FDIC Calls for Transparency in Bank-FinTech Deals

Hey FinTech Fanatic!

The Federal Deposit Insurance Corporation (FDIC) has extended the commentary period for its proposed rule on Bank-FinTech relationships to January 16, 2025. The rule focuses on recordkeeping requirements for FDIC-insured banks holding custodial accounts from third-party, non-bank companies.

"The evolution of banking and financial services has increasingly included Non-Bank FinTech companies offering consumers new options and alternatives for accessing banking products and services," states the FDIC in the Federal Register. The proposed rule, triggered by the Synapse bankruptcy case, would require banks to maintain accurate daily records identifying individual fund owners in custodial accounts.

The Bank Policy Institute and seven other financial services organizations have requested that the FDIC first consider their input on Bank-FinTech arrangements from a separate RFI before implementing new custodial recordkeeping requirements addressing these same arrangements.

What impact do you think these stricter recordkeeping requirements will have on Bank-FinTech partnerships? Share your thoughts in the comments!

Stay tuned for the latest updates. In the ever-evolving world of FinTech, being informed is your best asset 😉

Cheers,

#FINTECHREPORT

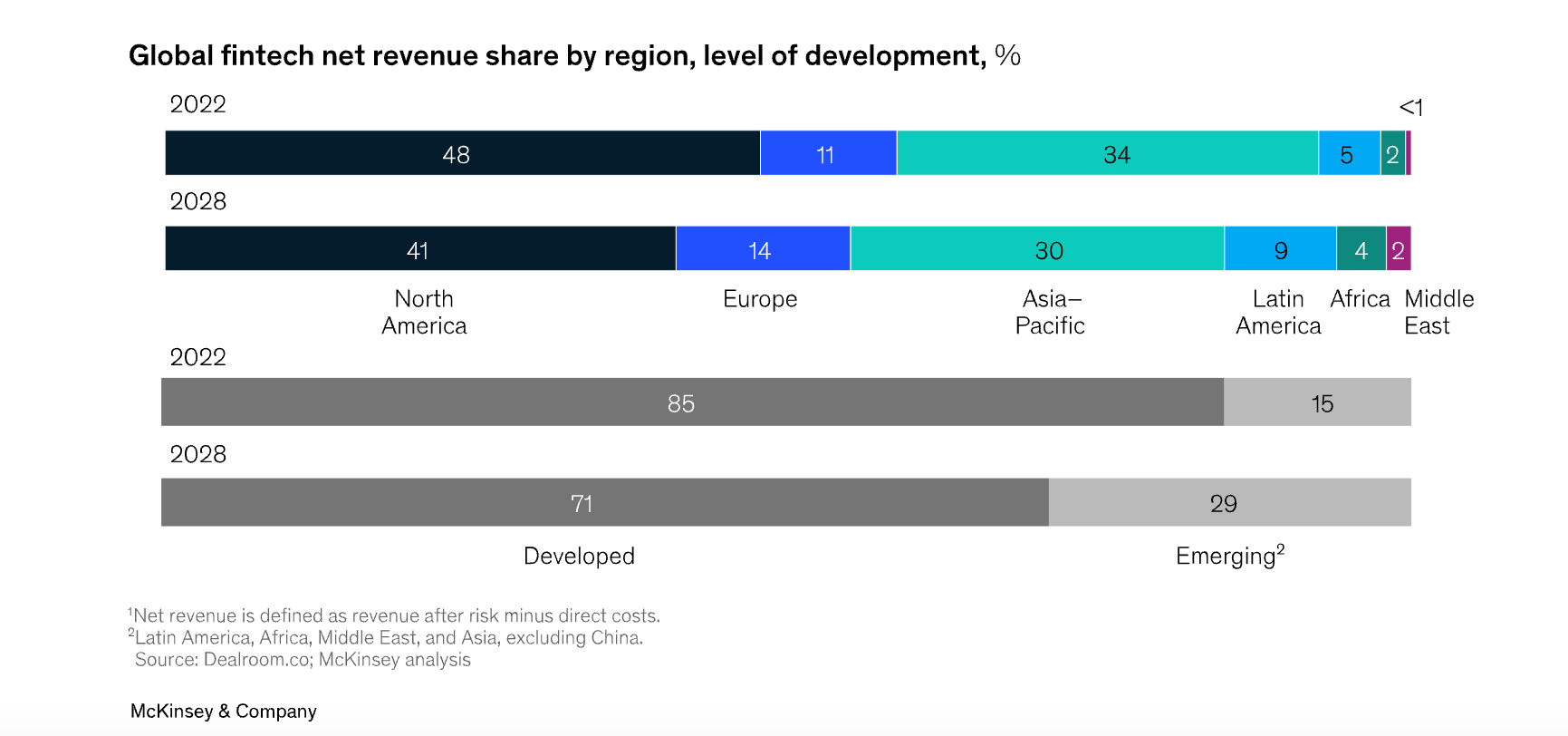

📊 FinTechs: A new paradigm of growth. In this report, McKinsey examines how FinTechs can continue to grow in strength and relevance for customers, the overall financial ecosystem, and the world economy, even in disruptive times. Access the full report here

