Kakao Founder’s Arrest Shakes South Korea’s Tech and Banking Sectors

Hey FinTech Fanatic!

The arrest of Kakao founder Kim Beom-su has created turmoil in South Korea's FinTech and AI sectors, highlighting deep-rooted issues in the country's business and political environment. Kim, once South Korea's richest person, was arrested on charges of stock manipulation during Kakao's acquisition of SM Entertainment.

This case has serious implications, particularly for Kakao's diverse business portfolio, which ranges from messaging apps to FinTech and AI.

If convicted, Kim could lose control of Kakao Bank, one of South Korea's largest internet banks, potentially disrupting the company’s future. Kakao's rapid expansion into various sectors has also led to internal challenges, with critics noting that its horizontal structure and "start-ups within a start-up" model spiraled out of control, causing public backlash and dissatisfaction among investors.

The case has revived concerns about the dysfunctional relationship between business, politics, and law enforcement in South Korea, with some viewing the prosecution as politically motivated.

The arrest also comes at a time when Kakao and other South Korean tech firms are under increasing pressure from global competitors, raising concerns about the future of the country's tech industry.

As Kakao shifts its strategy to focus on core businesses, the company's ability to navigate these challenges will be crucial.

Read more FinTech industry updates below and I'll be back with more news tomorrow!

Cheers,

ARTICLE OF THE DAY

🎤 In my latest Q&A, Yusuf Ürey, Co-Founder & CEO of Innovance, shares valuable insights into the company’s approach to digital transformation. Dive into our conversation to learn more about his vision and the innovative solutions driving their success.

#FINTECHREPORT

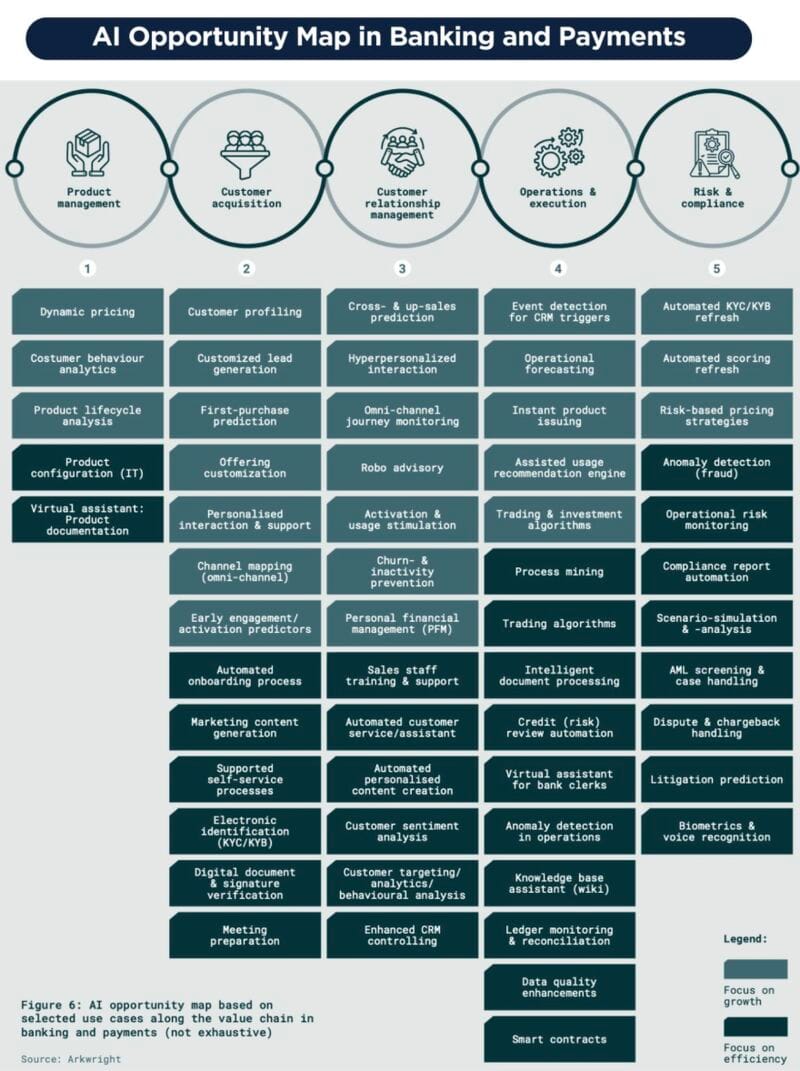

💡AI is revolutionizing the financial services industry.

