Inside Revolut’s Big Crypto Ambitions

Hey FinTech Fanatic!

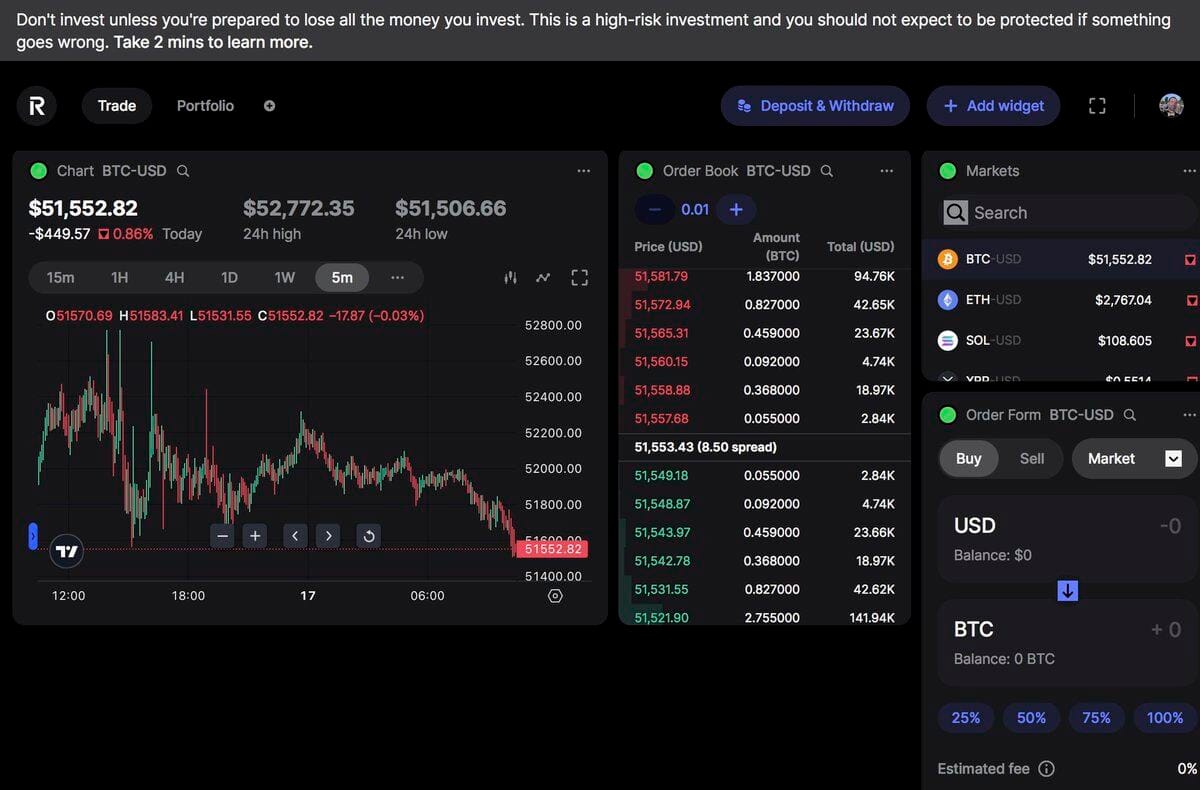

In February, Revolut announced to its customers the introduction of a crypto exchange tailored for experienced traders, signaling the FinTech giant's intent to capitalize on the flourishing bull market.

This move is not Revolut's debut in the cryptocurrency realm, yet it underscores the company's significant aspirations within the industry.

The expansion of its cryptocurrency division is evident, as Revolut is actively enhancing its team in the United Kingdom, Poland, and Lithuania.

Notably, in its London headquarters, the company is on the lookout for legal professionals who specialize in cryptocurrency regulations.

Additionally, Revolut is seeking to recruit experts in crypto-related financial crime analysis in both Poland and Lithuania, as revealed on its LinkedIn profile.

