Introducing Tap to Pay on iPhone for Venmo & PayPal Zettle Users

Hey FinTech Fanatic!

Hope your week kicked off on a high note! After a whirlwind of meetings, events, and crisscrossing the US, I'm hitting pause for a bit. You'll find me snowboarding, soaking up some downtime.

But, you know me – even in relax mode, I can't help but dive into the latest FinTech buzz first thing in the morning. And what's the fun in keeping all that juicy info to myself?

While I'm out here carving up the slopes, I'll make sure you're still on track to get your daily dose of FinTech news, just like always.

Enjoy the read and catch you tomorrow!

Cheers,

POST OF THE DAY

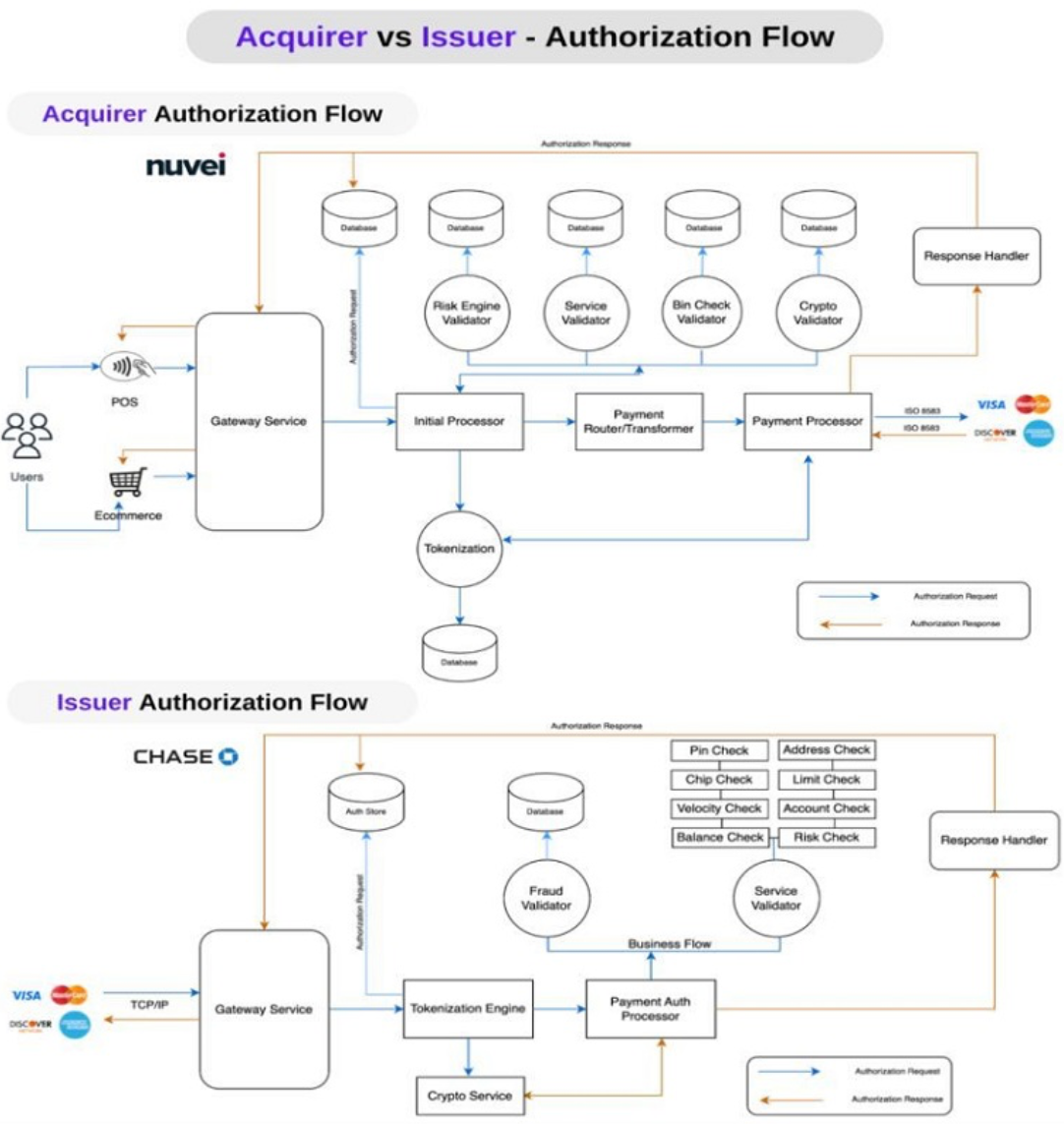

Acquirer VS Issuer - The Different Authorization Flows in a Card Transaction👇

#FINTECHREPORT

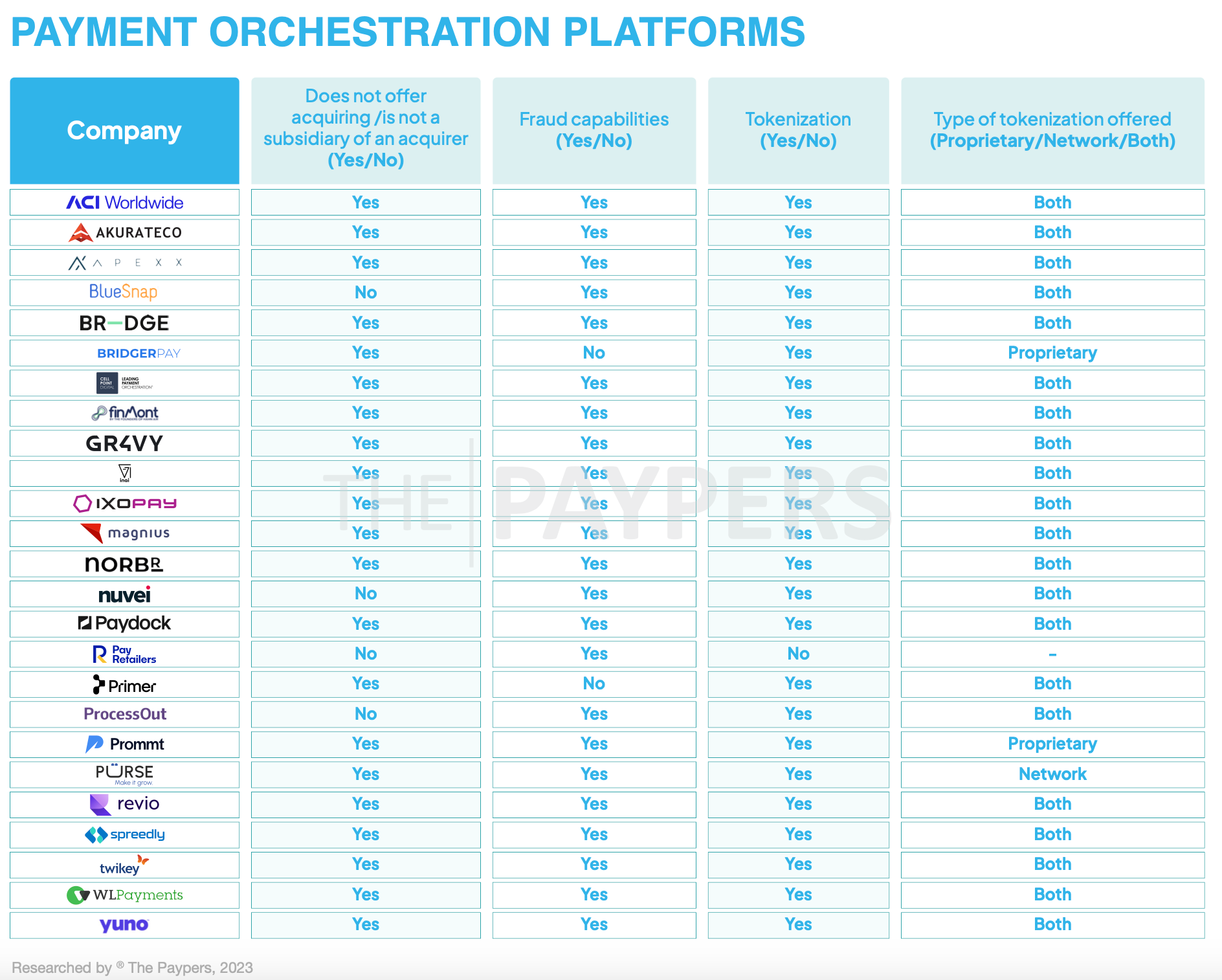

Payment Orchestration has become a buzzword in the world of payments.

Here is a list of Key Players:

INSIGHTS

🇺🇸Visa and Western Union announce expanded collaboration transforming how money travels cross-border. This will enable Western Union customers to send money to their family and friends’ eligible Visa cards and bank accounts in 40 countries across five regions. The agreement covers card issuance, integration with Visa Direct, and value-added services delivery, including risk products.

FINTECH NEWS

🇸🇬 Razer FinTech, the financial technology arm of Razer Inc., together with its B2B payments unit, Razer Merchant Services (RMS), have announced a dynamic rebranding initiative recently. In a statement, the company unveils a new single name, logo, and identity as Fiuu, signifying its ambitious plans to become a leading force in the future of digital payments.

