FinTech IPO Wave Put on Ice

Hey FinTech Fanatic!

A few months back, there was a quiet buzz building behind the scenes. After a dry spell of nearly three years, the U.S. IPO market was starting to show signs of life—and FinTech was right in the thick of it. Klarna, Chime, Circle, eToro… one by one, they were lining up, prepping filings, briefing bankers, and eyeing that long-awaited debut.

Then came the tariffs.

After a rough Q1, where the S&P 500 had already dropped 4.3%—its worst quarter since Q3 2022—the news added fuel to the fire. With a single announcement last week from Donald Trump, the index fell another 8%, wiping out nearly a year’s worth of gains. Affirm sank 18%. PayPal dropped 9%. Investors stepped back—and FinTechs followed.

By Friday, the retreat had started. Klarna was the first to pause its IPO. Chime pulled back just hours later, holding off on public disclosures. Circle, which had been working with JPMorgan and Citi to go live by early summer, froze its plans too. eToro, ready to kick off its roadshow this week, postponed everything. And a few more may follow in the coming days.

All signs had pointed to 2025 as a fresh start. Now, the resurgence many had hoped for is on ice. IPOs are still coming—but maybe not from where we thought, or when we expected.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

SPONSORED CONTENT

Get your copy of the internet's clearest look at pay by bank in the United States.

INSIGHTS

🌎 FinTech funding surpasses $1bn despite the limited number of deals. Internationally, the US maintained its dominance with four deals, while the UK again played runner-up with two. Germany, Spain, Italy, Vietnam, and Mexico each contributed a single funding round, highlighting the sector’s continued global reach.

FINTECH NEWS

🇮🇳 Navi Technologies plans to go public this fiscal year. Sachin Bansal, founder and executive chairman of the FinTech firm Navi Technologies, said that he would look at a public listing in the current financial year to raise more capital, which the company needs at this stage.

🇺🇸 Circle considering IPO delay due to market downturn. The company had been preparing to go public on the New York Stock Exchange under the ticker symbol “CRCL”. This postponement aligns with a broader trend of companies reassessing IPO timelines amid economic uncertainties.

🇮🇳 Tata Capital files confidential DRHP for mega Rs 15,000 crore IPO, aiming to list shares by September 2025. The IPO will include new shares and stake sales from Tata Sons. Tata Capital showed significant financial growth, with a revenue jump of 34% in FY24.

🌍 Africa’s first FinTech license passporting system sets the tone for future cross-border expansion. This license is a regulatory framework that allows FinTech companies to operate across multiple jurisdictions using a single license. Keep reading

🇬🇧 Lemon launches 0% interest SaaS financing product, backed by Siemens. The product is designed to improve cash flow for SaaS vendors by enabling them to receive upfront payments while allowing buyers to spread costs without incurring additional interest charges.

🇵🇭 Additiv expands its presence in APAC. This strategic presence will enable the firm to collaborate more closely with its clients and partners, ensuring seamless integration of its platform solutions into the Philippine financial ecosystem. Read more

PAYMENTS NEWS

🇮🇱 Airwallex enables businesses to collect and hold funds in Israeli Shekels. The new offering enables Israeli and global Airwallex customers to open accounts, facilitating seamless transactions in ILS via the Israeli payment network. Businesses can now benefit from local collection capabilities, real-time settlement for faster payments, and streamlined treasury management.

🇬🇧 Ecommpay shortlisted in ICA Compliance Awards Europe 2025. The payments platform has been recognised for customisable financial crime prevention. In partnership with Cable, Ecommpay has designed and implemented a groundbreaking solution, redefining financial crime compliance.

🇬🇧 VAMP Remediation Guide: The Subscription Playbook by Solidgate. Visa’s new Acquirer Monitoring Program (VAMP) raises the stakes for merchants in many sectors, especially those running subscription models. Solidgate's risk team breaks down exactly what to do to keep your fraud and dispute rates low. Get the playbook here

🌎 For the third consecutive year, Pomelo is recognized as an Endeavor Outlier. The company is part of the 10% of companies globally selected for its accelerated growth and real impact. In 2025, 37% of the more than 235 companies chosen as Outliers are from Latin America, and Pomelo is leading that transformation.

🇺🇸 Visa unveils slate of new services to power client growth. The new products make accepting payments easier and more secure in an increasingly complex commercial landscape. These services help businesses achieve their full potential by freeing up resources to focus on other business priorities.

🇪🇬 e& Egypt launches instant international money transfer via digital wallet. This new feature allows customers to receive money from UAE and Saudi Arabia instantly and securely without visiting branches or intermediaries. This comes as part of a strategy aligned with the Central Bank of Egypt’s efforts to promote financial inclusion and reduce the nation’s reliance on cash-based transactions.

🇻🇳 FOMO pay adds Vietnam to cross-border network with launch of VND accounts. The service enables merchants, corporations, and institutions to send and receive VND within Vietnam using locally issued virtual accounts under their own names via the country’s local payment infrastructure.

🌎 SumUp unveils new products and features to its global customer base of small businesses at the annual Beacon Event. The following products and features are designed to address merchant pain points, expanding SumUp’s existing industry-leading product ecosystem.

