HSBC Shuts Down Zing International Payments App After Just One Year

Hey FinTech Fanatic!

HSBC is shutting down Zing, its international payments app, just one year after launch according to Financial News. The bank had developed Zing in early 2022 with initial plans to expand into the Netherlands followed by Singapore and the United Arab Emirates.

According to a person familiar with the matter, the decision to close the business comes after challenges in restructuring Zing's compliance functions, a project internally codenamed "Project Green." The app's Netherlands waiting list page has already been removed from its website.

The documents reviewed show that HSBC had ambitious expansion plans for Zing, including acquiring regulatory licenses to serve customers in Singapore and the United Arab Emirates. This closure marks another setback for traditional banks attempting to compete with FinTech challengers who have been gaining market share through competitive foreign exchange services.

Interestingly, this news comes as Wise, one of HSBC's targeted competitors, reports significant growth with a 20% increase in customer numbers and cross-border volumes rising 24% to £37.8bn. Kristo Käärmann, Wise's co-founder and CEO, highlighted their expansion: "This quarter saw us take another step closer to achieving our mission, most notably through extending the availability of Wise to even more customers."

Read more global FinTech industry updates below 👇 and I'll be back tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily Digital Banking updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

POST OF THE DAY

💰 How do consumers pay in Latin America?

Here's a breakdown of the latest 2024 stats👇

#FINTECHREPORT

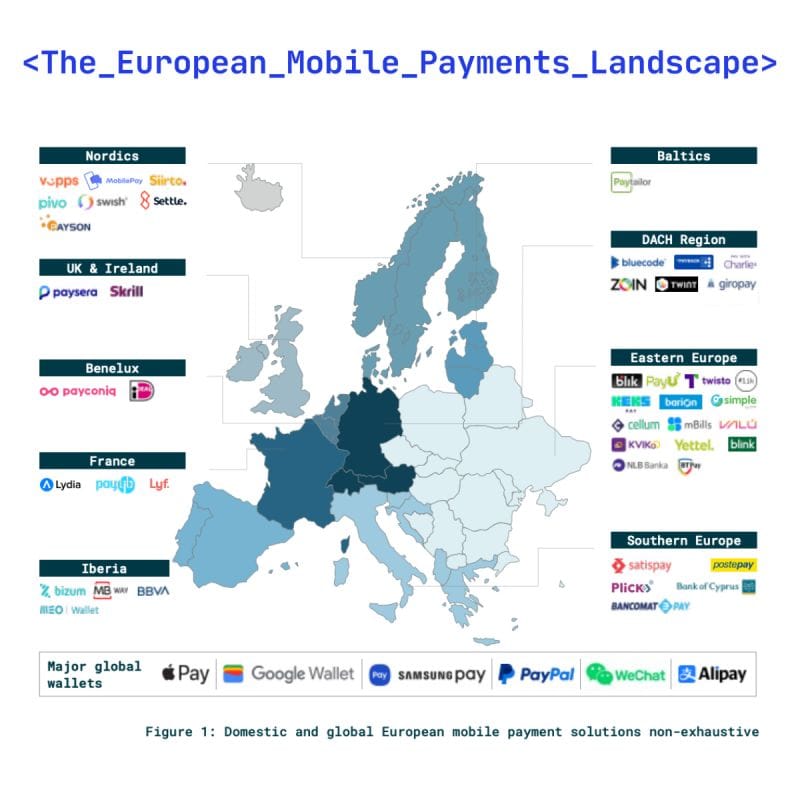

📊 The European Mobile Payments Landscape by Arkwright Consulting.

Which players are missing in this overview? Let's dive in👇

INSIGHTS

🇳🇱 Klarna ordered to halt In-Store Buy-Now-Pay-Later services. The Dutch government has expressed concerns over increasing consumer debt, especially among vulnerable groups like young people. Controversy arose over Adyen and Klarna’s plan to introduce BNPL services to physical retail stores.

FINTECH NEWS

🇪🇪 Wise: FinTech’s customers surge on back of payment deals boom. Wise said it continued to expect underlying income growth of 15-20 per cent in the full financial year on a constant currency basis, but reported growth is expected to be on the lower end of the range thanks to foreign exchange headwinds.

🇺🇸 Ramp encroaches into digital bank territory with new treasury product. With this product, businesses can store cash in a business account and earn 2.5% or in a money market fund for potentially higher yields. They can have quicker access to their cash to pay bills considering cash stored in the business account is liquid.

