How Well Do You Know FinTech? Test Your Skills Now!

Hey FinTech Fanatic!

The stablecoin sector is making headlines with three significant developments today.

BVNK, a U.K.-based stablecoin infrastructure company, has secured a $50 million Series B funding round led by Haun Ventures, with participation from Coinbase Ventures and Tiger Global, valuing the company at $750 million.

Ripple has announced the launch of its U.S. dollar stablecoin, RLUSD, on December 17. The token will be available on multiple platforms including Uphold, MoonPay, Archax, and CoinMENA, with additional listings planned on Bitso, Bullish, Bitstamp, and other exchanges in the coming weeks.

Meanwhile, Revolut's planned entry into the $200 billion stablecoin market faces obstacles. Sources familiar with the financial superapp's crypto operations told Sifted that internal red tape and regulatory challenges could prevent the project from materializing, similar to the previously announced self-custodial crypto wallet and native token projects from 2022.

Before you dive into today's news updates, make sure to test your FinTech knowledge with Jas Shah's Big FinTech Quiz of 2024! With 36 questions covering major industry developments, acronyms, and visual challenges, it's the perfect way to measure your FinTech expertise. Follow Jas for more FinTech insights and don't forget to share your score in the comments below!

And here’s something to look forward to: starting in 2025, I’ll be launching monthly FinTech quizzes to keep you sharp and up-to-date with the latest industry trends. Stay tuned—your next challenge awaits!

And if you’re interested in reading a bit about what’s been happening in FinTech, keep scrolling!

