Is Klarna the Next Robinhood?

Hey FinTech Fanatic!

Klarna is assembling a team to develop a product that will rival Robinhood's trading platform, allowing customers to buy and sell stocks through its app.

As revealed in an internal Slack message obtained by Business Insider, the company posted four internal job openings for roles needed to build this product.

"Our mission is to obliterate the barriers to consumer investing and empower every Klarna user to build their financial future in a single place - the Klarna App," the internal message said. "Think Trade Republic, Robinhood, N26… but with a Klarna-size upgrade."

This move into stock trading marks a shift for Klarna, which is preparing for an anticipated IPO, and traditionally focuses on its core business of providing buy-now, pay-later (BNPL) services for consumers.

What do you think about this move? Tell me more in the comments.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

FEATURED NEWS

🇺🇸 Bank drama for PayPal, Square after Wells Fargo bows out. For over 20 years, Wells Fargo was a key player in supporting major payments companies, but its recent exit has left a gap. JPMorgan is now the only major U.S. bank still active in this space, working with PayPal, Venmo, and Square, though it's unclear how much of Wells Fargo's business JPMorgan has taken over. Discover more

#FINTECHREPORT

📊 ACI Worldwide study reveals real-time payments to boost global GDP by $285.8 billion, create 167 million new bank account holders by 2028. ACI’s second Real-Time Payments: Economic Impact and Financial Inclusion report leverages data from 40 countries and reveals—for the first time—an empirical link between real-time payments and financial inclusion.

FINTECH NEWS

🇸🇬 Thunes enables banks to unlock mobile wallet payments via their existing Swift connectivity. Thunes' new capability lets Swift-connected financial institutions join its Direct Global Network, enabling fast, transparent cross-border payments to 120 mobile wallet brands globally, without requiring separate integration.

🇬🇧 Robinhood launched margin trading in the U.K., allowing users to leverage their existing asset holdings as collateral to purchase additional securities. Robinhood said Monday that it’s rolling out margin investing — the ability for investors to borrow cash to augment their trades — in the U.K.

🇺🇸 Atomic partners with MX to streamline deposit and bill pay switching. This partnership is designed to deliver a simplified account switching experience for financial providers and consumers alike. Read more

🇬🇧 Volkswagen Financial Services (UK), fined £5.4m by the FCA for not treating customers in financial difficulty fairly. The fine results from the company’s failure to adequately understand and address individual customer needs, which led to potentially serious outcomes for those impacted.

🇮🇳 Peak XV-backed MoneyTap improves its bottom line. The FinTech startup based in India, has significantly reduced its losses for the financial year ending on March 31, 2024, its latest audited financial statements reveal. Find out more

🇵🇭 Netguardians selected by PalawanPay to deliver Best-in-Class fraud protection for customers in the Philippines. PalawanPay, trusted by over 19 million customers in the Philippines for fast, affordable money transfers and payments, aims to enhance its fraud protection by partnering with NetGuardians.

🇸🇬 Broadridge Financial Solutions has indicated its readiness to support the Monetary Authority of Singapore (MAS) and the Australian Securities and Investments Commission (ASIC)'s new OTC derivatives reporting regulations, effective from 21 October 2024.

🇮🇳 Groww pays $160M tax as it returns to India amid a startup relocation wave. Nearly a dozen Indian startups are relocating their headquarters from the U.S. and Singapore to comply with Indian laws and facilitate IPOs, creating a tax event for both investors and the startups.

PAYMENTS NEWS

🇪🇸 CaixaBank switches on instalment payments with Apple Pay. The bank has become the first financial institution in mainland Europe to offer BNPL services to users checking out with Apple Pay. This new functionality enables customers to view available payment options and select their preferred payment method before completing their purchase.

🇺🇸 GoodRx and Partner Pharmacies to offer Affirm BNPL option. With this new offering, approved consumers will be able to choose an Affirm payment option for select medications at participating retailers on the GoodRx platform, the company said in a press release last week.

➡️ Nium enables financial institutions to connect to its real-time payments network via Swift. This initiative enables banks to process payments through Nium using their existing SWIFT capabilities, eliminating the need for complex API integration and reducing the cost of cross-border transfers.

🇮🇩 BRI teams up with Nium to upgrade cross-border payment solutions. This partnership aims to enhance cross-border financial services for BRI's individual and corporate customers in Indonesia, providing modern, real-time payment solutions to over 150 million account holders, including those in remote areas.

🇬🇧 Wise Platform boosts product suite, enabling more partners to offer faster, cheaper, secure, and convenient international payments directly from their own platforms. Among the new partners are some of the world's largest digital banking platforms

🇲🇾 PayMate launches Business Payments App for Malaysian SMEs. The app is designed to address the common challenges faced by SMEs, including cash flow issues, delayed payments, and limited access to affordable credit. Read on

🇺🇸 A financial technology trade group representing BNPL providers such as Block Inc. and Klarna Bank AB is suing to stop the Consumer Financial Protection Bureau’s rule that brings some credit card protections to the burgeoning market. The Financial Technology Association filed a lawsuit claiming the CFPB didn’t follow proper procedures in requiring BNPL firms to provide regular billing statements and refunds.

