Google Takes Legal Action Against CFPB Over Payment Arm Oversight

Hey FinTech Fanatic!

Google has filed a lawsuit against the Consumer Financial Protection Bureau (CFPB) in Washington, DC, contesting the agency's decision to supervise Google Pay.

The legal action follows the CFPB's recent announcement to bring large nonbank companies offering digital funds transfer and payment wallet applications under its supervisory purview.

José Castañeda, Google spokesperson, stated: "This is a clear case of government overreach involving Google Pay peer-to-peer payments, which never raised risks and is no longer provided in the U.S., and we are challenging it in court."

The company's lawsuit describes the CFPB's supervision as "a burdensome form of regulation," rooted in "a small number of unsubstantiated user complaints."

The CFPB has clarified that while Google Payment Corp is under its enforcement jurisdiction, its order "does not constitute a finding that the entity has engaged in wrongdoing." This supervisory notice marks the second of its kind to be publicly released by the CFPB since its 2022 declaration to examine nonbank financial companies.

What are your thoughts on the supervision of nonbank financial companies? Share your perspective in the comments!

Read more global FinTech industry updates below 👇 and I'll be back tomorrow!

Cheers,

FEATURED NEWS

🇺🇸 Google sues Consumer Financial Protection Bureau. The company challenged CFPB decision to place Google’s payment division under federal supervision. Google called the move burdensome and based on a “small number of unsubstantiated user complaints.” The CFPB cited consumer risk concerns.

#FINTECHREPORT

🇷🇼 Take a look at “Shaping the future of FinTech in Rwanda.” The Government of Rwanda has adopted a five-year FinTech strategy to systematically develop the country's FinTech ecosystem, fostering economic growth and socio-economic transformation while mitigating risks. This report details the strategy’s rationale, structure, key activities, and success criteria.

