Featurespace Set for Potential £700M Sale to Visa

Hey FinTech Fanatic!

Visa is in advanced talks to acquire Featurespace, a Cambridge-based fraud detection company founded in 2008, with a potential valuation of around £700 million.

The company, backed by the late tech entrepreneur Mike Lynch, specializes in machine learning software for fraud prevention, serving clients like HSBC and NatWest.

Lynch, who passed away recently, was a significant figure in British tech, having invested in Featurespace and served as a non-executive director for over a decade. Although the deal is not yet finalized, it underscores Lynch's legacy in supporting successful UK startups.

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

FINTECH NEWS

🇭🇰 Hong Kong FinTech start-up offers loans to unpaid subcontractors amid building slump. Riverchain’s digital platform offers relief to subcontractors, and features a risk model that capitalises on industry knowledge and the ability to unlock value from both unstructured and structured industry data.

🇮🇳 Paytm shares drop after report on regulatory scrutiny. Paytm shares fell Monday on news that India’s markets watchdog has sent its founder notices over alleged misrepresentation, a move the FinTech pioneer said was not a “new development.”

PAYMENTS NEWS

🇦🇺 Zeller unveils the first next-generation payments and POS solution designed and engineered in Australia. The FinTech announced the launch of Zeller Terminal 2, which offers premium design and unparalleled customisation at an affordable price point, setting a new benchmark in payments and POS technology.

🇺🇸 US-based Orlando Credit Union has unveiled its new merchant services through Fort Point Payments to help businesses streamline their payment processes. The new merchant services will enable businesses of all sizes to accept a variety of payment methods.

🇳🇴 IDEX Pay biometric card solution certificated by Visa. The Visa certification is the ultimate result of comprehensive biometric performance testing and ensures that payment’s scheme functional and security specifications are met. It also confirms that IDEX Pay is ready for scaled commercialization on the Visa payment network.

🇰🇭 TechCreate partners with IDEMIA Secure Transactions to Elevate Digital Payments in Cambodia. This collaboration signifies a momentous milestone in Cambodia's financial technology landscape, heralding a new era of innovation and digital payment adoption in the region.

DIGITAL BANKING NEWS

🇵🇭 GoTyme Bank has raked up 3.7 million users, PHP 17.3 billion in deposits. The rapid growth positions the bank on track to achieve its target of five million customers by the end of the year. PhilStar reported that GoTyme Bank has accumulated PHP 17.3 billion in total deposits during the same period.

🇬🇧 Revolut Business Payment Gateway integrates with BigCommerce. The integration will make online businesses’ payment processing smoother and offer their customers a seamless checkout experience, Revolut said in an Aug. 15 blog post.

🇨🇦 Koho rolls out reporting feature to help Canadian renters build their credit history. With its new rent reporting feature, both new and existing Koho customers who pay rent through the platform will have their rent payments reported directly to a credit bureau.

🇰🇼 Weyay Bank launches new multicurrency prepaid card. The new digital card empowers the bank’s app users to conveniently pay for purchases during travel and make online transactions using the currency they want. Keep reading

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Wyoming is pushing crypto payments and trying to beat the Fed to a digital dollar. The state is creating its own U.S. dollar-backed stablecoin, called the Wyoming stable token, which it plans to launch in the first quarter of 2025 to give individuals and businesses a faster and cheaper way to transact while creating a new revenue stream for the state.