FINTECH NEWS

🇺🇸 FDIC pushes for transparency in Bank-FinTech partnerships, focusing on better tracking of customer funds and accurate record-keeping. The proposed rule requires banks to reconcile custodial account deposits daily. Feedback deadline: Jan. 16, 2025.

🇺🇸 Expense management FinTech Finfare reports steady business growth. The firm is marking its three-years of business operations with a brand refresh and several industry updates/milestones. The brand revamp reflects the company's evolution and its commitment to transforming financial experiences.

🇶🇦 Britain and Qatar to formalize financial services cooperation. The companies were expected to sign a memorandum of understanding on Wednesday (Dec. 4) to promote cooperation in financial services, focusing on the development of sectors such as FinTech and green finance.

🇺🇸 Sage debuts AI tools for small business accounting teams. Sage has launched its AI tool, Sage Copilot, to help SMBs streamline accounting tasks, offering support for budgeting and financial queries. Available for early adopters in the U.S. and U.K., it aims to boost productivity, compliance, and focus on growth.

🇬🇧 FinTech firm Clear Street joins London Metal Exchange as floor-dealing broker. The NY-based company has obtained regulatory approvals to set up a UK trading operation, and is joining the LME as part of a broader expansion drive across Europe, the Middle East and Asia, it said in a statement on Wednesday.

