Klarna Eyes $15B US IPO—One of 2024’s Biggest Listings

Hey FinTech Fanatic!

Klarna is making a bold move—targeting a US IPO in April with a valuation of up to $15 billion! If successful, this would be one of the biggest FinTech listings of the year. The buy-now, pay-later giant is set to unveil its listing plans as early as next month, marking a major comeback after its valuation nosedived from $46 billion in 2021 to just $6.7 billion a year later.

After weathering a governance shake-up and cutting costs, Klarna is on track to return to profitability. The company has leaned heavily on AI to streamline operations and recently sold off loans to free up capital for growth. With the US market in its sights, Klarna’s IPO could be a defining moment in FinTech’s post-boom era.

Will Klarna’s second act be as big as its first? Stay tuned for more! 👇

Cheers,

P.S. Join the Stockholm FinTech Week Run! 🏃♂️ Kick off your day with a high-energy run at Stockholm FinTech Week! Join Ihor Harkusha and the Fintech Running Club on February 12, 2025, for a 7KM loop around Kungsholmen. Whether you're here for the cardio or the connections, it’s the perfect way to energize before the conference!

📅 Date: Feb 12, 2025

⏰ Time: 7:30 AM – 8:30 AM

📍 Start: Komet Café, Kungsholmsgatan 10, Stockholm

Meet fellow Fintech Fanatics & Running Enthusiasts, network, and get moving! Sign up here!

INSIGHTS

🇺🇸 Klarna is targeting an 𝗜𝗣𝗢 in the US. The buy-now, pay later credit company is preparing to unveil its listing plans in 𝗔𝗽𝗿𝗶𝗹 with a valuation of up to $𝟭𝟱𝗯𝗻. Klarna has narrowed its losses in the past year and appears on track to return to annual profitability.

FINTECH NEWS

🇸🇦 Tabby taps HSBC, JPMorgan, Morgan Stanley for IPO. The buy-now, pay-later firm is working on the deal. The IPO will add to an already busy pipeline of share sales in the kingdom. The firm could potentially look to raise additional cash ahead of the listing.

PAYMENTS NEWS

🇺🇸 ACI Worldwide earns membership in 95-Plus Composite Rating Club. The stock earns a 95 EPS Rating, which means the company is now outperforming 96% of all stocks in terms of the most important fundamental and technical stock-picking criteria.

