Flex Acquires A16z-Backed Maza for $40M

Hey FinTech Fanatic!

Flex, a FinTech startup helping business owners manage both personal and corporate finances, has acquired a16z-backed Maza for $40 million.

The deal comes less than two months after Flex raised $25 million in equity and secured a $200 million credit facility, which brought its valuation to $250 million. While often mentioned alongside Ramp and Brex, Flex positions itself differently: it targets mid-market business owners who also act as their company’s CEOs, rather than large enterprises or venture-backed startups.

Maza began as a financial app for Spanish-speaking consumers in the U.S., offering tools to open bank accounts and apply for ITINs. Over time, the team noticed many of their users were small business owners, often operating alone in fields like landscaping, construction, or cleaning. Maza shifted accordingly, building business tools for a growing solopreneur segment that had been largely overlooked.

That evolution drew Flex’s attention. As both companies built solutions for individuals behind small businesses, their products began to overlap. “Rather than build a parallel product, it made more sense to combine forces,” said Flex CEO Zaid Rahman. Under the new structure, Maza will rebrand as Flex Consumer, with nearly all of its team and its three co-founders joining Flex in executive roles.

The merger comes at a time when FinTech deals are on the rise again. According to CB Insights, Q1 2025 alone saw 184 M&A transactions globally, one more sign that consolidation may be a defining theme for the year ahead.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Dominate the Payments Space! Subscribe to my Daily PayTech Newsletter for daily updates and trends in the evolving world of payment technology. Revolutionize your payments expertise today!

