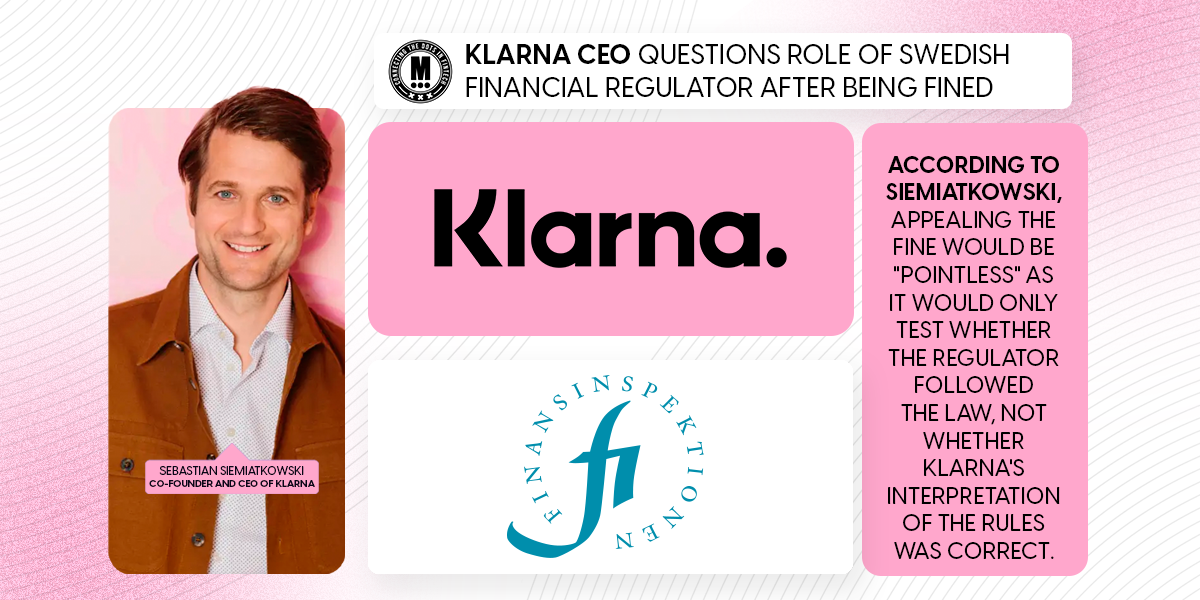

Klarna CEO Questions Role of Swedish Financial Regulator After Being Fined

Hey FinTech Fanatic!

Klarna has decided not to appeal its $50M fine from the Swedish financial regulator (FI) for anti-money laundering rule breaches, but their CEO is raising questions about regulatory oversight. Sebastian Siemiatkowski, Klarna CEO and co-founder, highlighted the challenges in interpreting compliance requirements, stating the company had actively sought guidance from FI on money laundering rules interpretation.

The regulator's investigation revealed that between 2021 and 2022, Klarna showed "significant deficiencies" in its risk controls, particularly lacking assessments of how their products could be used for money laundering or terrorist financing.

According to Siemiatkowski, appealing the fine would be "pointless" as it would only test whether the regulator followed the law, not whether Klarna's interpretation of the rules was correct. He emphasized that despite their proactive attempts to seek clarification, the regulator maintained that "their role is not to consult, we are to interpret, then they judge our interpretation."

Siemiatkowski argues that the current regulatory structure, where FI acts as "police, prosecutor, and court," raises important questions about regulatory effectiveness: "Not because there was money laundering, but because we interpreted 'wrong'." This hints at broader challenges FinTechs face in navigating regulatory compliance.

Have a great Tuesday. I'll be back with more FinTech industry updates tomorrow!

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

#FINTECHREPORT

📊 Revolutionizing cash flow forecasting with AI. AI is transforming cash flow forecasting, enabling treasurers to navigate complex financial landscapes with unprecedented accuracy and foresight. Here’s how

FINTECH NEWS

🌍 FinTech Ad Spending climbs 45% in last 3 Years. The 45% figure comes from Outfront Media, an advertising company whose clients include several high-profile FinTechs, including CashApp, Klarna, PayPal and its peer-to-peer arm Venmo. Also comes as FinTechs grow in popularity among users, with these companies setting the stage for potential acquisitions or initial public offerings (IPOs).

