Explore the Best FinTech Events This April - Special Invitation Inside!

Hey FinTech Fanatic!

Before we delve into today's FinTech news, I'd like to ask you something. What is the best FinTech event or meetup for me to attend in April? I'm currently organizing my travel schedule for the upcoming period and would like to know which event is a must-attend.

Of course, I'll be in New York City for FinTech Week, that's a given. If you're going to be around, I highly recommend requesting an invite for this excellent happy hour organized by my friends from The Financial Revolutionist. It presents a fantastic opportunity for us to meet in person, as I wouldn't want to miss this event for anything.

Let me know what your favorite FinTech event is, and perhaps I'll see you there!

Cheers,

#FINTECHREPORT

🇪🇺 Is the European Union finally moving towards a harmonized approach to combat moneylaundering? Let's explore KYC AML Guide's “New Anti-Money Laundering Rules’” report for further insights. Link here

FINTECH NEWS

🇬🇧 Robinhood launches to UK customers. The trading and investing app made infamous by the Gamestop saga, launched in the UK yesterday, after two failed attempts. This is the first step outside the US for the firm, after it shot to global infamy in 2021 as the central player in the so-called meme stock frenzy.

🇨🇳 Mastercard enables convenient and secure international remittances to Alipay Wallet. New connection to Alipay accelerates Mastercard’s fast-growing cross-border payment offering, addressing the demand for transparent, secure and efficient money movement. Read more

🇫🇷 Defacto is now officially the first B2B FinTech lender licensed as a “Société de financement” by the French Banking Supervisor. This pivotal milestone allows the company to join the small group of licensed FinTechs such as Klarna, Younited, and Alma who have also undergone rigorous evaluation.

🇬🇧 FCA hires chief internal auditor who has no audit qualifications. Concerns about the appointment were raised in a letter to the Treasury committee, which was signed by a former FCA worker who requested anonymity. The Treasury committee asked to scrutinise the City regulator’s appointment of an insider, as doubts are raised about his ‘objectivity and independence.’

🇬🇧 Zilch expects to be Profitable in months, and seeks IPO in 2025. The firm has held talks with the London Stock Exchange, New York Stock Exchange and Nasdaq about a listing, although it has yet to decide on a venue, CEO Philip Belamant has told Bloomberg. More on that here

🇦🇪 UAE’s Tungsten secures FSRA licence to transform custody for $23bln digital assets sector. Tungsten is the first UAE-built and regulated custody platform purposely designed to store digital assets securely for institutional investors. As a regulated custodian, Tungsten aims to provide peace of mind for institutions investing in digital assets, including cryptocurrency.

🇺🇸 Thredd announces expansion into the United States card issuing processing market. This strategic move highlights Thredd’s commitment to support its clients’ expansion plans in key global markets. The firm plans to continue building its U.S. client base by initially supporting clients and prospects that are looking to take their business stateside.

🇺🇸 Stax Payment founders launch AI-powered credit underwriting platform Worth AI. Leveraging AI, the platform processes thousands of traditional and non-traditional data sources to swiftly generate a unified 'WorthScore™️,' while building comprehensive business profiles in minutes. Read on

🇦🇪 The Emirates Integrated Telecommunications Company - which operates the du telco - has received licenses from the UAE Central Bank to offer financial services via digital platforms. It will be entering one of the hottest growth markets in UAE, which is financial services delivered over digital platforms.

