Klarna Criticized by FSA for Risk Assessment Failures

Hey FinTech Fanatic,

Klarna Bank AB is facing criticism from the Swedish Financial Supervisory Authority (FSA) over alleged shortcomings in its anti-money laundering efforts.

A preliminary assessment by the FSA indicates that Klarna may have violated several regulations outlined in the Money Laundering Act. Issues highlighted include deficiencies in risk assessment procedures and customer due diligence measures.

This scrutiny comes as Klarna prepares for a major initial public offering next year, following a strong 27% revenue increase in the first half of 2024. The company has yet to comment on how this regulatory challenge might impact its IPO plans.

Stay tuned for more updates on this and other FinTech news below!

Cheers,

#FINTECHREPORT

🇰🇿 Kazakhstan's FinTech startups have quadrupled since 2018 🤯 More Key Stats & Info in this FinTech report. Click here to learn more

INSIGHTS

🇮🇳 Indian credit cardholders can now select their preferred network—Mastercard, RuPay, or Visa—when applying or renewing cards. This change aims to boost competition and offer greater flexibility in the digital payments landscape. The new flexibility comes as part of the RBI initiative to enhance customer choice and foster competition in the digital payments space.

FINTECH NEWS

🇸🇪 Klarna criticized by Swedish Financial Supervisory Authority over risk assessment, DI reported. According to a preliminary assessment, the lender has violated several regulations, the authority said in a July letter to Klarna CEO Sebastian Siemiatkowski, Dagens Industri said.

🇸🇬 LTP selects Avelacom for low latency cross-venue crypto trading. This collaboration will benefit LTP’s clients -- hedge funds, quantitative funds like HFT companies, FoFs, and family offices -- by improving trading speeds and reliability across crypto markets.

🇦🇷 Latin America's e-commerce king says MercadoLibre has huge room for growth. The company’s CEO wants to triple the number of users, expand online payments, leverage artificial intelligence (AI) and use drones to reach more shoppers.

PAYMENTS NEWS

🇺🇸 PayPal partners with Shopify to power a portion of Shopify Payments in the U.S. PayPal will become an additional online credit and debit card processor for Shopify Payments through PayPal Complete Payments, a solution for marketplaces and platforms comprised of flexible and powerful developer tools.

🇦🇪 Network International and ruya Bank to provide digital payment technology. The partnership will enable ruya to offer customers a smooth and secure digital banking experience by seamlessly integrating advanced digital technology with Islamic banking principles.

🇸🇬 Digital asset-focused platform JST Digital gets in-principle approval from MAS. The approval follows a steady increase in trading activity that JST Digital experienced during the 2023 calendar year. Keep reading

🇮🇸 Seðlabanki Íslands expresses an interest in joining T2 and TIPS. The assessment will initially focus on TIPS, before looking at T2. The TARGET Services, which include T2 and TIPS as well as other services, are designed to promote a European payment landscape that is resilient, secure and efficient.

🇩🇪 Inpay allies with global payment orchestration platform FinMont. The new alliance will allow FinMont to incorporate Inpay’s global banking network into its own payments ecosystem, expanding its global reach and speeding up cross-border disbursement times for the benefit of its international travel merchants.

🇬🇧 Stripe-backed FinTech warns of Europe’s over-reliance on US payment systems. Europe should reduce its reliance on US payment systems as the prospect of a Trump presidency increases risks around the critical infrastructure’s resilience, the chief executive of Stripe-backed UK tech group TrueLayer has warned.

🇺🇸 68% of businesses plan to add Instant Payments within 2 years. Instant payments promise a more agile financial ecosystem, but the shift from traditional methods to systems like FedNow® and RTP® faces challenges despite widespread enthusiasm.

🇺🇸 Cogitate partners with One Inc to enhance digital payments for insurers. The partnership focuses on addressing the growing complexity of digital insurance payments, driven by economic changes and the increasing digitisation of the industry. Access the full article

🇪🇬 Contact Pay and Basata team up to boost e-payment infrastructure in Egypt. The agreement also aims to expand the horizon of digital financial services provided by Contact Pay across the country, reaching a wider customer base by leveraging Basata’s network.

