Kraken Expands Into Stock Trading

Hey FinTech Fanatic!

Kraken is the latest crypto exchange to step into traditional finance, launching stock and ETF trading for U.S. users. The move follows Crypto.com’s rollout earlier this year and mirrors a shift first made by Bitpanda, as crypto platforms expand beyond digital assets into broader market access.

In a move that signals a quiet but meaningful shift in digital finance, Kraken has opened the door to stock and ETF trading for select U.S. users. What began as a crypto-native exchange is now testing the waters of traditional finance, bringing equities and digital assets into a single trading experience.

The initial rollout includes more than 11,000 U.S.-listed stocks and ETFs, accessible to clients in ten U.S. states, with plans for broader national coverage in the coming months. It’s a phased expansion, but one that hints at a much wider ambition.

For Kraken, this is less about pivoting and more about layering. Crypto is still central to its identity, but the product now stretches across asset classes — crypto, stocks, cash, and stablecoins — all from one account, in one app. “Crypto isn’t just evolving, it’s becoming the backbone for trading across asset classes, such as equities, commodities and currencies,” said Arjun Sethi, Kraken’s Co-CEO.

It’s a steady shift — one that reflects growing demand for seamless, all-in-one access to financial markets. First Bitpanda, then Crypto.com, and now Kraken. It’s no longer a question of if crypto platforms will offer stocks — it’s when, and how fast.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Stay Ahead in FinTech! Subscribe to my Telegram channel for daily updates and real time breaking news. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

🇨🇴 Real-time payments are reshaping financial systems worldwide. In September 2025, Colombia will join this shift with Bre-B, a new system designed to modernize digital transactions. According to ACI Worldwide’s report, “Real-time payments: Economic impact and financial inclusion,” this type of payments could bring over 5.1 million Colombians into the financial system by 2028 and boost GDP by US$282M. Read the full analysis by Sonia Gómez, ACI Director of Solution Consulting - LatAm.

FINTECH NEWS

🇸🇬 Bizcap launches in Singapore, aiming to introduce same-day funding for eligible SMEs in the region. It will continue to focus on meeting clients' and users' needs, preferences, and demands in an ever-evolving market while prioritising the process of remaining compliant with the regulatory requirements and laws of the local industry.

🇸🇬 GXS acquires FinTech Validus’ Singapore business to boost business banking offerings. The deal will allow digital banks to offer short and medium-term working capital loans, as well as trade finance, making it more ‘complete when it comes to lending’.

🇬🇧 UK RegTech NorthRow explores sale. The platform has appointed boutique investment advisory firm Lazarus Consulting to explore options for growth investment or a full sale of the business. Keep reading

PAYMENTS NEWS

🇪🇺 Ecommpay helps HiQi simplify fuel payments across Portugal and Spain. This partnership enables its customers to top up their credit account quickly and simply via their preferred payment method. The app allows private and business drivers to refuel and pay hassle-free, directly from the app.

🇮🇳 UPI faces 3rd outage in less than a fortnight; transactions impacted. In the recent past, UPI outage was reported on March 26 and April 2. Users across the country experienced transaction failures on Saturday as the popular payment system was down due to a technical glitch.

🇦🇪 Visa enables money transfers through BenefitPay by mobile number in Bahrain. Visa+ service allows users to send money to Visa cardholders within GCC using only the recipient's mobile number. This move marks the first step in building a broader ecosystem that aims to connect multiple banks across markets.

REGTECH NEWS

🇸🇬 Latest legal information on FinTech markets and regulation. Recent article from Allen & Gledhill outlines key global and local FinTech trends, highlighting the rise of AI, embedded finance, super apps, and stablecoins, along with growing regulatory focus on consumer protection.

🇪🇺 PayFuture granted full approval for EU EMI License. The license approval marks a major milestone in PayFuture Group’s growth strategy, enabling EU merchants to expand their global reach into emerging markets through alternative payment methods (APMs) and with future capabilities to support card payments.

🇮🇳 RBI launches WhatsApp channel to share updates. The move is intended to share important banking updates and financial news in a simplified manner managing to reach people in remote areas. People across the country can join the channel by scanning a QR code shared by the central bank.

🇪🇺 Paysera selects iPiD as a strategical partner for VoP compliance and for global account verification. This collaboration aims to strengthen Paysera’s Know Your Payee (KYP) processes and ensure compliance with new EU regulations requiring financial institutions to verify payee details before processing transfers in euros.

🇦🇪 Virtual assets platform Hayvn, related entities fined $12.4mln in Abu Dhabi ADGM crackdown. The actions of the entities and individuals involved were particularly serious, as they conducted unauthorised Virtual Asset activities through an unregulated entity based in ADGM.

