FinTech on the Move: LA Wildfire Fundraiser Run

Hey FinTech Fanatic!

Networking in FinTech usually means coffee chats and cocktail hours. But at the FinTech Running Club we are changing it! It’s not just an idea anymore; it’s a growing community, bringing FinTech professionals together on the run.

Today I’m in San Francisco for the 2nd edition of the FinTech Running Club, running alongside Kelsey O’Hara and a group of inspiring FinTech professionals. And in March 15, we’re switching things up in Los Angeles with my friends from LA FinTech Connect for a special event: the Wildfire Fundraiser Run. It’s more than just a run—it’s a chance to come together, support a great cause, and raise funds for the California Fire Foundation, all while connecting with fellow FinTech enthusiasts.

Whether you’re a seasoned runner, curious about joining our community, or simply eager to support a great cause, I’ll be there in LA, excited to welcome you!

Sign up here and see you there!

More details on FinTech industry updates are below 👇

Cheers,

SPONSORED CONTENT

Ready to transform your financial products? Meet Ingo Payments at Fintech Meetup in Las Vegas to explore embedded banking. Stop by for drinks and a conversation—reserve your time now!

BREAKING NEWS

➡️ Bybit enhances market Clarity by making real-time crypto liquidation data public. The crypto exchange has launched an industry-first initiative by making all liquidation data accessible in real time via its enhanced API. This move aims to improve market transparency, empower traders, and boost institutional confidence in crypto.

FEATURED NEWS

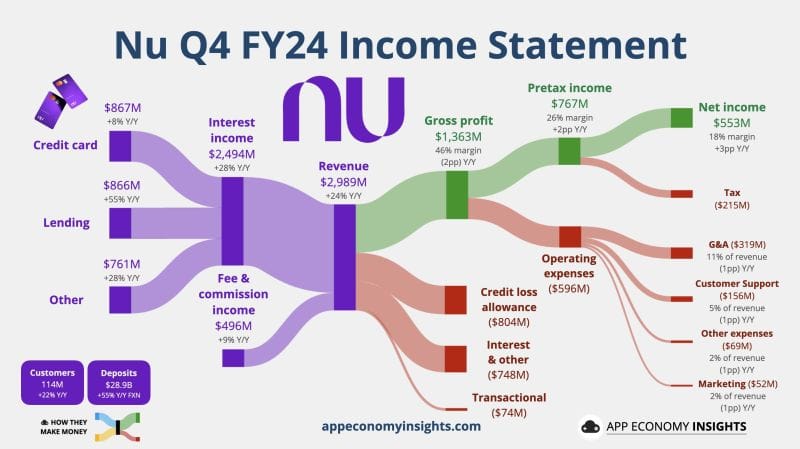

🔥 Nubank’s Q4 FY2024 Earnings are on Fire.

