Krafton Leads Cashfree’s $53M Round to Fuel Global Expansion

Hey FinTech Fanatic!

Cashfree, the Indian payments powerhouse processing over $80 billion annually, has secured $53M in fresh funding led by Krafton at a $700M valuation. The gaming giant sees strategic potential in payments, with Sean Hyunil Sohn, CEO of Krafton India, stating: “India’s FinTech industry is experiencing remarkable growth, and we believe Cashfree’s dominant position can be replicated globally.”

Akash Sinha, CEO of Cashfree, emphasized the opportunity: “There are synergies around building seamless payment flows for smaller ticket sizes.” With an expanding presence in the Middle East and cutting-edge solutions like SecureID and RiskShield, Cashfree is poised to redefine global payments.

Read more global FinTech industry updates below 👇 and I’ll be back with more tomorrow!

Cheers,

Stay on top of FinTech trends. Subscribe to FOMO now and catch the week’s most important news and updates.

ARTICLE OF THE DAY

🎤 In my latest Q&A, Drew Edwards, CEO of Ingo Payments, shares his insights on the evolving FinTech and banking-as-a-service (BaaS) landscape in 2025. He highlights that success will hinge on risk management, not just sleek UX. Many BaaS providers have prioritized speed over compliance, leading to regulatory scrutiny and failures. Click here to learn more

INSIGHTS

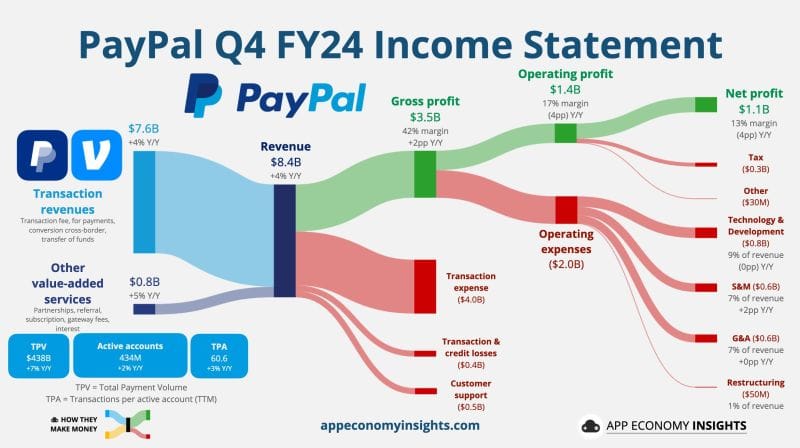

💰 PayPal reported slowing growth in its card-processing business even as fourth-quarter earnings topped analysts’ estimates.

FINTECH NEWS

🇸🇪 Why is this C.E.O. bragging about replacing humans with A.I.? According to Klarna, the company has saved the equivalent of $10 million annually using A.I. for its marketing needs, partly by reducing its reliance on human artists to generate images for advertising.

🇺🇸 Fiserv profit beats estimates as consumer spending remains robust. The firm beat Wall Street estimates for fourth-quarter profit, helped by strong demand in its banking and payments processing unit, sending its shares up 3.2% in premarket trade.

PAYMENTS NEWS

🇺🇸 ACI Worldwide recognized by Datos Insights in a report that highlights ACI's Enterprise Payments Platform for its expansive global reach, cloud-native architecture and robust payment capabilities that support all payment types, including cards and account-to-account. It also emphasizes ACI's innovative platform, modern APIs and modular services, which allow for intelligent payments orchestration.

🇬🇧 Safer Internet Day: Ecommpay records significant success in fraud protection for merchants. Marija Solovjova, Head of Fraud AML transactions & Disputes Department at Ecommpay commented: “At Ecommpay we are committed to continually developing new tools and improving existing ones to tackle fraud targeted at our merchant customers. We believe we are leading the e-commerce marketplace in using a combination of highly experienced fraud analysts and technology to identify and stop fraudulent transactions to protect businesses and consumers.”

🇦🇷 What are the areas with the highest growth potential in the FinTech world for 2025? Santiago Witis, Country Manager of Pomelo in Argentina, assures that the FinTech sector will grow significantly in 2025, but there are specifically two areas with exceptional potential: digital payments and loans/credit.

🇦🇷 MercadoLibre's payment processor offers Pix. The company is offering transactions using its payment processors in Argentina through Pix, the Brazilian instant payment system, as Brazilian tourists flock to the neighboring country for vacation.

🇺🇸 FIS unlocks second half of FedNow® potential with new send certification. The company announced it is certified to enable sending capabilities for credit transfers. This will enable FIS’ clients to fully harness the entire FedNow service by providing consumers and commercial borrowers with a modernized and unified digital payment experience.

🇪🇺 Numeral introduces Verification of Payee. The company announces fully managed verification solution to ensure seamless compliance for financial institutions ahead of the fast-approaching October 9, 2025 deadline. This mandates that payment service providers provide payers with verification details before initiating credit transfers.

OPEN BANKING NEWS

🇯🇴 Galaxy receives Central Bank approval to test open banking. Through its FINX Connect platform, FinTech Galaxy aims to empower third-party providers with secure, consent-driven access to customer data for innovative financial services. This will contribute to Jordan’s vision to become a regional leader in financial technology and a driver of financial inclusion in the region.

🇸🇪 Klarna CEO Slams EU Open Banking as a "Failure". His strongly-worded criticism came in response to OpenAI's launch of Operator, an AI agent that can autonomously perform tasks by interacting with web interfaces. He revealed that using tools like Operator to access bank accounts is "illegal by law" in the EU.

