FinTech Market Expected to Reach $1.5 Trillion by 2030

Hey FinTech Fanatic!

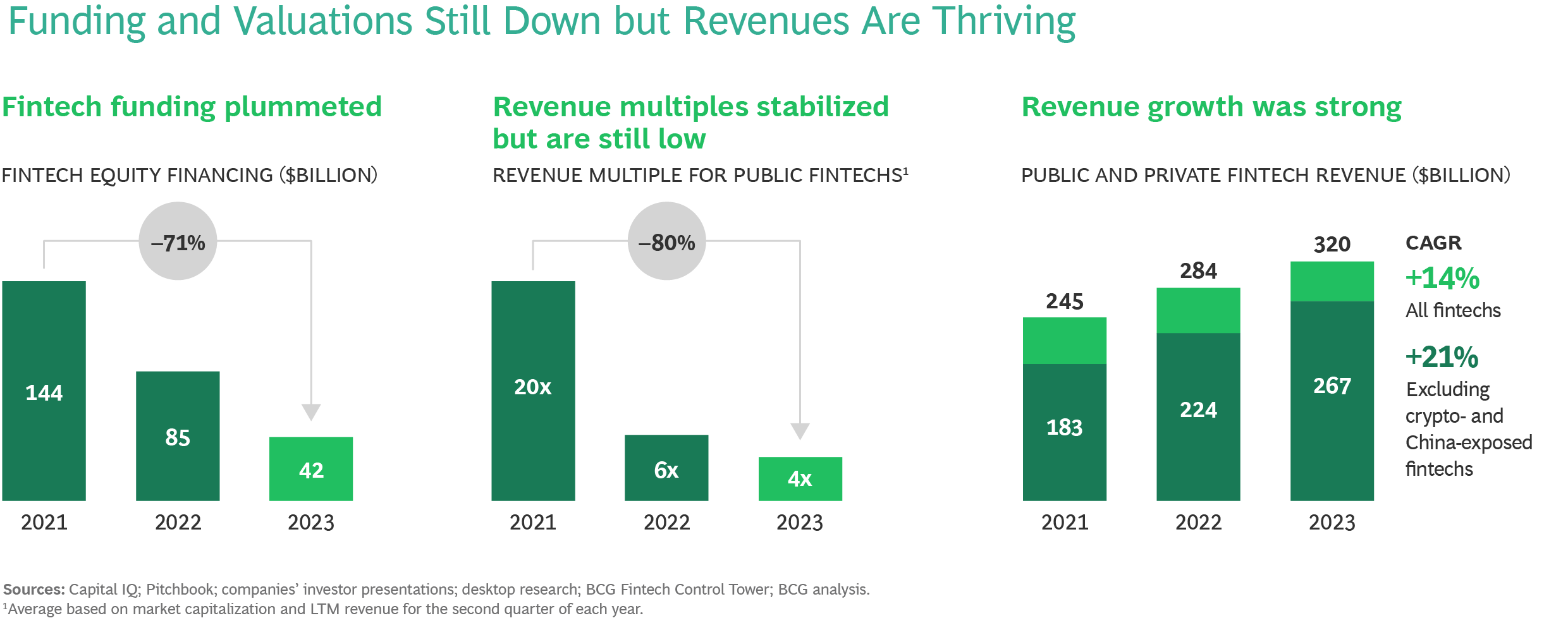

According to the latest report from BCG, the global FinTech market remains dynamic, poised for significant growth despite recent funding challenges. Innovations like GenAI and the vast number of unbanked individuals worldwide present immense opportunities.

The market is expected to reach $1.5 trillion in revenue by 2030, a fivefold increase from today. However, the focus is shifting from growth at all costs to prudent, profitable expansion.

This report, based on interviews with over 60 FinTech CEOs and investors, highlights four major trends reshaping the industry: the rise of embedded finance, the potential of connected commerce, the impact of open banking, and the transformative role of GenAI.

Key imperatives for FinTech stakeholders include:

- Prioritizing risk and compliance.