PAYMENTS NEWS

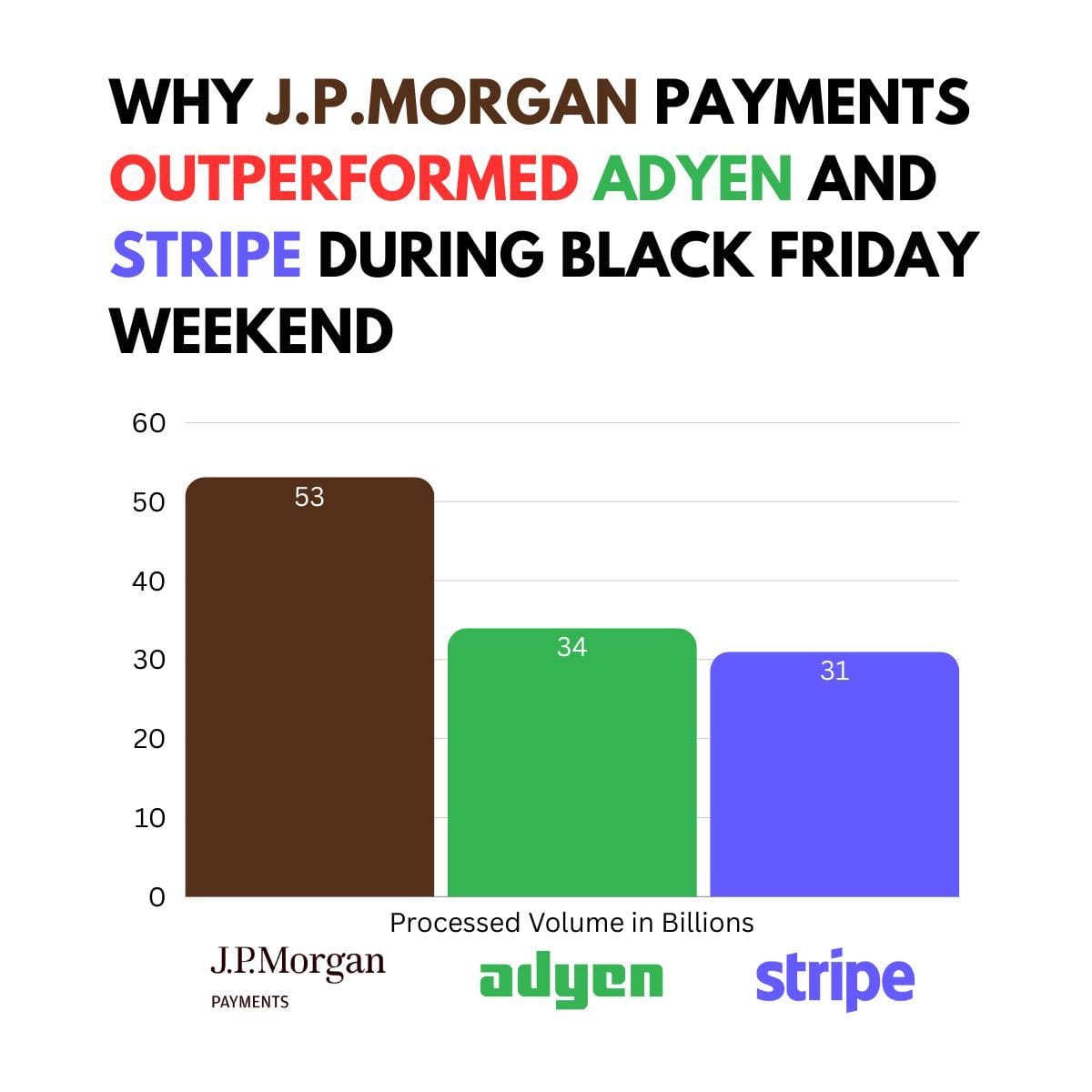

➡️ Why J.P. Morgan Payments Outperformed Adyen and Stripe During Black Friday Weekend.

With $𝟱𝟯.𝟭 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 processed during Thanksgiving week, a 17% YoY growth, and 6,000+ TPS at peak, J.P. Morgan Payments outperformed Adyen and Stripe during Black Friday Weekend 🤯

🇺🇸 Transform your workforce payroll and payments operations with Papaya Global’s AI solutions.

Papaya Global’s four core new platform technologies bring the payroll industry one step closer to creating a seamless workforce payments experience – regardless of location or employment model.

“After listening to our customers and spending countless hours rigorously planning, developing, and testing, I'm excited to launch the next phase of our platform technology.” Amit Levi, SVP Product.

Papaya Global’s new AI-powered solutions run on four central pillars: AI Data Connectors, Real-Time Workforce Payments, Papaya 360 Support, and AI Cycle Validation Agent.

🇬🇧 2025: Growth of new payment tech critical for merchants. 2024 has seen open banking, Buy Now, Pay Later (BNPL), and marketplaces continue to gain traction, and Moshe Winegarten, CRO at inclusive global payments platform, Ecommpay, believes 2025 will tell a similar story. However, he suggests other changes may evolve, not least within globalisation, as more merchants extend their reach to serve customers in other regions. Click here to learn more

🇬🇧 Mastercard reaches 'agreement in principle' to settle mass UK fees case. Mastercard faced a landmark lawsuit led by consumer advocate Walter Merricks on behalf of 46 million UK adults. After a five-year legal journey, it became the first mass consumer action approved in the UK, reaching the Supreme Court. More on that here

🇺🇸 TrueBiz approved by Mastercard as a Merchant Monitoring Service Provider. TrueBiz joins Mastercard’s Merchant Monitoring Program, offering advanced tools to detect merchant risks, such as prohibited content and transaction laundering.

🇺🇸 Buy Now, Pay Later has almost a billion reasons to celebrate the season. BNPL spending reached $991 million on Cyber Monday, setting a record, with total holiday-season BNPL spending projected to hit $18.5 billion. While shares of Affirm, Block, and Klarna rise, BNPL's retail spending share has modestly increased, reaching 7.7%.

🇺🇸 Higher $10 million RTP® network transaction limit empowers new uses. The Clearing House is raising the RTP® network’s transaction limit to $10 million starting February 9, 2025. This increase supports industries like real estate and supply chain, allowing businesses to make larger real-time payments, even outside traditional hours.