Flutterwave, Africa’s biggest startup, is shutting down Barter, a virtual card service it launched in 2017, as it focuses on its enterprise and remittance business segments. The FinTech told customers to withdraw their money in the app over the past month.

🇮🇳 Backed by Jio Platforms, Lizzie Chapman to launch new B2B FinTech venture next month. The B2B FinTech venture will be headquartered in Bengaluru. The startup has product, technology and other teams in place. Read more

🇬🇧 Funding Circle will offload its US arm in order to focus on its more profitable UK business, after the small business lender widened its losses in 2023.The former peer-to-peer lending platform reported “strong profit” in UK loans, which was offset by continued investment into its FlexiPay offering and its US business.

🇨🇳 Ant Group raises transaction limits for travelers on e-wallet services online with new PBOC policy. In response to China's new policies to facilitate international visits, Ant Group is raising single-transaction limit for international travellers using its cross-border payment services from USD 1000 to USD 5000.

🇸🇬 Currencycloud granted ‘In-Principle Approval’ for Major Payment Institution Licence by the Monetary Authority of Singapore. The licence will allow Currencycloud to provide a full suite of intra-regional and international services to Singapore businesses. More on that here

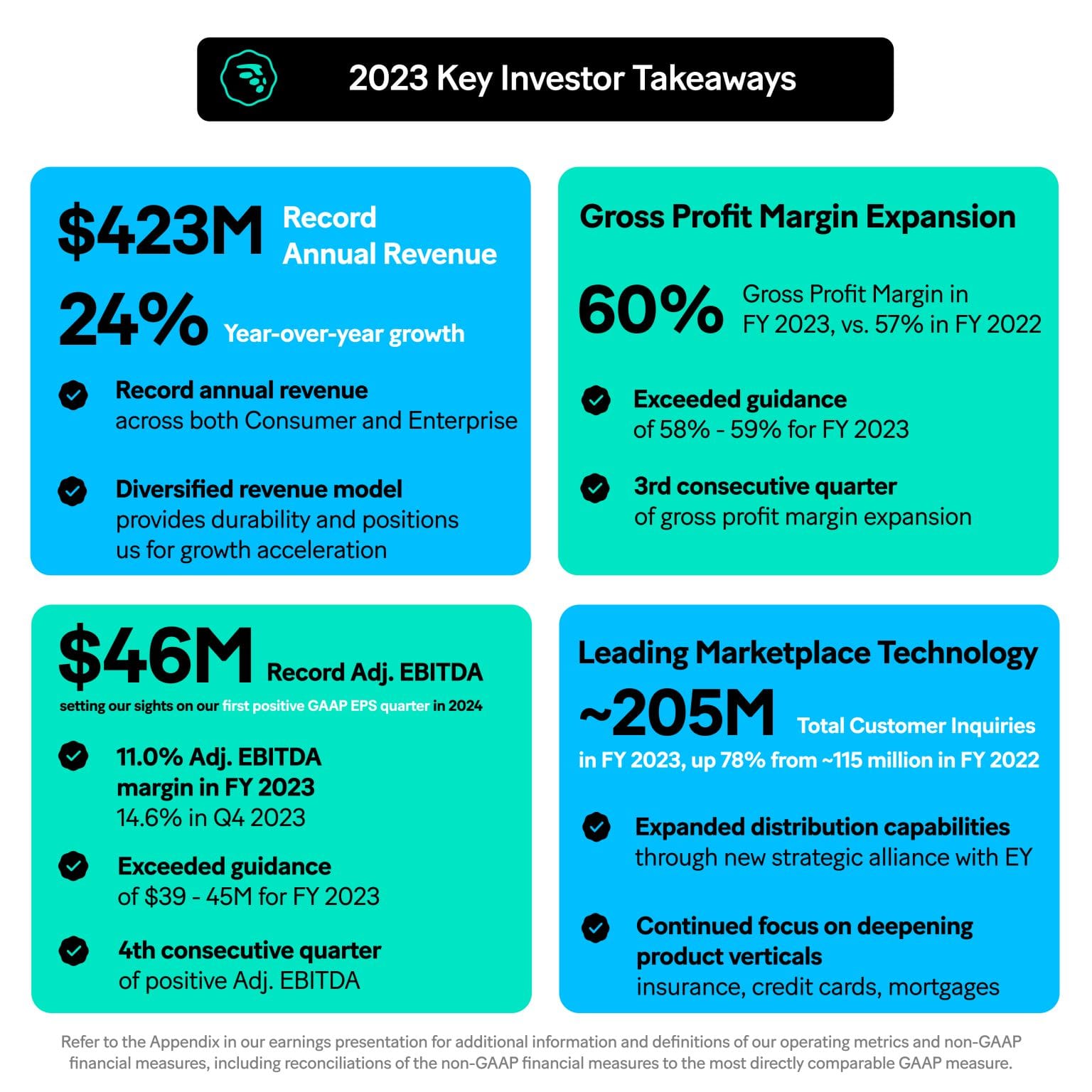

🇺🇸 MoneyLion roars ahead with positive earnings. The most recent earnings report from MoneyLion signaled improving financial performance for the challenger bank, which achieved a fourth consecutive financial quarter in the black and advised investors it was targeting its first quarter of positive earnings per share sometime this year.