INSIGHTS

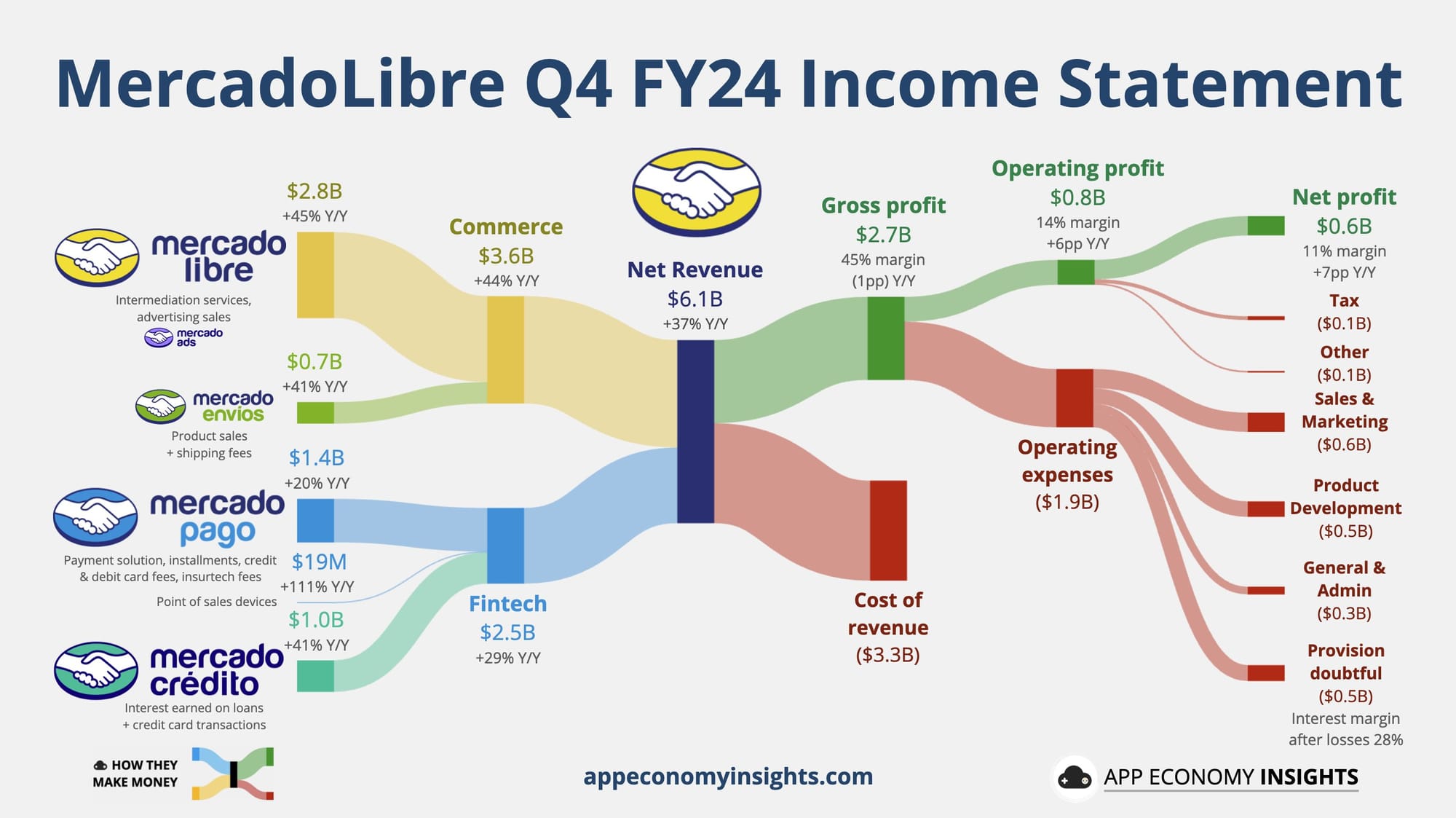

📊 LatAm’s e-commerce & FinTech Giant continues to grow at a strong pace.

Here’s a breakdown of Mercado Libre's latest Earnings👇

FINTECH NEWS

🇪🇺 PayQuicker expands instant and seamless clinical trial payouts for EU and UK. This real-time digital payment solution offers secure, compliant, and seamless participant compensation to streamline clinical trial organizers' payout operations, eliminating the need for onsite card issuing.

🌎 Forbes debuts 18 new firms to FinTech 50 list. B2B banking, Wall Street, and enterprise, payments providers dominated the list, making 31 out of the 50 picks. The remainder was dispersed between real estate, insurance, blockchain, and crypto. Familiar names on the list include Plaid, Coalition, and Chime.

🇺🇸 Dave completes transition to simplified fee structure. The company announced the completion of changes to its optional “Tips” and instant transfer feature for using its ExtraCash service. The model allows members to access credit with a simplified 5% fee structure including a $5 minimum and $15 cap.

🇵🇪 Do Payment prepares to enter the U.S. and Brazil. The company is following an ambitious roadmap. By 2025, the company aims to process over $700 million in transactions, marking a milestone in its growth. The next targets in its expansion plan are clear: the United States and Brazil.