Given the cryptocurrency market's impressive $1 trillion surge in the first quarter, Revolut's strategy to introduce more crypto-centric products in the near future, aiming to leverage the escalating interest from both retail and institutional investors, seems highly anticipated.

Scroll down for more interesting FinTech industry news updates and I'll be back in your inbox tomorrow!

Cheers,

P.s. If you like this newsletter and/or my other content, you can support me by becoming a member. I'll be forever grateful.

Now let's dive into the news of today:

BREAKING NEWS

🇮🇪 TikTok owner ByteDance misled the Central Bank of Ireland after HSBC shut down the Chinese company's bank accounts following a money laundering probe. In early 2023, Irish banking regulators contacted ByteDance with a pointed question: Why was the Chinese internet giant and parent company of TikTok moving large sums of money, likely in the tens of millions of dollars, out of its HSBC bank accounts? Find out more. Click here to continue reading.

#FINTECHREPORT

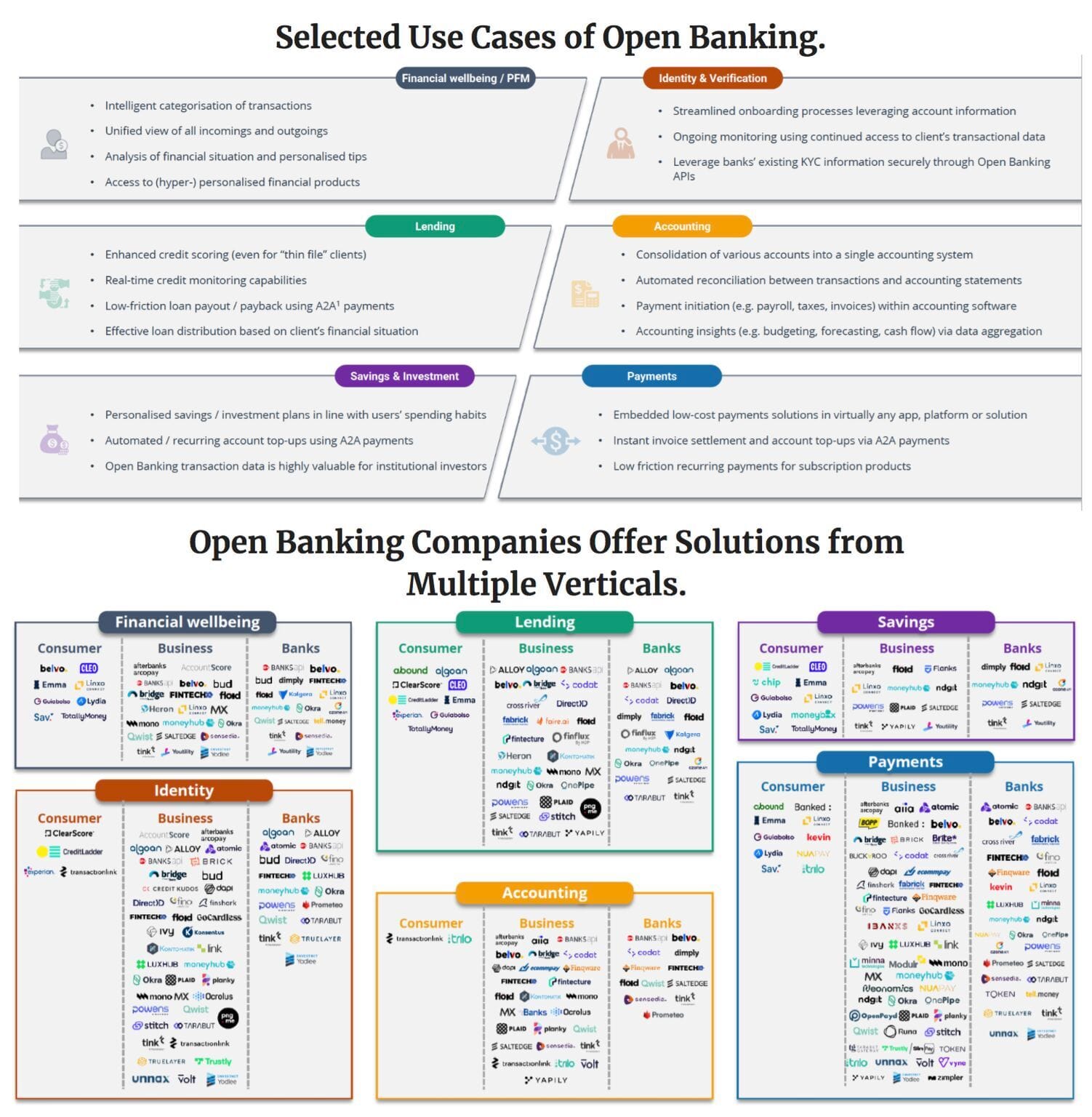

📊 Open Banking FinTechs offer solutions from multiple verticals to various end-user types:

INSIGHTS

⚠️ Cyber attacks cost financial firms $12bn says IMF. The data shows little sign that the risk is about to reduce and has led to the IMF to call for greater cross-border cooperation to protect the stability of the global financial system. The report also states that indirect losses such as reputational damage and security updates are “substantially higher.”

🇬🇧 GoHenry co-founder Louise Hill hits out at UK education secretary over comments that financial services firms are London-centric. Hill said she found the comment strange and added that GoHenry, which operates a flexible work policy, had staff living in Manchester, Edinburgh and Bristol. Learn more

FINTECH NEWS

🇲🇽 Uber has put a pause on its FinTech initiatives in Mexico despite holding an official license for financial products. In contrast, its competitors, DiDi and inDrive, are actively enhancing their services in payments, loans, and credit cards, betting heavily on digital finance's potential in the collaborative economy.

🤝 Dlocal and Papaya Global forge partnership to support complete workforce payments globally. The partnership aims to enable global organizations to pay employees worldwide, on time, and in local currencies. Mutual customers of both firms can now easily pay employees, partners, freelancers, and suppliers, streamlining the checkout process.