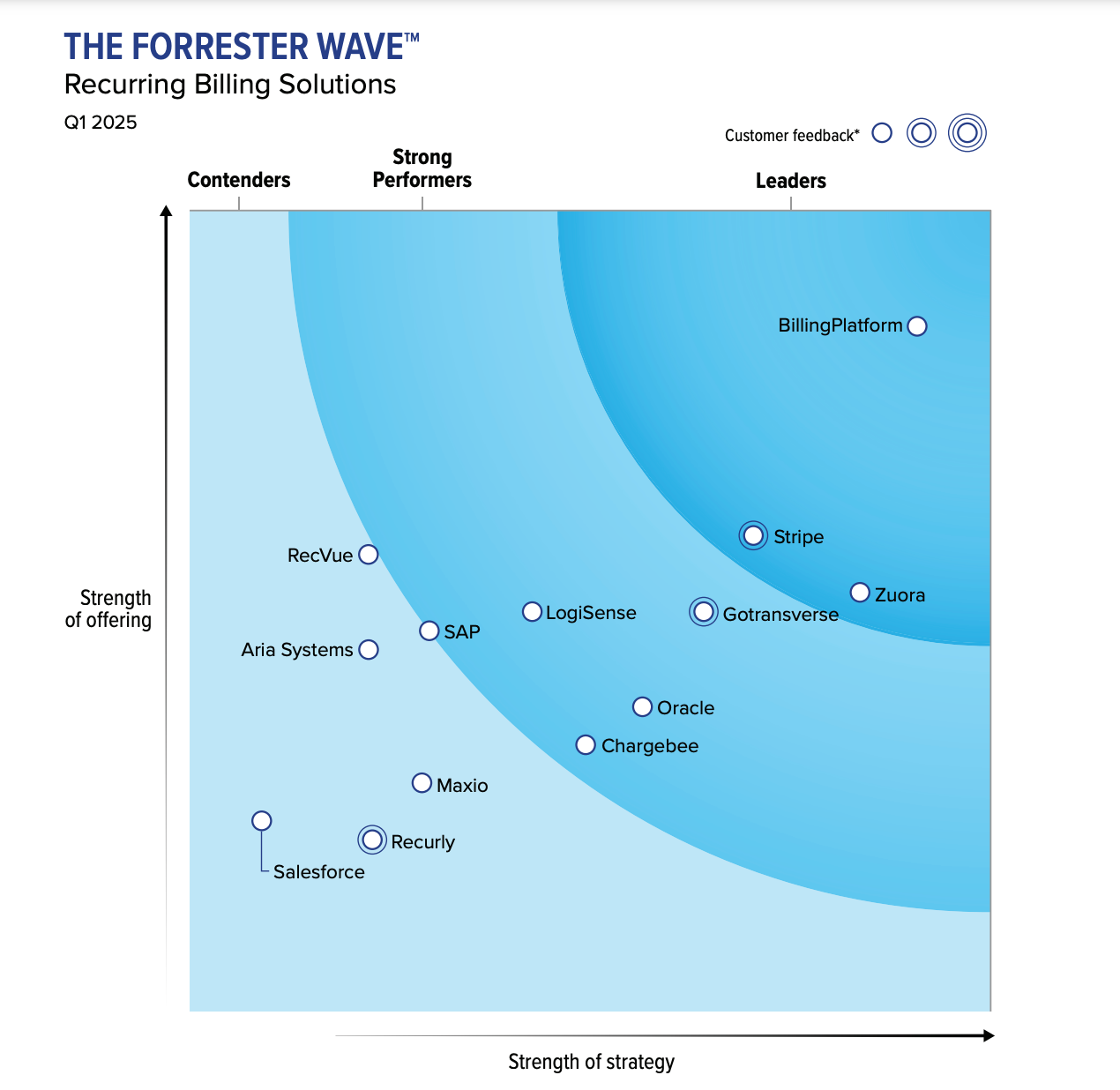

📰 The 13 𝗥𝗲𝗰𝘂𝗿𝗿𝗶𝗻𝗴 𝗕𝗶𝗹𝗹𝗶𝗻𝗴 Payments Solutions Providers that matter the most (according to Forrester..) and how they stack up 👇

REGTECH NEWS

🇺🇸 Union sues Trump admin over CFPB shutdown attempt and DOGE access. Office of Management and Budget Director Russell Vought was hit with two union lawsuits after he issued directives freezing much of the Consumer Financial Protection Bureau's (CFPB) work.

🌍 iPiD launches AI-Powered name Matching Solution for verification of Payee, thanks to Microsoft collaboration. This uses the power of Microsoft Azure OpenAI Service to address critical challenges in name matching and comply with Europe’s evolving Verification of Payee (VoP) requirements, set to take effect in October 2025.

🇬🇧 FCA intensifies scrutiny on misleading financial promotions. The FCA has decided to act against nearly 20,000 financial promotions in 2024, requiring them to be amended or withdrawn. The regulator raised particular concerns regarding promotions related to crypto assets, debt solutions, and claims management companies.

🇮🇳 India’s central bank launches exclusive internet domains to combat cyber threats. This aims to reduce cyber security threats and malicious activities like phishing; and, streamline secure financial services, thereby enhancing trust in digital banking and payment services.

🇬🇧 MPs quiz bank bosses over scale of IT failures after Barclays outage. The Treasury Committee wrote to banks including Barclays, HSBC, Lloyds and Nationwide. Addressing the UK chief executives, it asked them to outline the total amount of time that services have been unavailable due to IT failures in the past two years, and the number of customers affected.

🇪🇺 Youverse joins the WE BUILD project to advance the EU digital identity wallet. The platform is committed to contributing its expertise to this consortium, which aims to enhance business identification, legal representation, and data-sharing capabilities across Europe.

DIGITAL BANKING NEWS

🌏 TBC Uzbekistan deploys AI for enhanced efficiency and faster scalable growth. The bank is building an AI-powered digital bank of the future by focusing on personalization at scale, omnichannel experiences, and smart operations to drive profitability and excellence.

🇬🇧 Finastra debuts AI assistant for trade finance. It is designed to enhance the trade finance operations within its Trade Innovation solution. The tool bridges the knowledge gap in the trade finance industry, providing users with instant, accurate, and context-aware assistance.