🇩🇪 The Payments Group launches and lists on stock exchange. TPG launched a group of four cooperating specialist FinTech and paytech businesses. It offers a wide range of online payment services, including embedded financial services and global payment solutions.

DIGITAL BANKING NEWS

🇺🇸 Mastercard introduced a new product innovation, Mastercard Move Commercial Payments, enabling banks to facilitate near real-time, predictable and transparent commercial cross-border payments. The new solution aims to simplify operations and provide end-to-end visibility for banks and their customers, among other benefits.

🇺🇸 Evolve Bank & Trust said Saturday (Oct. 19) that it is preparing to return funds held at Evolve to Synapse Brokerage end users impacted by the Synapse bankruptcy. To provide information on the reconciliation process and the anticipated timeline for returning funds, Evolve will launch an online resource center on Wednesday (Oct. 23), the financial services organization said in a Saturday press release.

🇺🇸 Santander launches US digital bank to cut cost of auto lending. Spain's Santander launched its U.S. digital bank on Monday, which could help fund up to $30 billion in loans for vehicle purchases and broaden its retail business in the country, the bank's U.S. CEO Tim Wennes told Reuters.

🇦🇪 Tuum launches Foundations for Islamic Banking and Finance Solutions, a strategic move towards delivering comprehensive, Sharia-compliant financial services. It focuses on the key principles of Islamic banking, laying the groundwork for a full end-to-end platform designed to support the needs of Islamic financial institutions.

🇨🇭 UBS sells its 50% stake in Swisscard to American Express. After the transaction, Amex will become the sole owner of Swisscard, with Credit Suisse customers transferring to the existing UBS credit card platform. Continue reading

🇪🇺 Europe's banks under investor pressure to keep earnings growth alive. Europe's largest banks are in their healthiest state since the 2008-09 financial crisis, yet investors seek assurance regarding their long-term earnings power as interest rates fall.

🇨🇳 BNY and Mizuho Bank announce landmark agreement to collaborate for trade services. Through this agreement, both banks are able to enhance their services to clients through frictionless access to each other’s expansive trade network. Keep reading

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 DBS has rolled out DBS Token Services, a suite of banking solutions that integrates tokenization and smart contract capabilities with its existing services. This offering aims to enhance transaction banking capabilities and operational efficiencies for clients.

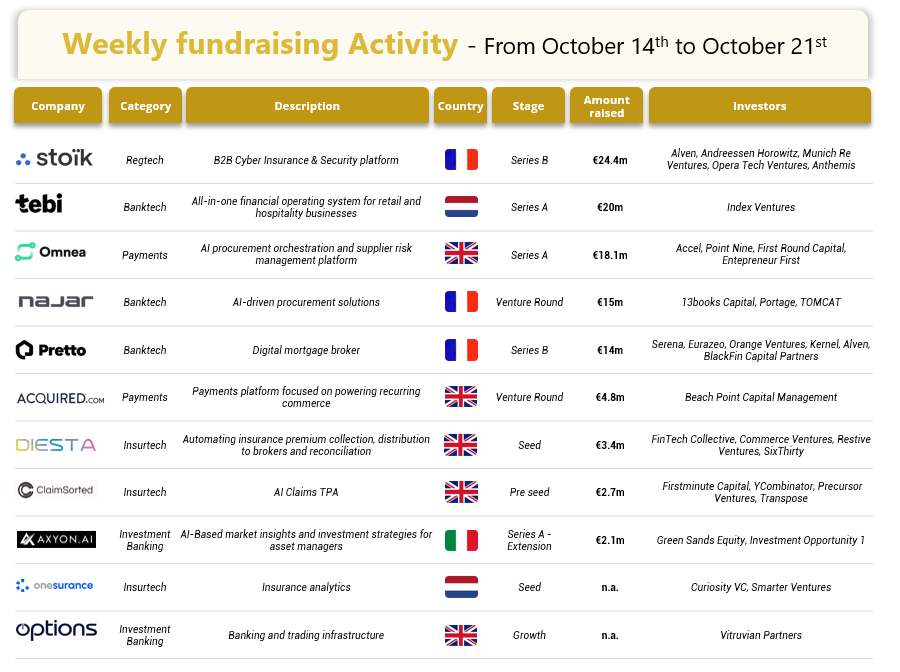

DONEDEAL FUNDING NEWS

💰 Last week, there were 11 official FinTech deals in Europe, raising a total of €105.1 million, with 5 deals in the UK, 3 deals in France, 2 deals in the Netherlands, and 1 deal in Italy. Read the complete BlackFin Tech overview article

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()