🇧🇷 Nubank will close NuInvest app and concentrate investments in one place. Despite this, NuInvest is still the bank's brokerage, and the changes are that investments will now take place in the designated space in Nubank's own app. Read the full article here

🇨🇴 FinTech Monet reaches a million microloans issued in Colombia. According to its most recent report, a total of over 85 billion pesos (21.7 million dollars in microloans) were disbursed in just three years in the fight against 'gota a gota' (illegal lending practice). Read more

🇺🇸 Fiserv CEO compensation rose last year to $28M🤯 Compensation for Fiserv CEO Frank Bisignano climbed 57% over 2022, as the value of stock awarded to him surged and he received a $3 million cash bonus. The pay bump for Bisignano last year was largely driven by a 43% boost in stock awards, which were valued at $23.3 million, according to the filing with the SEC on April 3.

🇨🇦 Airwallex rolls out borderless Visa Cards in Canada, giving Canadian businesses a streamlined approach to global expense management. The virtual card is issued by Peoples Trust Company, part of Peoples Group, and enables Canadian businesses to easily make payments around the world, everywhere Visa is accepted.

🇺🇸 Troubled FinTech Aspiration is suing fraud prevention platform Socure, saying it shouldn’t have to pay a $4 million bill for a contract it canceled. The suit alleges that Socure failed to deliver adequate services and then won a pricey contract renewal in part by providing Deepak Kumar, Aspiration’s former chief administrative officer, with lavish personal benefits and gifts.

🇲🇽 FinTech Fiado authorized as an Electronic Payment Funds Institution in Mexico. Pago Confiado joins a universe of 76 firms already authorized under the terms of the Law to Regulate Financial Technology Institutions, also known as the FinTech Law. It is part of the Fiado conglomerate, which offers financial services to Mexican migrants in the United States and their families in Mexico.

PAYMENTS NEWS

🇸🇬 Nuvei receives Singapore MPI license. This new license enables Nuvei to operate three types of payments services in Singapore, including domestic money transfer, cross-border money transfer, and merchant acquisition services, and complements Nuvei’s expansion across APAC, which includes launching direct card acquiring capabilities in Australia, and its continued growth in China.