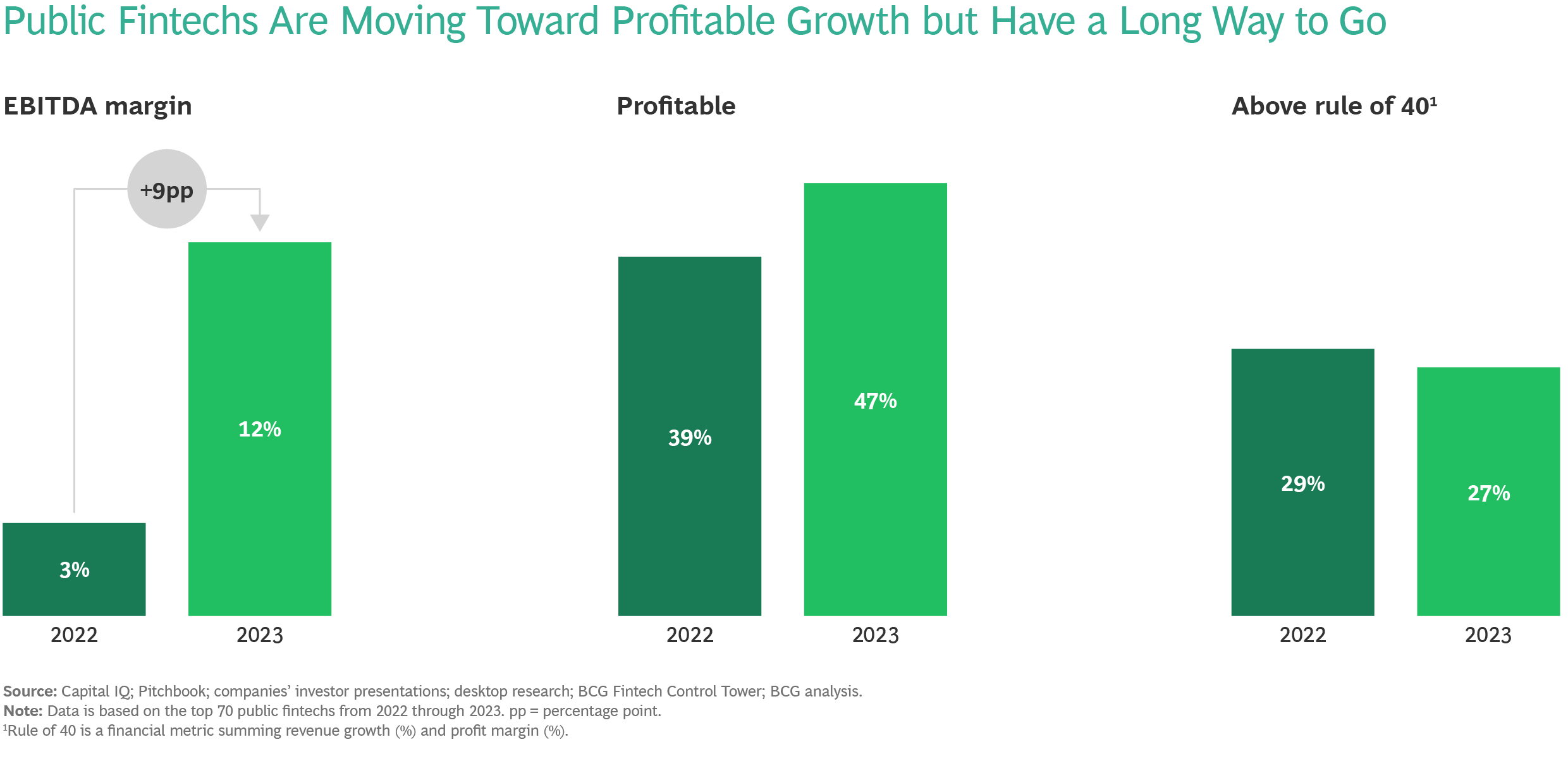

- Enhancing profitability by improving EBITDA margins.

- Preparing for IPOs with sustainable growth strategies.

- Leveraging retail banks as digital platforms.

- Government support for integrated digital public infrastructure.

In summary, the FinTech sector is evolving towards more sustainable and prudent growth, driven by technological advancements and a focus on compliance and profitability.