FEATURED NEWS

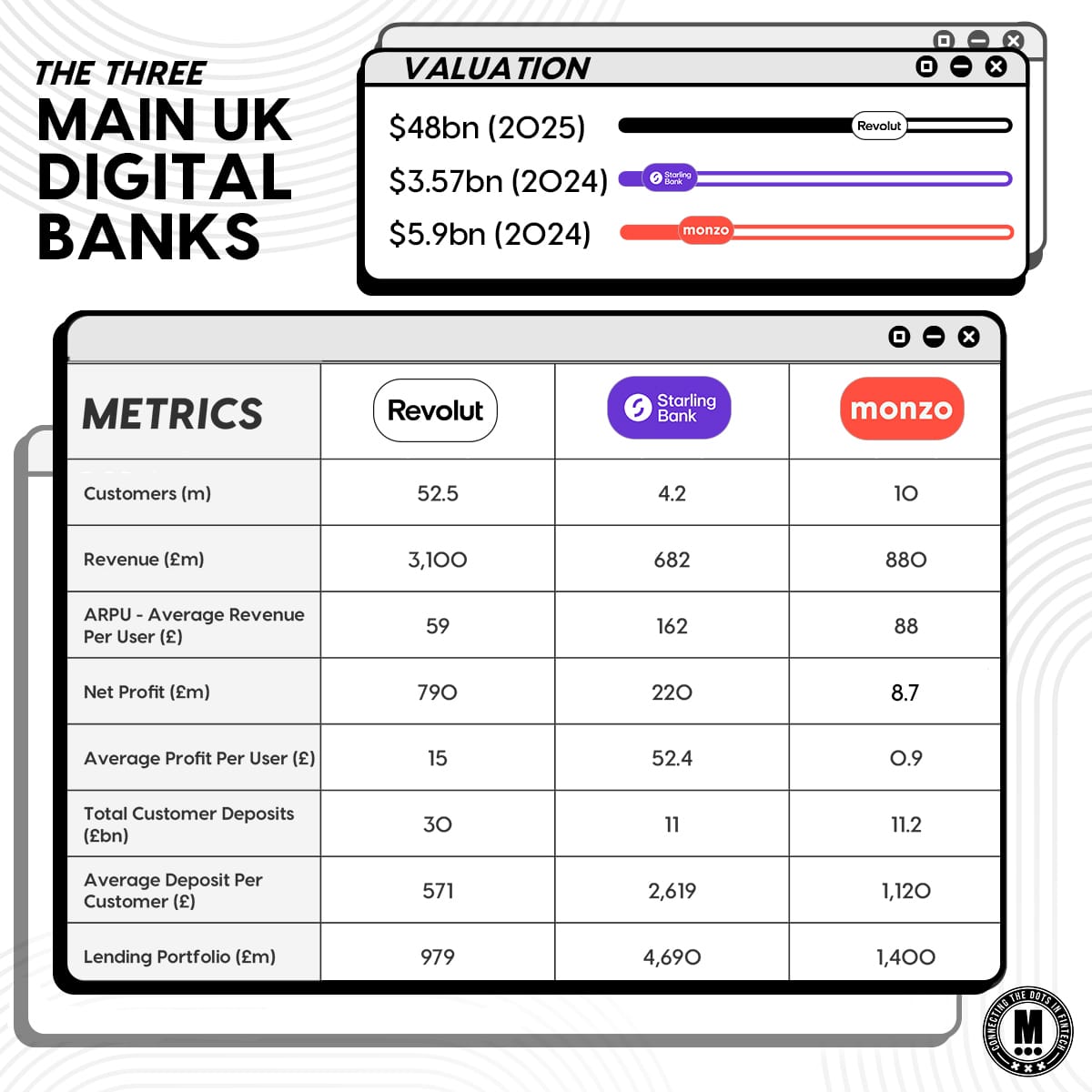

🇬🇧 Revolut released mind-blowing 2024 financial results. Here’s how the numbers stack up against UK rivals Monzo Bank and Starling Bank in financial performance in 2024.

🇿🇦 MTN falls prey to 'cybersecurity incident'. In a statement, the telco found no evidence that its critical infrastructure, core platforms, or services had been compromised. It added that its core network, billing systems, and financial services infrastructure remained secure and fully operational.

FINTECH NEWS

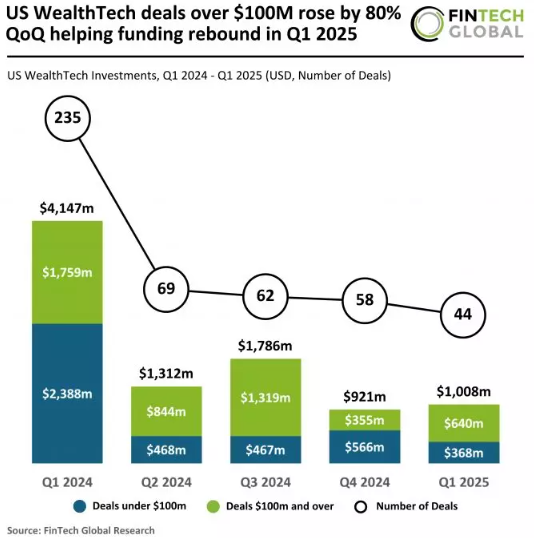

🇺🇸 US WealthTech deals over $100M rose by 80% QoQ, helping funding rebound in Q1 2025. Total funding in Q1 2025 reached $1bn, up 9% from the $921m raised in Q4 2024 but down sharply by 76% from the $4.1bn secured in Q1 2024.

🇪🇺 Euronext launches European Common Prospectus to boost IPO activity across the EU. This new prospectus, designed for use across all Euronext countries, complies with existing EU regulations and offers immediate benefits to issuers and investors.

🇲🇽 Mexico’s FinTech stars start to shine at last. Clara became the ninth Mexican startup to raise money with a valuation above $1bn, joining other “unicorns”. The startup issues corporate credit cards and uses a software system that generates invoices and allows managers to see transactions immediately.

🇺🇸 US FinTech firm Fiserv reports Q1 revenue drop. The Wisconsin-based payment processing firm’s shares fell approximately 7% in premarket trading. The company recorded adjusted revenue of US$4.79 billion, missing analysts’ expectations of US$4.84 billion.

🇸🇬 Revolut Singapore hits first year of net profitability in 2024. Annual revenue in Singapore rose by 70% year-on-year in the banking services and finance app. Deposit balances more than doubled across both retail and business accounts, Revolut claimed.

🇺🇸 Circle executive Dante Disparte denies claims of seeking US banking license. Instead, he said that Circle intends to comply with future US regulatory requirements for payment stablecoins, “which may require registering for a federal or state trust charter or other nonbank license.”

PAYMENTS NEWS

🇺🇸 ACI Worldwide, Inc. to release financial results for the quarter ending March 31, 2025. The company announced that it will report its financial results for the first quarter of 2025 on Thursday, May 8, 2025. Management will host a conference call at 8:30 a.m. Eastern time to discuss these results. Learn more

🇵🇰 Safepay is now officially a fully licensed Payment Service Provider in Pakistan. Reaching this milestone has been a remarkable journey, made possible by their relentless effort, belief, and dedication. Read more

🇺🇸 Worldpay has joined Global Dollar Network. As part of this collaboration, Worldpay will use USDG to settle merchant payments, improve cross-border transactions, and develop new stablecoin-based solutions aimed at increasing financial inclusion and driving broader adoption.

🇬🇧 Weavr launches Embedded Payment Run technology on Paperchase. The solution was designed to eliminate the difficulties of AP processes and boost efficiency, while EPR will allow AP and cloud account software to execute payments within a single workflow as well.

