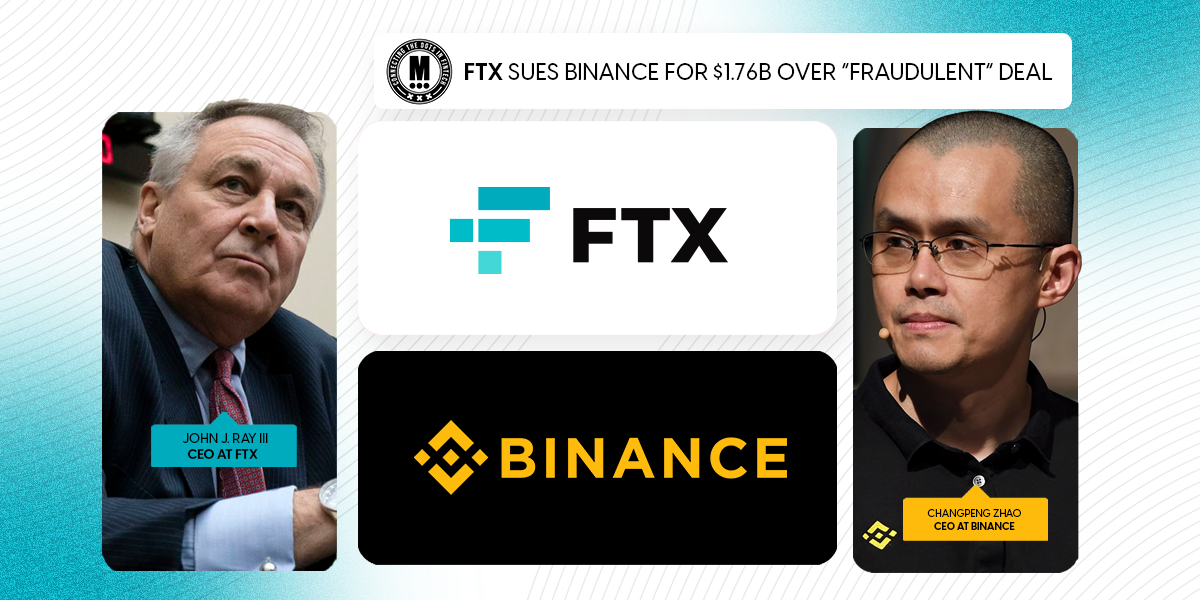

FTX Sues Binance for $1.76B Over “Fraudulent” Deal

Hey FinTech Fanatic!

The FTX estate is now on a relentless mission to recover what it claims as losses from none other than Binance and its former CEO, Changpeng Zhao. According to FTX’s latest court filing in Delaware, it seeks a staggering $1.76 billion, alleging a “fraudulent” deal orchestrated by Zhao and others during a 2021 exit from FTX.

FTX claims that its Alameda Research arm, already insolvent at the time, funneled both company and Binance assets into repurchasing a 20% share in FTX and an 18.4% stake in its U.S. branch, West Realm Shires. The filing labels the move as a “constructive fraudulent transfer” orchestrated by FTX’s co-founder Sam Bankman-Fried, now serving 25 years for fraud.

Binance, however, is standing firm. They refute the claims as “meritless,” pledging to “vigorously defend” their position. This legal face-off also drags in Zhao’s high-stakes November 6 post, where he cryptically stated, “Liquidating our FTT is just post-exit risk management… but we won’t pretend to make love after divorce.” His comments, alongside a subsequent declaration to liquidate Binance’s FTX holdings, are now under scrutiny as potential triggers that ignited FTX’s downall.

Enjoy more FinTech industry updates I listed for you below and I'll be back in your inbox tomorrow!

P.s. Want to boost your brand's visibility in the digital banking, FinTech, and payments sectors? Join us as a partner and connect with a highly engaged audience eager for industry-leading insights. This is a unique opportunity. to showcase your brand directly to decision-makers and innovators in the space.