Download the complete report for more interesting info, and enjoy more FinTech News updates I listed for you below👇

Cheers,

#FINTECHREPORT

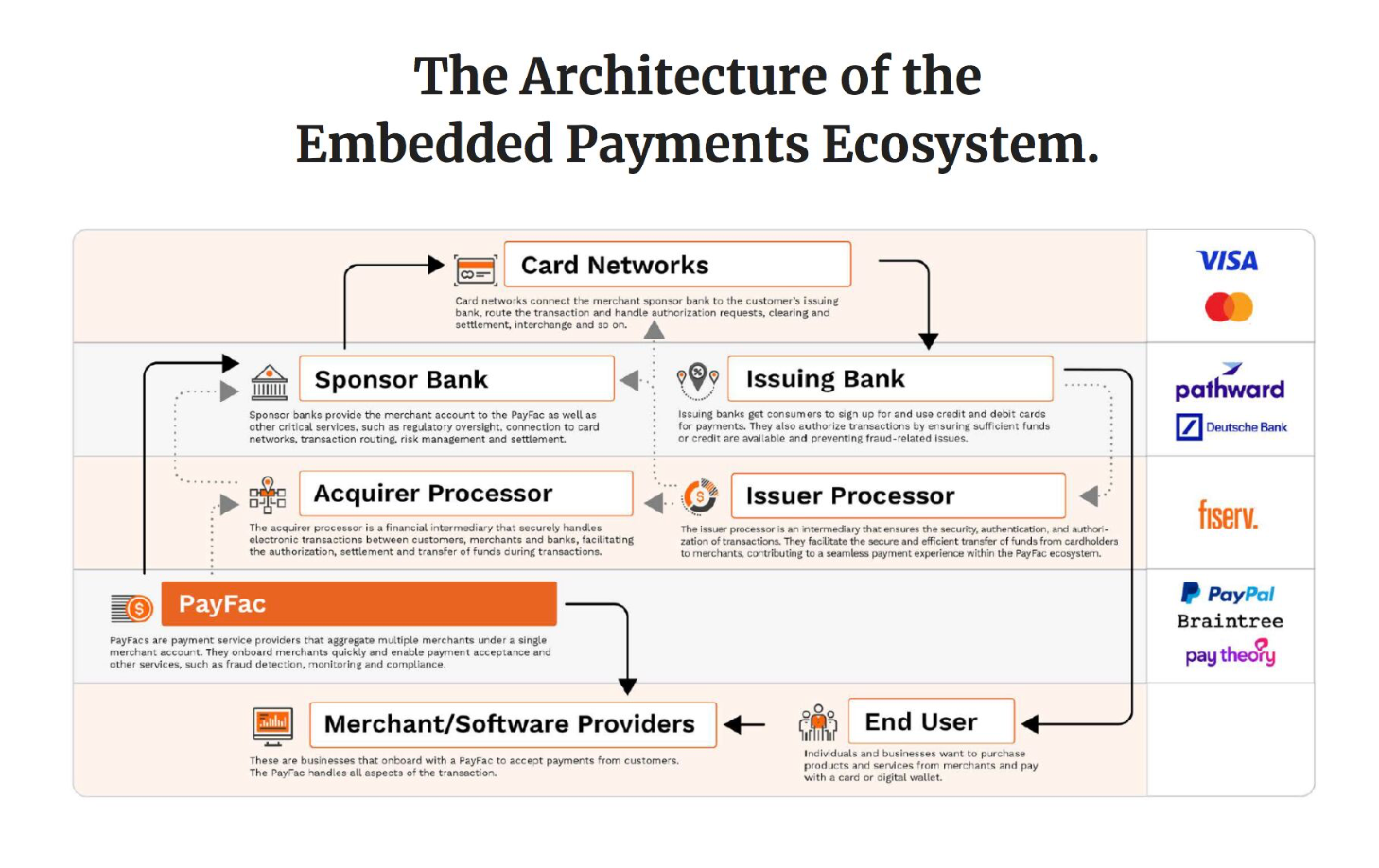

📊 The PayFac Economy and the Embedded Payments Revolution.