Let's dive into AI Opportunities in Banking and Payments:

PODCAST

🎙️ In this episode of FinTech Insider Insights, host Kate Moody delves into the intriguing intersection of financial services and sports. Joining the discussion are Suresh Balaji, CMO at Lloyds Banking Group; Steven Watson, Global Head of Brand & Content at Airwallex; and Paul Stoddart, President at GoCardless. Tune in for insights from these top experts. Listen to the full podcast episode

FINTECH NEWS

🇺🇸 a16z-backed FinTech Tally, which raised $172M in funding, is shutting down after running out of cash. In a LinkedIn post shared earlier Monday, founder and CEO Jason Brown said the “sad and difficult” decision to close down Tally was not the outcome the company had “hoped for,” but that “after exploring all options,” it was “unable to secure the necessary funding to continue our operations.”

🇰🇪 PrivPay, a Kenyan FinTech that allowed customers to make M-PESA transactions without revealing their personal details, shut down in May 2023 after Safaricom cut its access to M-PESA APIs. Safaricom’s action was connected to a worry that the FinTech’s offering violated several compliance issues, two people with direct knowledge of the matter said.

🇮🇪 GoCardless and Future Ticketing join forces to enhance ticket affordability in the UK and Ireland. The collaboration aims to simplify and reduce the cost of purchasing tickets and memberships for consumers across the two countries. The core of this partnership revolves around making event attendance more affordable.

🇬🇧 Paymentology achieves Mastercard’s Cloud Edge certification. The new certification aligns with Paymentology’s cloud-first approach. Mastercard’s Cloud Edge allows customers to connect to Mastercard from cloud providers of their choice and supports multiple hybrid connectivity patterns.

🇬🇧 Trustly UK surpasses £13bn in first half of 2024, outpacing 2023’s total and marking rapid growth in Open Banking adoption, with Trustly enabling organisations to enhance services for the country’s consumers. Read more

🇵🇹 Unlimit and Unicâmbio join forces to transform digital transactions with enhanced Unimoney Wallet. Customers of Portugal’s oldest and largest foreign exchange bureau can expect newly streamlined digital transactions and an even more seamless currency exchange experience.

🇺🇸 Mbanq enhances credit decisioning for banks and FinTechs with AI tech from SMEApprove. Mbanq implements AI-driven credit evaluation for financial platforms to enable faster, more accurate credit decisions when lending to small and medium-sized enterprises (SMEs).

🇺🇸 Visa and Plug and Play announce call for applications for inclusive FinTech Accelerator Cohort 2. The accelerator program will span six months and will culminate with a showcase at Plug and Play's bi-annual summit in Silicon Valley in June 2025.

🇺🇸 Centime announces innovative approach to Accounts Payable (AP) automation that goes beyond the basic promise of ROI. Centime's new offering not only streamlines the AP process but also provides businesses with an opportunity to earn cash-back interest, transforming AP functions into profit centers.

PAYMENTS NEWS

🇺🇸 ACI Worldwide, Inc., reports financial results for the quarter ended June 30, 2024. Here are the highlights: Click here for full details

🇫🇷 BLIK Code Payments on Worldline Tap on Mobile. The launch of BLIK code payments on Tap on Mobile is another step in the development of the app, which offers its users ever more options. This partnership brings Worldline one more step closer toward creating a universal solution for mobile payments.

🇸🇬 Alchemy Pay partners with Mesh to enable direct crypto payments from exchange accounts and wallets. Alchemy Pay has integrated the Mesh API into its crypto payment solution, enabling users to purchase goods and services at online and offline merchants using crypto funds from exchanges and wallets.

🇨🇦 Canada-based payment service provider Moneris has announced that it expanded its partnership with Wix to launch Moneris Total Commerce and support Canadian businesses. Moneris and Wix now aim to bridge the gap between online and in-store transactions via an integrated and unified commerce experience for merchants and their customers.

🇨🇦 Payroc launches Card-Present Payments in Canada with Moneris Go. By partnering with Moneris, Payroc offers a comprehensive solution for processing card-present payments, helping its partners streamline operations and simplifying vendor relationships.

🇮🇳 The National Payments Corporation of India discussed partnerships with startups to introduce biometric authentication for UPI transactions. This would enable users to verify payments using fingerprints on Android devices and face ID on iPhones, replacing the current UPI PIN. The move followed the RBI's proposal for alternative authentication methods to enhance security and user experience.

🇺🇸 Apple requiring Patreon to use In-App purchase and pay 30% fee for memberships. Patreon confirmed upcoming changes to its iOS app, which will see fees for new subscriptions go up because Apple is enforcing its App Store rules on digital purchases.

