FinTech, Fitness & Fundraising: Join Us in LA!

Hi FinTech Fanatic!

Another exciting week kicks off in the US! Today I'm heading from Austin, Texas, to my favorite city in the world (after my hometown Amsterdam, of course 😉)—New York City.

I'm halfway through a five-week US tour and loving every bit of reconnecting with friends and meeting new FinTech enthusiasts. But the highlight so far was probably our run in San Francisco with the FinTech Running Club.

Next up: a fundraiser 5k run in LA, together with the FinTech Running Club and the local LA FinTech community on Saturday, March 15th.

Want to join us? Sign up here. And if you'd like to support the LA Fire Department through our charity run, contributions are warmly welcomed here.

Your support means the world to me!

Have a fantastic week!

Cheers,

SPONSORED CONTENT

Ready to transform your financial products? Meet Ingo Payments at FinTech Meetup in Las Vegas to explore embedded banking. Stop by for drinks and a conversation—reserve your time now!

POST OF THE DAY

Payment Gateway 🆚 Payment Orchestration by Cell Point Digital

INSIGHTS

🇮🇹 Digital payments: 57% of Italian teenagers choose FinTech, leaving traditional banks behind. 57% of Italian teenagers aged 12-17 use digital payment tools, with 66% in the 15-17 age group. However, only 22% of parents choose traditional banks for their children's accounts, preferring digital solutions like PostePay, Revolut, and Hype.

FINTECH NEWS

🇮🇪 66,000 Revolut customers charged incorrect ATM stamp duty. The company is in the process of refunding around 66,000 Irish customers after they were charged incorrect amounts for stamp duty on ATM withdrawals. Customers of the FinTech bank were incorrectly charged a total of around €23,000.

🇩🇪 German court says EY not liable for damages in Wirecard lawsuit. The auditing company could not be held liable because its reports did not qualify as a "public capital market information", the judge said in justifying the decision. The focus of the trial now turns to former Wirecard CEO Markus Braun and remnants of the company represented by administrators.

PAYMENTS NEWS

🇺🇸 Checkout. com continues U.S. expansion with launch of San Francisco office. This strategic move underpins Checkout. com’s continued commitment to the region, which grew the fastest of all its global regions in 2024. The new office will support Checkout.com’s ambition of growing its headcount in North America in 2025 and better support and serve merchants residing on the West Coast.

🇪🇪 Card & APM logos in your checkout: Compliance, UX, and best practices by Solidgate. Card and payment logos are vital for assuring customers of secure transactions and meeting compliance requirements. Solidgate has assisted numerous merchants in optimizing their checkouts for conversions and compliance. This guide provides essential information on displaying credit card logos to enhance the checkout experience.