INSIGHTS

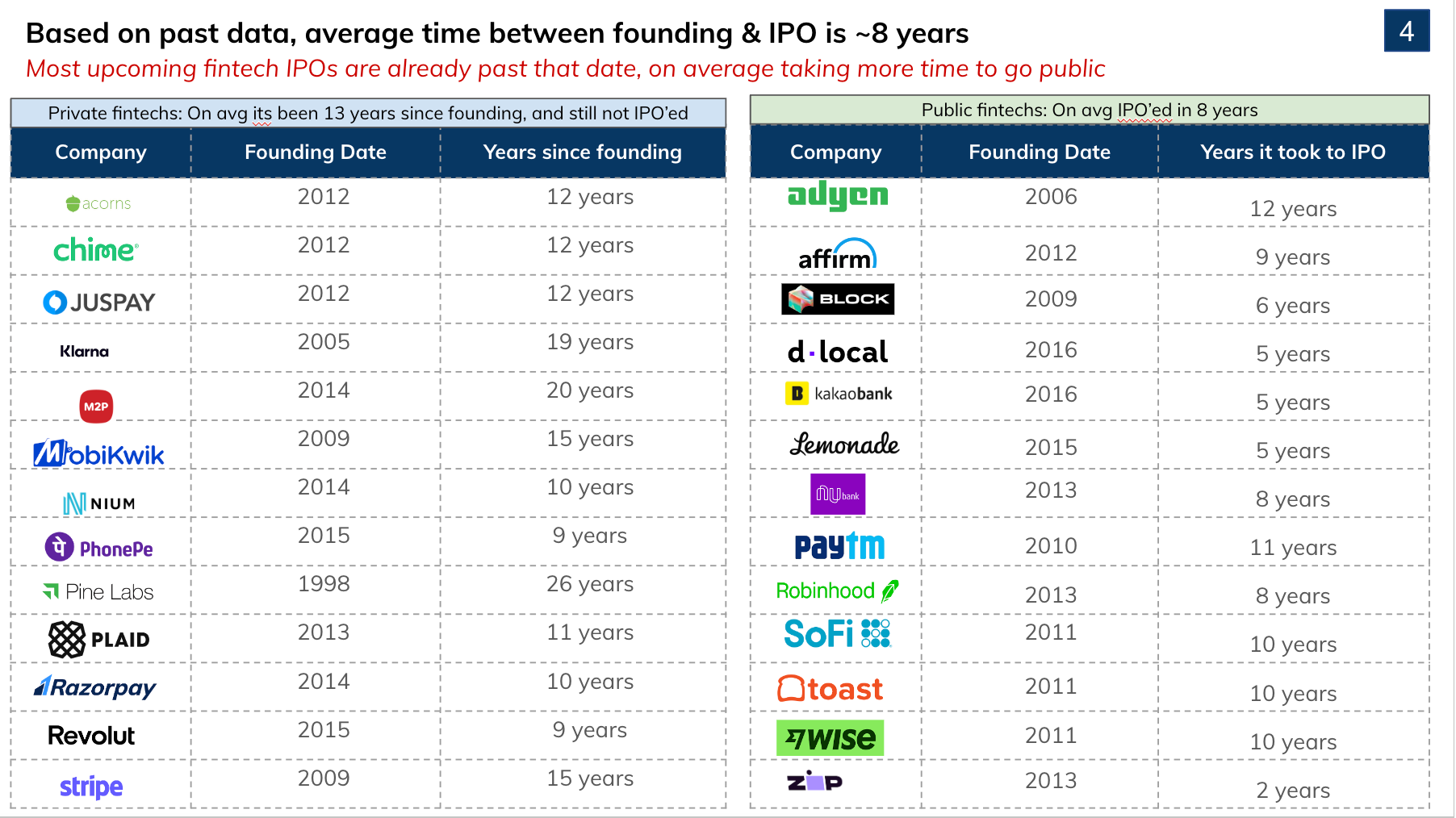

➡️ Based on past data, average time between founding & IPO is ~8 years. Most upcoming FinTech IPOs are already past that date, on average taking more time to go public:

Which FinTech do you think is going public first in 2025?

FINTECH NEWS

🇸🇦 Dubai-based FinTech Stake starts Saudi operations in partnership with Al Rajhi Seventh (RJ7), a local property developer. Stake has selected an income-generating commercial building located in North Riyadh for its inaugural fund on the platform. Read on

PAYMENTS NEWS

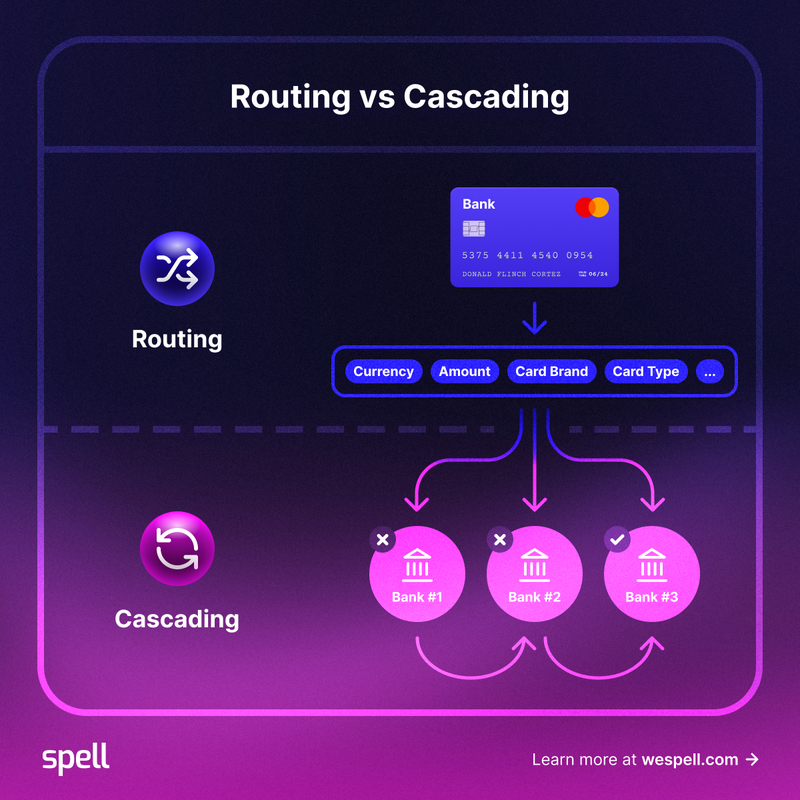

🇱🇻 Routing and Cascading Payments Explained: Techniques, Benefits, And What’s New. This article, by Spell, features some cases of how routing and cascading can optimize payments processing results for PayTech businesses. Spell offers multiple pre-built intelligent routing and cascading scenarios and are always ready to implement new custom-tailored solutions. Dive deeper—read full article

🇺🇸 Is “Data Is King” the New “Content Is King”? Content has been the cornerstone of SEO, marketing, and consumer engagement strategies. But as we stand on the brink of an AI-powered future, it’s time to ask: has content been dethroned? Is data the new king? Uncover the details in PayQuicker's full article.

