EU Nears Approval of Apple's NFC Access Proposal

Hey FinTech Fanatic!

The European Union's antitrust regulators are on the verge of approving Apple's proposal to grant access to its tap-and-go mobile payments system to competitors, following adjustments to certain terms, according to sources familiar with the situation.

This move would enable banks and third-party payment apps to facilitate contactless payments directly through iPhones, bypassing the need for the Wallet app or Apple Pay.

Within the European Economic Area (EEA), users will have the ability to designate a default non-Apple wallet app and contactless payment provider, triggering transactions with a simple tap at payment terminals or by pressing the iPhone's side button twice.

However, it's crucial to note that this NFC access initiative is exclusive to the EEA. Developers outside this region still lack access to the iPhone's NFC chip for tap-to-pay functionalities.

The significance of this development lies in the autonomy it affords customers. With NFC-enabled apps from their respective banks and payment providers, users can now enjoy contactless payments without Apple's direct involvement.

Traditionally, Apple restricted the use of the iPhone's NFC chip solely to Apple Pay transactions, inhibiting banks and financial institutions from offering their own contactless payment solutions on the iPhone.

The decision to open NFC payment technology to third-party developers in Europe, initially announced by Apple in January, comes in response to antitrust allegations from the European Commission (EC). The EC has accused Apple of anti-competitive behavior by limiting competition through its control over NFC chip access. By addressing these concerns, Apple aims to avoid potential fines and penalties.

In essence, this move not only marks a significant shift in Apple's approach to NFC technology but also signals a step towards fostering greater competition and innovation in the mobile payments landscape within the European market.

Have a great start to the week and I'll be back with more FinTech News updates in your inbox tomorrow!

Cheers,

P.s. If you like this newsletter and/or my other content, you can support me by becoming a member. I'll be forever grateful.

Now let's dive into the news of today:

#FINTECHREPORT

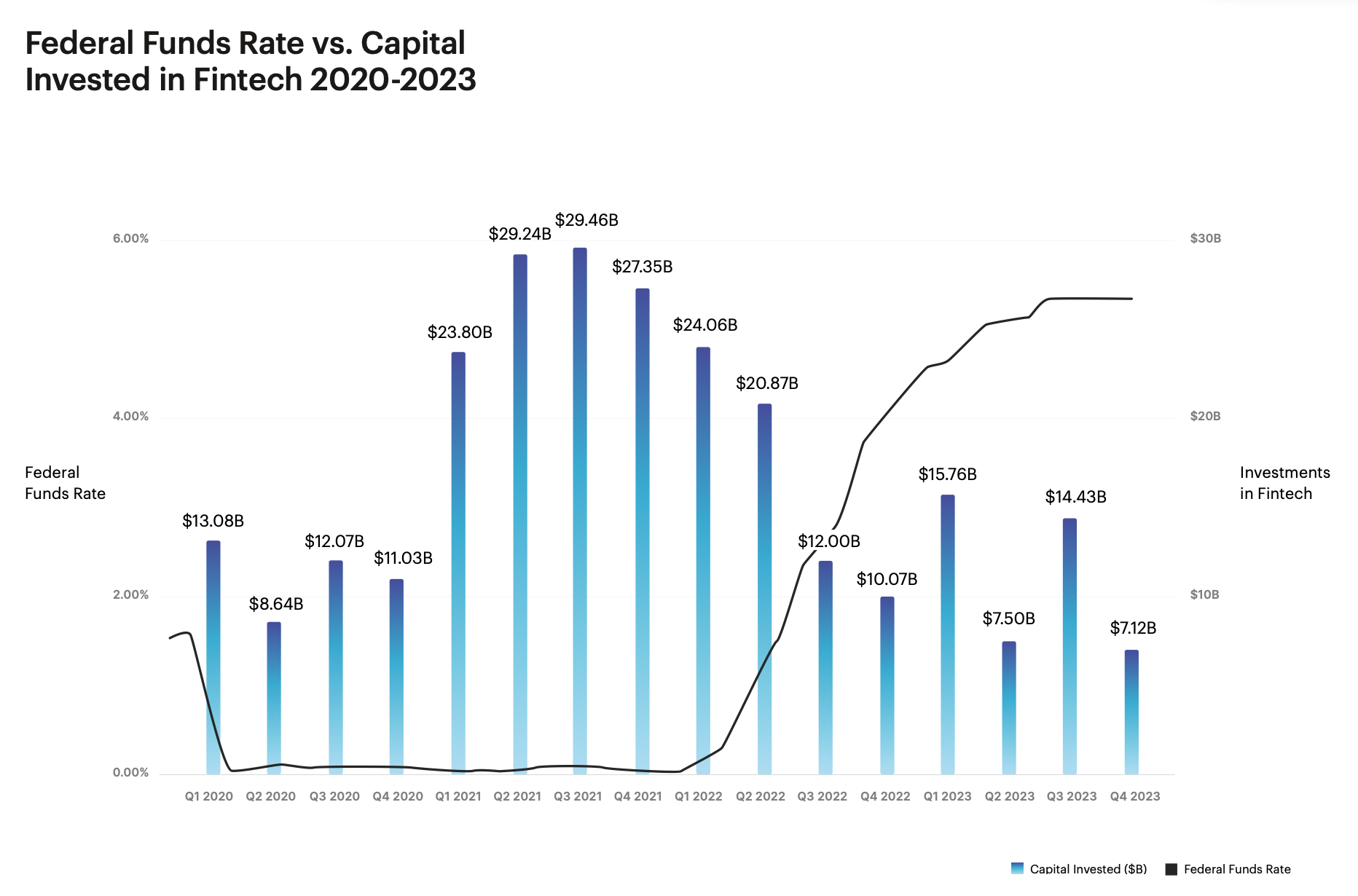

📊 Team8, a leading global fund that builds and invests in FinTech companies, released a new report on the future of FinTech, titled “2030 and Beyond: An Unconventional Look at the Future of FinTech. ” I highly recommend downloading and reading the complete report to learn all about it. Link here

FINTECH NEWS

🇬🇧 SBC-backed FinTech Monese, which has two million customers, is working on plans to split itself into two independent companies as it tries to break even, Sky News learns. The company which was in talks to raise funding at a valuation of over £1bn four years ago is to break itself up amid mounting losses.

🇺🇸 The Xbox Mastercard, issued by Barclays, now available in the U.S. with more value. This card is another step forward in Microsoft and Mastercard's longtime partnership that has supported safer commerce experiences, helped small business scale, and more. Read on

🇺🇸 TabaPay to acquire the assets of Synapse Financial Technologies, Inc. This represents a strategic expansion of products and services to fuel customer innovation, while providing business continuity for existing Synapse clients and banks.

🇳🇬 eTranzact International PLC has said its direct-to-consumer product is its future revenue driver as the company focuses on its best-performing business units. Based on its success in payments, eTranzact is betting big on mobile money. The thinking is that Nigeria’s unbanked population presents a huge opportunity for market penetration.

🇬🇧 Manchester Digital has launched a Manifesto for the Northern Tech Economy ahead of the mayoral elections that will take place on May 2nd. The Manifesto underscores the untapped potential of the North, citing over £1.1 billion investment in Manchester, Leeds, Liverpool, and Sheffield in the last five years, alongside a student population exceeding 250,000.

🇺🇸 Marqeta to deliver branded debit to early wage access vendor Rain. Through its strategic partnership with Rain, Marqeta can scale its early wage access offerings to more employers across diverse sectors of the economy such as healthcare, education and hospitality.

PAYMENTS NEWS

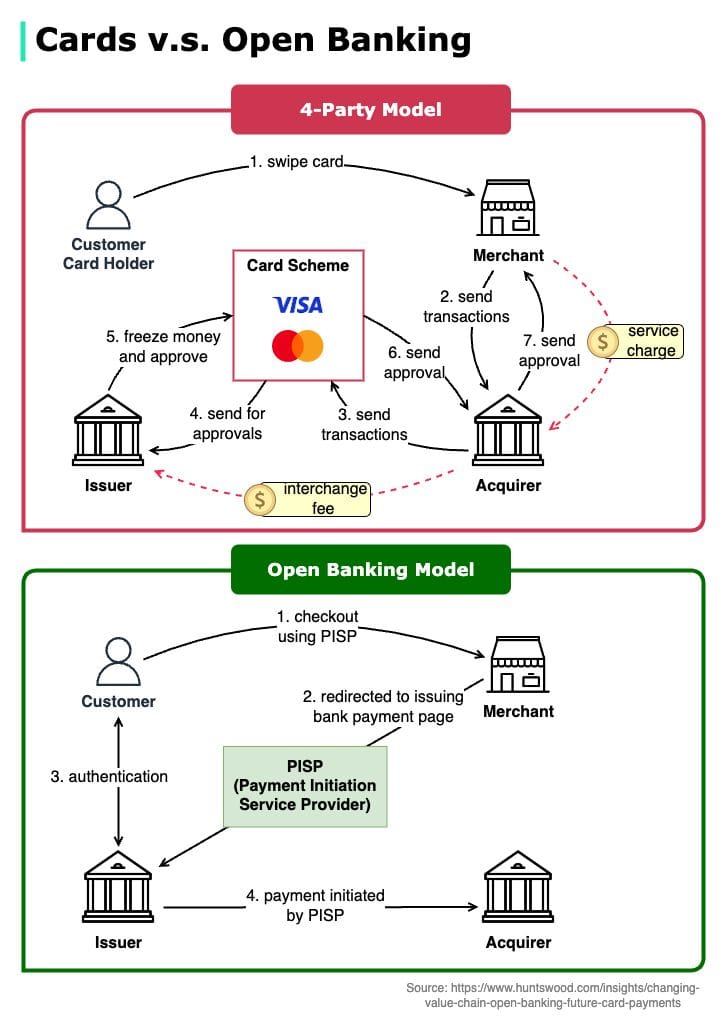

Open Banking 🆚 Card Payments.

