FinTech Leaders Unite: A Plea to Reconsider Paytm's Regulatory Hurdles

Hey FinTech Fanatic!

Paytm CEO Vijay Shekhar Sharma and team members convened with RBI representatives to deliberate on the imposed regulatory measures.

This development coincides with an appeal from a consortium of startup entrepreneurs to Prime Minister Narendra Modi, Finance Minister Nirmala Sitharaman, and RBI Governor Shaktikanta Das, with a plea to revisit the stringent regulatory measures imposed on Paytm Payments Bank.

Notable figures from the tech and business sector have highlighted the potential negative repercussions these restrictions could have on India's fintech landscape and its appeal as an investment destination.

The founders argue that the RBI's directives could not only harm Paytm's operations but also cast a shadow over the nation's reputation for business friendliness, urging a reassessment to protect stakeholders and encourage a healthy dialogue with the fintech community.

This call for action comes in the wake of RBI's decision on January 31, 2023, to restrict Paytm Payments Bank from conducting various banking activities, leading to significant market repercussions for Paytm, including a sharp drop in share price and speculative discussions around potential buyouts by major players like Jio Financial Services and HDFC Bank.

Despite the turmoil, Paytm's Vijay Shekhar Sharma has assured there will be no job losses as the company navigates through these challenges.

To be continued...

Read more interesting FinTech news updates below👇 and I'll be back in your inbox tomorrow!

Cheers,

POST OF THE DAY

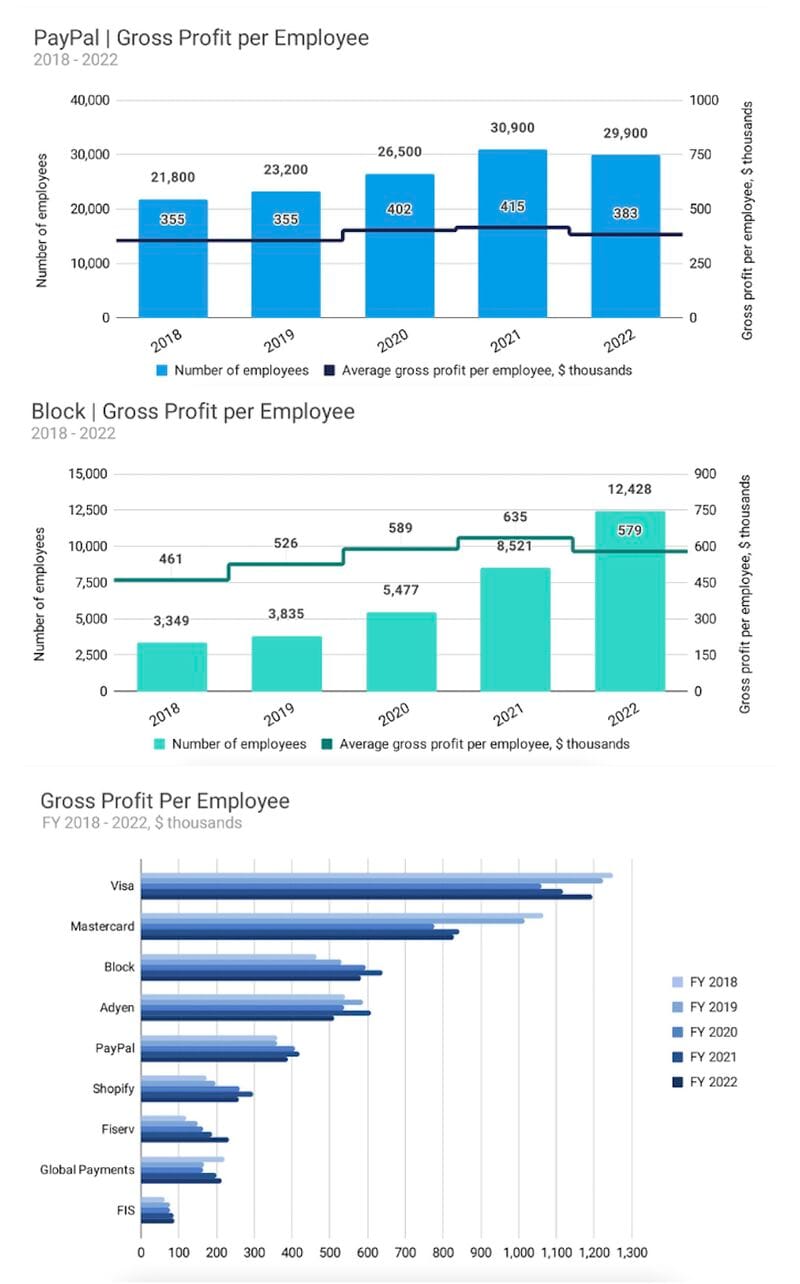

In light of recent layoffs at PayPal and Block: The evolution of employee headcount and average gross profit per employee, and how they compare to other Financial Services companies.