DIGITAL BANKING NEWS

🇬🇧 Revolut to take on American Express with move into reward credit cards. The rewards-based credit card would use Revolut’s own points system, named RevPoints, which it launched in July last year. The firm plans to add UK stocks to its trading platform in the coming days as some investors seek to diversify away from US equities in the aftermath of Donald Trump’s plans to raise tariffs on trading partners around the world.

🇦🇪 Wio Bank launches salary plan with market-leading 6% interest on savings. The Wio Personal Salary Plan converts a standard salary account into a comprehensive financial wellness tool. These features enable automatic wealth building, creating a foundation for improved financial wellness without requiring active management.

🇬🇧 HSBC to make HUGE change to mobile banking app for millions to rival Monzo and Starling. The bank, which serves over 15million UK customers, has revamped the app's interface and introduced new money management tools in a bid to better compete with digital-first challenger banks.

🇬🇧 Vemi launches pre-app Waitlist: revolutionising ethical banking in the UK. Vemi aims to address the unmet financial needs of many Muslim and values-led consumers, by providing ethical financial products and services. Read more

🇺🇸 U.S. Bank introduces all-in-one business checking plus payments acceptance. The account enables businesses to accept card payments with free same-day access to their funds and a free mobile card reader, in addition to checking with unlimited digital transactions and no monthly maintenance fee.

🇨🇭 Yuh 14+: Swiss FinTech innovation targets next generation of savers. Designed to promote financial independence and literacy, it offers a free Mastercard, TWINT integration for instant peer-to-peer payments, and fee-free weekly ATM withdrawals in Switzerland.

BLOCKCHAIN/CRYPTO NEWS

🇪🇺 Digital assets firm Gemini allows EU traders to use Plaid to deposit funds to wallets from bank accounts, which is described as a “significant enhancement” that will allow users in the region to fund their accounts and trade crypto with ease. Continue reading

🇬🇧 JP Morgan launches blockchain-based Kinexys Digital Payments in GBP / UK. As a result, it can now provide 24/7 support for corporate payments and foreign exchange for dollars, euros and pounds. The first clients to use the sterling services in London are LSEG’s SwapAgent and commodities trader Trafigura.

🇺🇸 Theya announces bitcoin management solutions for businesses. Built for startups, companies, exchanges, funds, and professional services, Theya for Business removes the need for custodians and simplifies the complexity of legacy wallet setups.

🇺🇸 Kraken expands beyond crypto: Announcing U.S.-listed stock and ETF trading. Clients can now seamlessly manage stocks, crypto, cash and stablecoins all in one place. Whether using the Kraken mobile app, the Kraken Pro mobile app, or Kraken Pro web experience, they can effortlessly rotate between digital and traditional asset classes.

PARTNERSHIPS

🇺🇸 FinGoal partners with unified API platform Quiltt. By integrating FinGoal’s transaction enrichment capabilities with Quiltt’s API, innovators and builders will now be able to offer their users a more insightful and personalized financial experience, across any of the open banking data access providers Quiltt supports.

🇦🇪 Emirates NBD launches Visa+ simplifying international money transfers. This innovative service offers Emirates NBD’s customers a more convenient, secure and faster way to send money to Visa cardholders within the GCC, reshaping the remittance and money transfer landscape in the UAE.

🌍 FinTechOS teams up with Fort to advance cybersecurity readiness. The company intends to ensure compliance with cybersecurity and digital resilience demands across all worldwide jurisdictions, aligning with third-party risk assessment criteria imposed by global banks, insurance firms, and FIs in their procurement processes.