Cheers,

#FINTECHREPORT

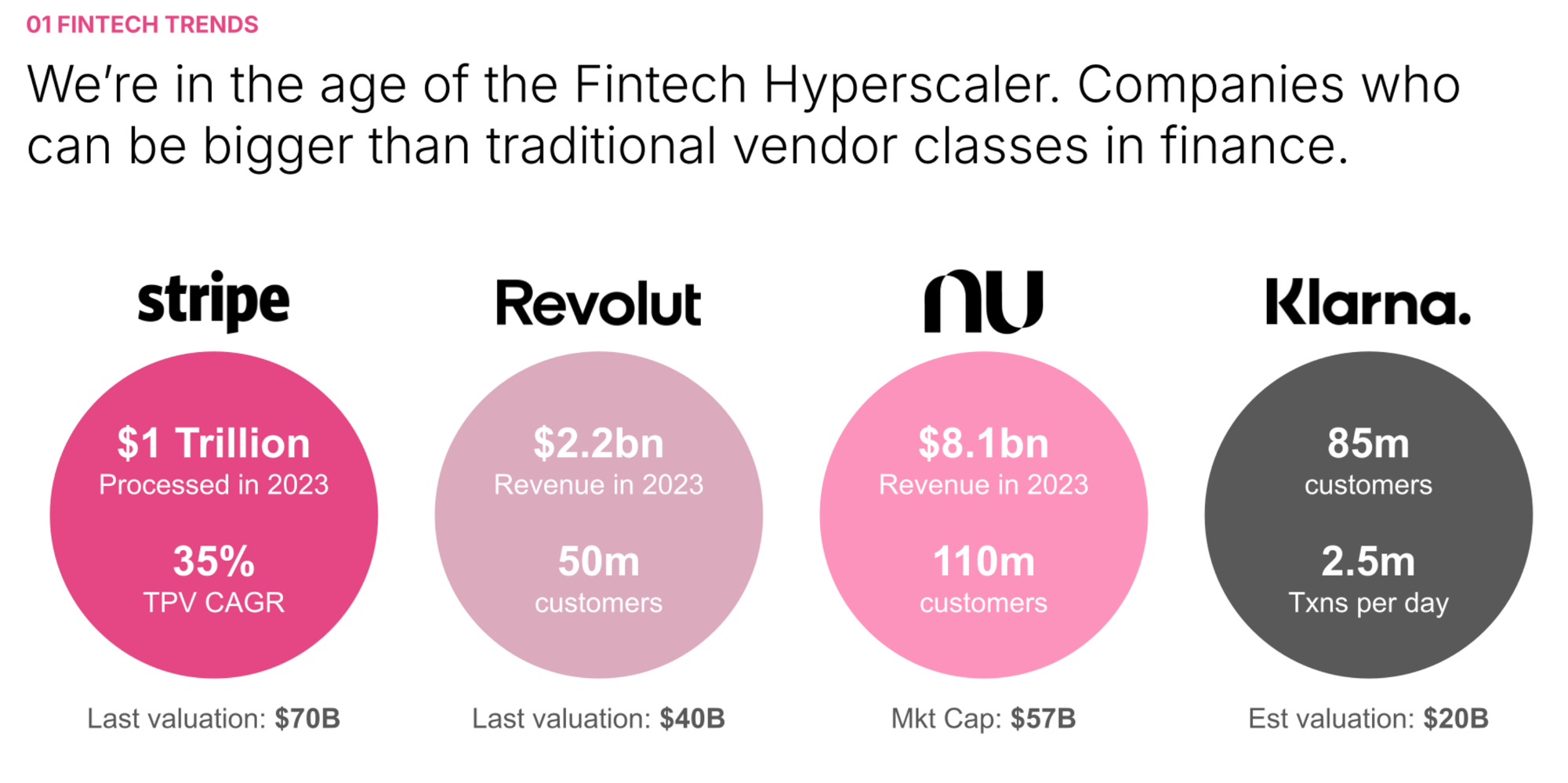

📊 Here are 𝟭𝟭 𝗞𝗲𝘆 𝗧𝗿𝗲𝗻𝗱𝘀 from the FinTech industry in 2024 by Simon Taylor👇

FINTECH NEWS

🇲🇾 Tranglo expands to 10 african markets. With its expansion, Tranglo supports payouts to 25 African nations. The firm assists financial institutions and businesses in making payments through its platform Tranglo Connect, which enables companies to confidently and securely send payments to more than 100 countries. Read more

PAYMENTS NEWS

➡️ Shaping the future of payments in 2025. The future of payments will be more digital, flexible, and consumer-driven. Account-to-account (A2A) payments, biometrics, and AI are enhancing security and usability. AI is setting new standards for payment security and user experience. Take a look at the six key trends shaping 2025 payments.

🇧🇷 AstroPay expands with Multi-Currency Wallet. AstroPay aims to simplify international money transfers, addressing delays and high costs often associated with traditional banking. The company seeks to offer a more efficient solution for global payments.

🇳🇱 PayU partners with Google Pay. This integration addresses the increasing market demand for efficient payment solutions, and provides a seamless and secure payment experience for both consumers and online retailers. Continue reading

🇺🇸 Remote adds USDC payouts for contractors. In partnership with Stripe, Remote supports USDC, a stablecoin pegged to the U.S. dollar, ensuring stability and eliminating cryptocurrency volatility risks. Payments are fast and reliable, avoiding delays common in international transfers.

OPEN BANKING NEWS

🇬🇧 Raisin UK leverages Salt Edge for open banking. The partnership with open banking innovator Salt Edge is to strengthen its compliance with UK regulations, ensuring secure and seamless financial solutions for customers. Read more

REGTECH NEWS

🇳🇴 Neonomics files complaint with Norwegian Competition Authority to support innovation in payments market. The complaint outlines a series of anti-competitive practices by Norwegian banks, financial services providers, and other entities controlled by Norwegian banks.

🇬🇧 PSR urges data sharing to fight app fraud. New reimbursement rules aim to encourage banks to prevent fraud, but PSR stresses that social media, telecoms, and online platforms must also address fraud prevention. The PSR urges these sectors to collaborate with payment firms to close vulnerabilities.

🇫🇷 Esma releases last policy documents for MiCA. ESMA has delivered extensive regulatory work over the past 18 months, comprising more than 30 Technical Standards and Guidelines, many of them developed in cooperation with the European Banking Authority (EBA). Continue reading

🇦🇺 Crypto Compliance enhanced by Banxa & Crystal Intelligence. This collaboration aims to enhance Banxa’s compliance and security measures, particularly as Australia’s cryptocurrency sector faces growing regulatory scrutiny. Click here to access the full piece

🇳🇱 Finom updates e-Invoicing for German compliance. This strategic update comes ahead of Germany's upcoming e-invoicing regulations, which will require all entrepreneurs to receive electronic invoices starting January 2025, with full mandatory e-invoicing for all businesses by 2028.

DIGITAL BANKING NEWS

🇷🇴 Revolut Bank opens in Romania. The digital bank has started the migration of customers from the Lithuanian entity to the local one and issuing Romanian IBANs to existing clients. This update aims to better serve Romanian retail and business clients' financial needs while expanding the bank's product offerings.