PAYMENTS NEWS

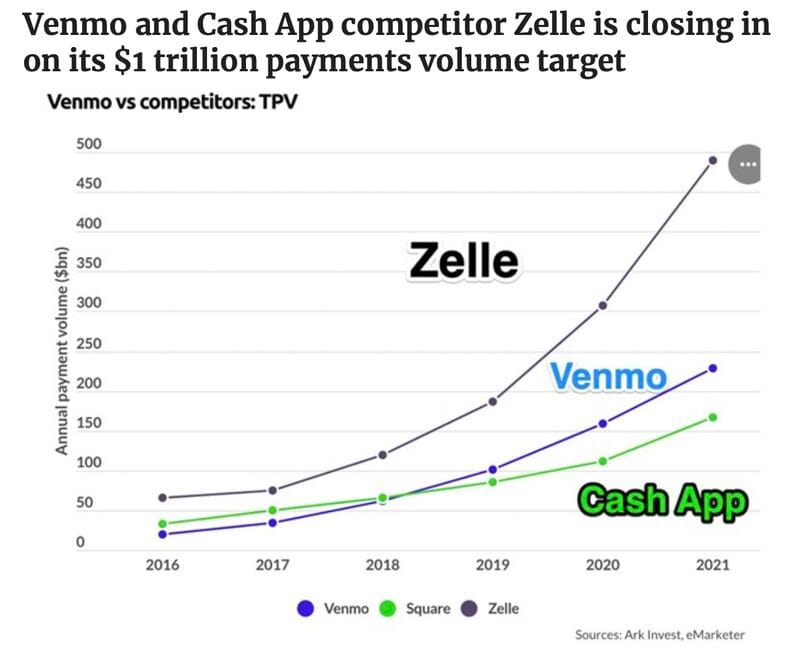

Venmo and Cash App competitor Zelle is closing in on its $1 trillion payments volume target.

Bolt, a checkout technology company, and Checkout.com, a global payment solutions provider, announced a partnership set to expedite their shared mission to advance ecommerce. Through this collaboration, Bolt will become Checkout.com’s exclusive one-click checkout provider and Checkout.com will become Bolt’s preferred payment partner.

🇺🇸 Galileo adds post-purchase installment payments to BNPL offering. The new API-enabled BNPL post-purchase offering is built for banks and FinTechs looking to seamlessly deliver their customers a more flexible financing opportunity. It supports repayment options for both existing debit and credit programs within established financial relationships.

OPEN BANKING NEWS

🇺🇸 The Financial Data Exchange (FDX) announces a significant milestone at its Spring Global Summit in Washington, DC, reporting that 76 million consumer accounts are now actively utilizing its FDX API for secure open finance data sharing. Read more here

DIGITAL BANKING NEWS

🇳🇬 OurPass will acquire MFB licence to offer more banking services to customers. The company will acquire the licence from the Central Bank of Nigeria in the coming weeks, allowing the startup to offer a broader range of financial services instead of relying on third-party partnerships. And while it’s still early days, the company has already set its sights on becoming profitable quickly.

🇺🇸 YC-backed digital bank Onyx Private tells customers it’s closing their accounts. Miami-based Onyx Private, a Y Combinator-backed digital bank that provided banking and investment services for high-earning Millennials and Gen Zers, is terminating its bank operations. More here

Revolut takes on Square and Sumup and rolls out a Point-of-Sale iPad application for businesses in the hospitality industry. Integrated with the Revolut card reader, the new POS product enables businesses to track sales trends, check inventory levels, and make data-driven decisions. Read on

🇪🇹 Commercial Bank of Ethiopia has lost more than £31 million after a technical glitch let customers withdraw and transfer money that was not in their accounts. The state-owned bank was hit by a system’s failure which lasted for several hours over the weekend. A cyber-attack has been ruled out.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase’s top lawyer blasts SEC after judge rebukes agency for ‘gross abuse of power.’ Paul Grewal, Coinbase’s chief legal officer, slammed the US Securities and Exchange Commission for wasting taxpayer money after a judge sanctioned the regulator on Monday for abusing its power in a case involving another crypto venture.