DIGITAL BANKING NEWS

🇺🇸 Santander has announced the launch of a new national, digital offering in the US under the Openbank brand in the second half of 2024. The rollout of Openbank in the US market marks the first time Santander combines all its core, proprietary technology to deliver an innovative and secure cloud-based banking platform.

🇬🇧 Digital bank OakNorth is in the early stages of testing to provide wire banking services in the United Kingdom. The London-based bank is beta-testing business banking services, including operational accounts, cards and payments, Chief Executive Rishi Khosla told Bank Automation News.

🇧🇷 Inter&Co, a neobank targeting the Brazilian diaspora in the US 🇺🇸, is setting its sights on rapid growth in the US market. Established in 1994, Inter, as it is known in its original market, serves over 31 million customers. The NASDAQ-listed firm aims to double its client base and achieve 30% efficiency and a return on equity of 30% by 2027.

🇮🇪 Digital bank, N26, is to begin offering joint accounts to users in Ireland. The service is available to all personal customers of the German FinTech, including those using its free N26 Standard service. Each customer can create one joint account with a maximum of two members.

🇧🇷 As another reinforcement for the Security of its customers, Nubank announced the launch of Verified Call: a new tool for over 90 million people who use the app in Brazil. The update allows users to check on the app’s home screen if they are indeed on a call made by Nubank when they receive a phone contact.

🇦🇪 Neobank Keytom launches with lofty ambitions for global expansion. UAE-headquartered Keytom positions itself as the all-in-one neobank for all digital asset needs, bridging traditional finance and crypto to build comprehensive products and bring about greater financial freedom.

🇧🇷 Brazil’s Central Bank introduces features to identify fraud attempts using Pix aliases. Banco Central Do Brasil (BCB), recently announced that it launched a new report on Pix aliases. Registrato users now reportedly “have access to the complete history of their Pix aliases, even those previously disabled.”

BLOCKCHAIN/CRYPTO NEWS

► Siren and Chainalysis partner to trace blockchain transactions. Through the collaboration, illicit activity is easier to identify in real-time across multiple data sources, including Chainalysis’ on-chain data, allowing investigators and analysts to map addresses to named services, detect illicit activity as it happens, and build cases.

