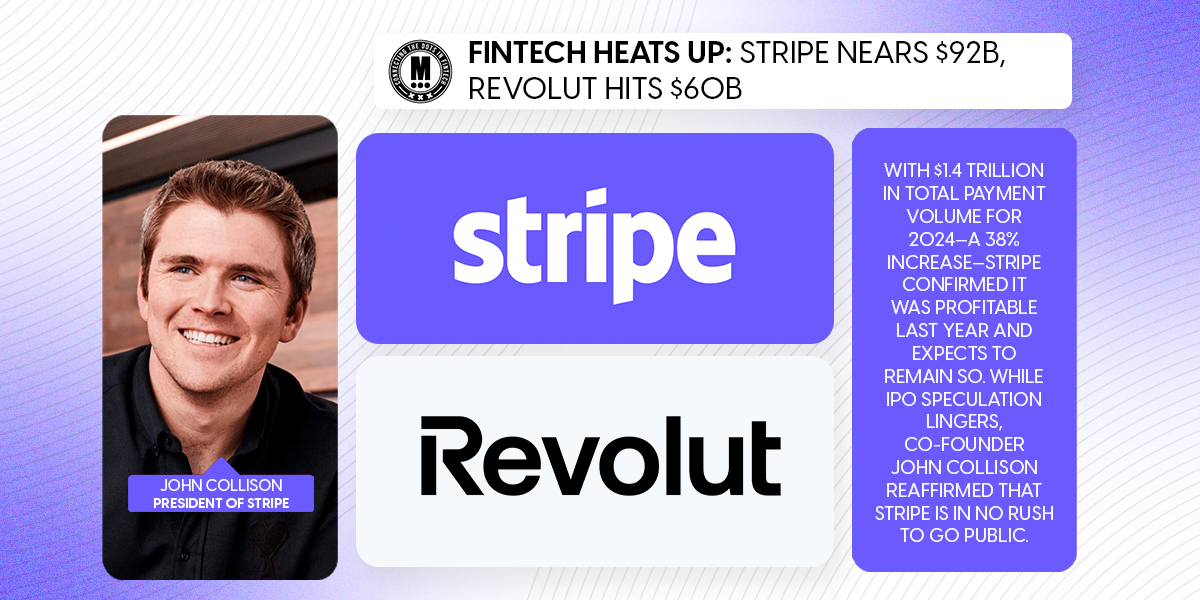

FinTech Heats Up: Stripe Nears $92B, Revolut Hits $60B

Hey FinTech Fanatic!

Stripe and Revolut are back in the spotlight, with valuations soaring and investor sentiment shifting. After a period of FinTech skepticism, recent moves suggest the tide is turning for these FinTech players. With IPO rumors swirling, the latest developments at both companies are adding fuel to the fire.

Stripe announced a new tender offer valuing the company at $91.5 billion, bringing it close to its 2021 peak of $95 billion. Just a year ago, the company’s valuation stood at $65 billion.

With $1.4 trillion in total payment volume for 2024—a 38% increase—Stripe confirmed it was profitable last year and expects to remain so. While IPO speculation lingers, co-founder John Collison reaffirmed that Stripe is in no rush to go public.

Meanwhile, Revolut is facing investor pressure to authorize a new secondary share sale at a $60 billion valuation, significantly up from $45 billion just six months ago.

The UK-based digital bank is set to report a record $1 billion in pre-tax profit for 2024, nearly doubling the prior year’s figure.

Read more global FinTech industry updates below 👇 and I'll be back on Monday!

Cheers,

BREAKING NEWS

🇬🇧 Revolut pressed to consider share sale at $60 billion valuation. Investors are pushing Revolut to consider offering another secondary share sale as new investors are scouring for ways to get a stake in the fast-growing FinTech. Revolut isn’t yet working on an offering and the company would need to authorize such a move.

FEATURED NEWS

➡️ Airwallex is set to launch its ‘Shifted Perspectives’ campaign for the 2025 Formula 1 season with the McLaren Formula 1 Team and acclaimed First Nations artist, Reko Rennie. “At Airwallex, we believe in pushing boundaries and challenging the status quo — whether in business, sport, or art. This collaboration with McLaren Racing and Reko Rennie is a testament to that mindset,” said Jon Stona, VP, Global Marketing, Airwallex.