PAYMENTS NEWS

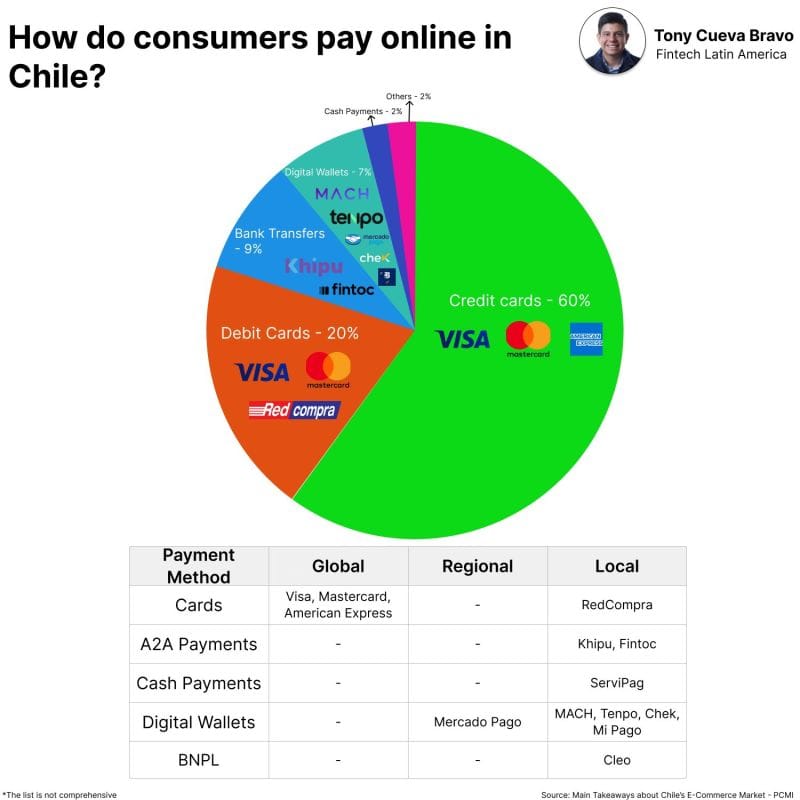

🇨🇱 How do consumers pay online in Chile?

🇬🇧 UK government issues £49m tender for payment services provider to underpin GOV.UK Pay platform. The move is part of the government’s push for open banking, highlighted in its National Payments Vision, which urged “the FCA and PSR to consider its commitment to developing open banking to drive delivery of seamless account-to-account payments.”

🇧🇷 Claro receives IP license, with capital of over R$ 263 million. The telecommunications operator has received authorization from the Central Bank to operate a regulated Payment Institution. The approval allows Claro Pay to operate in the roles of electronic money issuer and Payment Transaction Initiator.

🇬🇧 Mastercard wins UK court nod for £200m deal to end £10b class action claim. The Competition Appeal Tribunal approved the deal rejecting the litigation funder Innsworth Advisors Ltd.’s allegation that the settlement undervalued the claim.

🇺🇸 Chase to restrict use of Zelle for purchases through social media. Chase told customers that it will add some restrictions on their use of the peer-to-peer payment network Zelle with Chase. The new provisions include that it may delay, decline, or block Zelle payments that originate from contact through social media.

🇺🇸 Galileo enables brands to offer co-brand debit rewards cards. The program will initially focus on the hospitality and travel sectors. By enabling them to quickly offer loyalty-driven debit cards, Galileo helps boost customer engagement and drive increased spend.

🇧🇷 Pix Expands Again: Contactless, Bolepix, and Automation. The Central Bank (BC) announced that Pix proximity payments will be available to Brazilians. Users will be able to make payments simply by bringing their phones close to a compatible machine, without the need to open the bank app.

🇺🇸 Block shares plunge 18%, for worst day on market in 5 years after earnings miss. Block reported earnings of 71% per share, falling short of the average analyst estimate of 87 cents. Block’s Q4 revenue grew 4% to $6.0 billion ($230 million miss), while gross profit grew 14% to $2.3 billion, slightly below expectations.

▶️ Agents and LLMs can now understand, query, and execute Stripe with its new MCP server. Watch the video to see it in action, enabling voice-powered subscription management. (Source: Jeff Weinstein on X)

DIGITAL BANKING NEWS

🇵🇹 Revolut has received authorization from the Bank of Portugal to open Revolut Bank UAB's branch in the country. With this legal presence, Revolut will be able to offer local IBANs and more credit products for its clients. Read on

🇸🇬 Trust Bank reaches 1 million customers and unveils TrustInvest. Through TrustInvest, customers can choose from five different funds. With each fund designed to meet differing investment goals and risk appetites, ensuring a smooth and accessible experience.

🇬🇧 Four banks fined by UK regulator over gilt information sharing. Citi, HSBC, Morgan Stanley and Royal Bank of Canada will pay the penalties after a Competition and Markets Authority investigation found that between 2008 and 2013, some traders shared sensitive gilt trading info in private chats.

