IG Group Acquires Freetrade for £160 Million ($195M) in Major Investment Platform Deal

Hey FinTech Fanatic!

IG Group has announced the acquisition of UK neobroker Freetrade for £160 million (USD $195 million). The deal values Freetrade at approximately 5x its annual run rate revenues, based on Q4 2024 performance of £8.3 million, contributing to total 2024 revenues of £27.5 million.

Since its 2018 launch, Freetrade has built a significant market presence with 720,000 customers and £2.5 billion in assets under administration by the end of 2024. The company showed improving financial health in 2024, posting an "Unaudited adjusted EBITDA" of £2.1 million, compared to a £8.6 million loss in 2023.

The acquisition comes despite Freetrade's accumulated losses of nearly £100 million, including a £13.9 million loss in 2023 on revenues of £21.6 million, highlighting IG Group's focus on customer base and market position over historical performance.

Breon Corcoran, CEO of IG commented: “This is a rare opportunity to strengthen IG’s UK trading and investments offering and broaden our target addressable market. Freetrade is one of the most successful emerging players in the UK direct-to-customer investment market, with a strong brand, highly scalable technology and delivering rapid growth. I am delighted that Viktor and his team will join IG and continue to lead Freetrade.”

Stay tuned for the latest updates. In the ever-evolving world of FinTech, being informed is your best asset 😉

