inDrive Launches inDrive Money in Colombia

Hey Fintech Fanatic!

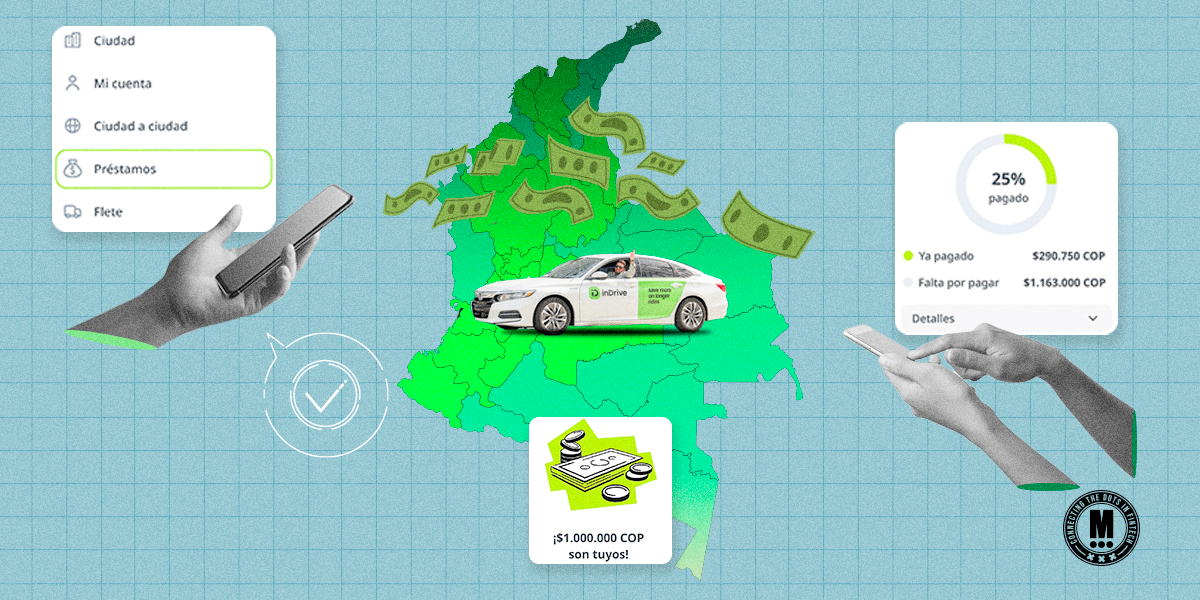

inDrive takes another step towards financial inclusion by launching its first financial product in Colombia—inDrive Money. As the world’s second most-downloaded mobility app, inDrive is expanding its mission to challenge injustice by offering gig economy workers, particularly drivers on its platform, an opportunity to access flexible income-based financing.

This new initiative, powered by a partnership with R2, a Latin American FinTech specializing in SME financing, offers loans of up to COP 1,000,000 (USD 240) for a flexible period of 3 to 5 months, depending on their activity on the inDrive app, to drivers in 17 cities across Colombia.

With seamless integration into the inDrive app, drivers can now manage their finances effortlessly while continuing to earn as usual. This move comes after a successful launch in Mexico earlier this year and signals inDrive’s commitment to ensuring financial freedom and equity for its service providers.

As inDrive continues to expand its financial offerings, it’s clear they’re not just moving people—they're moving the needle on financial empowerment in Latin America.

And now, into the news...

Cheers,

SPONSORED CONTENT

Check out Mangopay's guide to learn how its Fraud Prevention solution examines every touchpoint in the user journey to defend against every type of attack and accept more legitimate users. Less fraud, more conversion.

INSIGHTS

🔤 Open Banking Alphabets. Have you ever found yourself conversing with industry professionals, and it feels like they’re all talking in code? Here is a comprehensive alphabet:

Ready, set, go – from A all the way to Z! 🏁

FINTECH NEWS

🇮🇳 FinTech firm Cred's revenue rises 66%, losses decline to Rs 609 crore. The Bengaluru-based company reported a 66 per cent increase in revenue to Rs 2,473 crore in FY24 from Rs 1,484.6 crore in the previous year. Continue reading

🇦🇷 MercadoLibre, Latam's Amazon.com rival, rides high with AI, loans, drones. The company is finding new ways to serve customers in its online "ecosystem" to lock in shoppers and sellers. Its new offerings, ranging from credit to movies, have helped fuel its rapid expansion.