DONEDEAL FUNDING NEWS

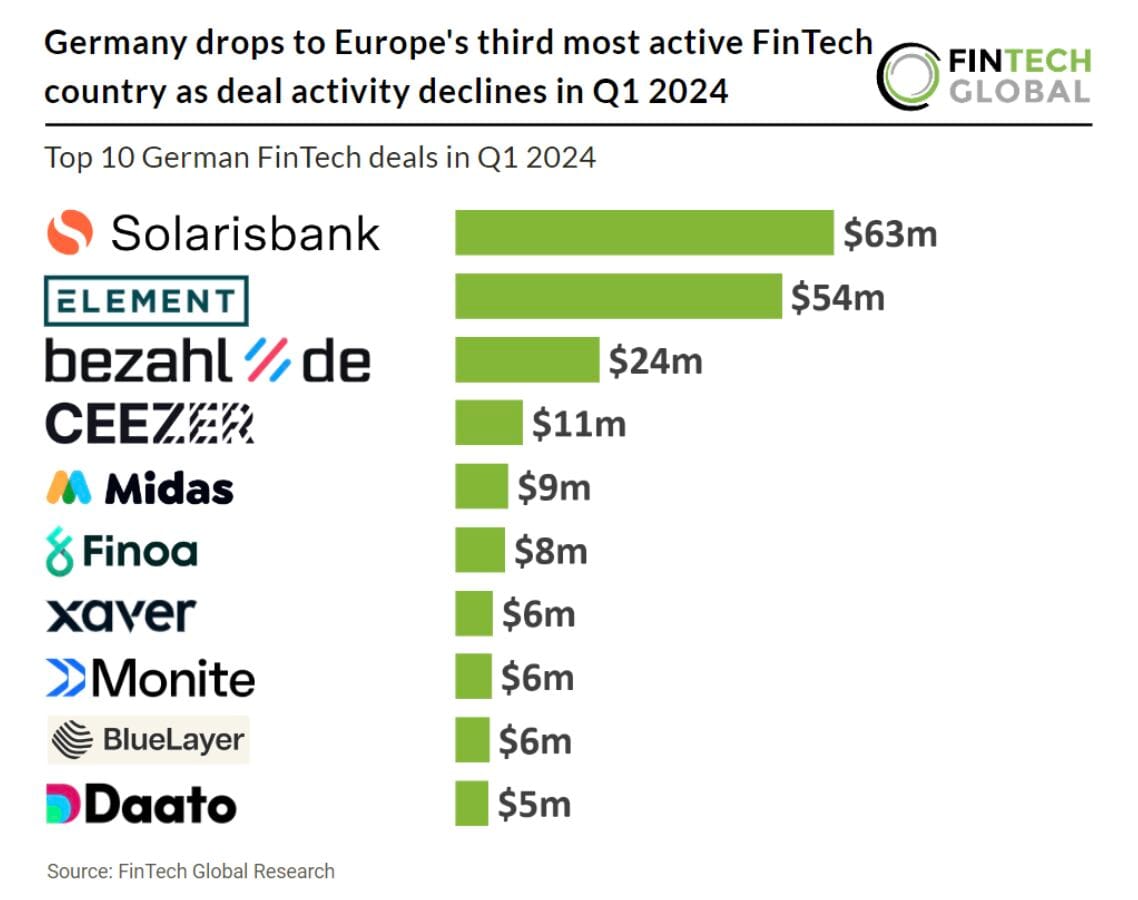

🇩🇪 Germany drops to Europe's third most active FinTech country as deal activity declines in Q1 2024.

More Key German FinTech investments stats in Q1 in 2024:

🇺🇸 FinTech infrastructure startup Parafin secures $125m warehouse facility. Parafin employs a machine learning-based underwriting model based on sales performance to determine eligibility and create personalized financing offers. Read more

🇺🇸 New York-based Adro reports $1.5 million pre-Seed funding round. According to a statement from Adro, the funding round was led by Era, with participation from Ex Nihilo Ventures and the Cornell Tech Syndicate. The firm will use the funding to scale its engineering team and accelerate the development of the platform.

🇬🇧 TransferGo secures $10m investment from Taiwania Capital. This investment aims to accelerate growth in the Asia-Pacific region and support the expansion of its new product offerings. TransferGo’s valuation has doubled since its last investment round in September 2021.

🇦🇹 Monkee's 'Save Now Buy Later' model gains momentum with new seven-figure investment. With 300,000 app downloads and savings goals surpassing €250 million, Monkee highlights a growing awareness and need for a shift in personal finance paradigms. This infusion of capital fuels Monkee's ambitions for further growth and expansion.

🇬🇧 Automotive FinTech Bumper accelerates with £2m investment. The fresh capital is earmarked for accelerating Bumper’s ambitious vision of becoming the leading payment platform for car dealers in the UK and across Europe. This includes investing in new product development and expanding the dealer network.

M&A

🇫🇷 French FinTech Linedata acquires AI software developer DreamQuark. The French start-up’s Software-as-a-Service (SaaS) AI engine enables the banking, insurance and wealth management markets of Asia and Europe to determine a “next best action” approach within client advisory services.

MOVERS & SHAKERS

🇳🇱 Rodrigo Graca Moura joins Backbase as Chief Financial Officer. Rodrigo brings to Backbase a deep finance and business partnering expertise with more than 20 years of experience in scaling enterprise software companies. Read on

🇮🇳 Paytm Payments Bank's MD and CEO Surinder Chawla resigns. As per the company, Chawla resigned citing personal reasons and to explore better career prospects. He will be relieved from PPBL on June 26. The central bank cited non-compliance of regulations and supervisory issues as reasons for the decision.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()