E-Money Markets Secures £700K to Modernize SME FX and Payments

Hey FinTech Fanatic!

London-based FinTech E-Money Markets has raised £700K in pre-seed funding to enhance SME access to FX and international payment solutions. The funding round, led by CH-1 Investment Group and angel investors, will support the development of its technology infrastructure and product expansion.

The company aims to bridge the gap between traditional FX brokerage and modern FinTech by integrating plug-and-play FX and payment APIs. Founded in 2022 by Harry Geller (ex-CurrencyCloud), Myles Birkett, and Vincent McCarthy, E-Money Markets provides a white-label FX and payments platform, designed to help brokers and financial institutions serve SMEs with advanced financial tools.

With this investment, the company plans to:

✅ Expand its FX and payments product range

✅ Secure regulatory licenses for broader adoption

✅ Onboard strategic partners in the FX brokerage industry

Scroll down for more FinTech industry updates 👇

Cheers,

SPONSORED CONTENT

Schedule a meeting at FinTech Meetup

POST OF THE DAY

The Most valuable European private Startups by country HQ 👇

FinTechs like Mollie, Revolut, Klarna, Lunar, and SEON are on the map!

FINTECH NEWS

🇪🇸 Santander says UK business is not for sale. The Financial Times reported that Santander had discussions with NatWest for a potential sale of the Spanish lender's UK retail business. But a Santander spokesperson said, "Santander UK is not for sale". Read more

🇺🇸 Coupa brings agentic AI features to spend management platform. The new features are aimed at boosting operational efficiency and supplier collaboration and engagement. The company’s new agentic AI offerings include contract intelligence, which is designed to “improve contract language analysis and process more contracts with standard and custom field extraction with AI advancements.”

🇩🇪 Prosecutors drop some charges against former Wirecard Chief. The prosecutors decided to speed up a case that has been underway since December 2022. They believe Markus Braun is all but certain to receive a long prison sentence for the remaining charges in the case.

PAYMENTS NEWS

🇪🇪 Why online payments fail, and how to recover lost sales, by Solidgate. This blog draws on years of experience optimizing payment performance for online businesses to explain the nature of failed payments and provide effective solutions. Learn more

🇱🇹 Checkout. com announces its partnership with Vinted. With AI-driven optimizations, Checkout.com’s Intelligent Acceptance has boosted Vinted’s acceptance rates by 4.15% in 2024, reducing failed transactions and increasing engagement. As a result, Vinted significantly grew its transaction volume with Checkout.com, reinforcing their strong partnership.

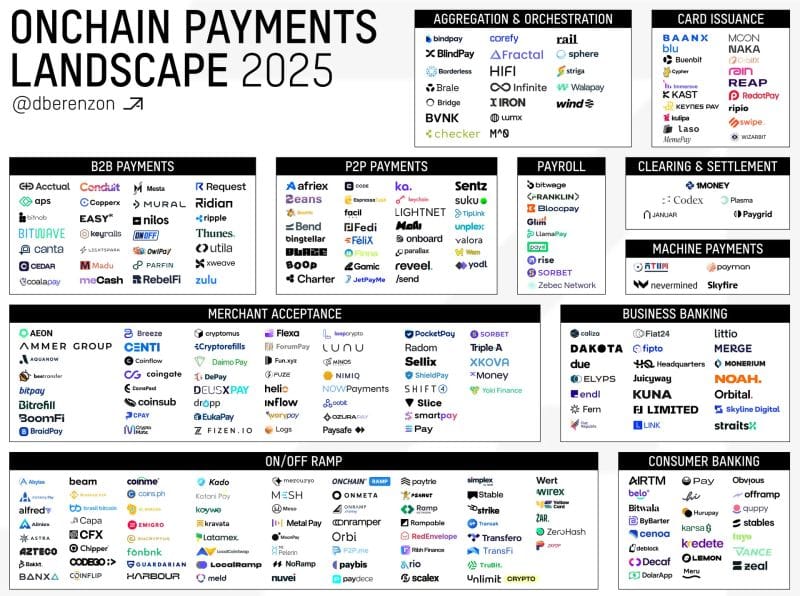

➡️There are currently ~280 payment companies building on cryptorails 👇

Which company is missing from this map?

🇺🇸 Adyen processing volumes jump 22% as digital payments surge. Company materials indicated that processed volume growth was up 22% in the most recent half, to 666.4 billion euros, while the EMEA was yet again a key net revenue contributor, growing 27% year on year. North America-related revenues were up 21%.

🇺🇸 MoonPay Balance is now live in the U.S. The feature, first unveiled to European users in November, lets users deposit funds to their account for zero-fee purchases. Users can also sell crypto back into their MoonPay Balance, making it easy to make later purchases or withdraw when it suits them.

REGTECH NEWS

🌏 Mastercard launches anti-money laundering service “TRACE” to combat financial crime in Asia Pacific. Powered by timely and large-scale payments data from multiple financial institutions, TRACE provides holistic intelligence, enabling tracing of financial crime across a payments network.