DIGITAL BANKING NEWS

🇩🇪 N26 is about to launch a bank account for businesses. The bank already offers consumer accounts and business accounts for freelancers. Now, it is stepping up and getting ready to compete with other neobanks that have already been offering these business accounts.

📊 IBM Study: Gen AI will elevate financial performance of banks in 2025. The report shares insights from analysis of industry C-suite leader sentiment, bank customer behavior and economic data from eight major markets and what financial institutions and their ecosystem partners can glean from the trends.

🇺🇸 Okoora announces its expansion in the US. The company is offering its Embedded Finance solutions and core API suite to financial institutions, FinTech firms, and non-financial businesses. This also includes multi-currency accounts, global payments, FX conversions, and currency risk management through hedging.

🇦🇺 CommBank and AWS expand collaboration to deliver global best cloud and AI capabilities. By rearchitecting a significant percentage of its workloads onto AWS, and using cloud native designs, Commbank is further simplifying the bank’s technology environment.

🇬🇧 Intelligent Search by Bud Financial set to be the foundation of customer AI experiences. Intelligent Search is able to understand and give detailed context to transaction search queries. It provides these detailed, actionable insights in a summary at the top of the list of transactions queried, turning transactional data into rich customer insights.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Peter Thiel-Backed crypto firm weighs IPO. Bullish Global, a cryptoasset exchange operator is considering an initial public offering as soon as this year. The company is working with Jefferies Financial Group Inc. and JPMorgan Chase & Co. on the potential listing.

🇩🇪 Amdax launches Novelist. The service aims to make crypto asset management accessible to retail investors, offering a much lower entry threshold than traditional asset management. The service focuses on managed crypto investing starting from €500.

PARTNERSHIPS

🇬🇧 Mastercard partners with Payrails. The company aims to accelerate digital payment transformation and offer services tailored to the needs of large enterprises, also provides efficient payment solutions that enable global businesses to improve complex transactions, boost flexibility, and optimise financial operations.

🇺🇸 Checkbook deploys Push to Card with Visa Direct. This strategic enhancement means customers can use Visa Direct to deposit funds to bank accounts linked to over 4 billion debit cards in real-time. Read more

🇺🇸 Square selects Peach to power credit card programme. This collaboration enables Square to integrate the credit card directly with its broader ecosystem of solutions, allowing sellers to manage their cash flow from the same platform they use to run their business.

🇵🇭 Netbank to deliver blockchain-based business financing to Jia Finance. By leveraging Netbank’s advanced banking infrastructure, Jia will scale its invoice financing solutions, bringing unprecedented access to capital for SMEs in the Philippines.

🇬🇧 GoCardless and Financial Cloud partner. The interface will allow businesses to manage payments and customer data in one place, providing actionable insights into customer behaviors and payment trends. The integration also enables merchants to scale – collections and payment reconciliation remain manageable, even as volumes grow in line with their customer base.

DONEDEAL FUNDING NEWS

🇸🇬 Tazapay aims to triple revenue in 2025 with stablecoin bet. Revenue hit US$3.5 million in Q4 2024 alone, giving the company an annualized run rate of US$14 million. Tazapay aims to boost revenue by 3x this year on the back of stablecoins becoming a “major growth driver”.

🇮🇳 Krafton leads Cashfree’s $53M funding at $700M valuation. “Krafton is a large organization, very active in the digital content space over the internet and payment companies like us see a sizable market opportunity alongside e-commerce, travel and other financial services,” Co-Founder and CEO of Cashfree, said.

🇺🇸 Anchor lands $20 million in Seires A funding. With this latest funding, the platform plans to double its workforce in the next year, accelerate its US market presence, and deepen strategic partnerships, building on the company's over 500% growth in 2024.

🇦🇺 Lawpath secures $10 million from Westpac, deepening its partnership with a legal technology startup already used by 500,000 businesses nationwide. Lawpath allows small businesses to draft legal documents, ranging from contracts to employment agreements and privacy policies, without the need to recruit a lawyer first.

M&A

🇺🇸 Stripe closes $1.1 billion Bridge deal. It paid a hefty price for a two-year old company, an amount that was about three times higher than Bridge’s valuation in a funding round in August. The deal gives Stripe a firm foothold in crypto, a market where it previously struggled to gain traction.

🇺🇸 Worldpay to buy fraud prevention platform Ravelin. Worldpay says Ravelin’s cloud-based AI platform will boost its portfolio of value-added solutions and help its customers improve authorisation rates. Continue reading

🇺🇸 Neuberger Berman to Buy $1 Billion in Consumer Debt From FinTech. This marks the largest purchase agreement for ClarityPay. The loans include retail and medical point-of-sale loans made to consumers. The deal is structured as a forward-flow agreement.

🇫🇷 Visma expands into France with Evoliz acquisition. This will boost Visma's offering across electronic signature, tracking of unpaid invoices with automated reminders, and managing purchase orders and delivery notes as well as automating expense collection, categorisation, and management of expense claims via a mobile app, supplier payments, and inventory tracking.

MOVERS AND SHAKERS

🇺🇸 MoneyGram Announces Luke Tuttle as CTO. In this role, Tuttle will lead product development and technology, overseeing engineering, platform operations, information security and emerging technologies like blockchain.

🇩🇰 Lunar appoints industry leader Nanna Bergmann to drive Moonrise expansion. This strategic move underscores Lunar's commitment to scaling its payments offering and establishing Moonrise as the leading payments partner for regulated FinTechs, PSPs and banks in the Nordics.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()