The diagram below by Hua Li shows the differences:

🇪🇺 Apple's offer to open up tap-and-go tech to be approved by EU next month, sources say. Apple's tap-and-go technology called near-field communication, or NFC, allows for contactless payments with mobile wallets. Continue reading

🇺🇸 Forage becomes SNAP EBT payment processor for Uber Eats. The partnership aims to enable payment processing of SNAP EBT, when the delivery platform launches the product in late 2024.

🇧🇷 Google Pay, Google's digital wallet, is now able to operate as a payment initiator within the Open Finance framework in Brazil. This means that the institution has completed all necessary steps to engage in this modality. Read more

🇨🇳 China's Ant Group in talks to launch Alipay+ in Indonesia, says executive. Launched in 2020, Alipay+ provides services and technology tools to global merchants and e-wallets that enable them to offer their users the ability to make payments in overseas markets with their local e-wallets.

🇦🇺 Finmo introduces Direct Real-Time Payment (RTP) integration in Australia through its partner bank, Australian Settlements Limited (ASL). This strategic partnership further expands Finmo's regional and global network capabilities, and is additive to its ability to provide cutting-edge RTP solutions to the growing merchant customer base.

REGTECH NEWS

🇺🇸 Cognizant and Fico pair up to fight real-time payments fraud. The joint offering would leverage both firms' artificial intelligence and machine learning technology to help banks and other payment service providers in North America protect their customers from fraud in the growing world of instant digital payments.

DIGITAL BANKING NEWS

🇮🇪 Revolut Ireland chief Maurice Murphy confirmed they currently have 2.8m users in Ireland, Revolut is close to launching mortgages in Lithuania - with Ireland following shortly after, and make a bold statement: ‘We are far better than AIB, Bank of Ireland and PTSB.’

🇬🇧 What a week it was for Revolut. They truly 𝗚𝗲𝘁 (𝗦𝗵)𝗶𝘁 𝗗𝗼𝗻𝗲.

Here are the Top 10 BIG News Updates from Revolut last week.

🇧🇷 What a week it was for Nubank 🤯

Here are the TOP 5 BIG News updates from Nubank last week.

🇦🇺 Mastercard launches mobile virtual card app to simplify travel and business expenses. HSBC Australia and Westpac will be the first financial institutions to offer organizations and corporate customers mobile wallet functionality through the Mastercard app.

🇨🇴 Banco de la República de Colombia launches new central securities deposity. Montran, a global leader in capital markets infrastructure, announced the successful launch of the new Central Securities Depository (CSD) platform at the Banco de la República de Colombia.

🇦🇪 Keytom launches in the UAE. Keytom, a new digital asset-focused neobank, has launched in the UAE with the aim to help customers better manage their digital assets “in one convenient location”. Read on

BLOCKCHAIN/CRYPTO NEWS

🇿🇦 Ivorypay, a leading blockchain-based payment and remittance startup in Africa has announced a strategic partnership with Tether, the company behind the world’s most widely used stablecoin, USDT. This partnership is set to empower businesses and individuals across Africa.

DONEDEAL FUNDING NEWS

🇬🇧 Lemon achieves £500K pre-seed investment for SaaS savings platform. The funding boost comes at a critical time, demonstrating the market's confidence in new FinTech solutions that address the needs of businesses globally, despite an economic downturn affecting FinTech investment trends.

🇹🇷 Fingate, a Turkish FinTech that offers services in the fields of Banking as a Service (BaaS) and open banking has received a $1.2 million investment. Fingate.io CEO Alper Akcan expressed that this investment demonstrates the validity of their past actions and serves as a catalyst for their future steps.

🇨🇴 Colombian Paytech company OnePay has successfully raised US$1.3 million to further strengthen its payment integration platform on WhatsApp. Andrés Silva, CEO of OnePay, revealed to Forbes that they are collaborating with Colombia's largest utility companies and have formed a partnership with Mastercard.

MOVERS & SHAKERS

🇺🇸 Versapay appoints Ed Neumann CFO. He will be responsible for Versapay’s financial strategies and will lead the charge on building and scaling a high-growth business model for the company. More on that here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()