JPMorgan Chase Nearing Deal to Take Over Apple’s Credit Card From Goldman Sachs

Hey FinTech Fanatic,

JPMorgan Chase is in talks to take over Apple’s credit card program from Goldman Sachs, potentially becoming the new issuer. However, the bank is seeking concessions from Apple before finalizing the deal. Discussions, which began earlier this year, have progressed in recent weeks but could still take months to reach an agreement, according to sources familiar with the matter.

In its search for a new partner, Apple has also explored options as Synchrony Financial and Capital One, to transfer its credit card program. Goldman Sachs, Apple’s current partner, had previously held similar discussions with American Express.

A partnership between Apple and JPMorgan would strengthen their relationship, as JPMorgan already offers Apple-related deals to its Chase customers. Apple, with over 12 million credit card users, is in need of a new issuer after Goldman decided to exit consumer finance.

JPMorgan, led by CEO Jamie Dimon, is negotiating to acquire the program but aims to pay less than the $17 billion in outstanding balances, given the potential subprime exposure. Some credit card portfolios with high delinquency rates often sell at a discount. Allison Beer, JPMorgan’s head of the credit-card division, is leading the evaluation of the program’s value.

Additionally, JPMorgan is looking to remove Apple’s requirement that all cardholders receive statements at the start of the month, a policy that caused issues for Goldman and attracted regulatory scrutiny.

With negotiations still ongoing, stay tuned for more updates as this story unfolds.

Cheers,

FINTECH NEWS

🇨🇴 Colombia's Rappi could be ready for IPO in 12 months, cofounder says. "It's within our plan to go public, it could be on the New York Stock Exchange," Borrero told reporters. "The idea is that as a company, in 12 months, we will be ready to come out with all the audit processes, with mature projections as well."

🇺🇸 FTC to use PayPal to send refunds in FloatMe settlement. Eligible consumers for a payment will receive an email by Sept. 20, the FTC plans to send PayPal payments on Sept. 23, and recipients should redeem their PayPal payment within 30 days, they said in a press release.

🇧🇷 Brazilian Banks call for accelerated credit card gambling ban. The Febraban has called on the government to enforce the planned ban on using credit cards for betting sooner than initially scheduled. Keep reading

🇮🇹 UniCredit to seek ECB approval to potentially buy up to 30% of Commerzbank, sources say. UniCredit's 9% stake in Commerzbank, a target for takeover for over two decades, might lead to a full acquisition if there is broad support for a deal that benefits Commerzbank, UniCredit, Germany, and Europe, according to UniCredit’s CEO.

Africa: Mastercard unpacks tailor-made financial solutions for region. Mastercard partners with organizations like MTN to boost the mobile money ecosystem, works with Access Bank to enhance cross-border remittances and e-commerce payments, and collaborates with governments to promote digital payment adoption.