#FINTECHREPORT

🇳🇱 In 2023, bunq reported an impressive pre-tax profit of €53.1 million, demonstrating its unwavering financial resilience and effective business operations in a fiercely competitive market. Check out the full C-Innovation report here

PODCAST

On this episode Patrick (Pat) Alex sits down with one of LatAm Fintech greats, Pedro Conrade, Co-Founder and CEO of Neon, a leading challenger bank in Brazil. They dive into the making of Neon, how the company has scaled, when is it right time to introduce new product features and how to manage acquisitions successfully. Listen to the full podcast episode here

INSIGHTS

🇩🇪 Oliver Bellenhaus, one of the 4 individuals on trial in the Wirecard case in Germany, has been released from custody after 3.5 years, subject to certain conditions. Bellenhaus is expected to leave the high-security prison in Munich-Stadelheim, where he is in pretrial detention, on Tuesday.

FINTECH NEWS

🇺🇸 Balance unveils suite of products covering B2B transaction lifecycle. The platform has unveiled a suite of artificial intelligence (AI)-powered products that span the B2B transaction lifecycle, from order placement to payment settlement. These AI-powered tools encompass net terms assessment and financing, payment cost optimization and accounts receivable (AR) automation.

🇬🇧 Klarna, the payments giant, has moved into its new London headquarters, billed as the “world’s largest co-working space” with proximity to the river Thames so employees can conduct “walk and talk” meetings. The layout of its new office will also support its cross-function teams so they can work together in a single space.

Atlantic Money receives green light for expansion across US, Canada and Australia. Users will then be able to transfer up to $1 million abroad at the current exchange rate and for Atlantic Money’s flat fixed fee. The demand for a fixed fee transfer solution in these new markets is substantial, with over $100 billion in annual transfers according to the World Bank.

Mastercard and Boost collaborate to power small businesses in Africa. This collaboration aims to provide support to distributors, wholesalers, and retailers in the FMCG sector, all of whom will be provided with Boost's innovative platform as a service to access essential working capital and Mastercard's acceptance solutions.

PAYMENTS NEWS

🇬🇧 Ant International and Yapily launch Europe’s first commercial variable recurring payments for e-Commerce, in partnership with HungryPanda. Starting on Feb 6, HungryPanda users in the UK can elevate their food delivery experience by placing orders via their mobile devices and seamlessly completing payments directly from their bank accounts.

Mastercard and Last Mile Solutions launch a universal payment-terminal solution for EV charging in Europe. By introducing an innovative and scalable payment gateway, this partnership addresses the need of electric vehicle Charge Point Operators (CPOs) to offer a convenient charging experience and comply with EU regulation (AFIR).

Sprinque partners with Mangopay to provide holistic payments solutions for B2B marketplaces. The collaboration enables merchants and marketplaces to take advantage of holistic and customisable payments infrastructures and terms, allowing them to grow revenues by tapping into B2B cross-border opportunities.

OPEN BANKING NEWS

🇳🇴 Neonomics selected by Lowell to roll-out account to-account payments across the Nordics. Lowell, a European leader in credit management services, has partnered with leading open banking provider Neonomics to enhance their payments offering, implementing, and enabling account-to-account payments in their Norwegian customer portal.

REGTECH NEWS

KYC 🆚 AML: The terms KYC (Know Your Customer) and AML (Anti-Money Laundering) are often used by regulators and compliance officers, sometimes interchangeably, which may cause confusion. Click here to learn more about these key terms.

🇸🇬 Tookitaki, a financial crime solution, has announced the rebranding of its Anti-Money Laundering Suite (AMLS) to FinCense. This strategic move is aimed at better representing the enhanced capabilities of its compliance platform, which seamlessly addresses both fraud and AML risks. Read more

DIGITAL BANKING NEWS

🇺🇸 EY announces alliance with MoneyLion to help banks accelerate their digital transformation and extend financial services. The Alliance leverages MoneyLion's embedded finance platform to help enhance the technological capabilities of traditional banking institutions.

