Klarna Teams Up with Stripe in Global Payments Push Ahead of U.S. IPO

Hey FinTech Fanatic!

Klarna has expanded its partnership with fellow FinTech unicorn Stripe, making its buy now, pay later (BNPL) service available to Stripe merchants across 26 countries.

This major distribution deal enhances their initial 2021 partnership formed during the Covid-19 pandemic, now offering improved functionality including A/B testing capabilities and real-time conversion rate measurements.

David Sykes, Klarna's chief commercial officer, highlights the deal's impact: "This is really significant for Klarna," noting that the company has doubled its new merchant count in the three months since beginning the integration with Stripe in October. The enhanced collaboration enables Stripe's merchants to access Klarna's BNPL services with more comprehensive features than their previous collaboration.

The expanded partnership comes at a strategic time as Klarna prepares for its highly anticipated U.S. IPO, following a confidential filing in November. According to Bloomberg News, the Swedish FinTech could reach a valuation of up to $20 billion, marking a significant milestone in the company's growth trajectory.

Don’t miss the FinTech updates coming up next, and I'll be back in your inbox tomorrow!

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

#FINTECHREPORT

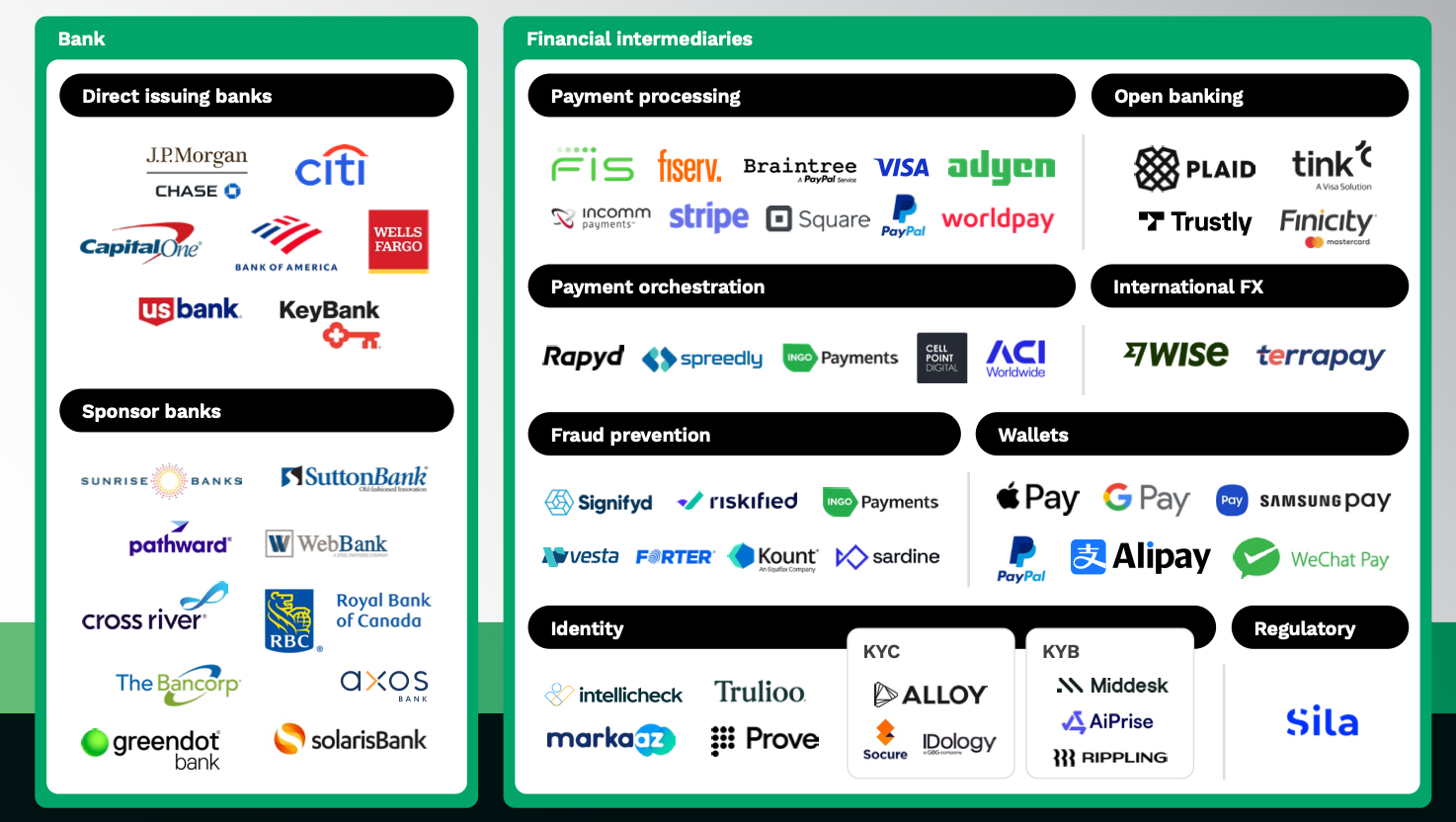

📊 "The Modern Money Mobility Ecosystem" report is a foundational report full of insights, exclusive graphics and actionable recommendations for navigating it. The following table provides a comprehensive overview of the various players in the financial technology and services ecosystem, categorized by their primary functions while acknowledging their presence in multiple areas of the ecosystem.