The PayFac Ecosystem handles transactional, regulatory, fraud, and risk needs for businesses integrating digital payments without becoming payment providers. It is dynamic, with entities often playing multiple roles:

FINTECH NEWS

💳 Mastercard targets Caribbean with FinTech solutions. As part of its global Financial Technology (FinTech) Express and Engage programmes, Mastercard is targeting the Caribbean with FinTech frameworks that enable FinTechs to enter a market and address relevant market challenges.

🇧🇷 FinTech for SMEs, Cora, receives authorization from Central Bank to Operate as a Financial Institution in Brazil. For Cora's founder and CEO, Igor Senra, the license will significantly expand the FinTech's range of credit products. Read on

🇬🇧 “Without the UK we’re not in business”, says Pleo boss, as the Danish unicorn soft launches in US. Pleo’s general manager of UK, Ireland and the Nordics, Ben Swails, talks through the UK business and how it is meeting the challenges it faces.

PAYMENTS NEWS

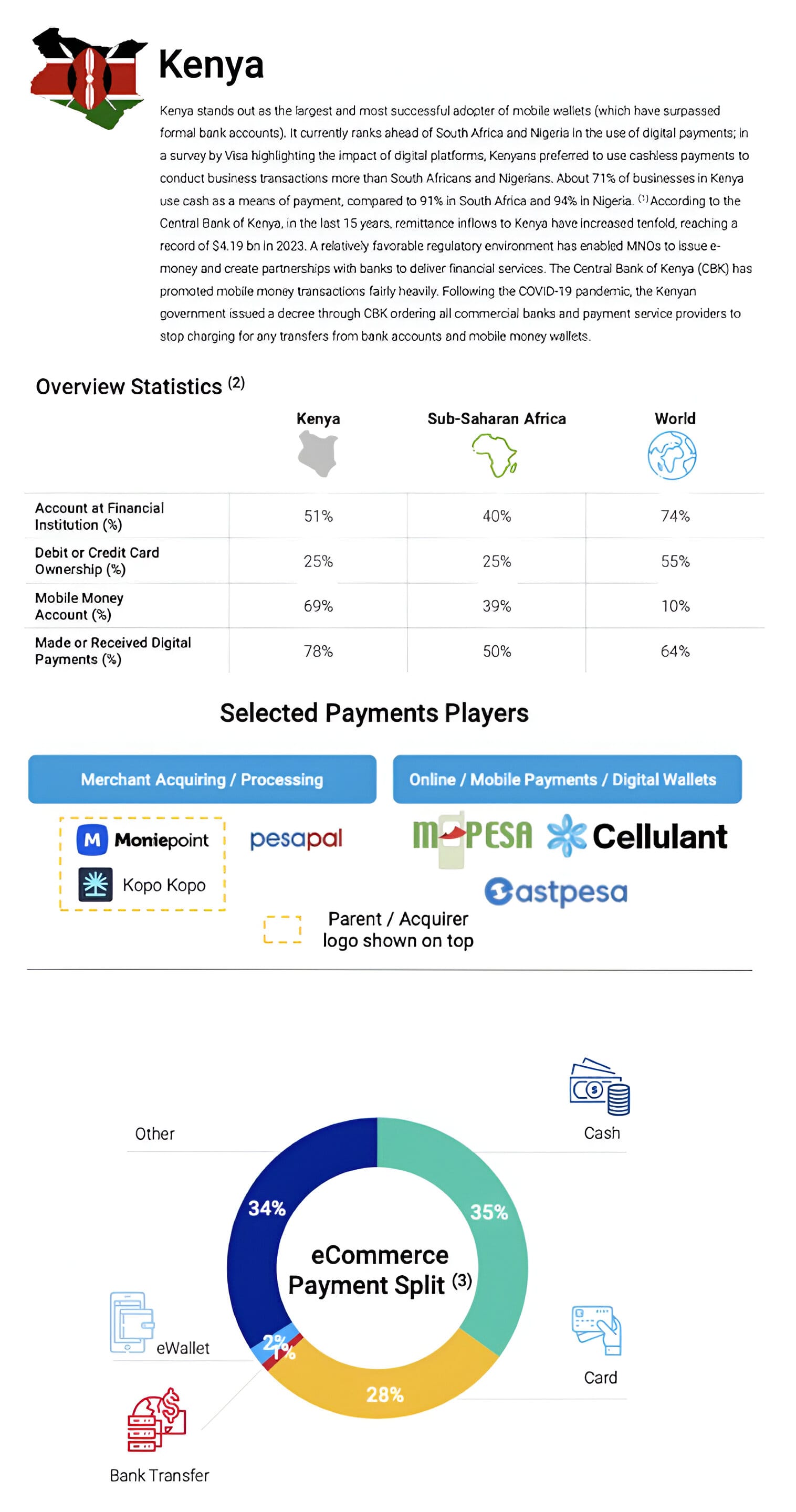

🇰🇪 Kenya: A Pioneer in the Wave of Digital Payments.

Let's dive into Kenya’s Payments Ecosystem:

🇦🇪 Adyen and noon join forces to transform the UAE e-commerce landscape with advanced payment solutions. Through this partnership, both companies aim to enhance customer experience, streamline payment processes, and drive innovation across the region.

🇩🇪 Security tech company Giesecke+Devrient (G+D) unveiled G+D Filia Unplugged, its offline payment solution. One of the features of the tokenized payment solution is that it works with existing payment systems, mobile money services, and future commercial bank tokenized deposit systems.