🇸🇬 SC Ventures launches billing FinTech for APAC SMEs. The FinTech investment and incubation arm of Standard Chartered, has launched Labamu, a platform that will offer SMEs digital billing, catalogue, stock and material management, plus customer relationship management and reporting services. Read more

🇮🇳 IndiaBonds.com launches Digital Fixed Deposits. The platform offers a fully digital, paperless onboarding process, including quick KYC completion, making it easy for retail investors to get started. Its integrated portfolio dashboard provides clear insights into cashflows, returns, and fixed income allocations, helping investors track and manage their investments efficiently.

🇬🇧 Zilch hits 4.5M customers, steady revenue growth. Zilch reported in September 2024 that it has generated $130 million or £100 million in revenue while turning the corner on profitability. The FinTech compares itself to other big name FinTechs like Revolut, Starling Bank, and Monzo in regard to its speed of growth. Checkout.com is Zilch’s primary acquiring partner globally.

🌍 15 AI-powered FinTechs to watch in 2025. Despite a funding slowdown in FinTech during 2024, investors remain optimistic, especially about AI-driven innovation. AI startups are transforming banking, investing, saving, and financial workflows. The sector’s potential positions AI as a key focus for future FinTech growth.

🇶🇦 FinTech investments key to Qatar's economic growth. The market is expected to grow by 7.04%, reaching $547.10m (QR1.9bn) by 2028. Revenue growth in the digital investment market is forecast at 7.53% for the following year. This highlights FinTech's pivotal role in Qatar’s economic expansion. Read more

PAYMENTS NEWS

➡️ Hard 🆚 Soft Card Declines, by Spell

Here is what you need to know:

🇬🇧 Merchants choose payment providers based on business commitment to ESG. A study by Ecommpay reveals that 61% of e-commerce merchants prioritize ESG commitments when selecting payment providers, with 38% considering it. Miranda McLean, Ecommpay’s CMO, emphasizes the growing importance of ESG in partnership decisions, urging providers to showcase their credentials.

🇸🇬 DBS: Digital Ang Baos gaining popularity with DBS/POSB reporting a doubling of customers using their digital gifting services in 2024 compared to the previous year. Over 70% were first-time users, transferring SGD 39 million during Lunar New Year. Read More

🇳🇱 ABN Amro's Tikkie Payments hit record 7.4 billion Euros in 2024. Earlier this year, Tikkie passed the milestone of 10 million users. People in the Netherlands mostly use Tikkie to share the costs of dinners, groceries and lunches, which are the three most common descriptions given for Tikkies. It is also becoming more and more common to share the costs of streaming services.

🇺🇸 DraftKings tries subscription payments. The company is promoting the new service by offering customers boosted offers if they sign up. DraftKings said: “The subscription service was designed to offer our customers an enhanced fan experience, creating more excitement and value to our extensive parlay offering”.

REGTECH NEWS

🇸🇪 Klarna CEO disputes Swedish regulator after fine. Sebastian Siemiatkowski, Klarna CEO, said the regulator, known as FI, had a “strange role as police, prosecutor, and court,” after the buy now, pay later firm decided it would not appeal against the $50M fine it received for breaking anti-money laundering rules.

🇺🇸 HighRadius Patents AI Document Capture Tech. HighRadius announced that it secured an exclusive patent by the U.S Patent and Trademark Office for a Machine Learning (ML)-based system and method for correcting image data. The new approach significantly “reduces the need for manual verification, while enhancing accuracy.”

🇺🇸 Broadridge tech optimises Pemberton’s operational efficiencies. Pemberton selected Broadridge’s technology to help it gain greater operational efficiencies and scale its private debt and collateralized loan obligation (CLO) businesses to meet growing demand. Read on

🇺🇸 US regulator warned banks on crypto, but did not order them to stop providing banking services to crypto companies. A court ordered the FDIC to release supervisory "pause letters" following a lawsuit by Coinbase-hired researchers. Continue reading

DIGITAL BANKING NEWS

🇨🇭 UBS investigates undisclosed Nazi-linked accounts at Credit Suisse. UBS is collaborating with independent ombudsman Neil Barofsky to investigate. Barofsky’s probe aims to address the legacy of these accounts held at Credit Suisse’s predecessor banks. The investigation underscores UBS’s efforts to ensure transparency and accountability.

