Investing in Startups at a Discount: A Deep Dive into VC Secondaries

In the dynamic landscape of venture capital, secondary transactions are gaining unprecedented momentum.

The venture capital secondary market is rapidly evolving, presenting a complex landscape of opportunities and challenges. Several platforms that facilitate secondary transactions have made it easier for buyers and sellers to engage in this burgeoning market. However, the journey of investing in startups through secondaries brings to the fore the concept of 'paper money' and the inherent risks and opportunities in start-up investing.

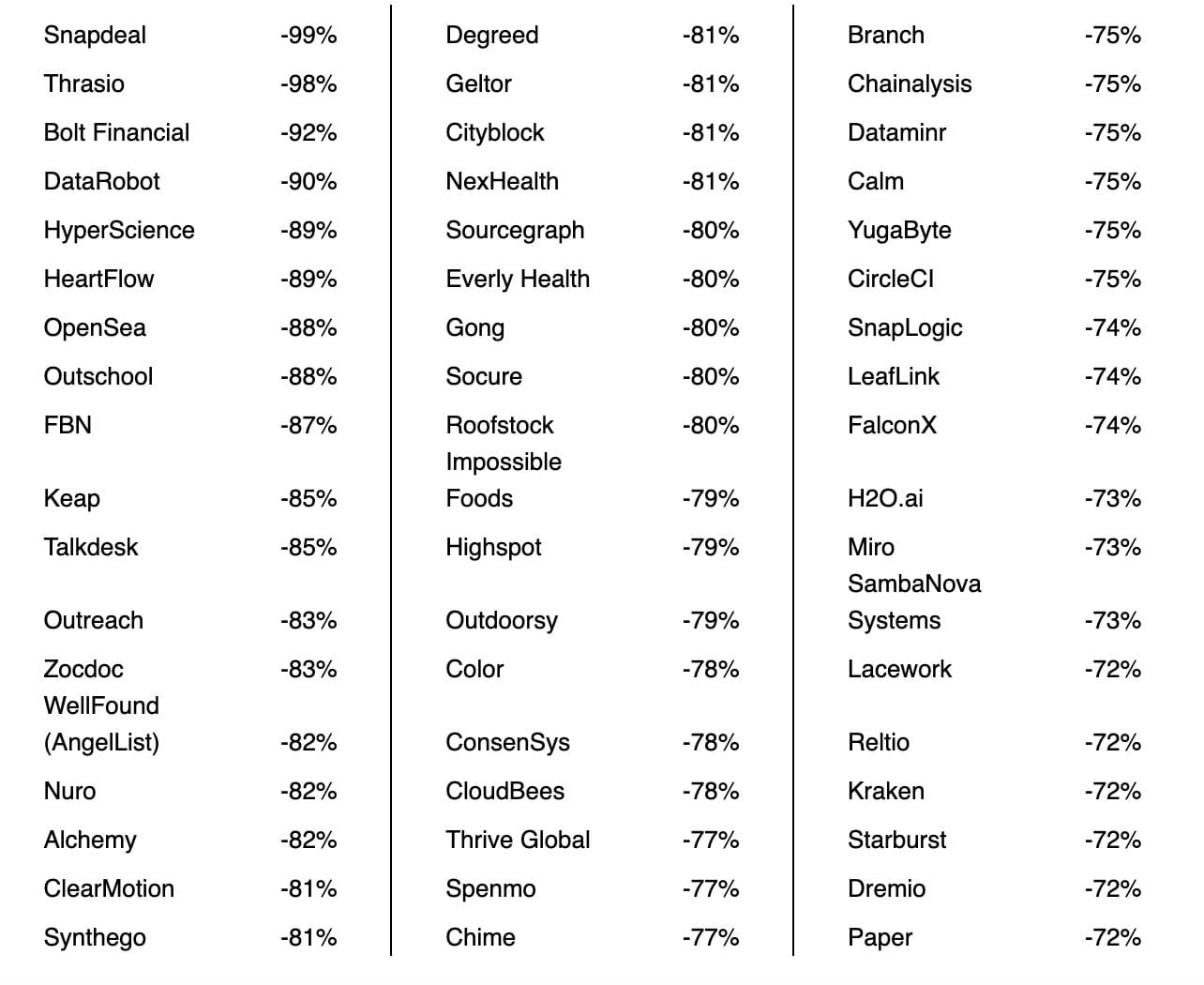

A fascinating dimension to this scenario is a list I recently found on linkedin in a post by Elana Dickman, highlighting startups with shares available at significant discounts compared to their last funding round.

Including some interesting FinTech deals as you can see in the picture below👇

This situation often arises when previous investors, founders, or early employees seek liquidity by selling their stakes.

Investing in startups is notoriously risky, with the oft-cited statistic that "9 out of 10 startups fail." Even more intriguing is the scenario where, despite investing in the successful "1 out of 10" startups, the outcome may not be financially rewarding.

The critical factor here is the nature of 'paper money' in startup investments. Until a liquidity event like an IPO or acquisition occurs, the value of an investment remains largely notional.

A high valuation on paper does not equate to liquid wealth, and market dynamics or internal company issues can lead to markdowns, impacting the realizable value of these investments.

However, these markdowns also present unique investment opportunities. For astute investors, this could mean entering the market at a point of lower risk and potentially higher value. It’s about seeing potential where others see peril.

The secondary market, therefore, is not just about seizing opportunities but also understanding the nuanced risks involved. This market is particularly attractive to investors seeking liquidity from previous high-valuation investments and those eyeing entry into startups at a discount.

As Industry Ventures and other major players like EQT and Blackstone capitalize on secondary opportunities, the landscape is rife with potential. The market's complexity, heightened by fluctuating public stock prices affecting LPs' exposure ratios and necessitating rebalancing, adds another layer to the investment decision process.

Successful navigation in this market requires an ability to discern true value in discounted deals and to understand the reasons for access to these transactions.

While the liquidity and transparency issues pose challenges, they also underscore the need for meticulous due diligence and strategic thinking.

In summary, the venture capital secondary market is evolving rapidly, presenting both challenges and opportunities. As liquidity becomes a more pressing need, this sector's growth is poised to accelerate, offering unique avenues for investors and founders alike.

For those in Europe who are interested in exploring these opportunities, Odin, a European frontrunner in providing sophisticated tools for VCs, angels, and founders, has recently enhanced its platform to facilitate these transactions with improved user experience.

Interested in structuring a secondary transaction or investing in private company secondaries? Reach out to Marcel van Oost

Comments ()