FINTECH NEWS

🇺🇸 Plaid’s revenue and usage rates jump as CEO sees ‘FinTech spring’. Revenue at Plaid jumped more than 25% last year, a person familiar with the matter told to Bloomberg. The growth came despite what was a lean time for most FinTechs, particularly those that serve consumers.

🇮🇩 Grab-Backed Super Bank said to consider Jakarta IPO. The digital banking company is seeking to hire banks to work on a potential share sale that could help it raise $200 to $300 million. Super Bank may seek a valuation of $1.5 billion to $2 billion in a potential listing.

🌍 Four FinTechs in Nordics talk 2025 plans and fears. "Throughout 2024, Nordic FinTechs have seen a surge in early-stage funding activity, with seed and Series A rounds drawing increased attention, with former VC backed operators and second time founders heading some of the most hyped cases," said co-founder of Signal.

🇧🇬 “We will be a unicorn today”, says CEO of Payhawk, Bulgaria’s first-ever $1bn startup. Hristo Borisov talks about the impact AI will have on Payhawk and the wider spend management industry. He said it marked a “new competitive playground” where Payhawk can challenge in the procurement and accounts payable space.

PAYMENTS NEWS

🇺🇸 Klarna scores global payment deal with Stripe to expand reach ahead of blockbuster U.S. IPO. The new deal improves functionality for Stripe merchants, including the ability to A/B test Klarna and measure real-time conversion rates.

🇨🇴 Yuno integrates with PayPal. This collaboration significantly enhances Yuno's offering, giving merchants seamless access to PayPal’s vast active user network, which now surpasses 400 million worldwide. Yuno-powered merchants can effortlessly offer PayPal’s secure and flexible payment option.

🇺🇸 Klarna seeks to offload US ‘pay in 4’ loans. The transaction would help free up capital for loan growth needed to satisfy potential IPO investors, ahead of one of the year’s most hotly anticipated stock market listings. This option allows consumers to split purchases at retailers’ checkouts into four interest-free payments, paid every two weeks.

🇧🇷 Bank of America’s take on Latin America’s digital payments advantage. “After many decades of the status quo in payments, Latin America is going through a major transformation,” Marcelo Moussalli, managing director and Latin America product head executive at BofA, told PYMNTS. The transformation is driven by Brazil and Mexico, which account for about two-thirds of LatAm's GDP, he said.

OPEN BANKING NEWS

🇬🇧 Square partners with Salt Edge. The partnership is valuable for users of Square Card in the UK. It empowers underserved SMEs in the region to stay on top of their finances and manage them all in one place. By integrating Salt Edge customers can choose to share their data with banks and other regulated third-party providers through secure APIs.

REGTECH NEWS

🇺🇸 SEC fines Robinhood $45 million. The SEC's order found that Robinhood Securities LLC and Robinhood Financial LLC breached over 10 provisions related to regulatory compliance, and also stated that the two entities failed to report trading activity, comply with short sale regulations, and submit timely suspicious activity reports.

🇺🇸 Shift4 Payments and SEC reach disclosure violation settlement. According to the SEC's order, in its annual filing and proxy statement for 2020, Shift4 failed to disclose that a sibling of an executive and director received about $1.1 million in compensation as a non-executive employee of the company.

🇺🇸 CFPB sues Capital One for cheating consumers. The CFPB alleges that Capital One promised consumers that its flagship “360 Savings” account provided one of the nation’s “best” and “highest” interest rates, but the bank froze the interest rate at a low level while rates rose nationwide.

🇺🇸 CFPB finds high Buy Now, Pay Later use among high-debt borrowers. The research revealed that more than three-fifths of BNPL borrowers held multiple simultaneous BNPL loans at some point during the year, and one-third had loans from multiple providers. Continue reading

DIGITAL BANKING NEWS

🇬🇧 Bank of England announces ‘Digital Pound Lab’ to test potential capabilities. The lab will function as a technology sandbox to allow experimentation of API functionality, innovative use cases for a digital pound, and potential use models for payment interface providers (PIPs) and external service interface providers (ESIPs).

🇩🇪 Jamie Dimon wants to take JPMorgan Chase to Germany and beyond. Dimon’s plan is to sweep through Europe’s major economies, capturing enough customers to generate a new profit engine. The company plans to launch Chase in Germany in late 2025 or early 2026.