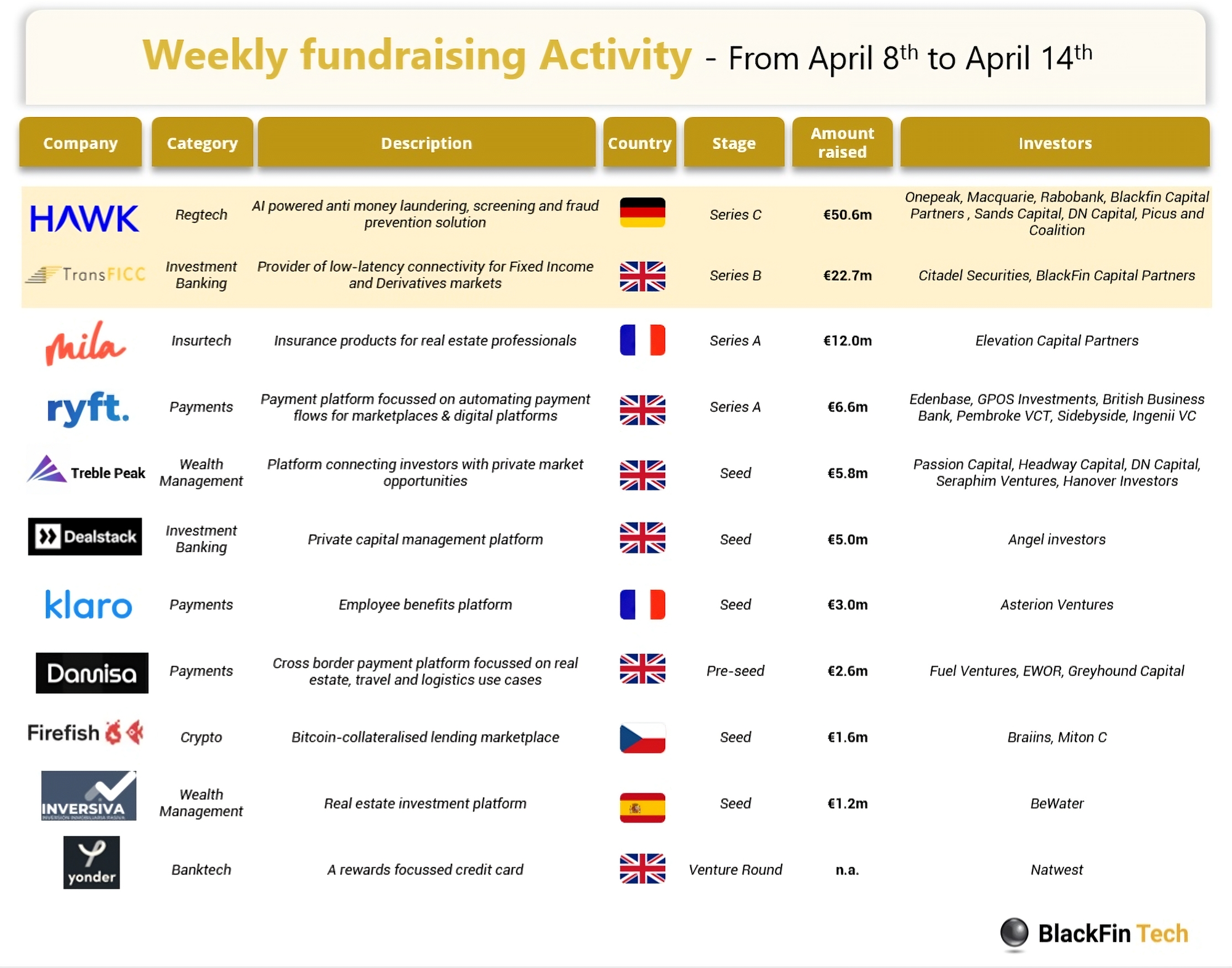

DONEDEAL FUNDING NEWS

💰 Over the last week, there were 11 FinTech deals in Europe, raising a total of €111 million in equity, 6 deals in the UK, 2 deals in France, and one deal in each of Germany, Czech Republic, and Spain.

🇬🇧 BBVA closes its first venture debt financing deal in the UK with Plum, for £15 million. This will help Plum expand its business and improve profitability with the company aiming to sharpen its customer offering and broaden its range of products.

🇬🇧 UK FinTech BKN301 with Italian roots closes £18.6M round to create a world without financial barriers. This funding will support BKN301’s international growth and enhance its BaaS Orchestrator platform, which offers core banking, payment processing, digital wallets, and other services for third-party integration.

🇺🇸 Tapcheck raises $225 million in equity and debt funding to redefine payday for America’s Workforce. This infusion of capital will further strengthen its capacity to empower employees nationwide and alleviate financial pressure by granting access to earned wages ahead of traditional pay schedules.

M&A

🇮🇳 Australian FinTech firm Findi completes $19m Bankit acquisition in India. Bankit’s network covers more than 12,000 pin codes, helping Findi strengthen its presence in India’s digital financial services market. The expansion is expected to improve financial inclusion across India by offering more services to underserved areas.

MOVERS AND SHAKERS

🇺🇸 Mastercard onboards Susan Muigai as Chief People Officer. Susan will lead Mastercard’s human resources strategy and function, focusing on all aspects of the organisation, from culture to learning & development to talent acquisition and engagement to compensation and benefits.

🇮🇪 TransferMate promotes Product Chief Gary Conroy to CEO. Conroy will take over from Sinéad Fitzmaurice, who is stepping down after six years in the role. While Fitzmaurice will remain "involved with the business", TransferMate has not disclosed the nature of her future position.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()