🇱🇹 BOBO adds Google Pay and Garmin Pay. The new features allow clients to make fast, secure, and contactless payments via smartphones and smartwatches, further improving BOBO’s digital offering. This feature offers flexibility and convenience, with support for in-store, online, and in-app purchases.

🇨🇳 Alipay sees tap! users pass 100 million, accelerating payment and AI innovations. Alipay Tap! further simplifies the payment experience for both consumers and merchants compared to the “scan-and-pay” model ubiquitous in China.

OPEN BANKING

🇦🇪 Pay10 first to launch on UAE's regulated Open Finance infrastructure. This is to promote secure, customer-permissioned access to financial data through licensed third-party providers. The regulation outlines a phased rollout and is a foundational component of the UAE’s broader digital economy and financial inclusion strategy.

REGTECH NEWS

🇪🇸 Spanish start-up Acoru launches fraud detection platform. The Madrid-based firm says its offering leverages pre-fraud indicators to identify mule accounts, detect early fraud signals, and mitigate money laundering risks by "continuously monitoring and classifying account types over time".

🇪🇺 Ondato obtains eIDAS certificates for qualified trust service components. This accomplishment increases Ondato’s role as a strategic partner for organisations aiming to expand or implement qualified trust services in line with EU law. Keep reading

DIGITAL BANKING NEWS

🇦🇪 UAE Digital Bank Ruya becomes first Shariah-Compliant Islamic Bank to enable bitcoin purchases with licensed partner Fuze. This new service is enabled through Ruya's licensed partner, Fuze, allowing everyday halal savers to buy and hold Bitcoin directly within their banking app for the first time worldwide.

🇧🇷 Nubank (ROXO34) is set to launch a new private payroll loan product. Eligible customers will be able to apply for and manage the loan directly through the Nubank app, with approval confirmations expected within 24 hours. Meanwhile, Nu Mexico receives banking license approval, paving the way for product portfolio expansion and increased financial inclusion, including the introduction of a payroll account, a key opportunity to increase financial inclusion in Mexico.

🇧🇷 Moneythor has recently expanded into Brazil. The company's goal is to "strengthen the relationship between banks and customers" by assisting financial institutions in transitioning to a model focused on loyalty and personalization, known as "deep banking."

🇷🇴 Romanian users hold over EUR 1.2 billion in Revolut accounts, lending up 88%. Romanian users and businesses also hold large amounts of money in their Revolut accounts and have used the lending facility extensively relative to the previous year.

🇺🇸 NuMark Credit Union selects Alkami to power its digital banking platform. The integration of Alkami Data & Marketing Solutions will empower NuMark with advanced data analytics and personalization tools, enabling the credit union to engage members with tailored financial solutions and timely insights.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Ripple announced it will not proceed with an IPO this year and does not need fundraising or market exposure, due to its billions in cash reserves. CEO Brad Garlinghouse also stated that external fundraising is not needed for the time being. Read more

PARTNERSHIPS

🇬🇧 DECTA partners with Paysecure to expand payment orchestration capabilities. For DECTA, this collaboration expands its distribution network, allowing more merchants to benefit from its comprehensive payment solutions. Continue reading

🇺🇸 Spin by Oxxo has partnered with Félix Pago to streamline remittance services for Mexicans receiving money from the United States. Through this collaboration, Spin users can generate a link within the Spin app, share it via WhatsApp with their sender in the U.S., and receive funds instantly.

🇺🇸 Pinwheel announces Integration with Q2's digital banking platform. With this integration via the Q2 Digital Banking Platform, banks and credit unions can provide consumers with instant direct deposit switching within their account onboarding journey.

DONEDEAL FUNDING NEWS

🇮🇳 Indian FinTech startup Bachatt secures $4m seed funding. This financing comes at a time when household savings rates in India are declining according to economic data, highlighting the timely nature of tools that encourage systematic saving behaviors.

🇸🇬 SG FinTech firm Surfin Meta raises $26.5m to help the unbanked. The company intends to use the newly raised capital to enter new markets and enhance its research and development of financial products for underserved communities. Read more

🇬🇧 WineFi secures £1.5M Seed funding for fine wine investing platform. The funding aims to enhance WineFi's platform, which offers data-driven access to fine wine investment opportunities, making this asset class more accessible to a broader range of investors.

M&A

🇺🇸 Flex acquires a16z-backed Maza for $40M as FinTech M&A heats up. Maza will rebrand as Flex Consumer, and Maza’s founders Arango, Robbie Figueroa, and Siggy Bilstein, will take on executive roles within the combined entity. Keep reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()