the French market, where demand for regulated crypto investment products continues to rise. The firm plans to introduce a broader range of investment solutions, including white-label products and tailored strategies.

PARTNERSHIPS

🇺🇸 Ingo Payments partners with Securely to deliver real-time merchant settlements with advanced ledgering and payment capabilities. This collaboration marks a significant milestone for both companies as Securely™ partners to bring Ingo’s full-service embedded banking platform to the market, combining proven payment infrastructure with an innovative approach to real-time merchant settlement through advanced ledgering and diverse payment options.

🇨🇦 Best Buy Canada selects PingPong as their first cross-border partner. Best Buy will begin expanding internationally and facilitate payouts to international sellers. By leveraging PingPong's global capability, it will have the opportunity to unlock new revenue streams and cross-border operational efficiencies.

🇦🇪 FinTech Galaxy and ProgressSoft join forces to advance open banking in MENA. This collaboration enables banks, payment service providers (PSPs), and regulators to streamline compliance, enhance digital transactions, and build scalable financial ecosystems.

🇸🇪 Zimpler partners with Swish to unlock direct participation. Through Zimpler’s direct participation, businesses can now integrate Swish faster, at a lower cost, and with greater stability. Explore more

🇺🇸 Skipify partners with Discover. The company will integrate advanced tokenization technology from the Discover Network to enhance security by replacing sensitive card information with encrypted tokens. The enhanced protection will also improve authorization and conversion rates for merchants and traders.

🇪🇬 TerraPay teams up with Banque du Caire to optimise remittance payouts in Egypt. Through this move, both intend to enable digital payouts to all bank accounts and mobile wallets across the region, in turn delivering more efficient, cost-effective, and secure remittance services for the Egyptian diaspora globally.

🇺🇸 Splitit partners with Highnote to enable installment payments for digital wallet credit cards and merchant endpoints. This allows shoppers to use an existing credit card at checkout. Splitit’s unique installment payment option will now be available through a digital wallet at the point of sale.

DONEDEAL FUNDING NEWS

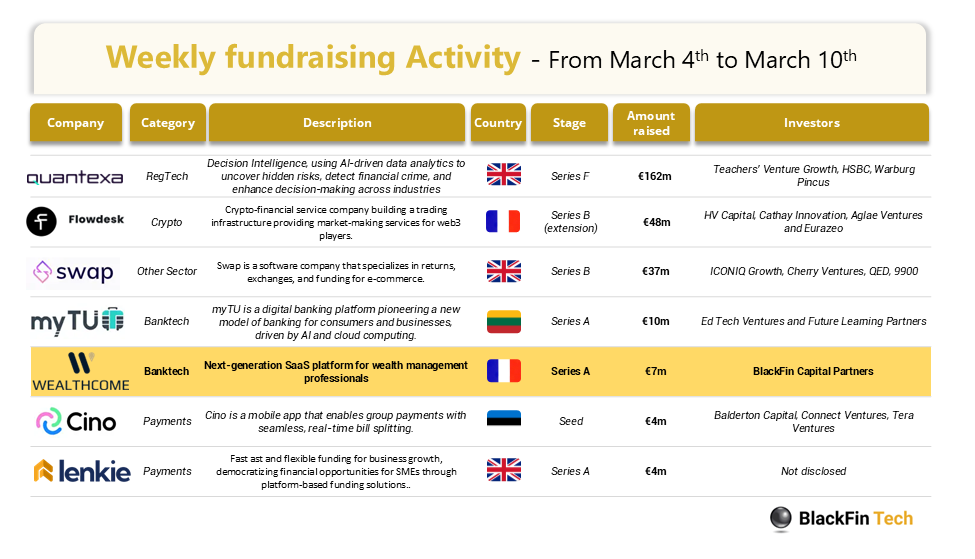

💰 Over the last week, there were 7 FinTech deals in Europe, raising a total of €272 million: 3 deals in the UK, 2 deals in France and 1 deal each in Lithuania and Estonia.

🇦🇪 UAE-based FinTech Klaim secures $26m to fuel regional expansion. The company aims to reshape the healthcare financial landscape by expediting medical insurance claim payments and improving cash flow for healthcare providers in the MENA region.

M&A

🇺🇸 Coinbase announces key acquisition to enhance privacy efforts on Base. This acquisition aims to develop privacy-preserving technologies, enhancing user confidentiality within the Coinbase ecosystem. Keep reading

🇩🇰 Safra Sarasin agrees to buy 70% stake in Saxo Bank, which has been looking for a new buyer for months, in a deal valued at around 1.1 billion euro ($1.19 billion). This deal has put a valuation tag of about 1.6 billion euros on the Danish online trading and investment services provider.

🇺🇸 Finovifi acquires Modern Banking Systems to expand core banking capabilities. This will enrich the suite with AI-driven banking operations, secure cloud-native solutions, and API connectivity with “enhanced compliance and real-time payment capabilities”.

🇨🇦 Barclays closes in on sale of merchant acquiring business. The bank said in February that it was exploring a sale or partnership for the merchant acquiring division, which has struggled to remain competitive in the face of increasing competition.

MOVERS AND SHAKERS

🇨🇴 Nubank Investor Relations Officer Jörg Friedemann to depart firm. Friedemann decided to leave for another opportunity, but no formal announcement has been made. He is expected to stay at Nubank through April. More on that here

🇬🇷 Natech appoints George Nikolaropoulos to CTO and George Rogkakos to CPO. These strategic moves underline Natech’s commitment to scaling innovation, accelerating digital transformation, and becoming a world-class product-driven company.

🇺🇸 PayPal appoints Joy Chik to Board of Directors. Ms Chik brings more than 26 years of corporate and board experience scaling products, services, and teams on a global level. Read more

🇺🇸 1Money Network builds leadership team with execs from OKX, Binance and Ripple. The additions include Chris Lalan as Chief Legal Officer and Corporate Secretary, Kristen Hecht as Chief Compliance Officer (CCO), and Brett Enclade as Chief Information Security Officer (CISO).

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()