🇬🇧 ClearBank joins Microsoft Azure Marketplace. This will open up ClearBank’s banking solutions and payments infrastructure to all Azure customers, presenting an important growth opportunity for ClearBank. Customers can now take advantage of the productive and trusted Azure cloud platform, with streamlined deployment and management.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Revolut stablecoin in doubt. Revolut’s plans to enter the $200bn Stablecoin market has hit some speedbumps and might never materialise. Industry experts question how new entrants can carve out market share. Revolut declined to comment on the status of the project.

🇺🇸 Stable, transparent, trusted. Ripple USD. Ripple USD combines fiat stability with blockchain efficiency: Instant global payments, 24/7, Seamless on/off ramps, and access value in real-world assets.

🇲🇽 Bitso Business exceeds $12B in 2024. Key results include a 90% year-over-year growth in transaction volume, surpassing $12 billion in total transactions. This growth highlights Bitso’s role in accelerating cross-border payments through blockchain technology. Read more

🇨🇦 Bitcoin rally outpaces Crypto ETFs. Canadian crypto ETFs have recorded C$578 million ($405 million) in net outflows this year, according to TD Securities, while U.S. Bitcoin ETFs attracted $36 billion in inflows through December 16. Read more

PARTNERSHIPS

🇭🇰 Crypto.com partners with Accor’s Loyalty Programme. This partnership aims to expand the use of crypto for everyday transactions. Crypto.com COO emphasized the significance of this market-first collaboration and hinted at future expansions, including the possibility of converting loyalty points into crypto.

🇺🇸 Morgan Stanley partners with Wise for corporate payments. This team-up makes Morgan Stanley the first investment bank to offer these corporate payment solutions via Wise. The solution complements Morgan Stanley's existing foreign exchange services for corporate and institutional clients.

🇧🇷 KEO World and Amex launch Workeo B2B in Brazil. The collaboration will help medium and large businesses digitize B2B invoice payments, improving cost efficiency and purchasing power. The partnership aims to provide broader access to financing for Brazilian SMEs, addressing gaps in traditional credit.

🇸🇪 Hemköp launches co-branded card with Enfuce, SEB, and Humla. This marks the first product from their collaboration, showcasing the potential of embedded finance in Sweden’s food retail sector. The partnership highlights how FinTech and retail are converging to deliver innovative, scalable, and secure financial solutions.

🇺🇸 CARD.com & Visa team up for global payments. The partnership aligns with CARD.com’s mission to provide innovative financial solutions. This expansion marks a significant step in enhancing its international financial services. Continue reading

🇫🇮 Tietoevry boosts payments with Visa Direct. This collaboration aims to integrate Visa B2B Connect into the Tietoevry Payment Hub, enhancing the payment capabilities of Tietoevry’s client financial institutions. Continue reading

DONEDEAL FUNDING NEWS

🇿🇦 Nubank expands to Africa and Asia with Tyme. Nubank announced an investment of US$150 million in Tyme Group leading their Series D round. Tyme aims to leverage this investment for expansion and improved customer experiences. Read More

🇬🇧 Crypto startup BVNK raises $50 million. The round values BVNK at around $750 million, according to a source familiar with the deal. CEO Jesse Hemson-Struthers, states that BVNK has an annualized revenue of $40 million and processes $10 billion in annualized transaction volume.

🇺🇸 Parafin secures $100M to boost small business finance. This funding reflects growing confidence in Parafin’s approach to embedded financial services, an area that continues to transform how small businesses access capital and manage their operations.

🇺🇸 Hedera Hashgraph raises $100M. The funds will focus on improving Hedera's public ledger and addressing challenges hindering mainstream adoption. This funding follows an earlier $18 million raised through a private token sale. Read more

🇬🇧 A2A Payments face headwinds, Volume raises seed round. The company has raised $6 million in a seed round led by United Ventures. It had previously raised a pre-seed round of $2.4 million in 2022. The company now plans to obtain FCA approval in the U.K. and expand internationally.

M&A

🇨🇦 Canadian FinTech Paystone acquires Ackroo, for $21 million in an all-cash transaction. The acquisition, set to close in February 2025, includes the purchase of Ackroo’s shares at $0.15 each, a 25% premium over its December 11 closing price. The move aligns with Ackroo's strategic goals given current market conditions.

MOVERS & SHAKERS

🇺🇸 Taktile appoints Stephen Brandes as VP of sales. Stephen brings over a decade of experience from Goldman Sachs, Bain & Company, Wunderkind, and Nitrogen. He recently developed a successful enterprise sales strategy and has strong expertise in strategy, operations, and sales leadership.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()