DONEDEAL FUNDING NEWS

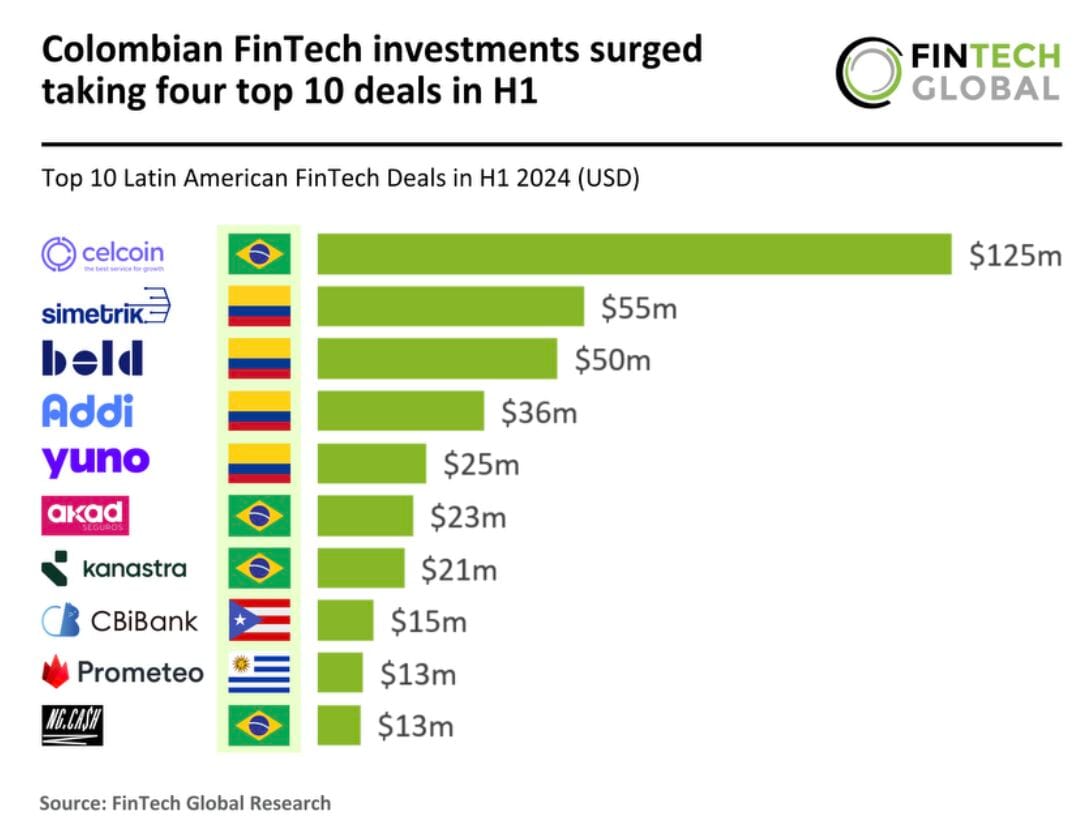

🇨🇴 Colombian FinTech investments surged taking four top 10 deals in H1

🇮🇳 FinTech startup Axio raises $20 million funding from Amazon Smbhav Venture Fund. The new funds will be used to drive growth, scale lending, expand use cases for checkout finance, and introduce more credit products to customers.

🇦🇺 Shift, a provider of credit and payment products to Australian businesses, has secured $23.7m in Series D Equity led by Peak XV Partners. This funding round follows the completion of a $230 million Asset Backed Securitisation in May 2024 and comes as the company marks 10 years in operation.

🇺🇸 Sorella Labs raises $7.5M funding. The round was led by Paradigm with participation from Nascent, Uniswap Ventures, Robot Ventures, and Bankless Ventures. The company intends to use the funds to expand operations and its development efforts.

M&A

🇬🇧 Visa is reportedly considering a $𝟵𝟮𝟱 𝗠𝗶𝗹𝗹𝗶𝗼𝗻 bid for fraud-prevention firm Featurespace. Sky News has learnt that Featurespace, which was founded in 2008 and is headquartered in Cambridge, is in advanced negotiations about a deal. Explore the full article

🇺🇸 Evolve partner PrizePool to shut down. According to a report by Jason Mikula from FinTech Business Weekly, Neobank PrizePool is shutting down its consumer app amid an acquisition. Read on

MOVERS & SHAKERS

🇬🇧 Miranda Mclean, CMO at Ecommpay, shortlisted in Women In Tech Employer Awards. Winners will be announced at a prestigious event in London on 12th November 2024. For several years, Miranda has advocated for women and other minority groups in the tech community. In her current role, she is driving change to make the company's payments platform as accessible as possible for broader financial inclusivity.

🇺🇸 Taktile appoints Jason Mikula as Head of Industry Strategy for Banking & FinTech. At Taktile, Jason will help drive product innovation, go-to-market, and communications strategy for the financial services industry. Learn more

🇬🇧 Tom Adams to join as new Adyen Chief Technology Officer. In the role as CTO at Adyen, Adams will oversee the strategic and technological vision of Adyen’s single platform which encompasses payments, data and financial products.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()