DIGITAL BANKING NEWS

🇺🇦 Revolut has 𝗡𝗢𝗧 filed any official applications. The National Bank of Ukraine governor said "We have not received any requests. We monitor the situation and take into account the information in the public space. If the NBU sees any violations of the law by the company, we will react immediately and accordingly. We also interact with regulators in other countries to investigate this issue."

🇺🇸 JPMorgan’s Dimon wants Washington to 'look at all the rules and regulations' affecting big banks. The new comments from the CEO coincide with attempts by the Trump administration to rein in one big bank regulatory agency and rethink how to restructure other big regulators that oversee the nation's largest lenders.

🇺🇸 Regions Bank announces latest innovation to help companies streamline cash flow. The name of the solution is Regions Embedded ERP Finance. The result is Regions’ clients now have the option of using this tool, powered by Koxa, to seamlessly connect financial data to their own enterprise resource planning (ERP) systems.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 SG’s Union FinTech launches blockchain platform. Using ZKsync technology, Union Chain aims to solve fragmentation and scalability issues, offering access to over 20 million verified users in Southeast Asia. Continue reading

🇺🇸 Coinbase fourth-quarter profit beats estimates on crypto trading boost. "We're really entering a golden age for crypto here. The opportunity in front of us is unprecedented to update the financial system and increase economic freedom around the world, the regulatory overhang is lifting," CEO Brian Armstrong said.

🇸🇬 Singapore appeals to some crypto firms despite lure of US. Despite Donald Trump’s plan to turn the US into the crypto capital of the planet, Suvashree Ghosh reports that some firms are still singing the praises of Singapore. Read More

PARTNERSHIPS

🇳🇬 AZA Finance and dLocal partner. The partnership will see dLocal’s cross-border payment infrastructure combined with the FinTech company specializing in payments and foreign exchange in Africa’s foreign exchange capabilities and network of regional licenses.

🇦🇺 NSW inks deals with big four banks and Citi to fix payments. Commonwealth Bank and National Australia Bank will join the existing three banking partners for the NSW government, a move it claims will improve liquidity and protect against market shocks.

🇬🇧 ShopMate announces partnership With DNA Payments to transform payment solutions for convenience stores. Through this strategic partnership, ShopMate is enhancing its support for retailers by integrating a seamless and efficient payment solution into its EPOS system, ShopMate Pay.

🇺🇸 Corridor platforms collaborate with Google Cloud to help financial institutions unlock the full potential of customer-facing GenAI applications while adhering to rigorous regulatory and compliance standards. Corridor's GenGuardX platform emerges as a comprehensive solution designed to bridge the gap between innovation and risk management.

🇨🇦 Pipe partners with Housecall Pro. The two companies are improving financial access for the industry by delivering Pipe’s embedded capital through the Housecall Pro platform. The move accelerates Pipe’s strategy of providing capital access to SMBs globally from within the software they already use to run their businesses.

🇬🇧 Capital.com expands collaboration with LSEG to deliver news, data and analytics essential to informing clients' trading decisions. Integration of LSEG's Data & Analytics AI-powered sentiment analysis and news feeds will help traders react quickly and with authority.

DONEDEAL FUNDING NEWS

🇬🇧 E-Money Markets secures £700K, bets big on future of SME FX. The investment will allow markets to fund its technology infrastructure to support wider adoption, expand its FX and payment product range to better serve brokers and SMEs, secure necessary regulatory licenses and onboard strategic partners within the FX brokerage industry.

🇨🇳 Gaorong Ventures invests $30 million in crypto unicorn. The firm invested in HashKey Group at a pre-money valuation above $1 billion. The valuation remains little changed from a year ago, when Hashkey raised $100 million and reached unicorn status, according to sources.

🇺🇸 Stablecoin firm Plasma secures $20m series A. The financing is aimed at supporting the development of Plasma’s blockchain network. Plasma is developing a blockchain specifically designed for Tether’s USD-pegged stablecoin, USDT. Continue reading

M&A

🇨🇳 Payoneer receives regulatory approval for its acquisition of a licensed China-based payment service provider. The transaction is expected to close in the first half of 2025, subject to customary closing conditions. Click here for more

MOVERS AND SHAKERS

🇸🇬 Zac Liew steps into new role as CCO at Coda after Curlec by Razorpay Exit. Zac brings extensive experience in FinTech and leadership to his new role where he will be driving Coda’s continued growth. Continue reading

🇬🇧 Moneyhub shutters D2C business, lays off “around 30%” of UK workforce. Staff were informed of the layoffs, which has led to the elimination of “approximately 36 positions”. The company’s D2C proposition will be closed down gradually “over the next 18 months”, sources say, coinciding with the expiration of existing paid subscriptions.

🌏 HSBC plans new round of investment bank job cuts next week. The latest phase of cuts will start in Asia, but will ultimately affect employees globally. Some cuts are already underway in the firm’s markets division but wider layoffs across the investment bank will begin as early as Monday.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()