Klarna 100,000 Plus Subscribers Milestone in the US

Hey FinTech Fanatic!

Over 100,000 US consumers have subscribed to Klarna Plus, the $7.99 monthly service offering exclusive discounts and reduced fees, as announced in a recent press release.

According to Klarna, subscribers saw an average saving of $18 in their first month of membership. They also mentioned that cash-back rewards for Plus subscribers are expected to launch soon.

While reaching 100,000 Plus subscribers within five months is impressive, it doesn't necessarily indicate strong consumer demand.

In 2023, Klarna had 8 million monthly active users in the US. (2024 data on monthly active users by geography is unavailable.) This conversion rate means only 1.25% of Klarna's active monthly user base has joined Plus—these are already loyal, reliable customers.

Emartketer anticipates 42.8 million people will use Klarna at least once this year. Given the small conversion of active customers so far, attracting a significant share of less-frequent users may be challenging.

What do you think? Is this milestone a big success for Klarna?

Cheers,

P.s. In today's digital landscape, ensuring a seamless yet secure customer journey is paramount.

Mangopay is delivering a webinar on this topic, hosted by MRC, to explore how platforms can provide a frictionless user experience while defending against the latest fraud techniques.

Join Ariel Shoham, VP of Product; Mateusz Chrobok Cybersecurity Evangelist; and Anda Kania Senior Product Marketing Manager for a free webinar entitled “The Unseen Risks: Identifying Hidden Fraud and Flaws in Your Customer Journey”

📅 July 3🕐 2pm CEST

📝 Register HERE

BREAKING NEWS

🇺🇸 Visa, Mastercard $30 billion swipe fee settlement rejected by US judge. Many merchants and trade groups including the National Retail Federation opposed the accord, saying card fees would remain too high, while Visa and Mastercard would retain too much control over card transactions. The decision could force the payments giants to negotiate a settlement more favorable to merchants, or go to trial.