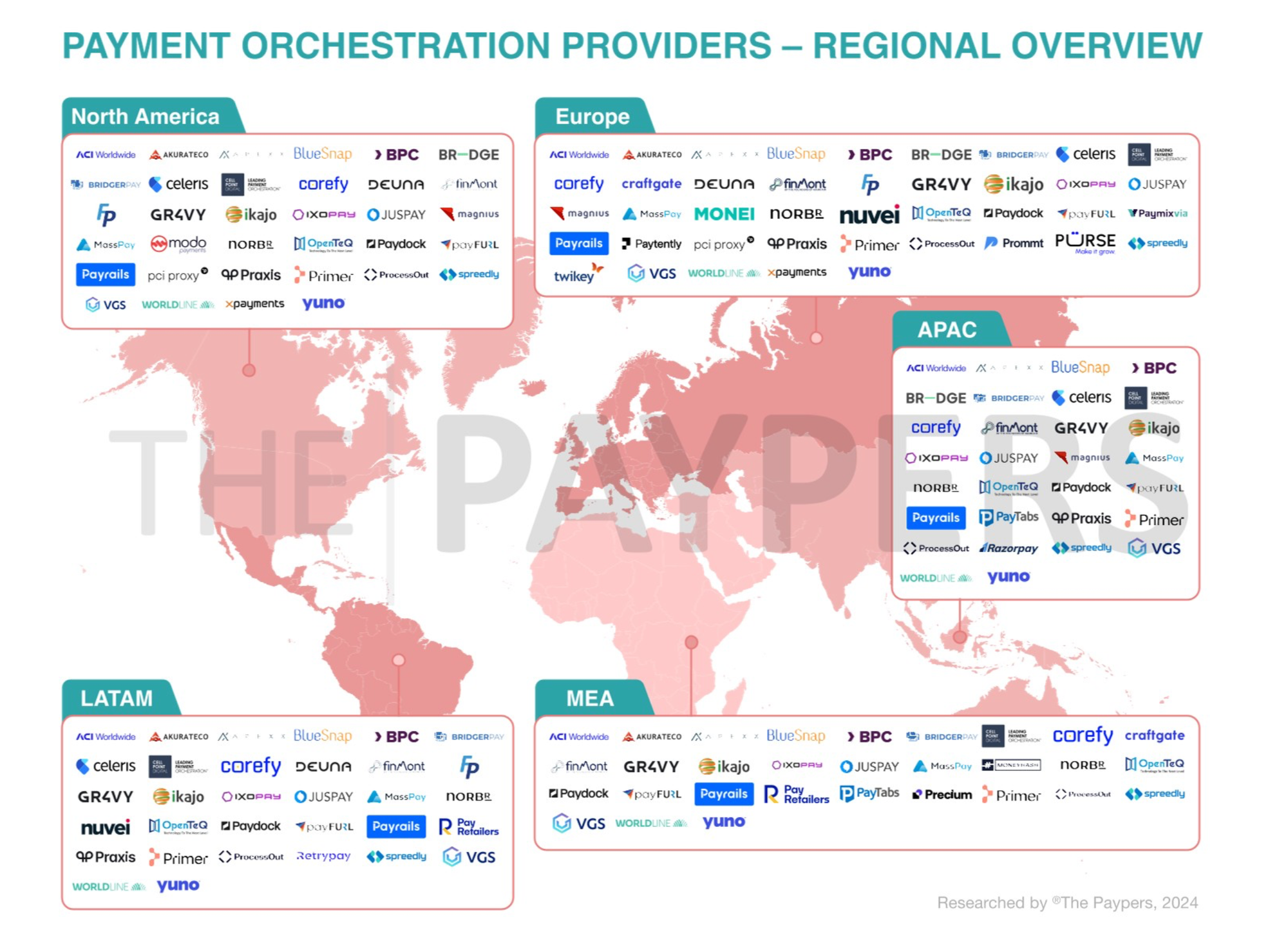

🌍 Global Map of Payment Orchestration Providers.

🇨🇴 “Cloud banking will be our innovation this year”: Fiserv. The company will introduce advanced solutions in digital payments, cloud banking platforms, and data analytics tools that will enable their clients to offer more personalized and secure experiences to their users.

🇧🇷 Revolut customers in Brazil can now send and receive Pix. Customers can send and receive Pix quickly, for free, and 24/7, paying bills, making purchases, and transferring money with ease. Revolut states it is connecting Brazil to the world with innovative financial solutions.

🇺🇸 PayPal needs help from its oldest friends. The company is striking a lot of new partnerships in the payments and commerce business these days. But its original cohort is still the most important: consumers. The digital-payments business has gotten a lot harder in recent years. Keep reading

REGTECH NEWS

🇱🇹 ConnectPay launches the first simplified embedded finance version. Designed to simplify compliance with PSD2 regulations for B2C businesses, it allows companies to easily integrate mandatory authentication requirements, reducing operational complexity and preventing revenue loss from failed compliance.

DIGITAL BANKING NEWS

🇺🇸 Citigroup erroneously credited client account with $81tn in ‘near miss’. The erroneous internal transfer, which occurred last April, was missed by both a payments employee and a second official assigned to check the transaction before it was approved to be processed at the start of business the following day.

🇬🇷 Ask Wire helps modernise Greece’s mortgage market through a partnership with Attica Bank. The platform aims to simplify real estate transactions by offering homebuyers access to various financial and market services.

🇬🇧 Online banking issues hit customers on payday for second month in a row. Nationwide and First Direct have both confirmed issues with their systems, leaving many customers without access to funds on payday. Continue reading

🇧🇷 Revolut launches checking account in Brazilian reais, including a debit card, bill payment services, and PIX integration. It aims to introduce a local credit card and a subscription-based benefits program offering discounts on various services.

🇲🇽 FinTechs in Mexico are aiming to become banks to offer more products to customers. This was agreed upon by directors of several institutions that entered Mexico as FinTechs and are now seeking or have already obtained a banking license in the country, including Nu, Mercado Pago, and Plata.

🇺🇸 Consumer Financial Protection Bureau drops lawsuits against Capital One and Berkshire and Rocket Cos. units. The moves are the latest sign of the abrupt shift at the agency since acting CFPB Director Russell Vought took over this month. Continue reading

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 SEC confirms dismissal of lawsuit against Coinbase. The Commission’s decision to exercise its discretion and dismiss this pending enforcement action rests on its judgment that the dismissal will facilitate the Commission’s ongoing efforts to reform and renew its regulatory approach to the crypto industry.

🇺🇸 SEC declares memecoins are not securities in landmark staff statement. The statement highlighted that memecoin transactions do not involve pooled investor funds or managerial efforts from a centralized entity, key factors in determining security status.