FINTECH NEWS

🇬🇧 Ecommpay charity auction raises over €7,000 for street child. Employees from the UK, Latvia, Kazakhstan and Cyprus offices came together to raise funds for Street Child, a charity dedicated to working with local organisations around the world to ensure every child has access to an education.

🇺🇸 Checkout. com continues U.S. expansion with launch of San Francisco office. The expansion is a result of increasing U.S. customer demand for a global payment solutions provider that can support ambitious, fast-growing retailers. The company works directly with businesses to handle payments in any country, via a single integration.

🇺🇦 National Bank of Ukraine warns that Revolut has not received any licenses or permits. The regulator noted that currently Revolut has not submitted relevant applications, has not contacted the regulator, and is not undergoing the licensing procedure. Read the full piece

🇬🇧 Marqeta announces TransactPay acquisition and CEO transition. The acquisition will further strengthen its platform, bolstering its digital payments capabilities for customers in the UK and the European Union. The firm also named Mike Milotich as interim CEO, replacing Simon Khalaf, who has stepped down from that role.

PAYMENTS NEWS

🇺🇸 Ondo becomes first RWA provider on Mastercard Multi-Token Network. The MTN allows banks to connect to applications built on the network digitally and can manage the increased complexities involved with domestic and cross-border commercial transactions.

🇧🇷 Belvo rolls out Biometric Pix in Brazil. By rolling out Biometric Pix, planned for 28 February 2025, Belvo aims to further improve the instant payment experience, providing scaled security, speed, and convenience for users and businesses. The solution includes financial institutions and ITPs.

🇺🇸 Stripe’s valuation climbs to $91.5 billion in secondary stock offer. The company revealed in its annual letter that it generated $1.4 trillion in total payment volume in 2024, up 38% from the year prior, also said it was profitable in 2024, and expects to remain so this year.

🇺🇸 Payoneer reports fourth quarter and full year 2024 financial results. The company saw exceptional growth in volume and revenue with B2B SMBs, drove increased adoption of high-value products, and expanded its financial stack. These achievements highlight Payoneer's scalable and profitable model, as well as its strong execution.

🇳🇴 K33 Markets introduces instant NOK deposits with Neonomics. This new feature provides a seamless and secure payment experience. It ensures faster access to trading opportunities for K33’s users with 24/7 instant or near-instant crediting of deposits, depending on the user's bank.

🇺🇸 Modern Treasury and Brico partner to transform payment operations through automated licensing. Modern Treasury’s payment operations software platform will provide mutual clients with an integrated money movement solution, with all the licensing compliance driven by Brico.

🇩🇪 Unzer launches Unzer Direct Bank Transfer. The payment method powered by open banking allows customers to pay directly from their bank accounts without needing a credit or debit card. The service is available to merchants in Germany and works seamlessly across all SEPA countries.

REGTECH NEWS

🇦🇪 Bybit receives in-principle approval to establish virtual asset platform in the UAE. This authorization moves Bybit closer to offering a broad range of digital asset services to both retail and institutional clients. This milestone marks a significant step in its mission to provide a secure, stable, and compliant platform for crypto traders in the region.

🇿🇲 Flutterwave launches in Zambia with payment system license. This new license positions the company to deliver affordable and secure mobile money services to enterprises in the country, facilitating both local and international trade, while boosting financial inclusion and economic growth.

🇲🇽 FinTech law loses strength and updates are necessary. According to Álvaro Vértiz, director for Latin America and the Caribbean at Grupo DGA, the arrival of new players drives the updating of the regulatory framework, allowing entities to migrate from one figure to another depending on the products they offer and based on their growth.