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

#FINTECHREPORT

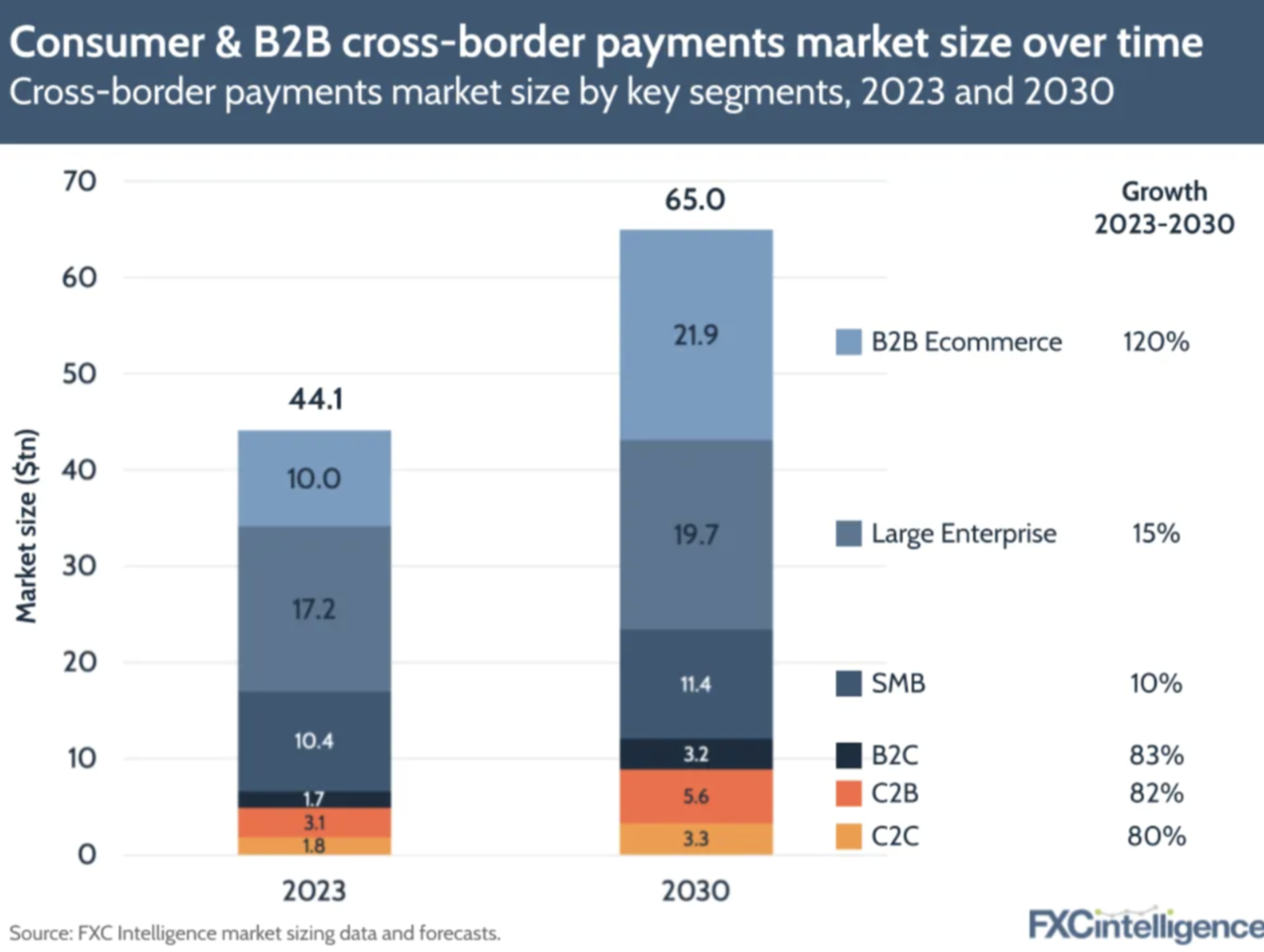

📊 How big is the cross-border payments market? 2032’s $65tn TAM. In this report, FXC Intelligence outlines the overall size of the market and how growth in key sectors is driving a significant upswing in cross-border payments between now and 2032. Download and read the full report

FINTECH NEWS

🇬🇧 Consumers lack awareness of the costs of BNPL. The Lending Standards Board reports that UK consumers are not aware of the true costs of BNPL according to a recent research which underscores the need for more awareness of these products. Read on

🇺🇸 Mastercard agrees to settle pay discrimination suit for $26M. The complaint accuses the company of underpaying female, Black, and Hispanic employees compared with their male and white counterparts, also agreed to conduct annual pay equity audits for three years and hire a psychologist to assess bias in its workplace.

🇮🇱 TradingView adds ColmexPro to list of partner brokers. With the integration with TradingView, ColmexPro brings its advantages to the TradingView platform. Simply find ColmexPro among available brokers, log in with your broker account credentials, and start your trading journey.

PAYMENTS NEWS

🇬🇧 Ecommpay empowers merchants to tailor payments pages with market-leading design tool. The new functionality allows for customisation of any part of a payment page layout as well as providing CSS and A/B testing for optimised performance. Moshe Winegarten, CRO at Ecommpay, commented: “The demand for greater customisation options within the market has been undeniable, and we’re proud to be at the forefront with this innovative tool." Read more

🇨🇿 Changelly announced the addition of Revolut's payment infrastructure. The technical integration allows users to purchase cryptocurrencies using Revolut Ramp, expanding the payment options available on Changelly's platform. Users can access 30 cryptocurrencies using 20 fiat currencies through various payment methods.

🇬🇧 JCB announced a strategic partnership with DOJO to expand JCB card acceptance in the UK. About 6,000 to 7,000 merchants will now be able to accept payments using JCB’s “front of wallet” card. At the same time, DOJO merchants will be exposed to a market of 164 million cardmembers across the globe.

🇬🇧 UK’s BNPL market booms ahead of Crunch Year. Britons are using BNPL like never before to fund their lifestyles. This model, allowing customers to spread out payments without interest or credit checks, has become the darling of retailers and is drawing a growing menagerie of FinTech companies.

REGTECH NEWS

🌍 Salv opens applications for Bridge cohort to protect customers from APP fraud and disrupt criminal networks. This exclusive cohort of 30 banks, FinTechs and crypto companies will share intelligence to tackle the growing issue of Authorised Push Payment (APP) fraud.

DIGITAL BANKING NEWS

🇺🇸 Apple is in talks with two new partners to take over Apple Card. A report from Reuters cites sources familiar with the matter and says Apple is in talks with Barclays and Synchrony Financial about taking over the Apple Card agreement. Find out more

🇺🇸 Block (SQ) was fined $80M for anti-money laundering violations. Block agreed to pay a fine to 48 state financial regulators after the agencies determined the company had insufficient policies for policing money laundering through its mobile payment service, Cash App.

🇬🇧 Countingup hits £10bn customer transactions mark. This achievement underpins the company’s growth, defining its position as a player in the UK’s business banking ecosystem. “This milestone marks a pivotal moment in Countingup’s journey and is a testament to the trust and confidence our customers have placed in us,” said the CEO of Countingup.

🇺🇸 Bank of America profits boosted by loan growth and robust trading. BofA more than doubled its net profits from the same period in 2023 to $6.7bn. The increase was flattered by the payment to top up the federal deposit insurance scheme in 2023 in the wake of the regional banking crisis, and excluding that cost earnings were 14% higher.

