Klarna Launches Save Now Pay Later Amidst IPO Preparations

Hey FinTech Fanatic!

After a fantastic week in Bogotá, where I met some incredible people, I'm preparing to fly back home to Amsterdam this Saturday. It's been a great experience, and I can't wait to return soon.

As I wrap up my time here, I wanted to share some interesting developments in the FinTech world, particularly from Klarna:

Klarna is making significant strides in the financial technology space with the launch of two new products aimed at bolstering its "buy now, pay later" (BNPL) services.

These initiatives come as the company gears up for a potential U.S. IPO, with Goldman Sachs reportedly being considered to lead the offering.

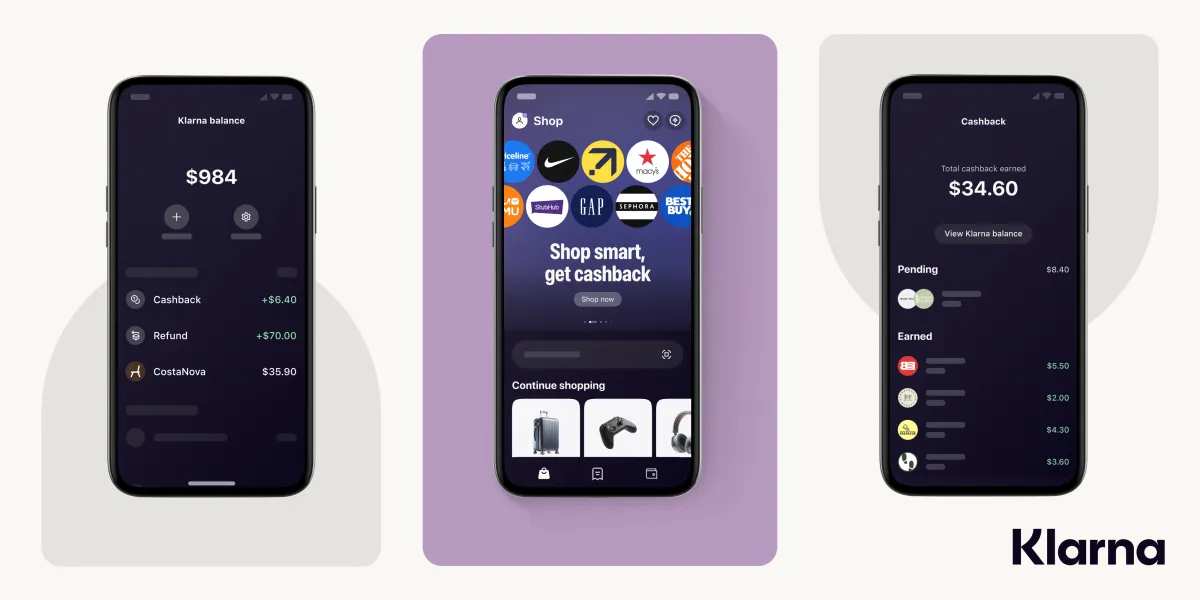

The first of Klarna's new offerings is a "balance" account available to customers in the U.S. and 11 European countries.

This feature allows users to deposit money directly from their bank accounts into Klarna, providing a convenient way to pay for purchases or installments using Klarna’s BNPL service. Klarna’s marketing slogan for this is “𝗦𝗮𝘃𝗲 𝗡𝗼𝘄, 𝗣𝗮𝘆 𝗟𝗮𝘁𝗲𝗿”

While U.S. users won’t earn interest on these accounts just yet, Klarna plans to introduce this feature in the future, aligning with its offerings in other markets.

In addition to the balance account, Klarna is introducing a cashback feature that rewards customers for shopping without needing a Klarna-issued credit card.

This enhancement marks a shift from Klarna's traditional BNPL focus to broader banking services, positioning it against major financial players like Apple, Robinhood, and Affirm.

These developments occur as Klarna refines its operations ahead of its anticipated U.S. IPO.

The company, which saw its valuation plummet from $45.6 billion in 2021 to $6.7 billion in 2022, has been restructuring by shedding non-core businesses and investing in AI.

Despite the valuation dip, Klarna’s U.S. market has seen significant growth, with revenues up 38% in the first quarter.

As Klarna continues to expand its product offerings and prepares for its IPO, the company is clearly aiming to solidify its position in the competitive fintech landscape.

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

FEATURED NEWS

📰 Yuno recently secured a $25 million Series A round to support launches in key Asian markets like Singapore, Hong Kong, and Thailand. Jonathan Hall, Head of Asia at Yuno, elaborates on Yuno’s strategic goals for these markets and how the funding will be utilized: Click here to learn more

INSIGHTS

🇺🇸 SEC fines firms $393 million in latest WhatsApp probe cases. Twenty-six financial firms agreed to pay about $393 million in total fines after the US Securities and Exchange Commission said they failed to keep their employees’ electronic communications, the latest fallout from the regulator’s so-called WhatsApp investigations.

FINTECH NEWS

🇺🇸 Mastercard collaborates with FinTech start-up, Scale. The collaboration will alleviate key technical and commercial barriers to entry that FinTech companies, aggregators, enablers, payment service providers (PSPs) and telcos face when launching payment programs.

🇺🇸 Google brings value-added services to its digital wallet. Google announced a new "Everything Else" feature for its U.S. digital wallet during the Made by Google event. This update allows users to digitally store IDs, insurance details, and other passes, reflecting the growing demand for more versatile digital wallet solutions.