🇺🇸 Wells Fargo launches new commercial banking platform with Q2. The platform is designed to “improve bankers’ ability to serve commercial clients and increase collaboration and efficiency” with this partnership.

🇺🇸 finova launches new app for savers. The native app aims to simplify the savings onboarding journey, addressing multiple common pain points and providing savers with a more streamlined digital experience. It includes essential features needed for everyday banking, ensuring users can accomplish tasks quickly and with minimal effort.

🌍 Digital bonds show significant growth. The Association for Financial Markets in Europe (AFME) has published the Distributed Ledger Technology (DLT) Capital Market report. It finds that global fixed income issuance totalled €3,049 million in 2024, or 260% up from 2023.

🇯🇵 NTT DATA unveils global insights on GenAI adoption in banking. The report has found that despite the growing adoption of GenAI technology in the industry, banks and financial institutions are split when it comes to outcome-based strategies only half of banks (50%) see it as a tool for improving productivity and efficiency.

BLOCKCHAIN/CRYPTO NEWS

🇵🇹 Ripple expands crypto payments to Portugal with Unicâmbio. This collaboration will make it easier and cheaper to send money between Portugal and Brazil using Ripple. Portuguese businesses can benefit from Ripple’s blockchain technology, enabling faster and more affordable international transactions.

🇨🇫 Central African Republic debuts meme coin 'experiment'. President Faustin-Archange Touadera said was a bid to raise the profile of one of the world's poorest countries. Meme coins are crypto tokens featuring branding or names referencing memes or internet trends.

🇺🇸 DOGE-Backed halt at CFPB comes amid Musk’s Plans for ‘X’ Digital Wallet. The DOGE gained access to the CFPB, initially, they had read-only access to documents, but by Friday night, they accessed all CFPB data, including sensitive records. By Sunday, the agency's operations were largely shut down. The situation left the CFPB with limited funding and suspended activities.

PARTNERSHIPS

🇸🇪 Kivra and Trustly launch direct debit version 2.0. This collaboration aims to establish a more effective model for digital payments in Sweden, leveraging the country's strong FinTech ecosystem to test new payment technologies.

🇧🇩 Trust Bank and TerraPay launch an international payment solution for Bangladeshi students going abroad to study. It offers a secure, completely digital, and frictionless process for international transactions, addressing the increasing demand for faster, more efficient cross-border payments.

🇺🇸 Conferma and WEX simplify B2B payments for Concur® Invoice Customers. This integration enables instant payments and allows businesses to manage working capital more effectively by utilizing WEX's credit terms. The collaboration aims to streamline payment operations, reduce costs, and provide greater control over financial activities.

🇮🇳 PayU partners with AdvantageClub.ai to unlock employee rewards. This collaboration aims to enhance employee engagement by offering a seamless experience across rewards, wellness solutions, sales incentives, and more, all on a single platform.