DIGITAL BANKING NEWS

🇦🇪 Wio Bank grows over AED 37bln in balance sheet in second full year of operations. This represents a growth of nearly 3x Year-on-Year. The bank has emerged as a leading example of how digital-first, customer-focused models can meet the needs of a modern customer base while reshaping the financial sector.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Avalanche Card launches, broadening everyday crypto use in regions with banking challenges. In partnership with Rain, it launches a revolutionary tool that enables users to use their crypto seamlessly anywhere Visa is accepted. Continue reading

🇦🇪 Hubpay & Aquanow launch UAE’s first regulated crypto payments for businesses. This collaboration will allow businesses across various sectors, including real estate, manufacturing, and general trading, to accept cryptocurrency payments securely and seamlessly alongside traditional fiat transactions.

PARTNERSHIPS

🌍 Stripe merchants can now offer Scalapay’s BNPL services. This move gives Scalapay access to +1 million businesses using Stripe for payments in Europe. Merchants, in turn, can seamlessly integrate a deferred payment solution, making purchases more flexible for customers.

🇺🇸 BNY teams with OpenAI to bring ‘Transformational’ AI to banking. The partnership gives BNY access to OpenAI artificial intelligence tools like the company’s Deep Research in hopes of boosting the bank’s in-house AI platform, Eliza.

🇮🇳 Paytm and Perplexity partner to bring AI-powered search to the FinTech's app. The company said the integration will allow its users to access AI-powered search features directly within the app. These features will provide real-time insights into financial decisions and everyday queries in local languages.

🌎 Uphold and Exa plan to bring crypto credit card and yield service to the mass market. The partnership will allow borrowers to take out crypto-secured loans, spendable on a credit card, and lenders to earn yield. The service will initially be available to users in Latin America.

🇦🇪 Mastercard collaborates with Emirates NBD to accelerate digital payment adoption through innovative acceptance solutions. The partnership will provide Emirates NBD’s corporate and government clients with best-in-class payment solutions, improving transaction efficiency and security.

🇦🇹 Austria’s regulatory reporting infrastructure to move to the cloud with Nasdaq AxiomSL. The agreement will see around 90% of credit institutions move their regulatory reporting infrastructure, upgrading their legacy on-premises solution to Nasdaq.

🇬🇧 Jarvis and Sonovate partner to offer pension alternative to Nest. This collaboration will permit Sonovate’s thousands of customers to utilise Jarvis’ innovative pension management solution, providing a tailored alternative to Nest pensions.

DONEDEAL FUNDING NEWS

🇩🇪 Taktile secures $54m to enable AI Adoption for decision making in financial services. The funds will be used to accelerate this momentum further as Taktile is equipping business teams with the necessary tools and controls to build transparent AI-powered risk decisioning.

🌍 Accel-Backed FinTech startup Nala eyes $120 million in next round by selling an equity stake of between 10% and 15%. It has raised a total of $50 million from backers including Y-Combinator Inc, DST Global Partners and Acrew Capital. Read more

🇺🇸 Lockchain.ai, AI-powered risk management platform for blockchain, raises $5M series A. The company plans to allocate the capital toward expanding its risk detection and compliance capabilities. Continue reading

M&A

🇺🇸 Digital financial advisory firm Betterment acquires Ellevest’s automated investing arm. The companies state that Betterment “will only be acquiring Ellevest automated investing accounts and assets under management; it will not be acquiring any additional accounts, technology, employees, or operations as a part of the transaction”.

MOVERS AND SHAKERS

🇬🇧 Monument Board appoints Michael Morley to its board. Michael will play a pivotal role in elevating Monument’s mass affluent offering by bringing his strong expertise in the high-net-worth sector and helping the bank to offer high quality services that are often reserved to private banking clients.

🇬🇧 Jon Burrell joins Weavr as Deputy CEO. Jon joins to accelerate the company’s next phase of growth, using his extensive experience in scaling financial services businesses internationally. His compliance, operations, and FinTech scaling expertise make him a strong fit as Deputy CEO.

🇨🇳 HSBC cutting staff numbers by 900 at China Pinnacle unit. A sharp reversal of the bank's ambition for the unit as part of its expansion plans in that country. The reversal underscores the challenges the Asia-focused bank faces to boost growth and profitability in China at a time when it is slashing costs to boost returns.

🇨🇾 XS.com appoints Stelios Pallis as CTO. His leadership will be pivotal in driving cutting-edge innovation, ensuring the company’s continued leadership in providing seamless, secure, and scalable trading experiences. Continue reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()