🇫🇷 French FinTech Hero secures payment institution licence from ACPR. Having obtained its ACPR licence, Hero is set to expand its presence across Europe. The company has also launched an all-in-one business account that includes a Visa

🇺🇸 Intuit and Adyen collaborate to help small and mid-market businesses get paid faster. This collaboration aims to accelerate payments and reduce late fees, helping UK SMBs improve cash flow. The two companies will initially integrate Adyen's embedded payment services into Intuit’s business platform through QuickBooks Online (QBO).

🇬🇧 Tribe powers up Ribbon’s issuer processing, enabling its UK launch. Ribbon will leverage Tribe’s Risk Monitor platform to assess card transactions in real-time, ensuring customer protection and compliance with AML requirements for EMI license holders.

🇬🇧 PayPoint and Lloyds join forces to empower the nation’s 60,000+ SMEs with new payments offering. This collaboration aims to enhance merchant support and accelerate growth, delivering better tools and services to their SME and retailer partners.

REGTECH NEWS

🇮🇪 5 most common fraud methods in 2024, according to AIB. Allied Irish Bank is urging customers to remain vigilant against fraud, especially as people take time off to relax over Christmas, and has revealed the five most common fraud methods seen in 2024.

DIGITAL BANKING NEWS

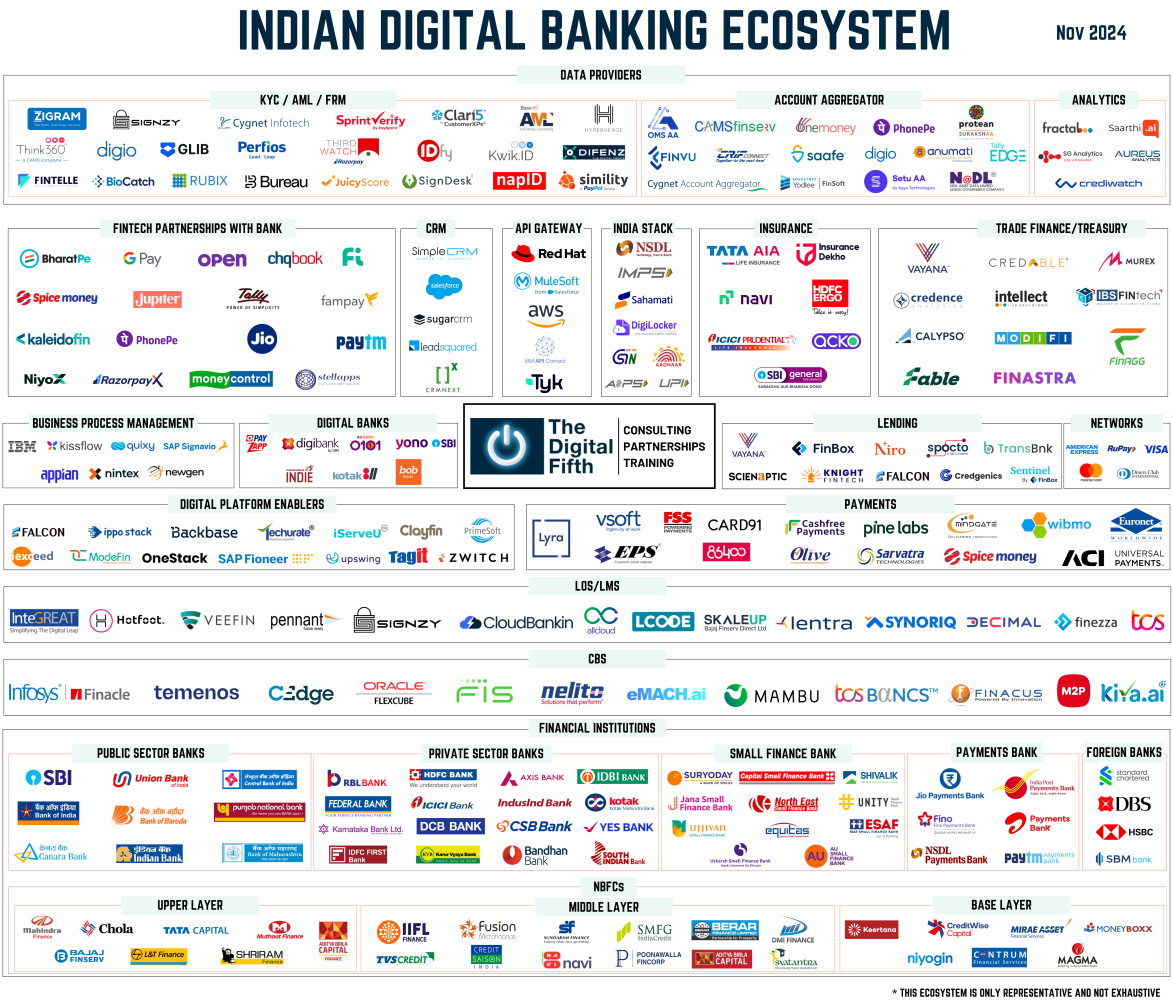

🇮🇳 Indian Digital Banking Ecosystem by The Digital Fifth 👇

Any companies missing in this market map?