🇺🇸 Gun-focused BNPL FinTech faces potential CFPB suit. Credova, a “buy now, pay later” provider focused on gun financing, is facing a potential enforcement action from the Consumer Financial Protection Bureau, according to a securities filing.

PAYMENTS NEWS

🌐 PayQuicker, a leader in global payouts orchestration, announced a collab with Thunes, a global money movement innovator, to expand its e-Wallet payout capabilities worldwide. The collaboration aims to address the increasing demand for more diverse, and flexible payout methods, especially in emerging markets where e-Wallets serve as essential financial tools.

🇬🇧 Paddle, a payments infrastructure provider, has opened applications for its third AI Launchpad, offering 75 ambitious AI founders the chance to participate in a 6-week program to help them build, launch and scale their AI-powered business ideas.

🇺🇸 Modern Treasury expands Instant Payments Support to mutual customers at 6 big banks. The expansion applies to customers of Bank of America, Cross River, JPMorgan Chase, PNC Financial Services, U.S. Bank and Wells Fargo. “By making instant payments easier to access for our customers, we’re helping them deliver better customer experiences while enabling real-time insight into cash flow,” said the firm's co-founder and CTO.

🇺🇸 FIS® announced that it is unlocking the Neural Payments solution to its clients, expanding the availability of peer-to-peer (P2P) payments by leveraging the company’s global scale and NYCE debit rails to bring this capability to a wider range of institutions.

🇺🇸 Zip announces strategic partnership with Stripe in the U.S. to accelerate market growth. With the new integration, eligible merchants can easily enable Zip as a payment method with a single click, which can help attract new customers and increase both conversion rates and basket sizes.

DIGITAL BANKING NEWS

🇧🇷 Operating since the beginning of the year, Magie, a FinTech founded by Luiz Ramalho (CEO), is transforming the financial market with its digital bank that operates exclusively within WhatsApp. Utilizing artificial intelligence (AI), Magie simplifies financial transactions, offering users a practical and secure solution without the need to access a separate banking app. Read all about it here

🇬🇧 SeerBit and Kuda join forces to enhance seamless online payments. The partnership enables millions of Kuda retail customers to make seamless payments on SeerBit’s checkout platform without inputting their card details, further assuring the security of their transactions.

🇬🇧 Science Card - a financial platform set up to accelerate innovation in science and technology, introduces a new e-money account and Mastercard debit card to help customers fund scientific research projects while they spend. This offering connects science with financial services, supporting research at leading UK universities.

🇺🇸 Fortuna Bank, an Ohio-based start-up, is preparing to open its doors after securing $20.7 million in funding and receiving conditional approval from the FDIC. The new financial institution will be majority female-owned and says on its website it will offer “boutique banking for small businesses.”

🇬🇧 Monzo rated as Britain’s top bank in survey of 36,000 people. The Competition and Markets Authority (CMA) published the findings of its latest survey of tens of thousands of people in Britain. Monzo was voted the best provider for individuals and businesses. Find out more

BLOCKCHAIN/CRYPTO NEWS

🪙 Bad actors on track to steal over $3bn in crypto heists in 2024, Chainalysis analyst says. The crypto analytics firm’s analyst made the prediction as bad actors have almost doubled the amount stolen to $1.6 billion in 2024 so far, up from $857 million stolen between January and July in 2023.

🇲🇽 LatAm crypto exchange Bitso taps Coincover to bolster digital asset protection. This strategic partnership will give Bitso complete protection against disaster situations, such as hacking or lost access, safeguarding customers’ funds.

🇮🇳 Binance returns to India as registered crypto exchange following 7-month ban. The company confirmed that it had registered as a reporting entity with India’s Financial Intelligence Unit to comply with anti-money laundering regulations for crypto exchanges operating in India.

🇧🇷 Binance to pay $1.7M fine in Brazil for derivatives trading violations. The Brazilian Securities and Exchange Commission (CVM) has ordered to immediately cease its activities and threatened the exchange with a daily fine of 1000 reais if it continued to operate without proper authorization.

DONEDEAL FUNDING NEWS

🇺🇸 Mesh, the modern connectivity layer for crypto that makes payments and deposits seamless, announced a new investment by QuantumLight, the innovative venture capital firm founded by Nik Storonsky, the CEO and founder of global financial superapp Revolut.

🇦🇪 UAE-based FinTech Yuze secures $30m investment to boost SME support. With the new funding, Yuze plans to extend its reach beyond the UAE, targeting one million SMEs and professional customers within the next five years. The company is set on breaking down the barriers that SMEs and independent professionals encounter when trying to access essential financial services.

🇨🇾 Neobank Keabank valued at €10.5m after fresh investment. The investment process involved nearly a year of comprehensive due diligence, reflecting careful evaluation and a strong belief in Keabank’s business model, technology, and team.

M&A

🇮🇱 TipRanks, an AI-based stock tip evaluator created after its founder got burned by bad advice, sells for $200M to Prytek, which had already been a big investor in TipRanks since 2017, most recently leading a $77 million round in the company in 2021. This acquisition increases Prytek's stake in TipRanks to 80%.

MOVERS & SHAKERS

🇧🇷 O2 hires former Cora and Stone executive as New CTO. João Freitas joins O2 with the goal of building an engineering department at the FinTech company, focusing on creating digital products with financial expertise. Read more

🇩🇪 European digital bank N26 announces updates to Management Board. After over 2 years at N26, Chief Regulatory Officer Jan Stechele will step away from his executive duties “at the end of Q3 2024.” Her tasks will be taken over by Chief Risk Officer Carina Kozole, with whom Jan has worked with very closely since she started at N26 in Nov. 2023.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()