PAYMENTS NEWS

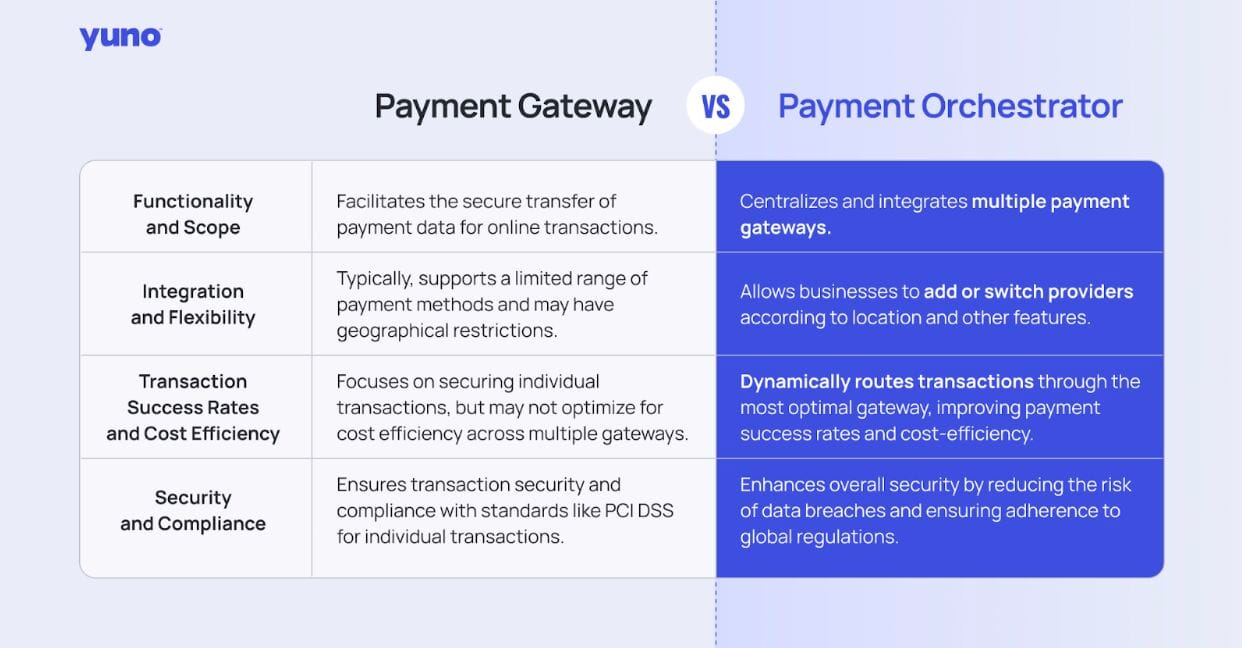

📊 Payment Gateway 🆚 Payment Orchestrator, by Yuno

Let’s dive in:

🇬🇧 Ecommpay shortlisted in Open Banking Expo Awards. The inclusive global payments platform, has been shortlisted in the prestigious Open Banking Expo Awards, in the Best Industry Partnership category.

Winners will be announced at the Awards ceremony on 15th October 2024 after Day One of the UK & Europe Expo at the Business Design Centre, London.

The payments provider has been focused on delivering the benefits of open banking to the online merchant marketplace in an accessible and cost-effective way, improving sales conversion and volumes.

🇺🇸 Affirm opens BNPL offering to Apple Pay Users. The recently announced integration allows Apple Pay users in the U.S. to pay for purchases via iPhone and iPad over time using Affirm, breaking down their payments into biweekly or monthly installments.

🇺🇸 FinTech Cherry pitches bond tied to BNPL cosmetic surgery loans. The startup is collaborating with Barclays on a potential healthcare asset-backed deal, with investor meetings scheduled for the coming weeks. The proposed bond would be secured by consumer loans provided by Cherry for cosmetic surgery, dental, or medical aesthetics.

🇮🇳 Razorpay’s Harshil Mathur discusses their omnichannel payment evolution, future growth in offline payments, international expansion towards south east asia, and the potential of India’s FinTech ecosystem. Read the full piece here

🇬🇧 ID-Pal and CLOWD9 enter global strategic partnership to revolutionise payment processing. The partnership advances CLOWD9’s mission to revolutionize the payment industry by integrating advanced payment processing with AI-driven identity verification, setting new benchmarks for security and efficiency.

🇺🇸 Capchase partners with Stripe as their first B2B BNPL payment method for the US. The Capchase Pay experience is now available inside the Stripe payments infrastructure which makes it even easier for SaaS businesses to leverage this flexible payment method.

OPEN BANKING NEWS

🇧🇷 Banco de Brasília (BRB) has officially been authorized to operate as a payment initiator within open finance, becoming one of 36 institutions offering this service. This new role enables users to conduct Pix payment transactions outside the traditional financial institutions' environment, facilitating account management through various platforms.

🇬🇪 FinTech Keepz makes Georgia's first live open banking transfer at National Bank of Georgia / Banking Association of Georgia event. Within the framework of the event, the parties once again talked about the benefits of open banking. Continue reading

🇺🇸 Zūm Rails establishes U.S. headquarters in Miami in preparation for 50% of revenue originating stateside. Miami was selected due to its emergence as a destination for some of the country’s largest technology and finance corporations following the Silicon Valley exodus of tech talent in recent years.

DIGITAL BANKING NEWS

🇺🇸 JPMorgan Chase could take over the Credit Card program from Goldman, and become the new Apple credit-card issuer, but is seeking concessions from the tech giant. Discussions started earlier this year, and have advanced in recent weeks, but a deal could still be months away, according to people familiar with the matter.

🇬🇧 Proxymity and J.P. Morgan deploy Vote Connect Total in the UK. The system enhances accuracy, efficiency, and transparency in proxy voting. The solution will also facilitate new features such as real-time investor communications and post-meeting voting confirmation services.

🇮🇳 Revolut is preparing for 2025 launch in India. London-based Revolut set up in India in 2021 but did not receive in-principle approval from the country’s central bank to issue prepaid cards and wallets until earlier this year. Find out more

🇬🇧 Monzo Bank is the first UK Bank to allow its Flex customers to choose monthly payments when shopping online with Apple Pay: The bank is introducing a new credit card feature that lets customers select monthly payments before finalizing their purchase online with Apple Pay through Monzo Flex.

🇺🇸 Florida’s EverBank inks $261m deal to acquire Sterling Bank. Once the deal closes, expected by Q1 2025, Sterling Bank will be merged into EverBank, with its branches becoming EverBank financial centres and its employees becoming EverBank associates.

🇺🇸 TransUnion and MoneyLion partner to deliver powerful personalized financial products and services. Through the partnership, MoneyLion will integrate TransUnion’s data and credit solutions into its credit-decisioning platform, ensuring that consumers receive personalized and relevant financial offers.