🇴🇲 Oman ATMs grow despite digital banking. The modest rise in ATMs reflects ongoing demand for accessible cash withdrawal services, especially in economically vibrant regions. However, financial institutions are keen to balance this with investments in digital banking infrastructure to cater to tech-savvy consumers.

🇶🇦 AlRayan Bank launches AlRayan Go mobile banking app. Through the Backbase-powered offering, users will be able to make top-ups to the Hala and Shahry mobile plans provided by Qatari telecoms provider Ooredoo, as well as pay bills to Kahramaa, the General Electricity and Water Corporation of Qatar.

🇮🇳 Federal Bank transforms corporate banking landscape with FedOne™. The bank has implemented Nucleus Software’s cutting-edge transaction banking platform FinnAxia®. This partnership signifies a transformative moment in modernizing Federal Bank’s corporate banking services, focusing on delivering exceptional value to corporate and SME customers.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 OCBC launches tokenised corporate bonds. According to OCBC, the tokenised bonds are available in S$1,000 denominations, enabling clients to diversify their portfolios more easily. The tokenised bonds, which reference investment-grade assets, are tailored to clients’ desired tenors and yields. Continue reading

🇺🇸 MicroStrategy buys bitcoin after stock offering. The preferred stock offering is part of its plans to raise $42 billion of capital through 2027 using at-the-market stock sales and convertible debt offerings. MicroStrategy has already surpassed two-thirds of its equity goals. Read more

🇺🇸 MatterFi’s Michael “Mehow” Pospieszalski’s plan to bring crypto mainstream. The company develops secure infrastructure for software and hardware wallets and custody systems, ensuring safety and accessibility. Inspired by traditional finance apps, users can send crypto using names instead of addresses.

PARTNERSHIPS

🇸🇪 Doconomy partners with KBC for youth financial wellbeing. Doconomy’s savings module helps users set personalized goals and develop sustainable saving habits. This collaboration aligns with KBC’s focus on empowering younger generations. The initiative combines financial and environmental sustainability in banking.

🇪🇬 PayMint launches Meeza Card with ADIB. According to ADIB-Egypt, the launch supports its initiative to advance financial inclusion “in line with the vision of the Egyptian government and the Central Bank of Egypt” by collaborating with FinTech companies to drive the nation’s shift towards a cashless society.

🇦🇺 Pepperstone sponsors Aston Martin Aramco. The sponsorship deal will see the online trading provider as the F1 team’s Global Forex and Trading Partner. By partnering up with Aston Martin Aramco, Pepperstone expects to gain further exposure across the globe as a renowned brokerage firm.