Ready to make an impact? Sign up here, and let's take your brand to the next level!

Cheers,

#FINTECHREPORT

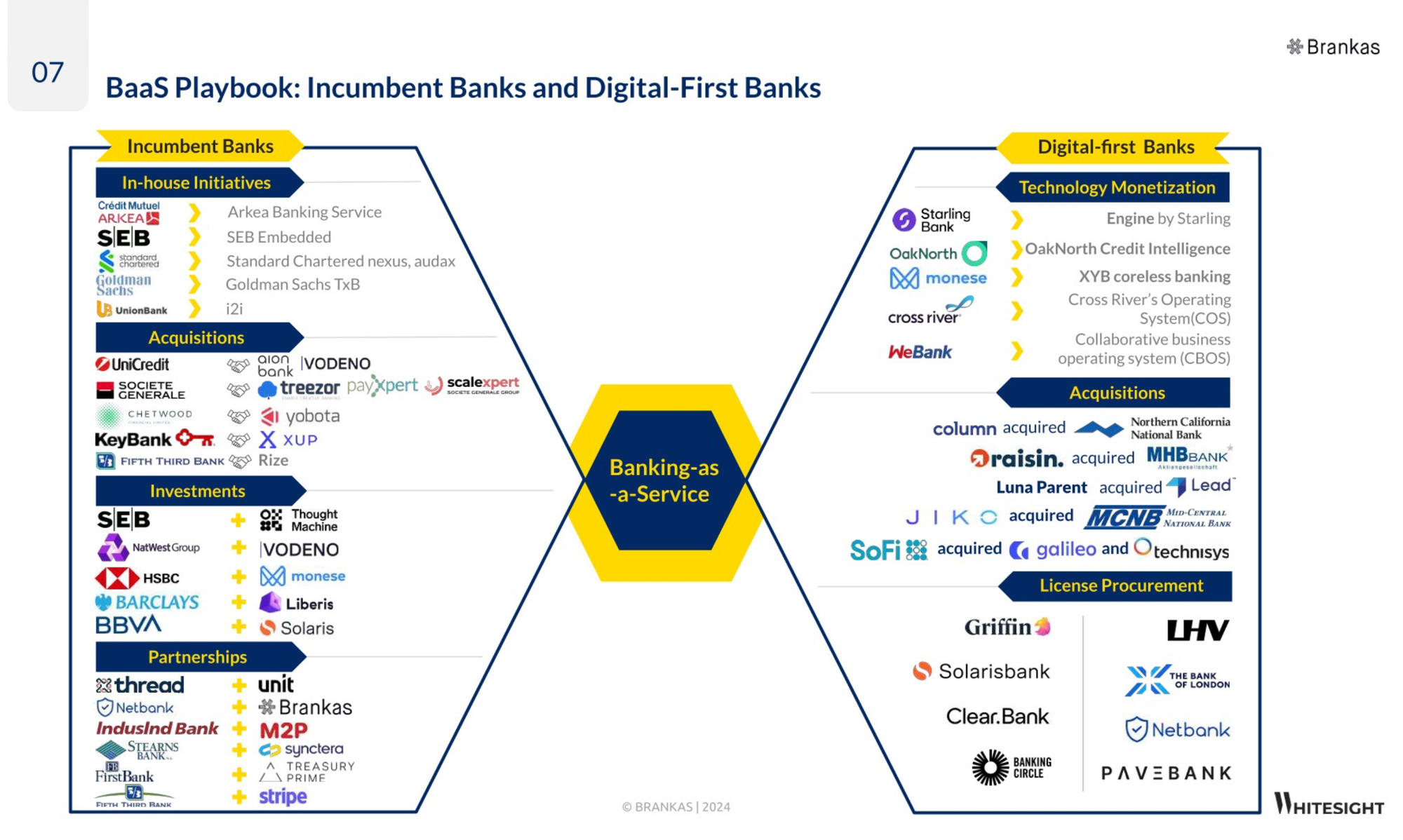

📊 Banking-as-a-Service (BaaS) – Rearchitecting Financial Services Landscape. The BaaS market is set to quadruple by 2032, reaching $𝟲𝟰.𝟳 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 with a 17% annual growth rate 🤯 Discover more