DONEDEAL FUNDING NEWS

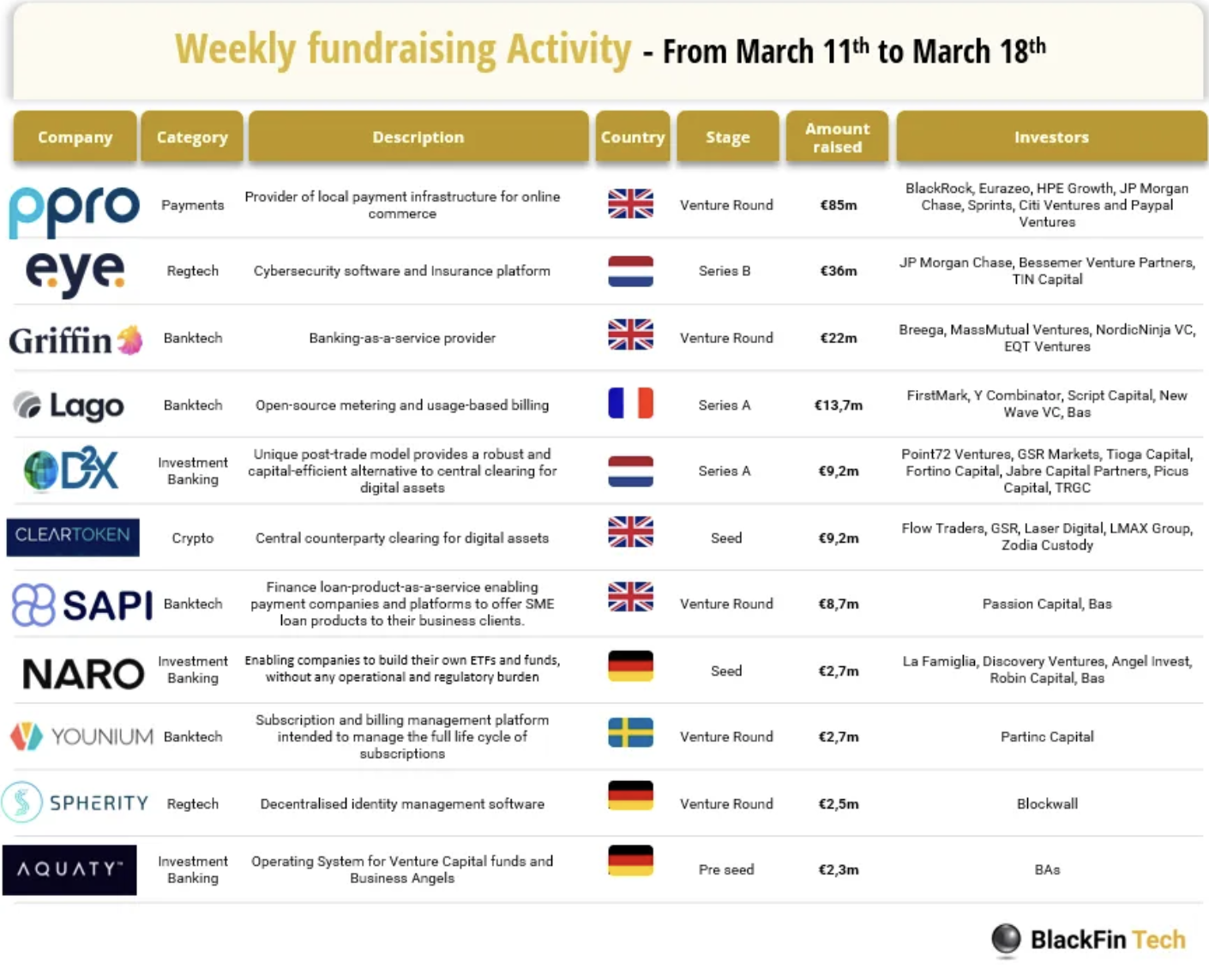

Last week we saw 11 official FinTech deals in Europe for a total amount of 194m€ raised with 4 deals in the UK, 3 in Germany, 2 in the Netherlands, 1 in France, and 1 in Sweden. Check out full article here

🇺🇸 Blockchain-focused Figure Technologies has secured $60 million in a bid to build a decentralized competitor to the largest centralized crypto exchanges. The company also looks to offer an alternative to stablecoins. Called Figure Markets, the new exchange seeks to use the Provenance blockchain to be a marketplace for a range of securities.

🇩🇪 Solaris raises EUR 96 million in funding. The current round consists of EUR 96 million in additional capital and a financial guarantee of up to EUR 100 million capital equivalent. Solaris will use the funds to onboard the ADAC(Allgemeiner Deutscher Automobil-Club) credit card program, strengthen its core capital and invest in the resilience of its platform.

🇺🇸 Miami-based Capstack Technologies has secured a $6 million strategic investment from Citi Ventures, marking a significant milestone in its mission to revolutionize banking technology. This investment coincides with establishing a high-profile advisory board and adding experienced executives from community and regional banks.

M&A

🇫🇷 Fractible, after only two years of operation, has been acquired by the Irish group Konvi, a leading platform in the fractional investment of luxury assets, boasting over 40,000 users and an international presence. This acquisition aims to cement Konvi's leadership in Europe and expand its footprint in France, a key market for Fractible.

MOVERS & SHAKERS

🇺🇾 dLocal appoints current Co-CEO Pedro Arnt as CEO, with Sebastián Kanovich, who has been CEO since 2016, becoming a Board Member and Head of Commercial and M&A Committee. Mark Ortiz, who previously worked at GE Capital, also joins the company as CFO, taking over from Diego Cabrera Canay, who announced his intention to move on from the company in late 2023.

🇺🇸 Grasshopper expands Fund and Sponsor Banking Team with addition of Gabrielle Piasio as Senior Vice President of Sponsor Banking. In this role, Piasio will help move the bank's strategic plan forward, providing financing for sponsor-backed, lower-middle market merger and acquisition (M&A) transactions. More here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()