🇬🇧 Validis secures strategic investment from Citi and Barclays. The banks will leverage Validis’ platform to automate financial monitoring, deliver underwriting-ready data faster, and reduce application and credit review time. This will support existing robust decision-making processes, important for managing risk in lending environment.

BLOCKCHAIN/CRYPTO NEWS

🇰🇵 North Korea stole over $659M in crypto heists in 2024, according to a rare joint statement by Japan, South Korea, and the US. It says the Lazarus Group, a known threat group of North Korean hackers, conducted social engineering attacks and deployed cryptocurrency-stealing malware like TraderTraitor to breach exchanges.

🇺🇸 Telegram-Linked TON blockchain to expand in the US, drawn by the prospect of a welcoming regulatory backdrop under the upcoming administration headed by Donald Trump. The Open Network — or TON — Foundation anticipates the “US will soon become a global crypto hub keenly focused on innovation.”

🇸🇻 Crypto firm Tether and its founders finalizing move to El Salvador. Tether would relocate to El Salvador after the cryptocurrency recently obtained a license there as a digital asset service provider. The company plans to hire 100 Salvadorans over the next several years.

PARTNERSHIPS

🇬🇧 ClearBank partners with Airwallex. Through the integration, Airwallex customers gain access to Confirmation of Payee (CoP), a bank transfer verification system that confirms the recipient's name matches their account details before payment processing.

🇺🇸 Sage Capital Bank selects Apiture to power digital banking. The bank will elevate the online and mobile experience for its customers through a modern, intuitive user interface and comprehensive feature set. Apiture’s Data Intelligence solution will further enable the bank to deliver a highly personalized experience to customers.

🌏 Thunes and Hyperwallet expand payout access for merchants across APAC. With this new alliance, Hyperwallet can help its expansive global merchant base, including some of the world's best-known ride-hailing super apps, marketplaces and social media platforms, offer customers their preferred method of access to funds.

DONEDEAL FUNDING NEWS

🌍 LemFi moves remittances further into Asia and Europe with $53M in new funding. LemFi will use the funding to extend its offerings, scale its payment network licenses and partnerships to provide hyper-localized service, and recruit talent for its next growth phase.

🇨🇭 Swiss crypto-focused bank Sygnum hits unicorn status after raising €56.54M strategic round, which increases Sygnum’s balance sheet to support its growth plans. The funds will also support the expansion of institutional infrastructure, the development of a Bitcoin-focused product portfolio, and potential strategic acquisitions.

🇬🇧 Zepz welcomes international finance corporation as new investor. IFC’s $20 million investment represents a key step in advancing Zepz’s mission to meet the financial needs of migrants by providing fast, affordable, and secure money transfer services.

🇫🇷 Abu Dhabi-backed VC firm, Further Ventures, invests in crypto tech startup Dfns. The startup, whose technology allows large companies to build and embed crypto wallets in their operations and applications, will use the funds to expand business with financial-services clients like banks and trading platforms, the firm's CEO said.

M&A

🇺🇸 Chainalysis has acquired Alterya. The company aims to provide real-time proactive fraud protection for payments, as well as improved fraud detection during Know Your Customer (KYC) exchanges, blockchains, and wallet providers. Continue reading

🇬🇧 Intelligent Lending announces acquisition of TotallyMoney. The acquisition means the group will grow to 250 staff based in Manchester, London, Cyprus, and Italy, with a growing customer base of more than seven million. Continue reading

🇧🇷 OKTO acquires U4C to expand Pix operations in Brazil. U4C provides payment technology solutions as an authorized Pix participant, using its integration with Brazil’s financial systems to enable instant payments directly on an app or website, without the need to open a third-party bank app or enter the recipient’s data.

🇨🇦 Clearwater agrees to buy investment management platform Enfusion for $1.5B. Both companies’ boards have agreed to the terms. Should Enfusion’s shareholders and regulators approve it, Clearwater expects the deal to close in Q2 2025. Read more

MOVERS AND SHAKERS

🇺🇸 JPMorgan's Piepszak exits CEO race to become operations chief. Succession planning is in focus across Wall Street, with JPMorgan at the center as Dimon approaches two decades in the top job. The bank has rotated senior executives across divisions to provide them with more well-rounded experience.

🇳🇱 Former Coinbase and OakNorth Execs join FINOM. The company strengthens its executive team with the appointments of Kristjan Kaar as CPO and Elke Karskens as CMO. These hires aim to accelerate the company's growth toward serving one million European SMEs by 2026.

🇺🇸 Synctera’s first CFO and the 2025 road to profitability. Synctera has announced the appointment of Matias Pino as CFO, a key role in achieving the company’s goals. Click here to learn more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()