DIGITAL BANKING NEWS

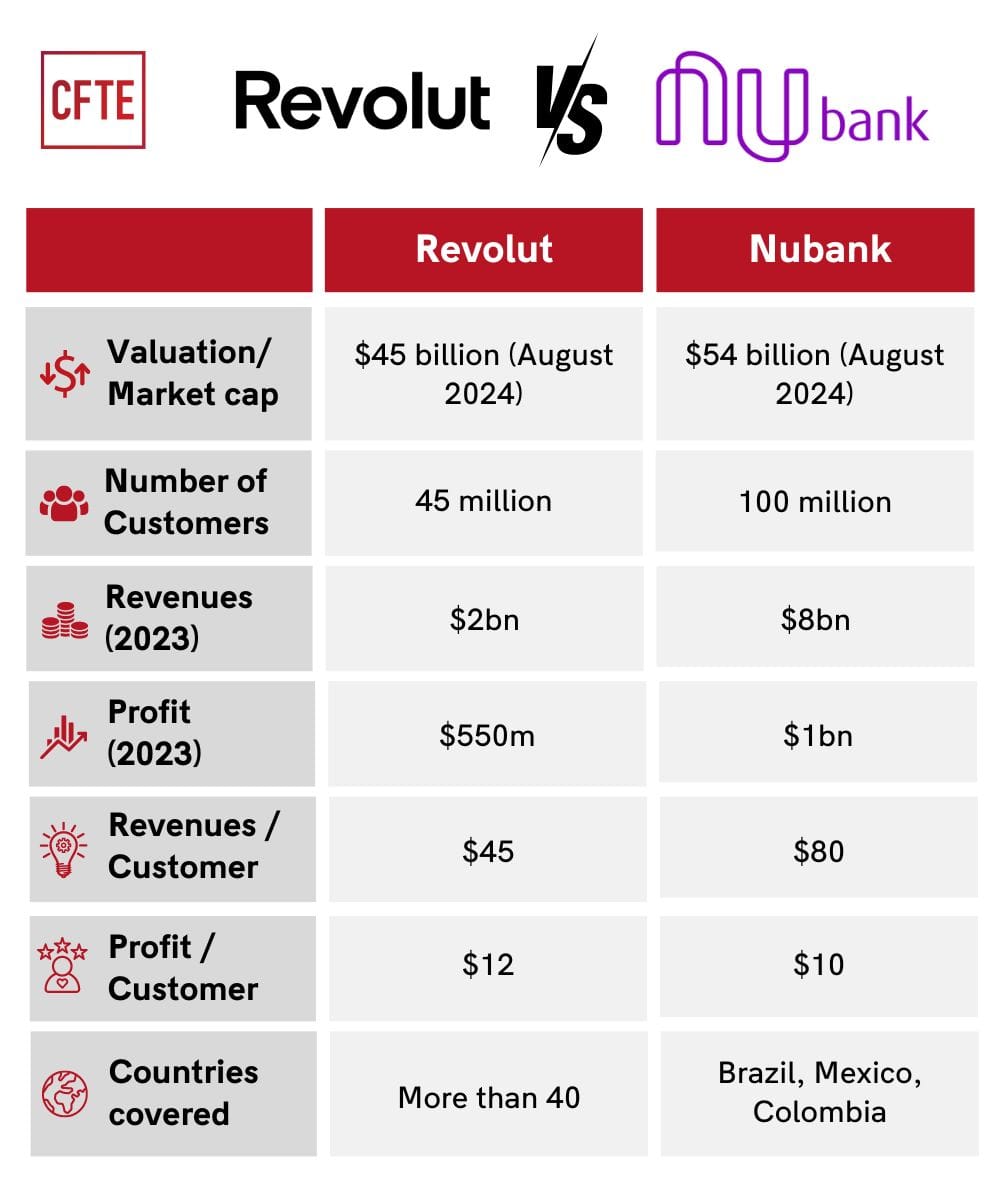

📊 Revolut 🆚 Nubank. Who performs better?

Let’s dive in

🇳🇱 Revolut and Tikkie simplify payments in the Netherlands. Revolut’s new feature makes it easier for its users in the Netherlands to split bills and manage payments seamlessly. By linking their Revolut accounts with Tikkie, users can enjoy enhanced financial versatility and convenience.

🇲🇽 Finsus, the third-largest "Sociedad Financiera Popular" (Sofipo) in Mexico, is preparing to start the process of becoming a bank. The company primarily operates in Mexico City, Monterrey (Nuevo León), and Guadalajara (Jalisco), and has reached 30% of municipalities with populations under 15,000. Carlos Marmolejo, CEO, and Norman Hagemeister, Chairman of the Board of Directors of Finsus, announced to Expansion that they plan to begin the necessary procedures with the National Banking and Securities Commission (CNBV) next month.