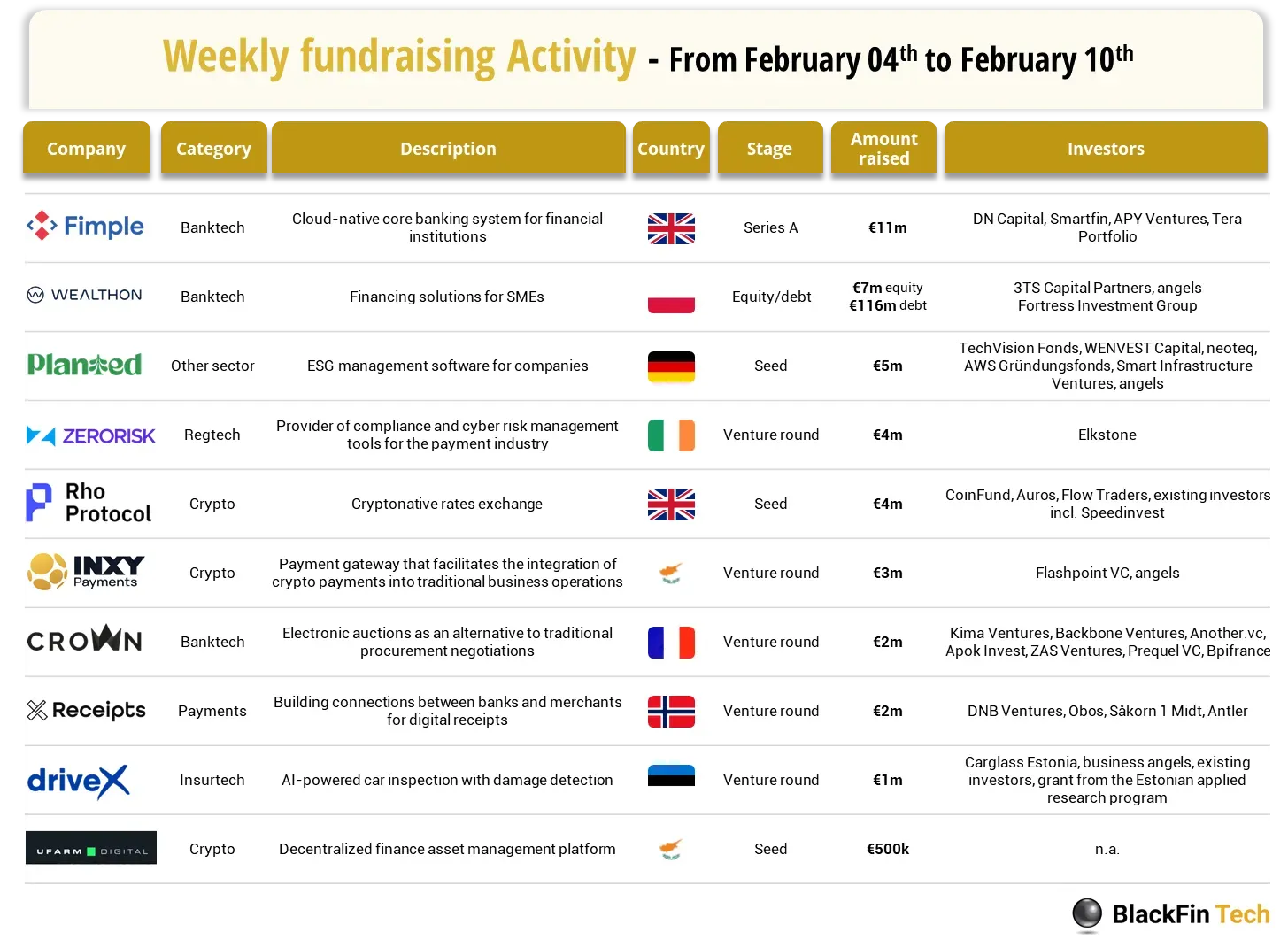

DONEDEAL FUNDING NEWS

💰 Over the last week, there were 10 FinTech deals in Europe, raising a total of €39 million in equity: 2 deals in the UK and Cyprus respectively, as well as 1 deal in Poland, Ireland, Norway, Germany, France and Estonia each.

🇬🇧 RegTech startup Datox secures pre-seed funding. This investment round marks a pivotal step for Datox AI as it continues to develop and refine its AI-powered solutions, ensuring financial institutions worldwide can meet regulatory demands with greater ease and efficiency.

🇲🇾 Earned wage access provider Payd secures $400,000 seed extension. This investment will accelerate Payd’s mission to enhance the financial well-being of employees across Southeast Asia. Continue reading

🇮🇳 Rupeeflo raises $1m pre-seed funding. The funding will enable the company to develop a comprehensive NRI investment platform, introduce instant UPI access, and expand its services internationally. Read more

M&A

🇺🇸 TD Bank seeks to raise $14 billion in Schwab Stake Exit. The bank will sell 184.7 million shares of Schwab’s common stock teeing up the biggest secondary share offering this year. Schwab has agreed to buy back $1.5 billion of its shares from TD, conditional on the completion of the offering.

🇩🇪 cleversoft completes acquisition of Fineksus. The combination of both companies brings together cleversoft's regulatory technology portfolio with Fineksus' expertise in real-time transaction monitoring and fraud prevention. Read more

🇮🇳 Perfios acquires fraud detection platform Clari5 for an undisclosed sum. The deal will enable Clari5 to expand its reach and will strengthen it ability to help financial institutions combat evolving financial crime, and the company will continue operating independently as a wholly-owned subsidiary of Perfios.

MOVERS AND SHAKERS

🇺🇸 JPMorgan names veteran Matt Sable and Melissa Smith to co-lead commercial banking. “Sable and Smith will lead a dynamic and growing business that serves more than 70,000 clients across 154 locations in the U.S. and Canada,” the release said.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()