INSIGHTS

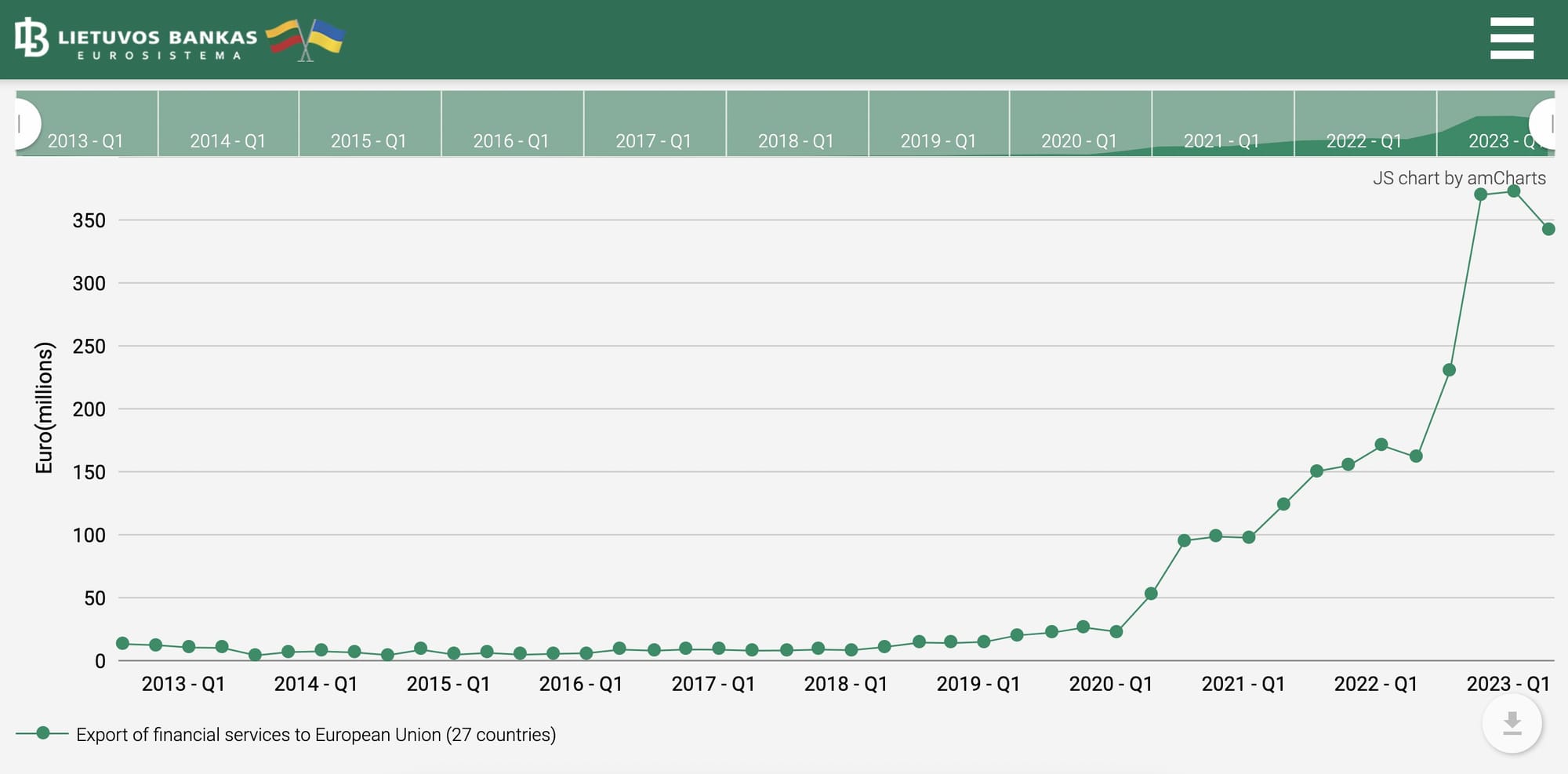

🇱🇹 Lithuania's export of financial services to the E.U. used to be <€8M/quarter.

In Q1 2024, export of financial services stood at €341 M 🤯

FINTECH NEWS

🇺🇸 PayQuicker has made impressive strides in 2024, solidifying its position as a leader in global payouts orchestration. With the onboarding of over 250,000 new payees in the first quarter alone and the acquisition of 30 high-profile customers, the company is experiencing its strongest growth yet.

🇺🇸 Klarna Plus, issued by WebBank, has reached a milestone of 100,000 subscribers in the US since its launch earlier this year. The Klarna+ subscription service allows members to maximize their shopping experience through access to a variety of features and offers, including waived service fees on the Klarna One Time Card, rewards, and access to special deals with popular brands in the Klarna app.

🇳🇬 OPay and Moniepoint issue 17 million Verve cards as Nigerian FinTechs switch from Visa and Mastercard. A change in consumer behaviour and macroeconomic conditions are leading Nigerian banks to issue local cards like Verve to customers, dumping international card schemes like Visa and Mastercard.

🇲🇾 MYDINPay launches as the latest player in Malaysia’s E-Wallet space. The launch event introduced attractive incentives for early adopters of the e-wallet. The first 1,000 registrants will get a RM5 voucher upon signing up. Find out more

PAYMENTS NEWS

🇦🇪 Nuvei secures UAE license. The Retail Services Category II License enables Nuvei to offer its comprehensive suite of payments technology to businesses operating in the thriving UAE market, including direct local acquiring, payment aggregation services, and domestic and cross-border fund transfers.

🇺🇸 GoCardless has announced a partnership with integration and automation platform Celigo to accelerate its growth through indirect channels. Leveraging Celigo’s integration platform (iPaaS) will enable GoCardless to build integrations between its payment platform and the back-end systems commonly used by businesses.

🇮🇹 Wearable paytech provider MuchBetter launches 'free' contactless payments ring in Italy. The ring is free as long as users load it with €100 through the associated app. Following its launch in Italy, it will also be available in Germany, Austria, the UK, Ireland and Poland.