FINTECH NEWS

🇬🇧 Solaris sells its Engage division to UK-based FinTech firm Suits Me for an undisclosed sum, as part of its strategic shift after deciding to scale back operations in the UK. The deal also includes selling Engage Card accounts. Continue reading

🇮🇩 Yup aims to be the ‘Nubank from SEA,’ but the road ahead is long. Just like Nubank, whose first product was a no-fee credit card, Yup offered only a physical credit card when it started in 2021. The platform began expanding its product portfolio in 2022 when it launched an e-wallet feature after getting an e-money license in Indonesia.

🇲🇾 SEA payment platform Tranglo expands to three Gulf states. This move addresses the demand for efficient remittance services, as the Gulf Cooperation Council region is home to over 31 million migrant workers, primarily from South and Southeast Asia, who depend on remittances.

🇸🇦 Silicon Valley’s General Catalyst makes first investment into Saudi Arabia through FinTech Lean Technologies. This, Lean Technologies CEO and co-founder Hisham Al-Falih told CNBC, signifies a 'huge vote of confidence in their view of Saudi's growth trajectory and its potential over the next decade.

PAYMENTS NEWS

🇸🇬 Airwallex joins the Pledge 1% Movement, setting aside equity (US$56M) to support the next generation of entrepreneurs. "As Airwallex enters our 10th year as a business, the time is right to build on our community initiatives to date and commit to an enduring impact program," said Airwallex CEO and Co-founder Jack Zhang.

🇹🇷 Thunes and Papara establish a bilateral partnership to enable cross-border transfers to and from Türkiye. This alliance allows Papara users in Türkiye to send money to over 3 billion wallets, 4 billion bank accounts, and 15 billion cards across 130 countries—making fast, affordable international transfers to Papara accounts possible for the first time.

🇱🇻 How to own a payment gateway? Learn how Spell's mixed model helps businesses that are unsure whether to build an in-house payment gateway or use a white-label SaaS solution to pick the optimal economic route without making any sacrifices. Explore more

🇨🇴 Yuno launches Smart Routing, a revolutionary payment solution leveraging proprietary data and intelligent algorithms, reinforcing its leadership in payment orchestration and commitment to empowering merchants with seamless, intelligent tech.

🇸🇦 BuzzAR launches BuzzPay, an AI-powered FinTech. The platform is designed to fully digitalise the payment processes for one million travelers, particularly from Asia, with a projected economic impact of USD 3.2 billion in Saudi Arabia by 2026.

🇮🇳 Careem Pay introduces instant transfers to Europe and business payments to India. Careem Pay, the digital wallet and FinTech platform within the Careem Everything App, has introduced a new remittance feature enabling secure transfers to businesses abroad, starting with India.

🇺🇸 Corpay Vehicle payments business helps drive profit. The business payments firm’s most recent quarterly earnings, reported Thursday, showed a 6% increase in adjusted profit, driven by growth in those segments. Keep reading

🇬🇧 USI Money to implement Visa Direct to enable fast, seamless payments. The integration of USI Money's technology with Visa Direct enables customers to send money directly to bank accounts and digital wallets worldwide, solidifying USI Money's position as a leading payment provider with diverse payout options.

DIGITAL BANKING NEWS

🇩🇪 Deutsche’s private bank fires over 100 senior bankers in cost-cutting drive. The bank has fired 111 senior managers in its retail and private wealth unit as it enacts cost cuts to meet 2025 targets, aiming to lower the unit’s cost-to-income ratio from 80% last year to 60-65% next year.

🇬🇧 NatWest reveals the fastest-growing scams of 2024. According to the NatWest data, fake parcel delivery texts, social media marketplace scams and AI-powered voice cloning fraud are among some of the modern cons that have seen the biggest rise this year.