🇺🇸 Freedom Bank of Virginia modernizes digital banking services with Apiture. With Apiture’s Consumer and Business Banking solutions, Freedom Bank’s customers benefit from modern, fully featured online and mobile solutions with innovative digital support options.

🇸🇬 Grab’s digital bank deposits surpass US$1.2B, loan disbursements hit US$639M. The company reported a 17% year-on-year increase in fourth-quarter revenue for 2024 to US$764 million, supported by growth across its ride-hailing, delivery, and financial services segments.

🇺🇸 Chime has confidentially filed to go public this year. If it were to go public today and receive a valuation in line with its peers, it could be worth $9.9B—less than one half of what they saw in the private markets, according to F-Prime. Read on

BLOCKCHAIN/CRYPTO NEWS

📊 2025 World's Most Trustworthy Crypto Exchanges & Marketplaces according to Forbes👇

🇺🇸 BitGo integrates with Core to unlock institutional-grade Bitcoin rewards. The integration bridges the gap between Bitcoin’s security-first ethos and the scalability and sustainability of decentralized finance (DeFi). This partnership reinforces BitGo as a trusted gateway for institutional Bitcoin access.

🇺🇸 SEC staff have agreed to dismiss their case against Coinbase. The case will reach a final resolution once the SEC Commissioners give their approval to the staff’s recommendation to dismiss the case. Dismissing the lawsuit may shift focus from legal battles to establishing crypto standards in Congress.

🇺🇸 JPMorgan says crypto faces downside risk as bitcoin. JPMorgan analysts warn that weakening institutional demand for CME bitcoin and ether futures is a bearish signal for crypto markets in the near term. The analysts say a lack of positive catalysts and fading momentum drive lower demand for crypto futures.

🇧🇷 Braza Group announces launch of BBRL stablecoin on the XRP ledger to strengthen the Brazilian and South American digital economies. This digital asset combines the stability of traditional currency with the benefits of blockchain technology. Its issuance aims to provide secure and cost-effective solutions for digital transactions for individuals and businesses.

PARTNERSHIPS

🇬🇧 Klarna to be rolled out in 600 Euronics stores across UK. The rollout is happening in two stages, starting with Klarna being live on Euronics.co.uk, allowing customers to split their purchases at checkout. Next, it will launch in up to 600 Euronics stores across the UK.

🇺🇸 FinTech Finzly streamlines Live Oak Bank wire services via STP with Fedwire Solution. The partnership with Finzly gives the bank payment infrastructure the flexibility to adapt to customers’ needs, while also allowing it to streamline operations for our internal teams.

🇺🇸 Corpay Cross-Border named the official FX Payments supplier of the FIG. Through this partnership, the FIG will be able to utilize Corpay Cross Border’s innovative solutions to help mitigate foreign exchange exposure from their day-to-day business needs.

🇳🇱 Backbase partners with Siili Solutions. The collaboration is expected to expand the regional resource landscape and provide financial institutions with the possibility to address the demands of the Nordic market with tailored solutions for their customers.

🇺🇸 DriveWealth expands 24-hour trading with OTC Markets partnership. The new service will enable DriveWealth to route investor orders more efficiently by analyzing pricing from multiple overnight venues. The service will take real-time pricing and liquidity into account.

DONEDEAL FUNDING NEWS

🇬🇧 Monument Bank in talks to raise £𝟮𝟬𝟬𝗺 ahead of Nasdaq IPO. The British-based lender has already raised about £135m from blue-chip investors since it launched in 2019. It has now secured roughly £30m of the £200m Series C financing it wants to raise during this year.

🇦🇷 WalletConnect Foundation secures $10 million in oversubscribed token sales, including 11-second sellout on Echo. The funds will enable the foundation to expand operations, grow its team, and support ecosystem initiatives benefiting developers, node operators, and strategic partners.

🇮🇳 PhonePe, India’s payments FinTech backed by Walmart, has begun preparations for a public listing on Indian stock exchanges. This move makes PhonePe the third major FinTech to go public in the country in the past 5 years. Continue reading

MOVERS AND SHAKERS

🇺🇸 MoonPay announced that it has appointed Derek Yu as Treasurer. Yu will oversee cash, liquidity and stablecoin management, banking and payment relationships, treasury operations, and both crypto and fiat asset management, among other responsibilities.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()