🇰🇪 Kenyan FinTech Leja processes $2 Billion in business transactions in 2024. This milestone reflects a 30% month-over-month growth rate and a cumulative 300% increase in B2B transactions over the course of a year. Continue reading

🇦🇺 RBA payments data shows massive surge in mobile wallets. For the first time, the RBA's latest retail payments data includes newer payment technology, revealing over 500 million payments via mobile wallets in October, totaling more than $20 billion.

🇺🇸 Paze Checkout Solution makes online shopping fast and streamlined for BofA clients this holiday season. Just in time for the holidays, all eligible Bank of America cards now support PazeSM, which is a secure, streamlined online checkout solution that uses card tokenization to protect cardholder information.

🇸🇬 Ant International joins Swift program to enhance cross-border payment solutions. The initiative, which launched as a pre-pilot program, explores real-world scenarios like tracking cross-border transactions across banks, and aims to improve transparency and user experience in cross-border payments.

🇧🇬 IRIS Solutions launches cardless bank payment app IRISPay for merchants, providing an alternative to traditional card-based payments. IRISPay allows businesses to accept account-to-account (A2A) payments via QR codes, eliminating the need for POS terminals and card networks.

🇰🇼 PayTabs to provide advanced payment solutions in Kuwait. PayTabs Kuwait, in partnership with Concept Combined Group Kuwait, will look to ‘transform’ the country’s digital payment landscape with payment orchestration solutions aimed at driving the digital transformation of its economy.

🇺🇸 US judge won't revive rule capping credit card late fees at $8. U.S. District Judge Mark Pittman in Fort Worth declined to lift an order that has blocked a new U.S. regulation capping credit card late fees at $8, a policy challenged by business and banking groups.

🇳🇴 Vipps launches an alternative solution to Apple Pay in Norway. Tap with Vipps will work on all card terminals that accept BankAxept cards, which corresponds to almost all card terminals in Norway. Access the full piece

🇺🇸 Circle and Pockyt join forces to simplify global payments with USDC. The integration will enable thousands of Pockyt merchants and over a million users to transition effortlessly between traditional and digital payment methods.

DIGITAL BANKING NEWS

🇨🇦 RBC opens up trading around the world to online investors. RBC Direct Investing clients can now trade online through London, Hong Kong, Frankfurt and Euronext Paris exchanges, and hold and trade in eight global currencies - including the British pound, Hong Kong dollar and Euro.

🇬🇧 GFO-X announces ABN AMRO Clearing, IMC, Standard Chartered Bank and Virtu Financial as strategic partners ahead of launch in Q1 2025. GFO-X has been working closely with these partners to deliver the requirements necessary to grow the institutional digital asset index futures and options market.

🇳🇴 Tietoevry Banking joins BIAN to set new global banking standards. This strategic move supports Tietoevry Banking’s international expansion and commitment to modernizing the banking sector through global standards and multi-vendor collaborations.

🇻🇳 Vietnam’s Cake digital Bank marks profitability milestone after 3 years. The bank attributes its success to strong growth, with revenue per user increasing threefold since 2023, reaching US$12 in 2024. It now serves nearly 5 million customers and processes an average of 400,000 credit applications each month.

🇸🇬 Ant International’s global growth surges, led by Alipay+. Ant International, a branch of Ant Group, announced growth driven by expansions in Alipay+, Antom, WorldFirst, and Embedded Finance. Cross-border transactions through Alipay+ have tripled in 2024, although specific transaction values remain undisclosed.

📰 Why the Coolest Job in Tech Might Actually Be in a Bank. For tech and AI talent, jobs at financial services companies are more desirable than they have ever been. Banks have been working hard to make it happen. Read the complete analysis here

BLOCKCHAIN/CRYPTO NEWS

🇱🇹 How accepting crypto payments can benefit education services. The education sector is evolving rapidly, including its payment methods. In 2024, the global eLearning market reached approximately $316 billion, with a projected annual growth rate of 5.3% through 2029, expected to exceed $75.5 billion. Explore Kuna Pay's article to learn more

🇦🇺 Butn and APX Lending partner to service the APAC crypto-backed lending market. The partnership combines Butn’s lending expertise and local market experience with APX Lending’s advanced crypto-backed lending technology to create a robust and secure platform, offering borrowers access to secured crypto-backed lending in the region.

🇺🇸 MicroStrategy buys more Bitcoin as funding draws scrutiny. The firm bought another $2.1 billion in Bitcoin while its combination of equity and fixed-income securities sales to finance the rapidly increasing acquisitions draws increased scrutiny.

🇪🇺 Paybis adds PayPal for crypto purchases in Europe. The Paybis integration is now live in Europe, enabling users to fund crypto purchases directly via PayPal. This simplifies the process for PayPal users, allowing them to buy a variety of tokens on Paybis and easily enter the crypto market.

