Klarna Considers Secondary Sale to Boost IPO Prospects

Hey FinTech Fanatic!

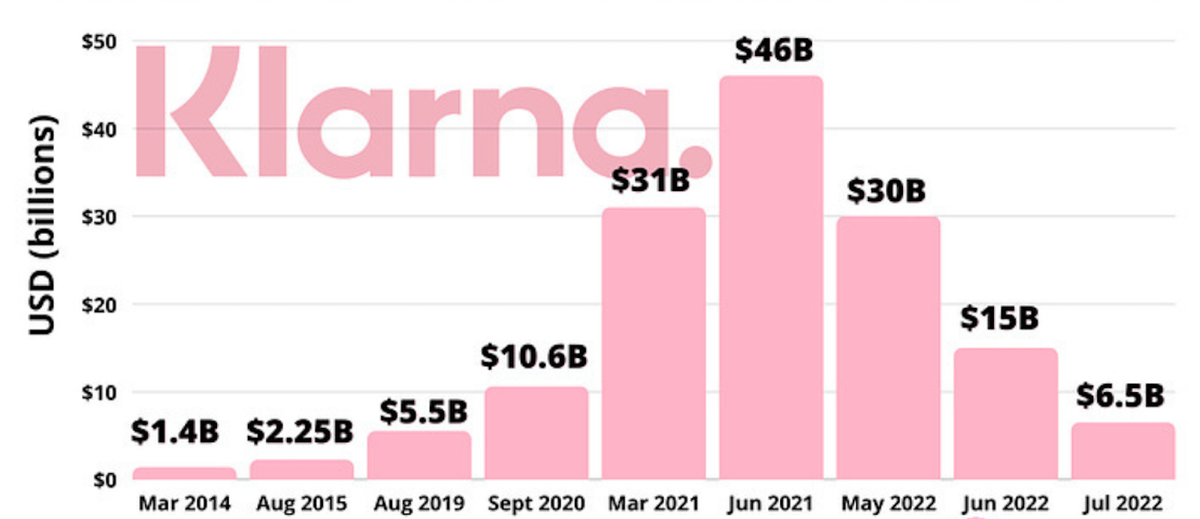

Klarna, the Swedish “buy now, pay later” firm, is preparing for a major IPO next year. Before that, it is exploring a secondary share sale to see if investors value it above its last valuation of roughly $7 billion.

Goldman Sachs is advising the company on this potential share sale, which could value Klarna at $10 billion or more.

Klarna’s secondary sale would allow it to establish a new valuation ahead of its IPO. The company had a peak valuation of $46 billion in 2021, which dropped by 85% the following year.

BlackRock, a major investor, has increased the value of its Klarna shares by 59% since last year, valuing the company at $9.5 billion. This secondary sale could help ease pressure on current shareholders before the IPO.

Other tech firms, such as British FinTech Revolut, are also preparing for IPOs and conducting secondary sales.

A higher valuation from this sale would enhance Klarna’s reputation after recent internal conflicts within its board, leading to leadership changes.

Cheers,

SPONSORED CONTENT

POST OF THE DAY

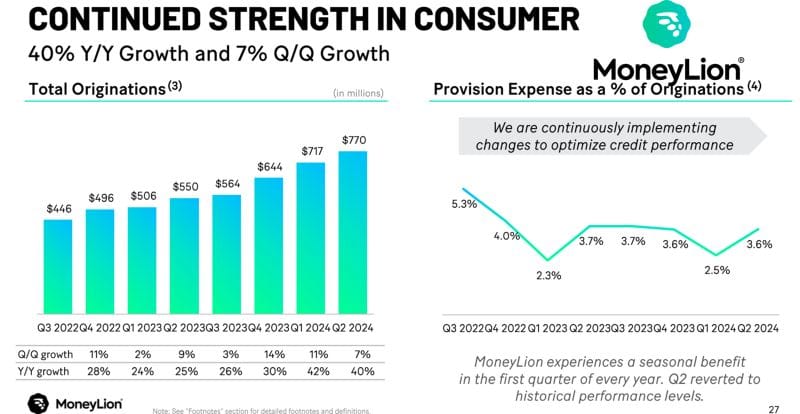

🇺🇸 MoneyLion reported earnings recently. Check out Cole Gottlieb's quick takeaways below: ⤵⤵⤵

FINTECH NEWS

🇬🇧 Orenda Finance partners with Tribe Payments. Orenda is an embedded financial service ecosystem, offering a suite of configurable products and services, including no-code embedded financial services and an end-to-end programme manager.

🇦🇪 Ziina becomes first venture-backed startup to secure UAE Central Bank SVF license. Alongside securing the license, Ziina is also reportedly in the process of raising a substantial financing round from institutional investors. Read on

PAYMENTS NEWS

📣 Unlimit and Yuno join forces to enhance payments for businesses worldwide. This strategic partnership will enable businesses of all sizes to streamline their online payments, reduce transaction costs, and improve the purchasing experience for their customers – no matter where they are in the world.

🇳🇱 Mondu BV secures an EMI License from De Nederlandsche Bank (DNB) in the Netherlands. The license will accelerate Mondu’s expansion across Europe while enabling the company to evolve even faster, support more customers, and launch complementary payment services like eWallets and Credit Cards.

🇩🇴 Apple Pay has officially launched in the Dominican Republic! Now, thanks to partnerships with Banco de Reservas, Qik Banco Digital Dominicano, Banco Popular Dominicano and Banco BHD, Mastercard cardholders can enjoy fast, convenient, and secure payments both in-store and online.