🇺🇸 Marqeta and Found bring streamlined expense management offerings to SMBs. By partnering with Marqeta, Found will have access to Marqueta’s user-friendly platform that provides tailored physical, virtual or tokenized cards that simplify expense management and enhance cash flow for its customer base.

🇨🇴 InDrive expands its financial services offering, launches inDrive Money in Colombia. The initiative to boost driver financial inclusion will be launched in partnership with R2, a LatAm FinTech specializing in SME financing. Fully integrated with the inDrive app, drivers can easily apply for loans, check balances, and more.

🇮🇳 Moneyboxx Finance expands branch network to 141 by entering South India. The company has 141 branches as on September 29, 2024, and plans 156 branches across 12 states by the end of October 2024, up from 100 branches in 8 states as of March 2024, recording over 50% growth in the branch network.

PAYMENTS NEWS

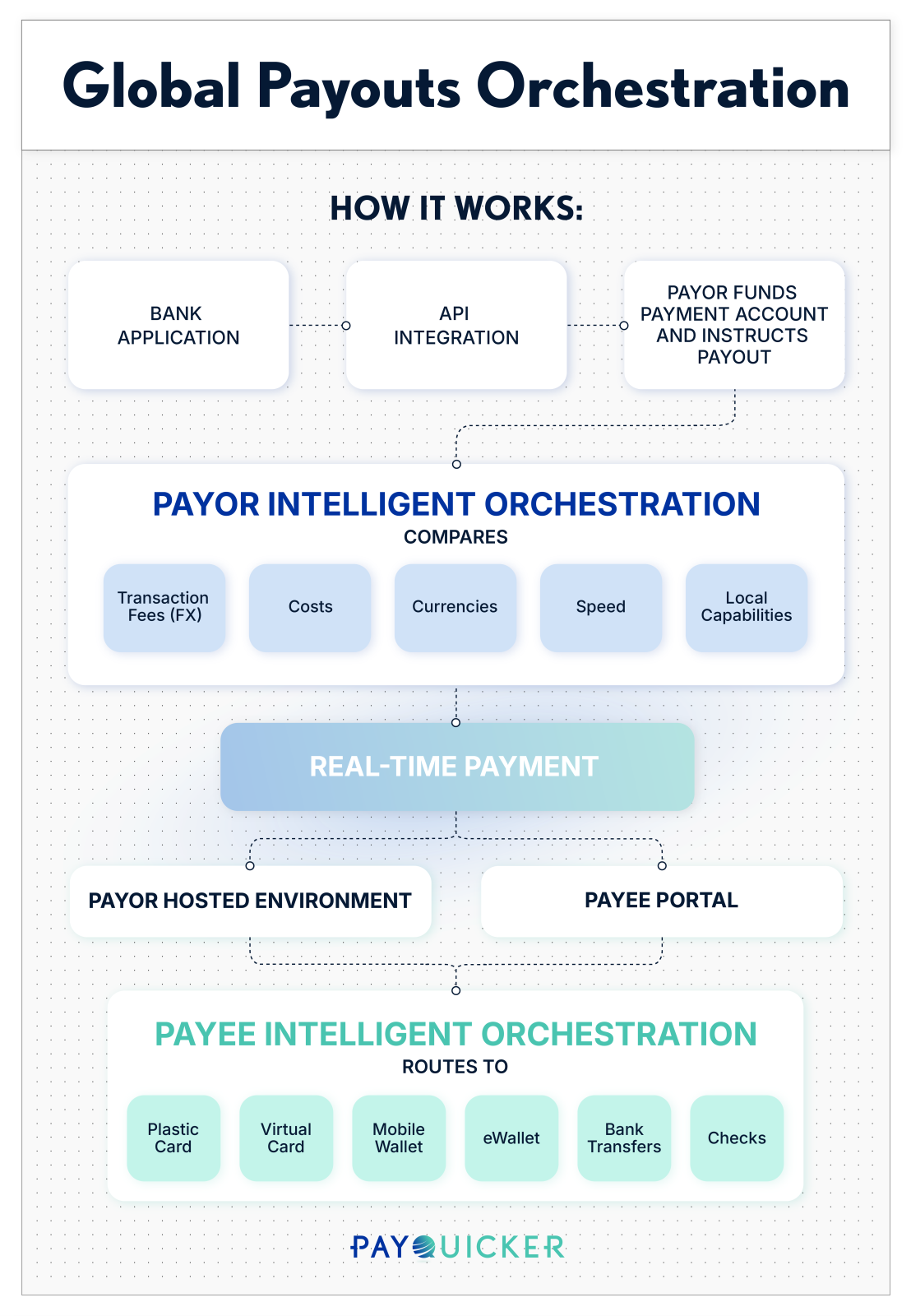

💳 What is Global 𝗣𝗮𝘆𝗼𝘂𝘁𝘀 𝗢𝗿𝗰𝗵𝗲𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 and how does it work?

PayQuicker explains it best:

🇦🇪 Mastercard and Amazon Payment Services to enable digital payment acceptance across Middle East and Africa. The firms have signed a multi-year commercial partnership agreement to digitize payment acceptance in Middle East and Africa, across countries including Bahrain, Egypt, Jordan, Kuwait, Lebanon, Oman, Qatar, South Africa and UAE.

🇺🇸 Jack Henry and Victor offer embedded payments platform for regional and community financial institutions to better support business customers. With this integration, financial institutions will have the opportunity to grow low-cost deposits and non-interest fee income. Read on

🇫🇷 EPI launches Wero, its European digital payment wallet in France. The Wero payment solution will launch for French customers of major banks, including BNP Paribas, Crédit Agricole, and Société Générale, starting in the second half of October 2024. The first Wero brand campaign will be launched in France on October 14th.

🇴🇲 NBO taps PayByte to enhance digital payment solutions in Oman. The partnership marks a significant step towards providing more convenient, secure, and innovative payment solutions for businesses and consumers in Oman. Link here