🇺🇸 Milo surpasses $65m crypto mortgage volume, indicating real-world utility for digital assets. It offers up to 100% financing on home purchases, “with loan amounts reaching up to $5 million, eliminating the need for a cash down payment.” Client assets are safeguarded through industry-leading custodians Coinbase and BitGo.

🇩🇪 Boerse Stuttgart partners with DekaBank to offer crypto trading for institutional clients. The tie-up is part of Boerse Stuttgart’s plans to expand partnerships with “additional European banks, brokers, and asset managers, further contributing to the mass adoption of cryptocurrencies.”

🇺🇸 Flexa launches Tap to Pay for crypto transactions, introducing the first NFC-Based hardware wallet payments for retail. This marks a major step in digital asset usability, allowing in-person transactions without the need for a mobile phone or internet connection.

🇰🇵 North Korea’s $1.5 billion heist puts the crypto world on notice. It wasn’t just the size of the exploit, although at close to $1.5 billion, it was the biggest ever by a wide margin. Within hours, it was clear that the attack was far more ambitious, and difficult to prevent, than any that preceded it.

🇺🇸 Trump reveals U.S. ‘Crypto Reserve’ Price Bombshell, sending XRP, Solana, Cardano, and Bitcoin Soaring. The bitcoin price shot toward $90,000 per bitcoin following Trump’s post, despite not being named as being included in the planned U.S. crypto reserve. Ripple’s XRP and ethereum rivals Solana and Cardano each rose between 20% and 50%.

PARTNERSHIPS

🇺🇸 Nacha welcomes ACI Worldwide to its preferred partner program. With AI-enabled, cutting-edge fraud management, ACI provides precise, actionable intelligence to mitigate threats while reducing operational costs. Read more

🇺🇸 Wirex announces the expansion of its stablecoin payment platform in partnership with Bridge.xyz. Through this collaboration, Wirex Pay enables U.S. users to make payments directly from non-custodial wallets via card and bank transfers while maintaining full control over their funds.

🇺🇸 Uniswap partners with Robinhood, MoonPay, Transak to turn crypto into cash. Users in more than 180 countries can sell supported crypto assets to deposit funds directly into their bank account through the platforms, Uniswap announced. Read more

🇺🇸 Adyen and Bilt partner to further enhance payments platform for Bilt members nationwide. President of North America at Adyen, expressed excitement about supporting Bilt’s exponential growth. He also highlighted that the partnership with Bilt provides them with top-tier payment technology, helping enhance their loyalty program and create better experiences for their customers.

🇺🇸 Green Dot and Marqeta join forces to enhance cash services for businesses and their customers. This relationship addresses the demand for essential cash services while bridging the digital divide among cash-preferred consumers, allowing consumers and businesses to conveniently and affordably deposit cash into digital bank accounts.

🇪🇪 Crassula selects tell.money to streamline open banking compliance and enhance payment security with Confirmation of Payee. By integrating tell. money’s open banking and Confirmation of Payee solutions, Crassula is enabling its clients to meet PSD2 compliance requirements while enhancing security and fraud prevention.

🇶🇦 Mastercard and Sadad to fuel digital payments in Qatar. The new partnership aims to evolve the market’s e-commerce landscape, enabling seamless shopping experiences, higher conversion rates, and helping to reduce fraud. Read more

🇺🇸 Orum teams up with Visa Direct to launch faster payments. The collaboration enables U.S.-based customers to easily and quickly move money via Orum’s Deliver API and Visa Direct. Customers will be able to use its Deliver solution to reach 99% of bank accounts in the US via a linked debit card.

DONEDEAL FUNDING NEWS

🇺🇸 Accounting hasn’t fully embraced AI yet, Quanta just raised $4.7M to change that. With this fundraise, the startup plans to move beyond its current niche of early-stage software companies to larger businesses, including ones with multiple corporate entities.

M&A

🇬🇧 Founders of hospitality cash-back app cash in with seven-figure sale. The change in business model and resulting success has led to Enigmatic Smile, an Essex-based rewards and loyalty software company, acquiring Lux Rewards for an undisclosed seven-figure sum.

🇧🇷 Trio buys PayBrokers to advance in online betting and gaming. The purchase aims to strengthen their position in this growing sector, with a focus on enhancing digital payment solutions for betting platforms. This move is part of their strategy to capitalize on the increasing demand for online gambling and gaming services.

🇺🇸 Alkami to acquire MANTL to expand account opening capabilities. It plans to fund the acquisition with cash of approximately $380 million and restricted stock units issued to continuing MANTL employees with an estimated value of $13 million at transaction closing.

MOVERS AND SHAKERS

🇺🇸 Goldman Sachs adds John Waldron to board, lining up potential CEO succession. Waldron joins to its board of directors a month after he was given a retention bonus, cementing his position as a potential successor to CEO David Solomon. Waldron, 55, joins Solomon, 63, as the second member of the management committee to have a seat on the board.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()