🇵🇭 AllBank has announced its partnership with online payment gateway SKYPAY in order to offer customers and clients in the Philippines the possibility to use QR payments. The partnership reflects the shared commitment to offer secure, efficient, and extended services for the convenience of clients and merchants.

🇬🇧 Worldline deepens BKN301 alliance, targets EMEA FinTech growth. Both companies extended their partnership, integrating Worldline's Issuing and Acquiring solutions into BKN301's services. This collaboration aims to enhance digital payment offerings in EMEA markets.

🇸🇪 Zimpler and Swish partnership boosts merchant payment efficiency and growth. This collaboration will provide Zimpler’s merchants with an optimized payment solution combining the strengths of Zimpler’s account-to-account (A2A) payments and Swish’s seamless transaction capabilities.

DIGITAL BANKING NEWS

🇮🇪 Central Bank of Ireland may delay Revolut plans to offer mortgages from early next year. Financial experts said there was some confusion about what level of supervision the Central Bank of Ireland would impose on Revolut’s mortgage operations.

BLOCKCHAIN/CRYPTO NEWS

🇪🇺 The Hong Kong Monetary Authority (HKMA) and the Banque de France (BdF) have joined forces to explore the use of wholesale central bank digital currency (CBDC) and tokenisation for cross-border transactions. HKMA is the first non-European central bank to join the Eurosystem’s wholesale DLT settlement trials.

🇳🇬 Binance exec struggles to cope as Nigerian money laundering trial resumes. Battling coughing fits, a visibly ill Tigran Gambaryan looked on as his defence lawyers grilled government officials in two days of court proceedings in Nigeria’s Federal High Court in Abuja this week.