PAYMENTS NEWS

🇺🇸 PayQuicker launches new Trust Center to serve as a resource for its clients, partners, and anyone interested in its commitment to security and compliance. The Trust Center will provide transparency into PayQuicker’s security posturewith access to the latest overview of their certifications and compliance programs.

🇮🇳 Flipkart launches UPI services to counter third party apps. Flipkart has launched unified payments interface (UPI) services which will allow its users to set up their own UPI handle for online and offline merchant transactions within and outside of the e-commerce marketplace.

🇺🇸 PayPal has launched Tap to Pay on iPhone for Venmo and PayPal Zettle users across the U.S., allowing small businesses to accept contactless payments without extra costs or devices. This is the latest development in PayPal's ongoing efforts to help small businesses sell more, grow their business, and manage their finances more efficiently.

🇬🇧 British bank NatWest is killing off its buy now, pay later (BNPL) service less than two years after launch. The bank will begin closing BNPL accounts from May after lower than expected take up, according to The Sun. Click here to readthe full article.

🇮🇳 Cashfree Payments, India's leading payments and API banking company, launched 'Embedded Payments', India's first platform centric payment solution for software platforms. This solution equips software platforms with the tools to facilitate seamless payment experiences for businesses, thereby fostering growth.

🇳🇵 The National Payments Corporation of India (NPCI) on March 8 said that the Unified Payment Interface (UPI) is now live in Nepal. The NPCI International Payments Ltd (NIPL) and Fonepay Payment Service have signed a pact for cross-border transactions between India and Nepal. Read the full piece here

OPEN BANKING NEWS

🇺🇸 Mastercard, Dwolla using open banking to pursue separate markets. Both firms, which have obvious roots in payments, are using this technology to broaden relationships with different customer segments — consumers in Mastercard's case, and business clients in Dwolla's.

🇻🇳 SAVIS and Konsentus accelerate open banking in Vietnam. This open banking framework will provide the foundational bedrock for open banking in Vietnam and will allow the market to take the next step towards an open data sharing ecosystem It puts the nation amongst other market leaders in the region.

🇺🇸 Mastercard partners with Fannie Mae for a new single-source mortgage verification service. In partnership with Mastercard Open Banking, powered by Finicity, Fannie Mae aims to enhance access to affordable housing by streamlining the application process for lenders, reducing manual document preparation.manual document preparation.

DIGITAL BANKING NEWS

🇬🇧 Revolut’s new UK boss said it is ‘determined’ to get a banking licence – more than a year after it insisted approval was ‘imminent’, and leaves door open to London IPO. Francesca Carlesi, who joined in December, said the financial app is ‘moving in the right direction’ after long delays. ‘We are determined to do the hard work to get there,’ Carlesi said.

🇺🇸 US digital dollar is “nowhere near” development, says Federal Reserve chair. Fed Chairman Jerome Powell stated that the Fed is not near to rolling out a digital dollar, emphasizing the Fed's reluctance to adopt a system needing user data. He stressed the government's disapproval of a service enabling monitoring of citizens' transactions.

NTT DATA builds a Center of Excellence on Tuum technology to drive core banking modernization. The strategic partnership is designed to integrate Tuum’s smart migration techniques with NTT DATA’s broad spectrum of professional services and successful migration experience to deliver cost-effective, scalable banking solutions worldwide.

🇺🇸 Oxygen shuts down abruptly its neobank. The banking platform notified its consumers of this decision in a letter containing important, time-sensitive information. Read the complete letter here for further insights.

DONEDEAL FUNDING NEWS

🇺🇸 Carputty secures $80M in new funds to accelerate growth. The FinTech announced the successful closure of a $75 million warehouse/financing facility with Silicon Valley Bank (SVB) with an additional equity investment of $5M.This SVB agreement, replacing the former $20 million facility, is a major step in Carputty's expansion strategy.

🇺🇸 Argyle, a provider of direct-source income and employment data, announced the successful closing of a $30 million funding round led by Rockefeller Asset Management’s FinTech Innovation Fund. This growth capital includes a mix of equity and debt to fuel the firm’s continued adoption and expansion of its automated income and employment verification platform.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()