European Central Bank Pressures Revolut, Green Dot Faces Penalties, Nubank Celebrated

Hey FinTech Fanatic!

The European Central Bank (ECB) has urged Revolut to enhance its financial crime controls and governance after a review raised concerns. This follows similar issues delaying the UK FinTech's banking license application. The ECB, now directly supervising Revolut Holdings Europe UAB, has found several deficiencies in the subsidiary's control environment. Revolut’s rapid growth and its significant role in Lithuania’s banking sector—holding €12.1 billion in assets—prompted the ECB to intensify its scrutiny.

In the US, Green Dot Corporation faces a $44 million penalty and a consent order from the Federal Reserve Board due to a deficient anti-money laundering (AML) program and consumer protection issues related to its debit cards and tax services. Green Dot must overhaul its AML controls, improve internal audits, and enhance its suspicious activity monitoring to comply with regulatory standards.

On a positive note, Brazil's Nubank has been named the Best Digital Bank in Latin America by Euromoney Awards for Excellence 2024. Recognized in multiple categories, Nubank stands out for its innovation and customer satisfaction. With over 100 million customers across Brazil, Mexico, and Colombia, Nubank is a leading global digital banking platform, recently celebrated by Fast Company, Interbrand, and Forbes for its impact and growth.

Have a great start to the week and I'll be back in your inbox with more FinTech industry news tomorrow!

Cheers,

Join my Telegram channel for instant access to daily updates and exclusive breaking news from the FinTech industry. Connect with fellow FinTech Fanatics and stay ahead with the latest trends and insights.

POST OF THE DAY

🚀 Today, Nubank is worth over $63 billion, making it the largest bank in Brazil and one of the most valuable FinTechs in the world. In April 2014, the purple card was used for the first time and it didn’t go as expected…

In the one-minute video below, the moment is captured when David Vélez, Cristina Junqueira, and Edward Wible went to a store to perform the first transaction in Nubank's history.

INSIGHTS

📝 Carol Grunberg, the Chief Business Officer at Payments Orchestration platform Yuno, explains the upcoming trends in payment processing. Click here to learn more

FINTECH NEWS

🇦🇺 Airwallex, the Australia-founded leading financial platform for modern businesses, has become the first major payments company to be granted an Australian Financial Services Licence (AFSL) by the Australian Securities and Investment Commission (ASIC) to offer businesses access to retail investment products. This is an additional licence from the AFSL that Airwallex has held for its existing payments and foreign exchange business since 2016.

🇮🇳 Indian FinTech Paytm’s struggles won’t seem to end. The company on Friday reported that its revenue declined by 36% and its loss more than doubled in the first quarter as it continues to grapple with a regulatory clampdown that has significantly curtailed business at its payments bank subsidiary.

🇧🇷 Nu Asset Management, Nubank’s Investment Fund Manager, announces new ETFs. These two new funds will allow investment “in low-volatility stocks (LVOL11) or in securities that enhance returns during market upswings, albeit with higher historical risk (HIGH11).”

🇺🇸 Payroc announced the launch of its invoicing solution, Roc Services, designed specifically for service industry professionals. Roc Services provides a mobile application paired with the BBPOS Chipper 3X card reader, allowing merchants to accept payments on the go without disrupting their workflow.

🇺🇸 CFPB proposes rule for paycheck advance products. The interpretive rule is designed to help ensure US workers know the costs and fees of paycheck advance products. Alongside the interpretive rule, the CFPB released a report on employer-sponsored paycheck advance loans that prompted the bureau’s guidance.

PAYMENTS NEWS

🇧🇷 FinTech company PagBrasil, specializing in payment solutions, has invested R$ 15 million in the creation and development of Pix Internacional and Pix Roaming. The company expects these new tools to handle R$ 1 billion in 2025 and R$ 2 billion in 2026.

🇺🇸 Jifiti has announced the release of its Tap Now, Pay Later technology, which enables consumers and business customers to add their approved loan or credit funds into any digital wallet. Jifiti has already rolled out this technology to banks and merchants in the US and Europe.

🇶🇦 India’s NPCI International Payments Limited announced teaming up with Qatar National Bank to allow UPI payments in Qatar. The tie-up will allow both non-resident Indians (NRIs) and Indian travellers to make payments for their shopping and other activities in the Gulf country.

OPEN BANKING NEWS

🇬🇧 UK-based D•One has announced that NewDay, an unsecured consumer credit provider, went live with its Open Banking connectivity and transaction categorisation solutions. This initiative aims to provide individuals with limited credit histories access to credit options that they might not have benefited from before.

REGTECH NEWS

🇫🇷 Sopra Banking software announces strategic partnership with Finom. This partnership aims to ensure top regulatory compliance and security in the French FinTech market through comprehensive compliance and user verification services.