🇺🇸 Stripe launches No-Code adaptive pricing for businesses globally. Stripe users globally on Checkout or Payment Links can turn on Adaptive Pricing with one click in their dashboard. Stripe supports merchants in 50+ countries with Adaptive Pricing, enabling them to present in local currencies to buyers in 150+ countries around the world.

🇺🇸 PayPal Holdings, Inc. announced that Fastlane by PayPal is now available for U.S. businesses of all sizes, helping to increase their sales and drive customer loyalty in time for the upcoming holiday shopping season. Continue reading

OPEN BANKING NEWS

🇸🇬 Brankas and Boost Capital have launched LoanLink, the first chat-based lending solution of its kind in Southeast Asia. LoanLink provides a user-friendly chat interface that facilitates seamless integration and instant loan applications.

🇬🇧 Flexys partners with Moneyhub. By partnering with Moneyhub, Flexys will enhance its offering with cutting-edge Open Banking technology, providing unprecedented insights and streamlined processes for both collections professionals and their customers.

🇺🇸 Nacha announces Visa as Preferred Partner. Through Tink, Visa combines the power of its payments and open banking expertise to build innovative products that optimize ACH payment experiences, making it easier for users to connect accounts and provide trusted parties with access to their financial data.

DIGITAL BANKING NEWS

🇺🇸 Greenlight teams up with Google Wallet to bring financial independence to New Kids Smartwatch. From now on, Greenlight’s debit card can be seamlessly added to the Google Fitbit Ace LTE so kids can learn to spend wisely and safely tap to pay on the go with their smartwatch.

🇻🇳 HD Bank launches Vikki Digital Bank in Vietnam powered by Thought Machine’s Vault Core. Vietnamese commercial bank HD Bank has leveraged its existing relationship with core banking vendor Thought Machine to launch Vikki Digital Bank.

🇲🇽 Kapital Bank reports historical records in credit placement, acquisition, customer growth and revenue during 2Q24. As of the second quarter of the year, Kapital Bank reported a credit placement of 2 billion pesos, marking a 70% increase from the previous quarter.

🇵🇭 Tonik Bank is now in Cebu. This move underscores Tonik's vision for financial inclusivity, offering accessible banking solutions to more Filipinos. Now, customers in Cebu can access Tonik's full range of products and services.

🇺🇸 BMG Money and WebBank team to offer employment-based loans. The partnership aims to broaden financial inclusion for employees and retirees with limited access to socially responsible loan programs, the companies said in an Aug. 6 news release.

BLOCKCHAIN/CRYPTO NEWS

🇪🇺 Bitstamp announces a partnership with Stripe to support Stripe's fiat-to-crypto onramp in EU. Through this partnership, Bitstamp will manage fiat-to-cryptocurrency conversions and transfers to consumers, expanding Bitstamp-as-a-service and solidifying cryptocurrency's role in digital payments.

🇺🇸 Transak first to introduce wire transfer to buy Crypto in US. The introduction of wire as a payment method to purchase cryptocurrencies is a notable step towards enhanced accessibility and convenience for cryptocurrency enthusiasts across the nation.

🇨🇦 Crypto exchanges must register as investment dealers in Canada. The CSA and the Canadian Investment Regulatory Organization (CIRO) have issued a statement “reminding” crypto trading platforms that they must comply with Canadian securities laws by registering as investment dealers and having membership with CIRO.

🇯🇵 Japan’s top finance regulator hesitant on Crypto ETF approvals. The head of Japan’s finance regulator said “cautious consideration” is needed in deciding whether to follow the likes of Hong Kong and the US by approving crypto-linked exchange-traded funds.

DONEDEAL FUNDING NEWS

🇵🇭 Philippine FinTech GCash still eyeing IPO after MUFG investment. The Philippines’ top mobile payments provider GCash is still keen on going public after its latest investment round pushed the FinTech company’s valuation to $5 billion.

🇺🇸 Octane raises $50 million in series E funding round. The capital will fuel Octane's expansion into new markets, supercharge its growth in existing markets, and position the company even more favorably for long-term success. Read on

M&A

🇺🇸 NY-based FinTech Payoneer has acquired Skuad, a Singapore-based global HR and payroll startup, for $61 million in cash, the company exclusively told TechCrunch. Payoneer said it could also pay up to another $10 million, contingent on if Skuad meets various performance goals within the first 18 months of the acquisition.

🇺🇸 Sendsprint expands to the US with Nobel Financial Inc. acquisition. This will enable Sendsprint to offer money transfers and gift-sending from customers in 16 US states. The acquisition comes at a time when remittance flows to Africa continues to grow.

🇺🇸 Flywire has announced plans to acquire Invoiced, aiming to strengthen its B2B payments division. This move is expected to enhance Flywire’s software suite for its global clients and target market. Flywire estimates this market to encompass around $10 trillion in global payment volume.

MOVERS & SHAKERS

🇺🇸 Remitly Global appoints finance professional Vikas Mehta as CFO. Mehta will lead all “aspects of Remitly’s financial planning and analysis, procurement, accounting and tax, investor relations, and treasury.” Keep reading

🇺🇸 Torpago announced the hiring of Chris Boncimino to head Business Operations. He will lead business operations with a focus on growth and product development for Torpago's ‘Powered By' program management service.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()