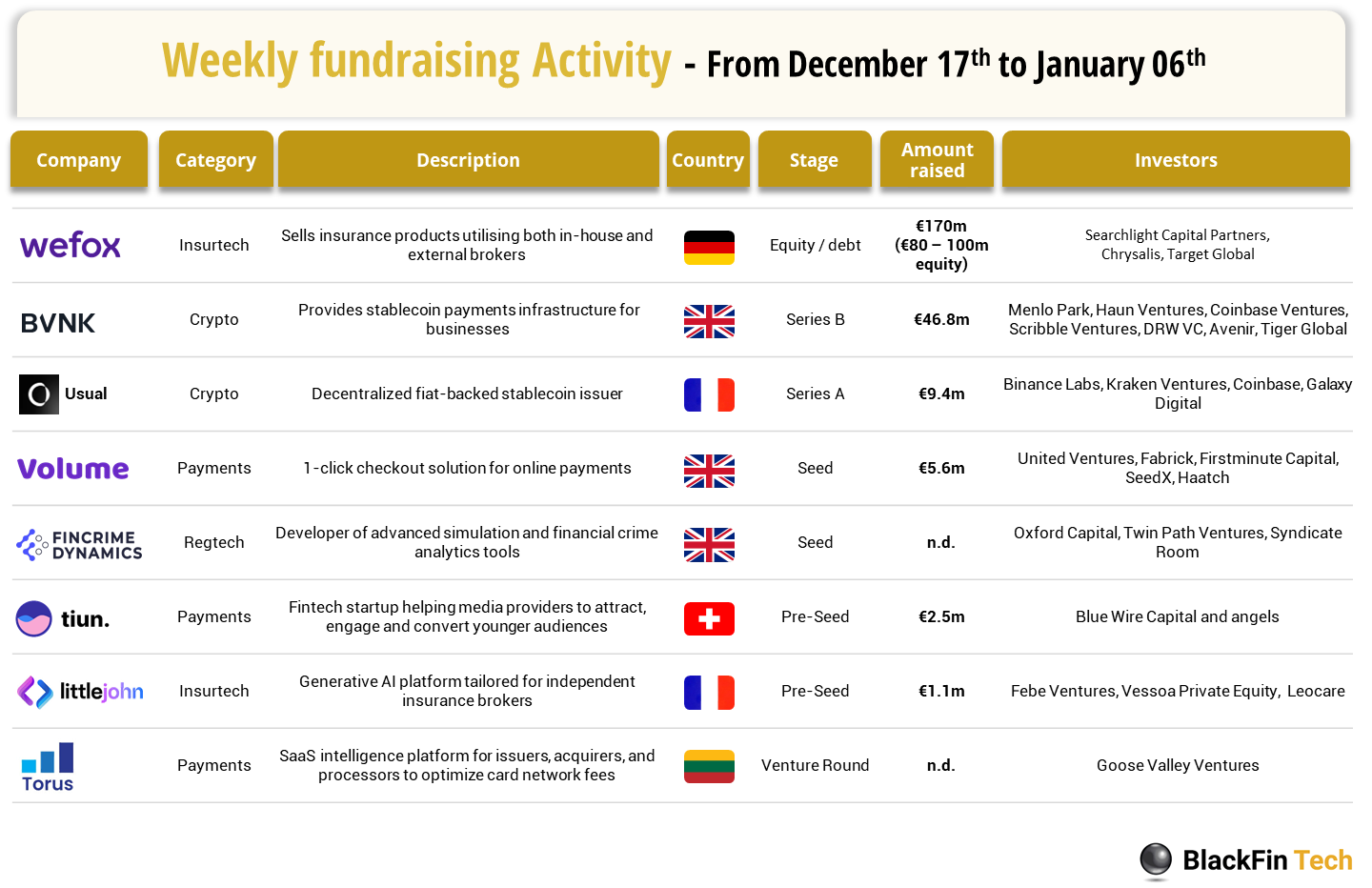

DONEDEAL FUNDING NEWS

💰 Over the last three weeks, there were 9 FinTech deals in Europe, raising above €145 million in equity, with 3 deals in the UK, 2 deals in France, 1 deal in Germany, 1 deal in Switzerland, and 1 deal in Lithuania. Read the complete BlackFin Tech overview article

M&A

🇺🇸 FalconX acquires Arbelos Markets. This acquisition will further enhance FalconX’s capabilities to provide customers with access to deeper liquidity and bespoke derivatives solutions, supporting institutions with a more sophisticated and diversified range of trading strategies.

🇯🇵 SBI acquires majority stake in Solaris. SBI’s €100 million investment will bring the total funding to €150 million. Additional financing through AT1 bonds is part of the deal. Solaris confirmed a coordinated financing concept has been submitted to shareholders for approval. The agreement is expected to be finalized this month.

🇺🇸 Elite acquires Tranch to streamline law firm payments. Elite’s acquisition of Tranch will enhance its ability to augment law firms’ financial and business management processes by delivering elevated, end-to-end visibility and management of revenue cycles to help firms accelerate growth. Click here for more information

MOVERS AND SHAKERS

🇺🇸 HSBC names Lisa McGeough as US CEO. McGeough is the first woman CEO to lead the bank's operations in the region in more than a decade. She will be responsible for the Asia-focused lender's growth in the United States, including the expansion of its corporate and institutional banking business in North America.

🇺🇸 Onbe hires Sayid Shabeer as CPO. "As financial institutions and software companies increasingly seek to embed modern payment capabilities into their platforms, Sayid's experience in building scalable solutions and market-driven innovations will help us extend our reach across new segments and clients,”says Bala Janakiraman, CEO of Onbe.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()