🌎 Virgo and Vaulta launch cross-border remittance network VirgoPay. The VirgoPay service will allow users to add funds using traditional local payment rails, such as bank transfers, e-transfers, and card processing, or directly from a crypto wallet, and enables users to select from a range of fiat currencies.

🇺🇸 Stripe applies for US Banking License to expand merchant acquiring capabilities. Stripe’s application for a Merchant Acquirer Limited Purpose Bank (MALPB) charter has been accepted by the state of Georgia’s Department of Banking and Finance, bringing the financial infrastructure giant one step closer.

🇺🇸 FinTech FIS to help power real-time rewards for payments and commerce network Bilt. The Premium Payback solution seeks to drive more engaged cardholder behavior for its clients by connecting participating issuers with participating merchants to allow customers to redeem their points directly at the point of purchase, which can provide immediate savings.

REGTECH NEWS

🇺🇸 FTX cancels nearly 392,000 customer claims over KYC failure. Financial institutions need legal approval through KYC verification to establish user identities. Unverified customers are ineligible to receive any funds from the bankruptcy estate assets.

DIGITAL BANKING NEWS

🇬🇧 Airwallex to seek UK and US banking licences to expand into lending and compete with global banks. Chief Executive Jack Zhang said, “We are planning to apply for a UK banking license. The UK is one of the most FinTech-friendly markets, and the FCA remains one of the best regulators and would later seek to obtain a US one by buying a bank.”

🇬🇧 ClearBank reports first group results, with increased underlying profits at UK bank. These show that the business has made progress on its growth strategy, positioning itself for long-term international expansion. The UK business posted annual pre-tax profits, with strong growth in fee-based income, deposits, and clients.

🇬🇧 Metro Bank partners with AI startup Ask Silver to tackle fraud. With the new service, customers can upload images of any communication or transaction they feel could be fraudulent and Ask Silver’s AI tool to analyze the material, sending a response via WhatsApp as to the likely risk of fraud and next steps.

🇮🇳 Revolut gets RBI nod for PPIs, wallets. With the PPI license in place, Revolut can now offer both international and domestic payment solutions under one platform in India. Through its mobile wallet product, Revolut will also be able to offer UPI payment services to its Indian customers.

🇬🇧 Kroo fights back against “Lazy Money” with launch of its Cash ISA. Krooʼs Flexible Cash ISA allows users to earn 4.30% AER variable whilst topping up or withdrawing on demand, without penalties, and without affecting their £20,000 allowance.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 SEC clarifies that most stablecoins are not securities. The clarification comes as the stablecoin sector of crypto has been ramping up on increasing optimism that Congress will pass its first piece of crypto legislation this year and that it will focus on stablecoins.

🇧🇷 Brazilian court authorizes crypto seizure for debt collection. The Third Panel of Brazil’s Superior Court of Justice unanimously authorized judges to send letters to cryptocurrency brokers informing them about their intent to seize an account holder’s assets to repay creditors.

🇲🇹 OKX receives fine from Malta’s FIAU. Following a compliance review by the FIAU in April 2023, the authority identified gaps within OKX's compliance and AML frameworks. Despite remediations being made by the company to its processes, systems, and procedures in the intervening time, the fine remained above €1million.

🇺🇸 eToro delays IPO as Trump’s tariff shock rattles Wall Street. The company joins several others that have postponed multi-billion-dollar offerings following market volatility triggered by former President Donald Trump's announcement of a sweeping new round of tariffs.

PARTNERSHIPS

🇬🇧 Viva.com expands near-instant payment footprint across Europe, with UK launch of Mastercard Move. This step enables businesses across 24 European countries to send and receive near-instant payments regardless of currency and geography, enhancing operational efficiency and customer satisfaction.

🇪🇬 Mastercard and PayTabs collaborate to empower Egypt’s small and medium enterprises. Through this collaboration, PayTabs will leverage Mastercard’s global network and digital payments capabilities to provide merchants with a white-labelled digital payments platform.

🌍 Verve expands payment frontiers with global partnerships and contactless innovation. The company has partnered with leading international and regional payment platforms, including Temu, AliExpress, PalmPay, and FortisPay. These integrations enhance Verve cardholders’ access to global e-commerce marketplaces and digital payment solutions.