🇧🇷 MoneyGram, a global leader in international money transfers, has integrated Brazil's instant payment system, Pix, into its website and app. This integration was made possible through a partnership with BS2. Click here for full details

🇺🇸 Constellation partners with SavvyMoney to Offer Enhanced Credit Decisioning, Analytics and Financial Wellness Solutions to Constellation Digital Banking Platform Users. Access the full article

🇳🇱 Fincluded introduces PINCARD, the payment account for migrant workers. With PINCARD, Fincluded provides a solution with a simplified signup process and documentation requirements, enabling migrant workers to quickly and easily access a Dutch payment account and participate in the payment system.

🇬🇧 Monzo outage hits customer payments. Thousands of Monzo customers were left unable to make payments on Tuesday thanks to a technical problem with the digital bank's app. Customers flooded X with complaints about being unable to access their accounts or contact the company.

🇷🇺 Russia's central bank on Tuesday cancelled the banking licence of American Express Co's Russian subsidiary after the U.S. lender's unit filed a voluntary liquidation request. Click here for further insights

🇺🇸 Lili teams with Dun & Bradstreet on Business Banking. Through this integration with Dun & Bradstreet, Lili continues its mission to simplify business finances and provide business owners with the tools they need to succeed.

🇺🇸 Pibank, the Direct Banking Solution of Intercredit Bank, launches its U.S. presence. The direct bank, which already has a robust presence in Spain and Colombia, will now be offering its high-yield, customer-centric savings products to U.S. consumers.

🇮🇳 India’s Axis Bank and Visa partner on ‘Ultra-Premium’ Credit Card. The new card, Primus, will be offered by invitation only and will cater to select, ultra-high-net-worth individuals — defined as those with a net worth of over $30 million — Axis Bank, one of the largest private sector banks in India.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Ripple USD: the stablecoin begins beta testing on XRP Ledger and Ethereum. RLUSD, the new stablecoin by Ripple pegged 1:1 to the US dollar, is starting beta testing on XRP Ledger and Ethereum. At the moment, RLUSD has not received regulatory approval.

🇺🇸 US SEC sues over alleged $650 million global crypto fraud. The SEC on Monday sued the cryptocurrency company NovaTech and its married co-founders, saying they fraudulently raised over $650 million from more than 200,000 investors worldwide, including many Haitian-Americans.

🇹🇭 Thailand launches crypto regulatory sandbox to ‘facilitate experiments.’ Thailand’s Securities and Exchange Commission said the sandbox is now open for applications for participants including crypto exchanges, brokers, custodians and fund managers.

DONEDEAL FUNDING NEWS

Crypto startups get small bump, $2.7bn funding in second quarter, study says. This was a 2.5% increase in invested capital, but a 12.5% decline in the number of deals when compared with the previous quarter, the study noted. The bigger deal value and lower number indicate deal sizes increased during the quarter, it said.

🇰🇼 Tether to make strategic $3 million investment in Kem, paving the way for financial inclusion in the Middle East. This marks a significant milestone in Tether’s mission to revolutionize traditional payment systems and foster financial inclusion on a global scale.

🇺🇸 KeyCorp receives strategic minority investment from Scotiabank. As part of the transaction, KeyCorp and Scotiabank plan to explore commercial opportunities to partner together in the future to best serve their respective client bases. Read on

🇮🇳 Wealthtech startup Infinyte Club raises $3.6 million in funding round led by Elevation Capital. The funds will be used to enhance the technology and grow the team. This financial year, the startup plans to attract more investors and expand its range of asset classes.

🇺🇸 PayZen secures $32M Series B, $200M debt facility to grow its ‘care now, pay later’ product. The round values the company upward of $200 million, according to a person familiar with the deal. This arrangement also seems to benefit healthcare systems.

🇮🇳 Innoviti raises $8.3m in Series E round led by Random Walk Solutions. Innoviti Technologies, India’s payments-centric retail SaaS platform for enterprise brands, has announced that it closed its Series E round, raising a total of $8.3 million (INR 70 crore.) as a combination of equity and debt.

🇮🇳 Cross-border payments FinTech Skydo raises $5 mn from Elevation Capital. The company will use the funds to expand its operations and invest in its risk monitoring and compliance systems. The company said it has applied for the Cross-Border Payment Aggregator (PA-CB) licence from the Reserve Bank of India.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()