🇻🇳 ABBANK invests in Backbase to launch digital banking platform. With this launch, ABBANK provides business owners with enterprise-grade technology and digital banking capabilities, leveling the playing field and delivering a seamless, secure platform for business growth and financial management.

BLOCKCHAIN/CRYPTO NEWS

🇨🇭 AMINA Bank supercharges stablecoin offering with free USDC custody. This offering represents a key milestone in the bank's ongoing commitment to driving stablecoin adoption and delivering value to clients worldwide. Also, the bank offers stability and global reach for holders.

PARTNERSHIPS

🇺🇸 FreedomPay partners with Mastercard on payment solutions. By combining the capabilities of both companies, the collaboration is intended to simplify the process of connecting merchants with acquirers and broaden the range of accepted payment methods across various regions.

🇪🇸 Nuvei partners with Outpayce from Amadeus. This partnership positions Nuvei as a global leader in advancing Outpayce's innovative payment ecosystem. Travel businesses can access Nuvei's expansive suite of payment capabilities, enhancing their ability to process transactions efficiently and securely across geographies.

🇬🇧 10x Banking has partnered with DLT Apps. This partnership offers a fast and convenient migration journey from legacy and non-legacy systems onto 10x, that prioritises data integrity and quality with DLT Apps’ TerraAi. By combining the capabilities banks can better address modern data migrations.

🌎 Bluefin integrates with Visa Platform Connect. This integration facilitates a ‘single’ connection for merchants using Visa Platform Connect, allowing for payment processing in multiple currencies across Visa and other card networks. Read More

DONEDEAL FUNDING NEWS

🇫🇷 Hyperline has raised $10M led by Index Ventures. The startup’s client base has expanded by more than 20 times since 2023, from a handful of early adopters to more than 150 small and medium-sized software and technology businesses. The funds will be used to build out commercial function to satisfy international demand.

🇬🇧 Nomura-backed Komainu raises $75M in Bitcoin. The investment will incorporate Blockstream’s collateral management and tokenization solutions, support the firm’s global expansion and integrate advanced crypto tech. The funding includes the establishment of a Bitcoin treasury to manage the funds.

🇺🇸 KYB verification startup Arva AI raises $3M. The AI has built an AI-enabled platform for automating AML and KYB verification processes. Customers can integrate it into their systems via API, or they can use a robotic process automation approach where its agents authenticate and conduct actions themselves.

🇪🇸 Brickken secures $2.5M to expand tokenized assets platform. Brickken announced the successful funding marking a significant milestone. The newly raised capital will be used to fund its European expansion and to advance the transformation of asset management through blockchain.

🇺🇸 Prepaid payments platform Recharge raises €45M to go on M&A spree. “We see an opportunity to grow faster through M&A and there’s a number of opportunities in other markets and segments that we can consolidate, especially as this industry is still so young,” Recharge’s CEO said.

M&A

🇲🇽 TransUnion signs $560m deal to boost Mexico stake. The deal would take TransUnion’s ownership to 94%, valuing the Mexican company at $818 million, also includes TransUnion de Mexico’s consumer credit business and excludes the company’s commercial segment.

🇮🇳 Amazon to buy Indian BNPL startup Axio for over $150M. The e-commerce group signed the acquisition agreement in December after completing due diligence. The transaction requires approval from the Indian central bank. Continue reading

🇬🇧 IG Group to acquire Freetrade for £160M. “This is an exciting opportunity to accelerate our growth and delivery of new products and features on our award-winning platform. IG’s vision for Freetrade is closely aligned with our own and its backing will be of huge benefit as we continue to scale the business,” CEO and co-founder of Freetrade said.

🇮🇹 Namirial acquires Digital Technologies. Namirial will benefit from access to Digital Technologies' e-invoicing hub that serves multiple international jurisdictions, effectively all countries that have already integrated e-invoicing across Europe, South America and Asia.

MOVERS AND SHAKERS

🇺🇸 InspereX recruits Scott Mitchell as CEO. “Scott will accelerate our growth by driving client service and expanding the value-added investment and technology solutions we provide to broker-dealers, institutional investors, and financial advisors focused on helping investors achieve their objectives," founder and Chairman of InspereX said.

🇪🇺 PayRetailers appoints Natalie McGowan as VP of Acquiring & EU Payment Partners. With over two decades of experience in the payments industry, Natalie brings a wealth of expertise in payment networks and international growth strategies. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()