🇧🇷 Nubank reaches 100 million customers in Brazil. This number represents 57% of the adult population in the country. Nu had already reached this milestone globally in May. This achievement reflects the focus on customers and leveraging technology to build an efficient, low-cost platform, according to Brazil CEO Livia Chanes.

🇪🇺 Four in five European businesses have issues with legacy banks, says research. Nearly four in five (79%) European businesses report issues with legacy banks, including excessive fees, slow transactions, and poor mobile experiences, according to new research by challenger bank Revolut.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 FTX sues crypto exchange Binance and its former CEO Zhao for $1.8 billion. FTX alleges Binance and Zhao sold back stakes in FTX and its U.S. entity, funded by Alameda Research’s use of FTX and Binance tokens plus Binance’s stablecoin. More here

🇺🇸 FTX also sued Anthony Scaramucci to recover creditor funds. The suit is one of several by bankrupt crypto firm FTX to recover funds owed to creditors, with FTX alleging founder Sam Bankman-Fried engaged in "a campaign of influence-buying" as the company struggled with cash flow.

🇨🇦 Crypto Firm’s CEO freed after CAD 1 million ransom. Dean Skurka, CEO of Canadian publicly listed crypto holding company WonderFi, has been released unharmed after a kidnapping incident. The company owns one of Canada's major crypto exchanges.

PARTNERSHIPS

🇺🇸 Sandbar and Greenlite partner to streamline AML Investigations for banks and FinTechs. Through this collaboration, FinTechs and banks now have access to complementary technology from Sandbar and Greenlite, helping automate key compliance tasks and improve operational efficiency.

🇬🇧 Travelex launches complete ATM technology refresh with NCR Atleos. The new ATMs feature enhanced capabilities including touch screens, barcode readers, and contactless withdrawal options in select European locations. Continue reading

The Payments Group partners with HubPeople to bring cash payments to 100m daters. TPG will initially accept 17 currencies in cash payments. Users can also pay for their dating services/subscriptions with TPG's evoucher solution, a fast, secure service that closely resembles using an Amazon voucher or gift card.

DONEDEAL FUNDING NEWS

🇦🇷 Argentina’s Ualá reaches $2.75 billion valuation in new funding. The Argentine neobank has raised $300 million from investors at a valuation of $2.75 billion, the latest funding haul for one of the most valuable startups in Latin America.

🇨🇦 Neo Financial raises $360M to accelerate growth and position itself as leading challenger to banks in Canada. Consisting of CAD $110M of equity and CAD $250M of debt, the new capital will accelerate the expansion of Neo Financial’s suite of innovative financial products, providing competitive alternatives to traditional banks.

🇧🇷 Brazilian FinTech Tako emerges from stealth with sizable seed round led by a16z and Ribbit Capital. Tako launched its product in 2023, with CEO Fernando Gadotti noting the company processed tens of millions in payroll while operating in stealth. He also said the company plans to expand as it grows into building more features like instant payments.

🇬🇧 Stocks and options trading app, Investa, raises £700k in their first crowdfunding campaign. The investment will help the team to maintain its speed of development and scale marketing operations as they approach launch. Read more

M&A

🇨🇭 Swiss market operator SIX to acquire UK's Aquis. SIX Group will buy Aquis Exchange for £207 million ($266.91 million), offering shareholders 727 pence per share in cash—double its Friday closing price. The deal comes amid growing competition in the European exchange market.

MOVERS & SHAKERS

🇪🇸 PayRetailers appoints Patrick Lemay as Head of Corporate Development. With over 16 years of experience across FinTech, financial services, and payments, Patrick brings valuable expertise to PayRetailers’ corporate development team. Throughout his career, Patrick has managed high-profile projects in both the private and public sectors.

🇬🇧 Paytently hires veteran salesperson and FinTech exec to senior role. Paul Marcantonio has been appointed General Manager of Paytently, bringing 20 years of FinTech experience to support the company’s growth amid rapid technological advancements transforming the industry.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()