DONEDEAL FUNDING NEWS

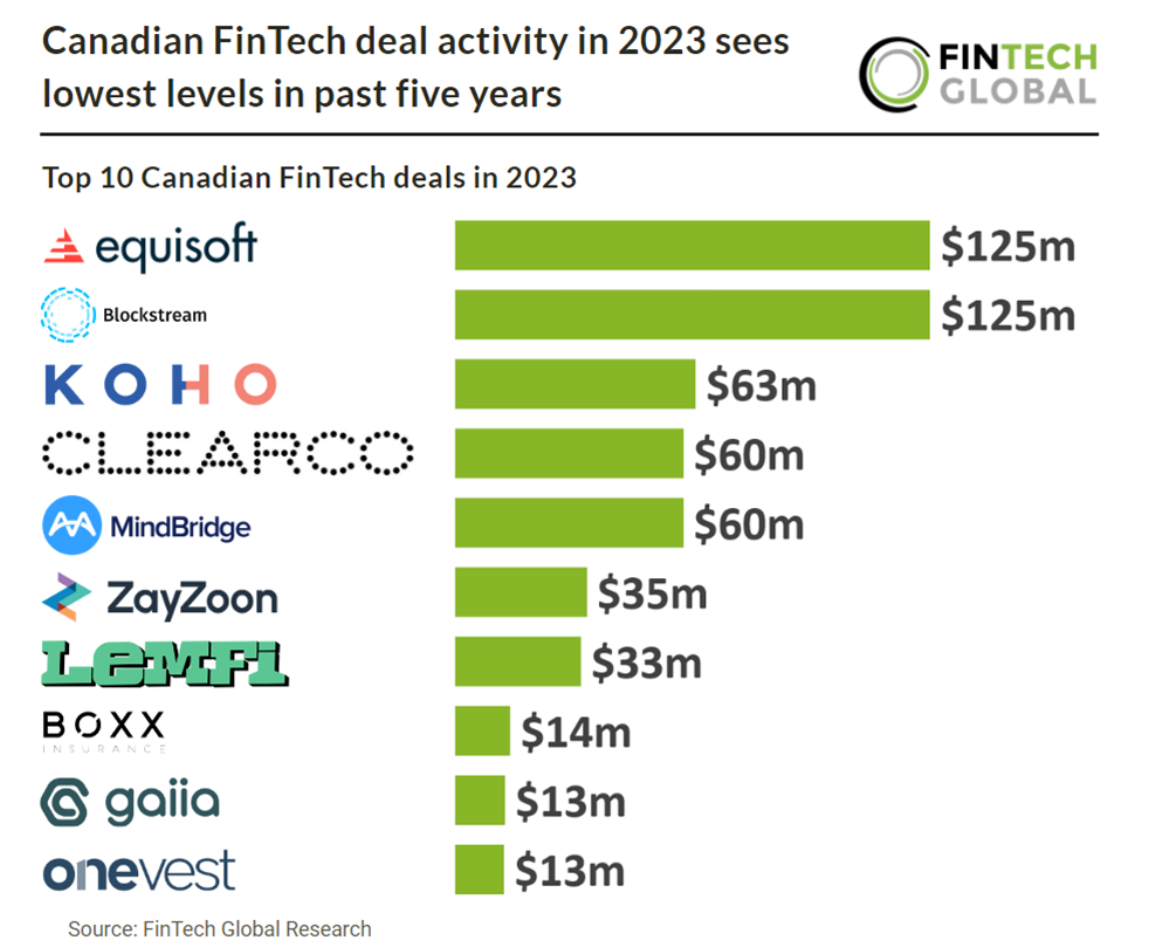

🇨🇦 Canadian FinTech deal activity in 2023 sees lowest levels in past five years.

Key Canadian FinTech investment stats in 2023:

🇬🇧 FreeBnk raises $3M in funding. The company intends to use the funds to support ongoing research and development to create its app that enhances accessibility, security, and customization, used specifically to the needs of those new to digital asset investment.

M&A

🇩🇪 Berlin-based FinTech Vivid Money has acquired fellow German FinTech Pile and its treasury solution as it looks to expand its Vivid Business offering for small and medium-sized enterprises (SMEs) launched at the start of the year.

🇦🇪 CoinDCX acquires BitOasis. India’s cryptocurrency exchange CoinDCX, is expanding internationally through the acquisition of BitOasis, a digital asset platform in the Middle East and North Africa, the companies said Wednesday. Keep reading

🇬🇧 German digital tax platform Taxfix enters UK market with TaxScouts acquisition. The partnership aims to simplify tax filing and empower users. The terms of the transaction will not be disclosed. Read on

🇳🇬 Zedcrest acquires RMB Nigeria Stockbrokers Ltd. Zedcrest, a Nigerian debt and equity capital markets investment firm, has acquired the Nigerian arm of RMB Stockbrokers for a figure between ₦400 million and ₦420 million, according to a person familiar with the proceedings.

MOVERS & SHAKERS

🇮🇱 Viola FinTech appoints former Payoneer CEO Scott Galit to its advisory board. Galit said: “I’m excited to partner with the Viola FinTech team to harness our decades of operational expertise to empower talented entrepreneurs to build large companies that reshape financial services.”

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()