OPEN BANKING NEWS

🇬🇧 Truelayer expands partnership with Stripe to power a new Pay By Bank feature in the UK. After unveiling Pay by Bank in May, Stripe has now chosen TrueLayer as its open banking payment partner in the UK, integrating Pay by Bank into Stripe Elements as a new payment method for UK users.

REGTECH NEWS

🇱🇹 iDenfy partners with Bitlocus to secure crypto exchange platform with Biometric ID Verification. iDenfy’s full-stack Know Your Customer (KYC) solution will aim to increase conversions and help Bitlocus maintain a simple and compliant verification flow. Read on

DIGITAL BANKING NEWS

🇰🇬 Thunes and Commercial Bank Kyrgyzstan | MBANK forge strategic alliance to transform cross-border payments in the Silk-Road Region. The collaboration empowers local licensed institutions and merchants to conduct a wide range of transactions, including B2B, P2P, B2C, and C2B payments.

🇬🇧 Lloyds sets up anti-scam working group to tackle fake websites. The formation of the working group follows Lloyds' warning about a surge in rogue retailers using fake websites to trick people into purchasing items that don’t arrive, driving a 211% increase in card payment disputes this year.

🇺🇸 Rapid Finance announces integration with Q2’s digital banking platform to provide Small Business lending solutions. The integration will allow financial institutions to offer flexible financing options and fast access to working capital, including small business loans, sales-based financing and business lines of credit.

🇦🇺 Judo Bank upgrades its lending business banking platform with Thought Machine technology. After an extensive market search, Judo Bank has chosen Thought Machine as the vendor capable of meeting its requirements as it continues to scale. Continue reading

🇮🇩 Indonesia’s Krom Bank taps AWS Cloud expand its digital banking services. By leveraging AWS cloud technology, Krom Bank, the first in Indonesia to use the AWS Asia Pacific (Jakarta) Region, can rapidly develop and improve its services, ensuring data compliance while offering faster service to local users.

🇬🇧 Revolut’s decision to move into a shiny new Canary Wharf HQ in June came shortly before it won its years-long battle with regulators for a UK banking licence. The switch to the heart of London’s financial district is symbolic — the fast-growing FinTech startup that urged staff to “get sh*t done” is now a respectable name aiming to compete with more established firms.

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Brazil preps new round of CBDC pilots. The country's central bank has been working on a digital real project for several years, beginning a first pilot phase in 2023 testing privacy and programmability functionalities through the implementation of a specific use case.