DIGITAL BANKING NEWS

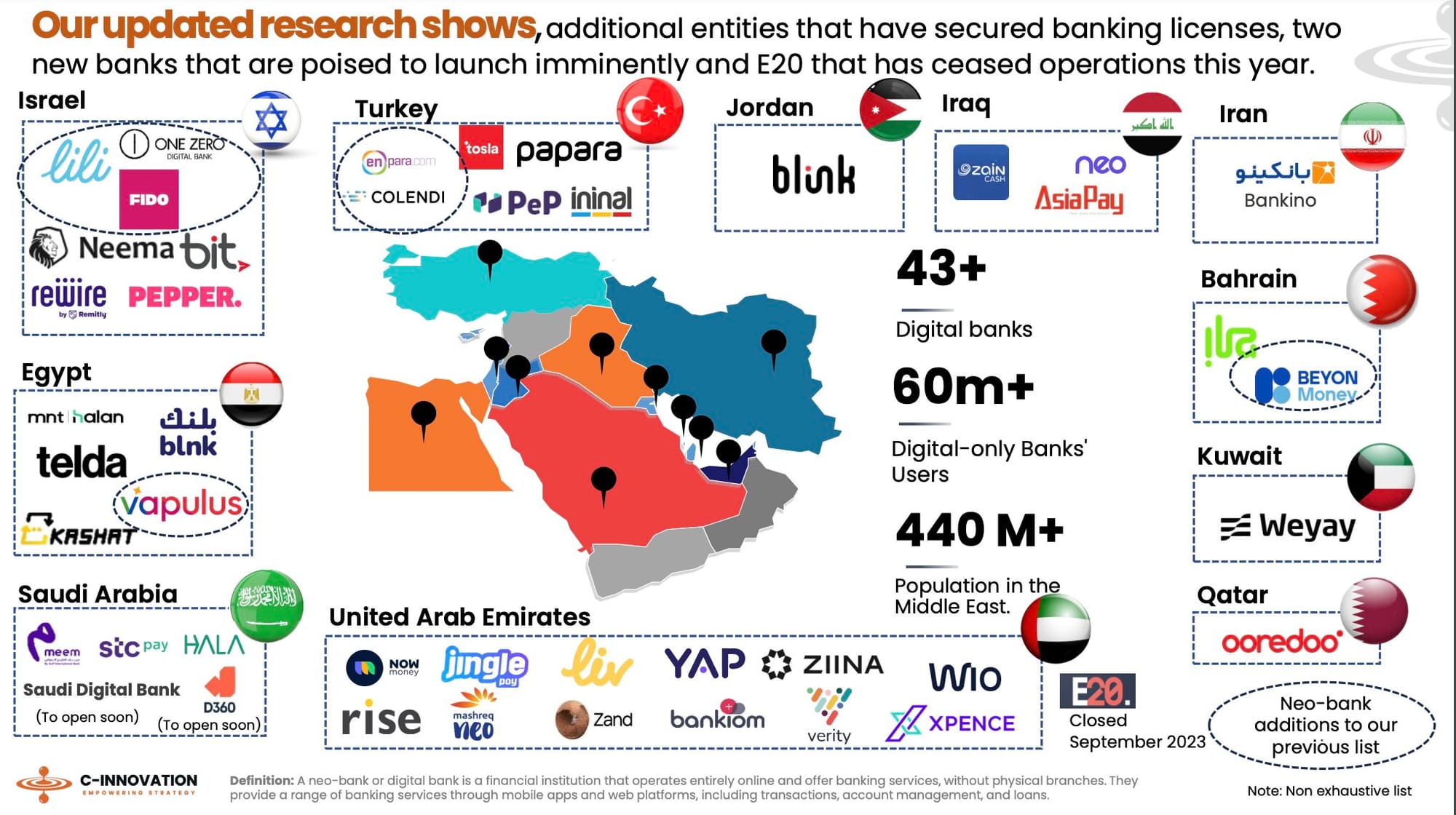

🌍 Now we know that Revolut and Nubank are looking to enter the MENA Region, let's have a look at a digital banking market map from the region:

𝗪𝗵𝗼 𝗶𝘀 𝗺𝗶𝘀𝘀𝗶𝗻𝗴 𝗶𝗻 𝘁𝗵𝗶𝘀 𝗼𝘃𝗲𝗿𝘃𝗶𝗲𝘄?

🇬🇧 Clearbank eyes flurry of new products amid ‘huge demand’ for FinTech. The London-based firm is planning to hire new staff and tap into fresh revenue streams for its next phase of growth, CEO Emma Hagan told City AM. Read more

🇨🇦 TD Bank in talks about money laundering plea. The Canadian bank is in discussions with U.S. prosecutors over the agreement, stemming from criminal charges that its American arm failed to prevent money laundering, The Wall Street Journal (WSJ) reported Sept. 27.

🇬🇧 Chase launches major new campaign to help customers ‘See What Their Money Can Do’. The new platform and campaign – which comes three years after Chase’s launch in the UK – signifies the next step in Chase’s growth as it continues to broaden its product offer and supports a wider range of customers’ financial needs.

🇪🇪 Complytek partners with Advapay to provide core banking solutions. By teaming up, Complytek and Advapay intend to ensure that, even if they maintain their unique offerings, FinTech companies can benefit from an integrated solution. More here

🇬🇧 Bank of England and FCA joint approach to the Digital Securities Sandbox. The Digital Securities Sandbox policy statement sets out the Bank and the FCA’s joint approach to safely adopting new technologies in the operation of financial market infrastructure.