DIGITAL BANKING NEWS

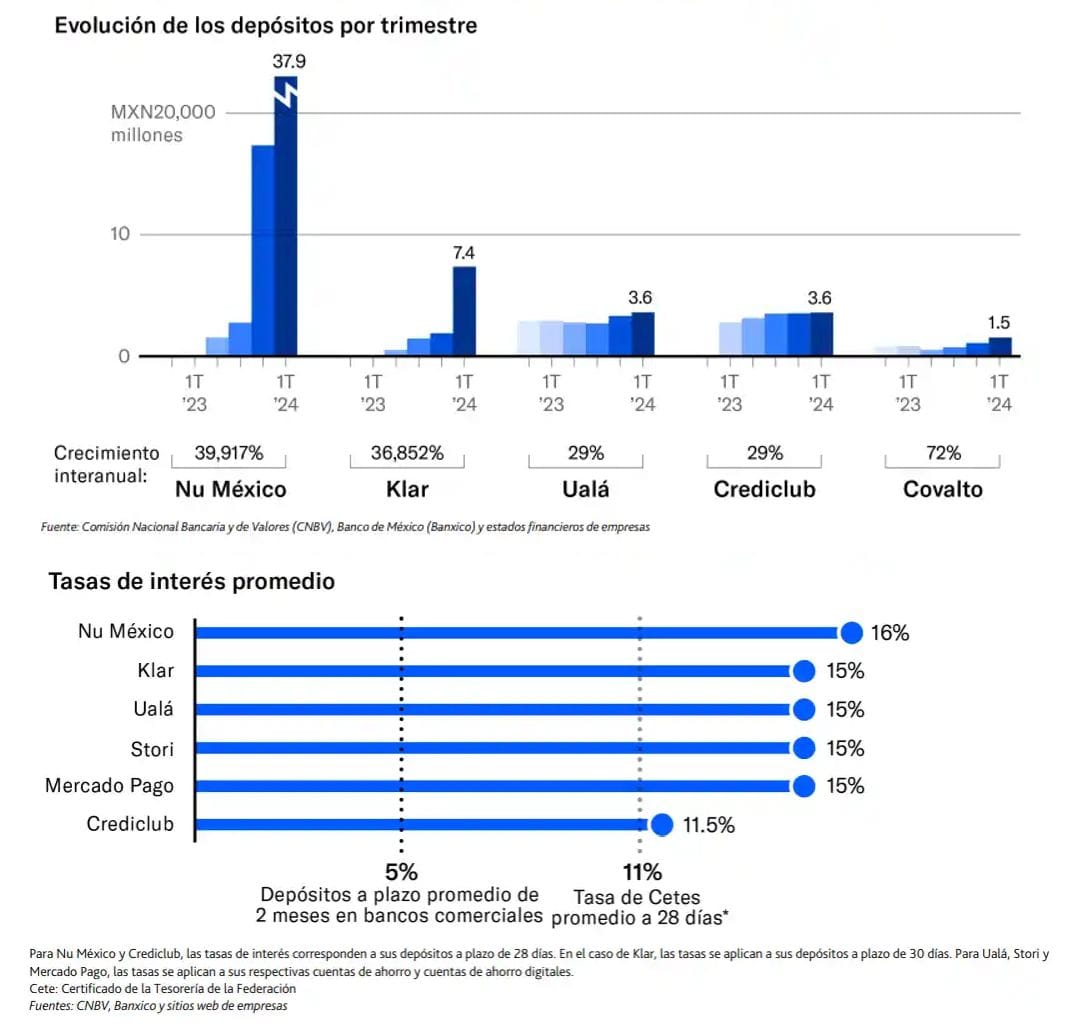

🇲🇽 Mexico is emerging as the next regional innovation center for FinTechs, according to Moody’s.

🇹🇭 AirAsia’s FinTech subsidiary, BigPay, has officially launched in Thailand. A standout feature of the app is the virtual Visa card, which can be used immediately for purchases at various merchants. Additionally, users have the option to order a Visa Platinum Prepaid plastic card if desired.

🇯🇵 Rakuten Card Co Ltd has announced the release of Rakuten Card Lite, the first English language app from the credit card company focused on the international community in Japan. The company aims to leverage a shorter development cycle and offer Simplified Chinese, Traditional Chinese and Korean language support in the future.

🇬🇧 Bank of England's CHAPS payments system goes down, impacting large transactions. The bank has blamed a "global payments issue" for delaying high-value and time-sensitive payments in the UK. The issue appears to have originated with a problem with the global SWIFT service, although other nations' financial infrastructure was not affected.

🇸🇬 Tonik interest income triples in 2023, eyes cash flow breakeven by next year. While the company is still loss-making, Tonik aims to be the first profitable digital bank in the country. Despite facing numerous competitors since its 2021 launch, the sector has attracted over $700 million in investments.

🇦🇺 AmEx violates Aussie Credit Card Sale Compliance: Must pay AU$8 million. According to the court, the credit card issuer breached the DDO rules between 25 May 2022 and 5 July 2022, as it must have been aware of the inappropriateness of the target market determinations (TMDs) due to high cancelled application rates.

DONEDEAL FUNDING NEWS

🇺🇸 Aven raises $142m in Series D to bring home equity-backed credit card. The growth investment will be used to offer Aven’s Home Card in all 50 states, scale Advisor, and expand into new categories, including auto-backed cards, mortgage refinance, and more.

🇸🇬 PEXX, a FinTech startup specializing in stablecoin-to-fiat payment platform, announced that it has closed a $4.5m seed funding round. The fresh capital will be utilized to enhance the company’s engineering and product teams. More on that here

🇺🇸 Allium, a blockchain data platform that works with the likes of Visa and Stripe, has raised $16.5 million in a Series A funding round. The firm is hoping to capitalise on the increase in blockchain adoption and the proliferation of different networks, which will see the volume of data surge exponentially.

🇪🇬 FinTech Dopay secures $13.5 million series a extension round to bank the next billion workers. The company plans to launch a range of new financial services and expand its multi-bank, multi-country platform to other markets. Read on

🇲🇾 Wise AI, Malaysian artificial intelligence company specialising in eKYC and digital identities, has raised its Series A funding round. The sum was not disclosed. The funding will enable Wise AI to advance its goal of creating digital identities in Southeast Asia.

MOVERS & SHAKERS

🇺🇸 Boku, a provider of global mobile payment solutions, announced the appointment of Rob Whittick as its new Chief Financial Officer with immediate effect. Rob, a Chartered Accountant, joins the Boku executive team and Board having spent over 25 years at Natwest Group plc. Keep reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()