🇮🇳 Jar turns cash flow positive. The three-year-old startup, which offers savings and investment services to consumers, achieved the milestone while still growing by more than 10 times last year. The profitability push comes as many Indian startups are improving their financials and paring down expenses to become ready for IPOs.

PAYMENTS NEWS

🇸🇪 Ecommpay adds Swish to payment platform to improve checkout experience for Swedish customers.“The addition of Swish is an important step in our mission to make payments fully accessible and inclusive to all consumers, regardless of geography”, said Rosanna Helm-Visscher, Head of Commercial Partnerships, Ecommpay. “Merchants can enable regional payment methods for more than 200 countries across Europe, Asia, Latin America and North America, ensuring every customer sees a familiar payment method when checking out.”

🇧🇷 Pix transactions exceed 6 billion monthly. Matera has released its latest Pix by the Numbers report, showcasing the remarkable growth of Brazil’s Pix payment system and its innovative developments for 2025. The report covers data through Q4 2024, revealing that Pix continues to outpace credit and debit card usage.

🇬🇧 BR-DGE partners with Brooklyn Travel to power payments modernisation. BR-DGE will maintain connectivity to its existing payment partners, add new acquiring connections for resilience and transaction routing options and will provide access to new payment methods.

🇫🇷 IDEMIA launches smartphone enrolment for biometric payment cards. The company aims to deliver to its customers a reliable and convenient enrolment journey. These cards enhance security in the event of loss or theft, reducing the risk of fraudulent contactless payments.

🇪🇺 Marqeta powers Trading 212’s expansion into continental Europe. Trading 212 aims to upend the status quo in financial services and democratize access to markets with free and easy to use apps, enabling anyone to start their wealth building journey. Read more

REGTECH NEWS

🇺🇸 Trump’s SEC launching ‘crypto task force’ to develop clear regulations for industry. The panel’s task will be to develop a clear set of rules while also addressing issues regarding registration of coins. It will work with federal departments and agencies, including the Commodity Futures Trading Commission.

🇬🇧 FCA proposes £100 contactless limit removal and calls for SME support legislation. The decision follows the success of digital wallets with biometric logins, which currently bypass the limit. The FCA plans to prioritize SME lending under new powers expected from the Data (Use and Access) Bill.

🇮🇩 Google hit with $12.6M fine in Indonesia for monopolistic practices in payment system. The antitrust watchdog launched an investigation into Google in 2022 for its market dominance. The agency found that the Google Pay Billing System had charged fees up to 30%, higher than other payment systems.

🇺🇸 Nasdaq report highlights $25-$50 billion savings in bank compliance. The report finds that financial institutions are turning toward strategic technology partners that offer holistic best-in-class solutions to their biggest risk and compliance challenges as a means of addressing the exponential increase in complexity.

🇦🇪 Paymob secures UAE Central Bank retail payment services licence. The license authorises Paymob to offer merchant acquisition, payment aggregation services, and domestic fund transfers. This milestone enables the company to provide merchants with its full suite of omni-channel solutions that drive growth and competitiveness.

DIGITAL BANKING NEWS

🇸🇬 Revolut automates investment: launches Robo-Advisor in Singapore. The service will be tailored to investors by assessing their risk tolerance and financial goals through a series of questions. Customers only need to deposit funds into their portfolios, and the Robo-Advisor will handle market investments automatically.

🇩🇪 finmid expands SME financing to eight new European markets. The move marks a milestone in the company’s mission to provide scalable, compliant, and efficient cross-border financing solutions. The company provides a platform-powered financing network, enabling software platforms to become personalised and convenient points of finance for SMEs.

🇬🇧 HSBC to close international payments app Zing a year after launch. HSBC plans to shut down Zing after struggling to restructure its compliance functions under Project Green, aimed at improving fraud controls, meeting regulations, and aligning with anti-money laundering policies, according to internal documents.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 MoonPay launches Recurring Buys. This feature allows users to purchase a fixed amount at regular intervals and implement a dollar cost averaging (DCA) strategy, helping to reduce the impact of market fluctuations and avoid the stress of market timing.

🌍 Sygnum accelerates its expansion with Societe Generale-FORGE’s EURO Stablecoin. This parthership is a key part of Sygnum’s B2B internationalisation strategy as the Sygnum group builds on its network of partner banks in Switzerland to expand further into Europe with the MiCA regulation now in force.