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 ComplyCrypto Depository Limited granted FCA registration for cryptoasset exchange. With a focus on transparency, regulatory adherence and innovation, ComplyCrypto is positioned to play a leading role in the UK’s crypto-compliance market.

PARTNERSHIPS

🇮🇳 BUSINESSNEXT and MongoDB team up to accelerate autonomous operations in financial services. The collaboration will empower banking and financial services with the technology needed to deliver exceptional customer experiences and drive autonomous operations.

DONEDEAL FUNDING NEWS

🇸🇬 Singapore's Sleek secures $5M in debt financing led by FinTech Nation Fund. The company stated that this latest round of financing will help the firm continue growing in the markets it serves and expand its service offerings, all while maintaining the high standard of support its customers expect.

MOVERS & SHAKERS

🇮🇪 Bank of Ireland names Akshaya Bhargava as its new Chair. Mr Bhargava will take up the position on January 1, 2025 and replaces Patrick Kennedy who has been Bank of Ireland Chair and Governor since 2018. Read full article

🇬🇧 LHV Bank appoints Mike Goodenough as Director of Banking Services. In his new role, he will drive the development of strategic initiatives to accelerate growth for the bank’s Banking Services business in the UK and Europe as well as enhance the product offerings and further strengthen relationships with clients and partners.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()