🇬🇧 WealthKernel taps Griffin to expand Its product portfolio with savings accounts. This partnership enables WealthKernel to embed savings accounts into its API, offering FinTechs and wealth managers a streamlined way to support diverse wealth-building goals and timelines.

🇬🇧 NatWest Group Innovation team launches new FinTech Growth Programme. The programme supports NatWest’s ambition of leading the future of banking with the hope that some of the participants will help drive the bank’s innovation pipeline. Read on

🇺🇸 Barclays reaches $19.5 million settlement over a securities fraud lawsuit in Manhattan. Shareholders claimed they lost money after Barclays sold $17.7 billion more debt than regulators allowed. The bank admitted the overissuance was a preventable mistake.

🇬🇧 UK FinTech Stenn to 'defend against' HSBC Innovation Banking application to put the startup into administration. The application consists of two filings, which were both submitted recently, relating to two companies under the wider company umbrella of the Stenn group. In each filing HSBC Innovation Bank is listed as an applicant for Stenn.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase CEO issues warning to law firms hiring former government officials that targeted crypto. Brian Armstrong, Coinbase CEO, warns law firms hiring ex-government officials who targeted the crypto industry and committed “bad deeds.” He states that Coinbase will no longer work with such firms.

PARTNERSHIPS

Crypto.com and Mastercard collaborate to scale digital payments in GCC region. This initiative focuses on scaling financial innovation in the region, promoting the adoption of cryptocurrencies, and providing secure, efficient payment infrastructure.

🇬🇧 Santander and Pemberton agree on a strategic partnership to launch Invensa, a new company focused on providing large and mid-sized corporates with supply chain inventory solutions, enabling scalable, efficient inventory financing and management.

🇬🇧 Gatehouse Bank enters home finance partnership with ColCap UK. The collaboration with Gatehouse Bank allows ColCap UK to diversify and expand into new market segments. The agreement also includes a sale of circa £100 million of Gatehouse Bank’s beneficial interest in its existing home finance portfolio.

🇵🇭 Filipino FinTech Starpay partners with OceanBase. This partnership aims to upgrade the Relational Database Services (RDS) within Starpay's technical stack, improving its system performance and operational efficiency. Continue reading

🇲🇾 Atome partners with Valiram to expand payment solutions. Valiram partners with Atome to offer embedded financing and flexible payments at over 200 stores in Malaysia, including brands like Victoria’s Secret and Michael Kors. The solution will expand to 40 stores in Singapore soon.

🇪🇬 Contact Pay, eKhales expand partnership to offer PoS payment solutions. This partnership enables Contact customers across the country to conveniently settle their payments via eKhales’ expansive partners network of PoS terminals.

DONEDEAL FUNDING NEWS

🇨🇭 Brighty raises $10M for crypto-integrated digital banking platform. Brighty is a personal finance app that combines traditional digital banking experience with stablecoins and decentralised finance. The funds will be used to expand the company’s presence in Europe and the UK.

🇳🇱 Amsterdam’s ThreatFabric raises additional funds from Rabo Investments to enhance banking security. The funds will support ThreatFabric’s international expansion and strengthen banking system security. The company also plans to establish a long-term partnership with Rabobank.

MOVERS & SHAKERS

🇬🇧 Philip Symes joins Checkout. com as interim Chief Financial Officer. Philip brings extensive experience in payments, notably as CFO of Visa Europe for 10 years, and will support Checkout's international expansion into regions such as Brazil and Canada.

🇺🇸 DailyPay appoints accomplished commercial leader Ryan Mang As Chief Commercial Officer. In his new position, Mang will deliver on the company’s customer-first vision by uniting and overseeing DailyPay's go-to-market teams, including marketing, revenue and customer office.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()