🇺🇸 Cryptocurrency financial firm to plead guilty after novel FBI probe. The probe, dubbed "Operation Token Mirrors," marked the first time the FBI directed the creation of its own digital token, as well as a fake cryptocurrency company to help bait and catch fraudsters in the market.

PARTNERSHIPS

🇺🇸 JetBlue now takes Venmo online bookings, a first for airlines. Venmo payment options are the latest effort from JetBlue to enhance its services and boost profits. The struggling low-cost carrier has searched for new revenue streams as larger airlines introduce their own budget options, increasing competition for those flyers.

🇺🇸 P2P selects Mbanq to simplify banking for Brazilians in the United States. CEO of Mbanq said, "This partnership demonstrates Mbanq’s commitment to empowering FinTech platforms to achieve their vision. Mbanq provides the necessary technology, compliance expertise, and scalability to help P2P deliver secure and flexible financial solutions."

🇩🇪 Metzler Bank and Unique announce innovation partnership. This partnership will enable Metzler to integrate Unique’s state-of-the-art AI solutions into their operations, enhancing their decision-making processes, client engagement, and overall operational efficiency. Continue reading

🇪🇺 BUX partners with State Street on bringing SPDR ETFs to EU investors. Through this collaboration, BUX will provide its clients access to SSGA SPDR ETFs as well as educational content on investments, which aims to equip investors with information on a wide range of topics in order to make decisions that better suit their investment needs.

🇬🇧 Tandem Bank automates income verification with Sikoia partnership. "This collaboration aims to eliminate administrative burdens, ensure consistent and auditable decision-making, and ultimately enhance the customer experience," founder and CEO of Sikoia said.

DONEDEAL FUNDING NEWS

🇩🇪 Tapline secures €20 million. This funding enables Tapline to scale its operations, expand its innovative platform, and support the growth of SaaS companies across Europe. It also secured a bespoke debt facility from WinYield to finance its debt portfolio in non-dilutive capital to SaaS and subscription businesses.

🇺🇸 Highnote clinches $90m in Series B. The new funds will be utilized to expand in the embedded finance market by enhancing its acquiring services aiming to accelerate growth and expand its market presence in the US, offering a holistic approach to embedded payments to both small businesses and large enterprises.

🇬🇧 Aslan roars to life with £4m seed funding. Its new funding will enable Aslan to augment its rewards offering and expand its workforce. Aslan provides reward cards offering tax-efficient cashback on everyday spending for its clients' employees. Continue reading

🇬🇧 Vertice bags $50M for its AI-powered SaaS spend platform. The startup has now raised around $100 million in total, and while it’s not disclosing valuation, sources close to the company said it is around $500 million. This Series C was an up-round, valuing it higher than the “several hundred millions” it was pegged at 12 months ago.

M&A

🇺🇸 Ally and CardWorks reach agreement on sale of Ally's Credit Card Business. The firms will work together to ensure a smooth transition for customers and employees. The transaction is expected to close in 2025, subject to the completion of customary closing conditions.

🇺🇸 Rent-to-own startup Divvy Homes selling to Brookfield for about $1 billion. The outcome is not a fire sale as previously described in other reports, although it is less than the $2.3 billion that Divvy was last publicly valued at in 2021. The deal is expected to close in mid-February.

MOVERS AND SHAKERS.

🇬🇧 Starling Bank appoints Raghu Narula as Chief Banking Officer. In his role as CBO, Raghu will be responsible for driving customer and commercial growth as well as innovation across all the bank’s customer segments with a focus on the development and launch of new products, customer propositions, and go-to-market strategies.

🇩🇪 Brite Payments hires George Parks Davie for Open Banking knowledge. In his new role, Davie will help expand Brite’s product offering across new and existing geographies and, in addition, will lead the newly-created ‘Payments Domain’ within Brite. Read more

🇬🇧 Mangrove Capital installs Christopher Horne as CEO at The Bank of London. Catherine Brown, chair of The Bank of London’s UK Board, comments: “Christopher’s appointment reflects our commitment to building a leadership team that embodies excellence and vision. His wealth of experience will be instrumental in driving operational excellence and positioning the bank as a leader in the financial services sector.”

🇺🇸 One Inc. announces Scott G. Stephenson as New Board Chairman. "Scott’s extensive capabilities coupled with the existing strengths of our distinguished board members will be invaluable as we execute upon the next phase of our growth," has said the company’s CEO.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()