DONEDEAL FUNDING NEWS

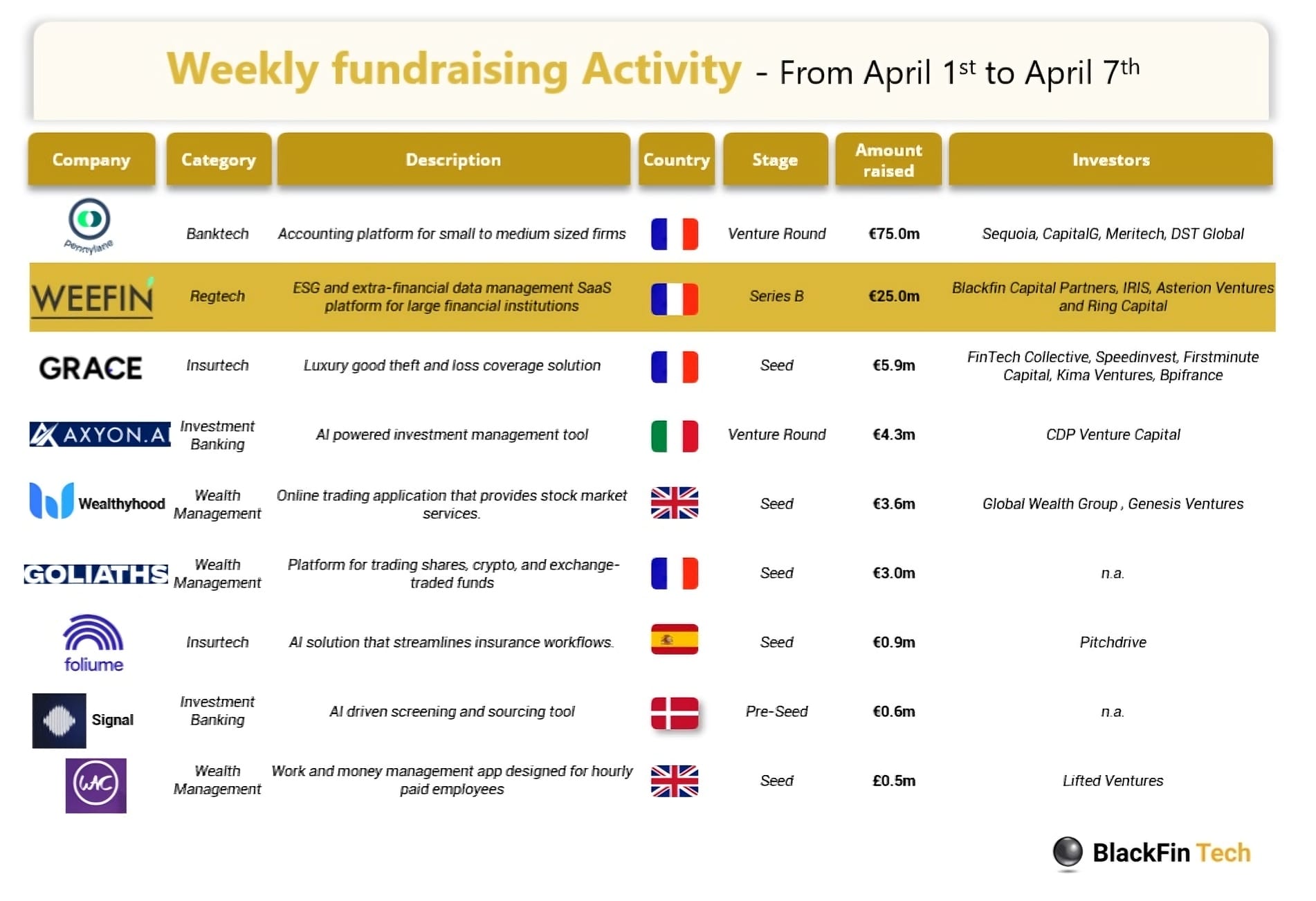

💰Over the last week, there were 9 FinTech deals in Europe, raising a total of €120 million in equity, 4 deals in France, 2 deals in the UK and one deal in each of Italy, Denmark and Spain.

🇮🇳 Juspay secures $60 Mn to boost payments infra with AI. The startup plans to deploy the fresh capital to fuel its AI capabilities and drive innovations to boost workforce productivity and merchant experience. Read more

🇮🇳 Easebuzz secures $30 million in funding led by Bessemer Ventures. The funding will help accelerate the FinTech company’s product portfolio in online payments, expand its vertical Software-as-a-Service offerings, and venture into offline payment solutions, including point-of-sale and UPI QR-based Soundbox solutions.

🇫🇷 Pennylane raises €75m to become the preferred solution for European companies. This fundraising marks a new stage in this mission. In particular, it will support an ambitious hiring plan, aiming to reach 800 employees by the end of the year.

🇱🇺 Regtech Mopso closes €1m seed round, partners with Armundia Group. It aims to use the funding to develop new product features, make regulatory compliance more efficient, and expand in the European market. Continue reading

🇬🇧 FNZ raises $500m to fuel "long-term business plan". The funding will provide financial strength to support FNZ’s long-term business plan, with the company looking to boost customer delivery through further tech development as well as increase its investment in people and operations.

M&A

🇦🇺 Aussie paytech Fat Zebra continues expansion with SecurePay acquisition. The acquisition will see the company add thousands of active merchants to its customer base, help bolster its local position, and enhance the company's ability to provide a comprehensive suite of payment solutions, spanning enterprise, platform, and SMB segments.

MOVERS AND SHAKERS

🇺🇸 Aeropay appoints Joe Perna as Sr. Director of Risk. At Aeropay, he will lead partner risk strategy to develop smart, scalable programs that strengthen compliance and support sustainable growth. Read more

🇮🇱 eToro’s Shir Shalom Departs. Shalom is the second eToro employee to announce their departure in recent weeks, potentially signaling a broader management shift as the company prepares for its long-anticipated public offering.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()