🇬🇧 UK banks hail Regulated Liability Network experiments. The RLN is envisaged as a common ‘platform for innovation’ across multiple forms of money, including existing commercial bank deposits and a shared ledger for tokenised commercial bank deposits.

🇺🇸 Old Second National Bank partners with Newgen for digital account opening. The bank selected Newgen’s advanced digital account opening and maintenance solution to enhance its account management processes. This solution will automate the entire account opening lifecycle, improving operational efficiency and customer engagement.

Private sector partners join Project Agorá. More than 40 private sector financial firms, convened by the Institute of International Finance, will join the Bank for International Settlements and a group of leading central banks in Project Agorá to explore how tokenisation can enhance wholesale cross-border payments.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Trump backs crypto venture world liberty financial. “Crypto is one of those things we have to do,” said Trump, whose comments Monday Sept. 16 were reported by the New York Times. “Whether we like it or not, I have to do it.”

PARTNERSHIPS

🇩🇪 PUMA partners with Payrails to transform online payments and improve the shopping experience for customers worldwide. The collaboration will enable shoppers to have a wider variety of payment options and receive a more seamless buying experience - regardless of their location or payment method.

🇺🇿 Uzum partners with Mastercard to boost financial literacy in Uzbekistan. The companies have launched two free online courses to help Uzbek consumers understand how to conveniently and safely use debit and credit cards. This is one of the first efforts to boost the popularity of digital payments and FinTech in the region.

DONEDEAL FUNDING NEWS

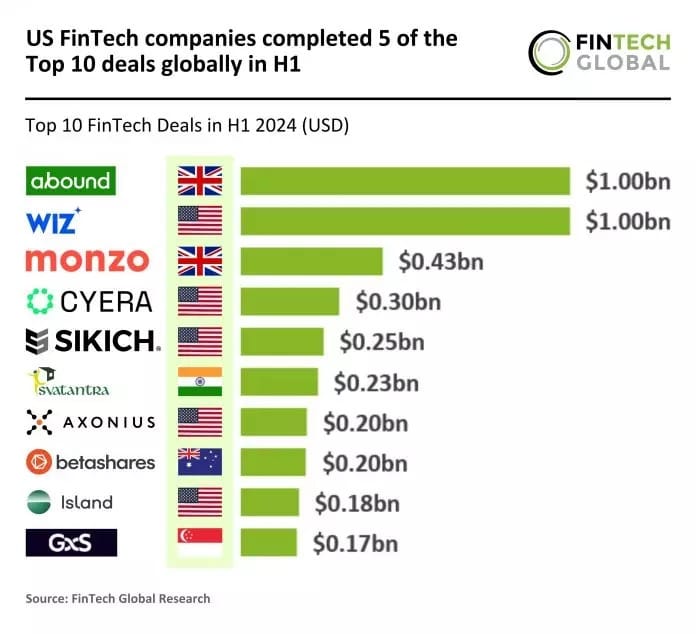

🇺🇸 US FinTech companies completed 5 of the top 10 deals globally in H1.

🇮🇳 Indian InsurTech Onsurity raises $21m to fuel expansion plans. With the new capital, Onsurity plans to launch additional digital product lines tailored to the needs of SMEs, enhance its technology infrastructure, and improve the overall claims experience for its customers.

🇦🇷 Ex Mastercard Executive, Carlo Enrico, invests in Startup Pomelo, joins board. Pomelo and Enrico declined to say how much he invested or what equity stake he will hold. Enrico joins the three co-founders and representatives of venture capital firms Kaszek and Monashees on the board.

🇲🇾 Maybank announces investment in Funding Societies, Southeast Asia’s MSME Digital Finance Platform. The transaction represents the inaugural investment “under a new initiative at Maybank to strategically invest and partner with best-in-class digitally-enabled organisations across ASEAN.”

🇸🇪 Savr receives investment from Incore Invest. The amount of the deal was not disclosed. The company intends to use the funds to extend its offering to now include equities, alongside mutual funds and with plans to add ETFs in the future.

MOVERS & SHAKERS

🇱🇺 Ex-Meta Payments Director becomes new Mangopay CEO. Sergi Herrero, confirmed as Mangopay’s new CEO, is dedicated to continuing the platform’s upward trajectory. He succeeds Romain Mazeries, who stepped down after six years as CEO but will remain on the board to work with other members.

🇸🇪 Swedish neobank Northmill hires Julie Chatterjee as new group CEO. She joins Northmill directly from Multitude Bank, and assumes the role previously held by Tord Topsholm, who stepped down in February. Continue reading

🇧🇷 FinTech Clara taps new finance head as Brazil operations grow 'quickly.' Clara's new Director of Finance, Travis Foxhall, will oversee financial operations and work on fundraising, he said in an interview. He joins Point72 Ventures and previously served as chief of staff at Brazilian digital bank Neon.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()