DONEDEAL FUNDING NEWS

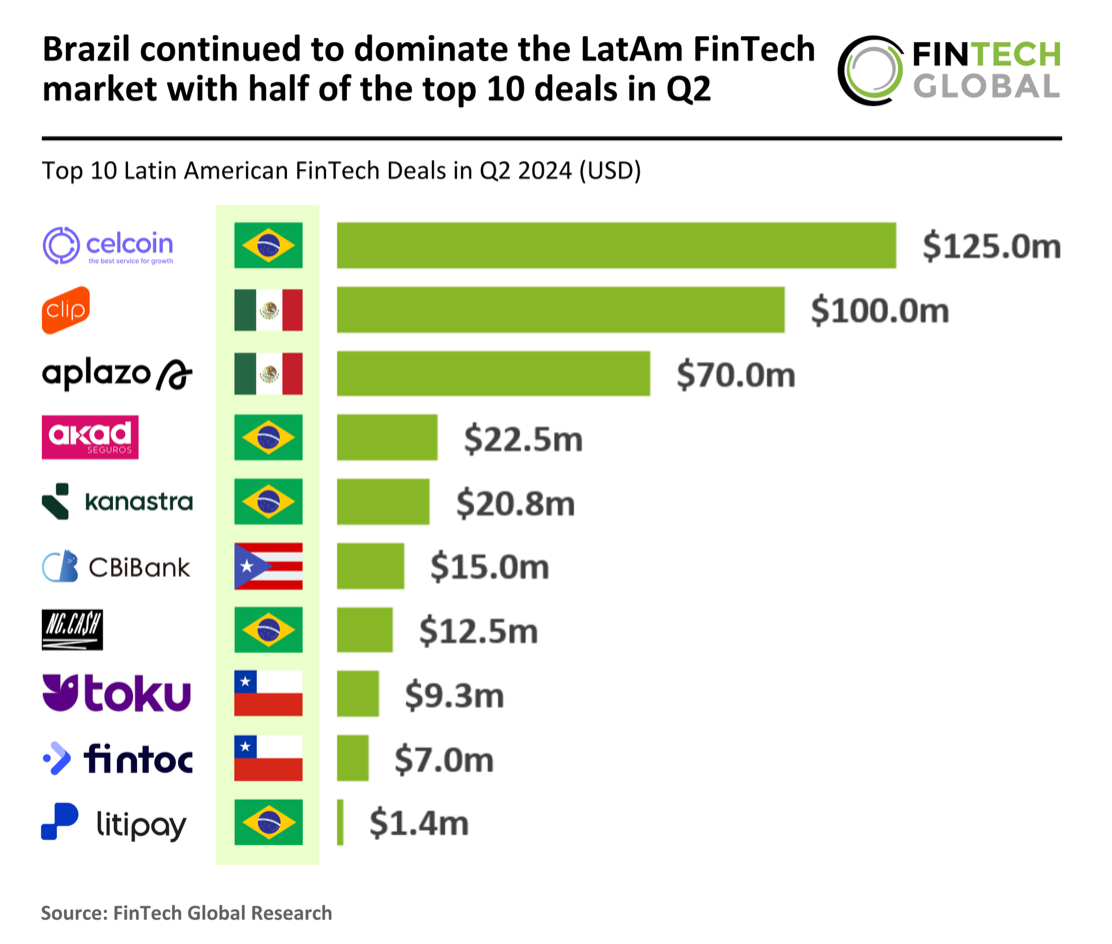

🇧🇷 Brazil continued to dominate the LatAm FinTech market in Q2 👇

🇬🇧 The Bank of London Group has announced a fresh funding round just days after it was served with a winding-up petition by the U.K.’s tax authorities and its CEO said that he would step down from his post. The FinTech said on Sunday that it had raised £42 million ($55 million) in August in an over-subscribed funding round.

🇺🇸 AI bookkeeping startup Finally has raised another big round: $200M in equity and debt. The company plans to deepen its investment in sales and marketing and add new features such as a module for global hiring in its hiring product and more support for payments on the finance side.

🇬🇧 Klarna-Backer Atomico raises $1.24 billion to spur startup growth in Europe. With the new funds, CEO Niklas Zennström said Atomico will remain focused on companies like these as well as those in FinTech and climate tech. Read on

🇨🇿 VC market in Czech Republic is "getting more professional", says Jaroslav Ton, founder and CEO of Malcom Finance. He said: “It is not just about one or two funds anymore like it used to be 10 years ago. Right now, there are plenty of venture capital funds out there. I think that is great news."

M&A

🇺🇸 Mercury acquires Teal. The acquisition enhances expertise in accounting, simplifying complex financial workflows. Partnering with Mercury provides accountants and their clients access to a trusted bank account used by over 200,000 companies.

🇺🇸 Global Payments acquires Yazara. Global Payments partners with over 5 million merchants across more than 100 countries. This extensive global network will enable Yazara and Global Payments to connect with an unprecedented number of merchants.

🇺🇸 GTreasury acquires CashAnalytics, an advanced cash forecasting solution. The acquisition of CashAnalytics strengthens GTreasury’s offerings by providing a rapid, seamless treasury automation solution that integrates smoothly with their Digital Treasury Solutions.

MOVERS & SHAKERS

🇦🇺 Australia's Westpac names new CEO, moving on from governance crisis. Anthony Miller, a former head of investment bank Deutsche Bank in Australia who joined Westpac in 2020, will take over on Dec. 16 after Westpac's annual meeting, Australia's oldest bank said.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()