🇹🇭 AIS seeks partners for virtual bank. Advanced Info Service (AIS) is in talks with PTT Oil and Retail Business (OR) and a digital platform provider on a potential partnership to apply for a virtual bank licence from the Bank of Thailand.

🇷🇴 Revolut reached 3.5 million retail customers in Romania. Romanian customers made 644 million tx last year with Revolut cards and app; the total number of tx increased by 75% compared to 2022. Read full article

🇺🇸 NYC $53 million pilot program to make pre-paid credit cards accessible for migrant families seeking a stable station at the Roosevelt Hotel. Families will be assisted in buying food using the city cash. City Hall has stated that in its initial stages the program will first begin with 500 migrant families for short-term hotel stays.

Tyme Group’s gameplan for winning digibank race in Philippines and Vietnam: Digital banking start-up TymeBank achieved net profitability at the end of 2023, less than five years after its launch. TymeBank's SME lending portfolio helped the Tyme Group reach an annualized revenue run rate of $160m last year. More here

🇺🇸 City National Bank imposed with USD 65 million fine. The OCC mentioned that the fine was imposed because the financial institution was reportedly engaged in unsafe and unsound practices, as well as having gaps in its overall risk management and internal controls.

🇩🇪 N26’s CEO Valentine Stalf predicted a 2023 IPO. Now he’s got a new timeline for going public. Once Germany’s most valuable startup, the company has had to U-turn on expensive international expansions, pay hefty fines to its national regulator for rule breaches and face a raft of senior exec departures, as the promise of a 2023 IPO never materialised.

🇧🇷 Nubank has laid out ambitions to be Latin America’s biggest financial services group as the $44bn-valued digital lender is predicted to hit the milestone of $1bn in annual profits. Chief executive David Vélez told FT the company could become the region’s largest in the sector by customer numbers, with expansion under way in Mexico and Colombia.

DONEDEAL FUNDING NEWS

🇨🇦 Canadian FinTech deal activity in 2023 sees lowest levels in past five years. Check out the key Canadian FinTech investment stats in 2023. Link here

🇪🇪 Tuum raises EUR25m series B financing, led by CommerzVentures, to fund product and market development. The fresh infusion of capital will bolster Tuum’s international presence, allowing it to target new territories in the DACH region, Southern Europe, and the Middle East, where it is opening a new office.

🇪🇸 Bankflip, the data capturing and processing platform for financial services, successfully raises a €2.6 million funding round. The objective of this funding round is to strengthen the company’s position in the Spanish market, explore new adjacent verticals requiring document/data capturing and processing, and enter new markets like Portugal in 2024.

🇿🇦 Mastercard firms up MTN fintech deal at R100-billion valuation. South Africa's MTN has signed definitive agreements with Mastercard for a minority investment of up to $200 million into MTN's mobile money arm at a valuation of $5.2 billion. The deal was originally announced last October, and is still subject to “customary closing conditions”.

M&A

🇦🇺 Australian payments infrastructure provider Fat Zebra has acquired local open banking technology platform Adatree. Financial terms were not revealed. Fat Zebra says the acquisition puts it in a position to own the smart payment, action initiation space that will be powered by incoming regulations. Read more

MOVERS & SHAKERS

🇬🇧 Revolut has been big on financial crime hiring in the past few years, with roles in the division seemingly being the most abundant. Now, however, the man leading the initiative has left Revolut to join rival Wise. Aaron Elliott-Gross joins Wise as global director of product compliance in London, leading "the first line product compliance function."

🇨🇦 Saba El-Hilo and Tim Morris will join Neo’s leadership team. Saba and Tim will help Neo’s growing team accelerate its mission to build a better financial future for Canadians. Keep reading

🇧🇪 PPRO appoints Eelco Dettingmeijer as CCO and Mariette Ferreira as CMO to accelerate growth. Eelco brings over a decade of experience in payments, and over two decades in international sales roles; Ferreira joins the company as a CMO with over 15 years of B2B marketing experience, including 10 years within the fintech industry. Link here

Eyal Sivan joins Ozone API as General Manager for North America. This strategic hire marks the company’s expansion into the North American market, highlighting its commitment to bringing transformative open banking technology to a broader audience.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()