🇪🇺 EU payment gateway Computop is calling on merchants to join pilot trials of the bank-backed European Payments Initiative's Wero wallet scheme. Wero transactions will usually be carried out by the customer in the bank’s own app or in the new Wero wallet.

🇺🇸 Frost Bank taps Finzly for FedNow and RTP instant payments. The partnership will allow Frost Bank to meet the growing demand for instant money movement by offering the ability to send real-time payments while also providing greater choice when making payments.

🇸🇪 Gr4vy, a cloud-native payment orchestration platform (POP), is extending its partnership with Trustly, a FinTech in open banking payments, to launch in Europe. The partnership allows Gr4vy’s online merchants to include Trustly as a payment option, offering greater flexibility and convenience to customers.

OPEN BANKING NEWS

🇺🇸 Mastercard Open Banking partners payroll data aggregator Argyle to expand income and employment verification to include permissioned access to payroll data. With 90%+ coverage of the U.S. workforce, financial institutions can now digitally verify an applicant’s income and employment in just moments.

DIGITAL BANKING NEWS

🇵🇭 Zed, a credit-led neobank, announced it has received its Certificate of Authority to Operate as a standalone credit card issuer from the Bangko Sentral ng Pilipinas (BSP). “Our BSP license makes us the first Philippine neobank to offer credit cards as a standalone issuer,” said Co-founder Danielle Cojuangco Abraham.

🇬🇧 Monzo saw a 57% decrease in customer queries after rewording one description on the website. Monzo has been focusing on how it utilises the use of language across its app and website, seeing some strong results from small changes.

🇪🇺 Qonto signs with Wise Plaform. With the integration of Wise, Qonto’s customers will now be able to pay their partners faster, in more countries, and with a more transparent and reliable platform. Read on

BLOCKCHAIN/CRYPTO NEWS

🇱🇺 Crypto exchange Bitstamp will delist Tether’s EURT and other stablecoins that do not comply with the European Union’s new laws for crypto assets before the June 30 deadline. The exchange will not list or market new tokens that don’t comply.

🇧🇷 Brazilian neobank Nubank has partnered with payments platform Lightspark to offer the Bitcoin Lightning Network to its 100 million customers in LatAm. Lightspark said that it’s working with Nubank to start the Lightning “integration, mapping, and building potential products” and would have “more to share in the future.”

🇦🇹 Bitpanda, the Vienna-based cryptocurrency broker and FinTech unicorn, announced Tuesday that its user base has surpassed 5 million retail investors. The milestone comes after a significant growth period in Q2 2024, when the number of retail traders grew by 25%. Keep reading

DONEDEAL FUNDING NEWS

🇺🇸 Crossover Markets scores $12 million funding round. Crossover Markets is best known for its execution-only electronic communication network, CROSSx, a low-latency institutional trading venue for digital assets, comprising an advanced matching engine and smart order routing.

🇩🇰 Viio, a spend management platform, has announced it has raised over £2.7 million to help accelerate its ambitious growth plan. Viio has been a startup for seven years but really hit "product market fit" in 2023 and can therefore fuel growth now. Learn more

🇺🇸 Payabli closes $20m series A to scale operations and drive innovation for its payments infrastructure and monetization platform. The new funding will also enhance security and scalability, boost customer acquisition, and help software partners integrate and activate processing volume more efficiently.

🇺🇸 Rainforest lands $20M to challenge Stripe with embedded payments for SaaS providers. Rainforest is capturing volume as software platforms migrate from legacy processors such as Fiserv and FIS. As that happens, it competes against companies like Stripe to embed financial services and payments.

M&A

🇺🇸 Just 7 months after announcing a $6M seed round, Hyperplane, a San Francisco-based data intelligence startup that is building foundation models for banks, has been acquired by Brazil’s Nubank. The two companies did not disclose the price of the acquisition.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()