🇬🇧 Archax and XDC Network form partnership to drive innovation and Growth in real world asset tokenization. Through this partnership, the two firms will combine the power of a regulated digital asset platform with innovative blockchain solutions to enable financial institutions to access tokenized real-world assets (RWAs) cost-effectively and efficiently.

🇺🇸 Coinbase: FDIC put brakes on crypto banking at US lenders. Coinbase is reportedly accusing a U.S. financial regulator of hindering cryptocurrency banking activity, according to a Dec. 6 Coindesk report citing court documents uncovered by History Associates, a research firm aiding Coinbase in its June lawsuit against the FDIC and SEC.

🇺🇸 Firms ride Bitcoin wave to raise billions from convertible debt. Investors have been piling into companies with ties to the industry, opening the floodgates for fundraising. Read full article for further insights

PARTNERSHIPS

🇺🇸 MobiFin and INETCO partner to deliver cutting-edge digital banking and payments security. This partnership will enable financial institutions to maximize the security of their digital banking services while providing a seamless, unified digital banking and payment experience to the customers.

🇬🇧 TrueLayer partners with Ryanair. The partnership represents an important step for both companies, as they will focus on optimising the overall customer experience and accelerate the development of travel finance. Keep reading

DONEDEAL FUNDING NEWS

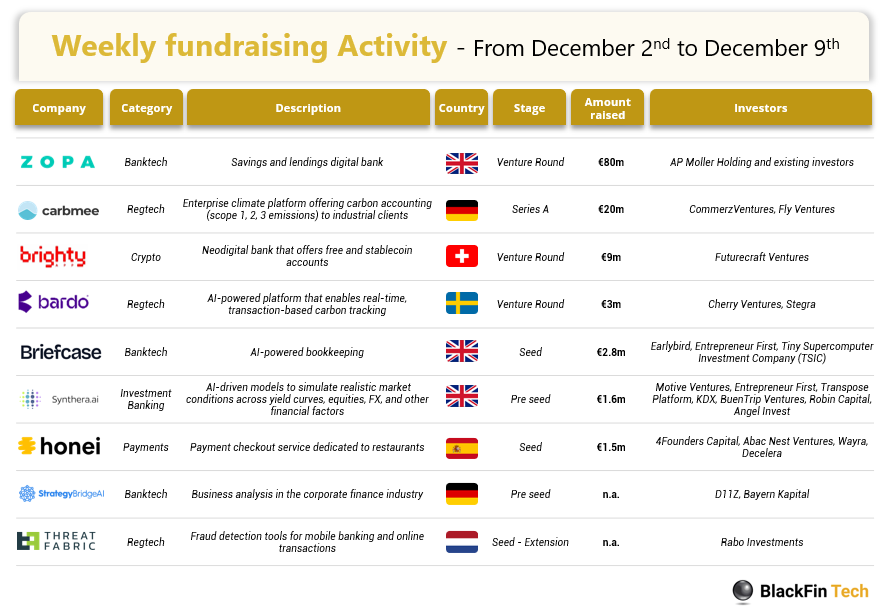

💰 Last week, there were 9 official FinTech deals in Europe, raising a total of €119.6 million, with 3 deals in the UK, 2 deals in Germany, 1 deal in Switzerland, 1 deal in Sweden, 1 deal in the Netherlands and 1 deal in Spain. Read the complete BlackFin Tech overview article

🇩🇪 German wealthtech startup NAO raises €3.4M to make private investments more accessible across Europe. The company has recently introduced B2B solutions for venture capital investments in collaboration with Chartered Investment, and aims to further develop its platform and grow its customer base.

🇯🇵 Paytm’s Singapore arm will sell its stake — in the form of Stock Acquisition Rights (SARs) — in Japan’s PayPay for around USD 280m. Through this deal, PayPay is valued at JPY 1.06 trillion (USD 7bn) and accordingly, PayPay SARs held by Paytm Singapore are valued at net proceeds of JPY 41.9 billion (after netting off the exercise cost of SARs).

MOVERS & SHAKERS

🇸🇬 Cyril Han to take over as Ant Group CEO in March 2025. This leadership transition comes as Ant Group sharpens its focus on growth through its Alipay platform, artificial intelligence (AI), and its global business expansion. Read more

🇦🇺 HSBC exec Nuno Matos to succeed Shayne Elliott as new CEO of ANZ Group. Matos stated that his initial focus as CEO will be to "build on the work already underway and ensure all stakeholders derive even better value from their relationship with ANZ.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()