eToro to End Most Crypto Trading in Deal with US SEC

Hey FinTech Fanatic,

Cryptocurrency trading has become very famous in recent years, and with that, platforms like eToro, are being closely watched by regulators. As part of a settlement with the U.S. Securities and Exchange Commission (SEC), eToro will stop offering nearly all cryptocurrencies to its customers 🤯

Additionally, eToro has agreed to pay a $1.5 million penalty to resolve charges of operating as an unregistered broker and clearing agency in connection with its cryptocurrency services.

The SEC alleged that eToro provided its U.S. customers the ability to trade crypto assets that the regulator deemed to be securities since at least 2020, but did not comply with the registration requirements of federal securities laws.

The company neither admitted nor denied the SEC's findings.

Moving forward, eToro customers in the United States will only be able to trade bitcoin, bitcoin cash, and ether. The company will provide its customers the ability to sell all other tokens for 180 days.

Will you be affected by this settlement? Tell me more in the comments.

Cheers,

#FINTECHREPORT

📊 Unlock the future of commerce: How eCommerce platforms can become FinTech hubs in 2024.

The rapid evolution of FinTech is transforming industries by making financial services more accessible, user-friendly, and tailored to consumer needs. This wave of innovation is now extending beyond traditional finance, giving eCommerce platforms the opportunity to integrate FinTech solutions that not only enhance customer experience, but improve revenue and streamline operations, unlocking significant cost savings.

Mangopay reveals five FinTech experiences to revolutionise eCommerce, tap into new revenue streams and save over 15% on payment processing costs.

Get the free guide here and start transforming your eCommerce platform today!

INSIGHTS

🇬🇧 Revolut founder and CEO Nik Storonsky 'sells between $𝟮𝟬𝟬𝗺 𝗮𝗻𝗱 $𝟯𝟬𝟬𝗺 stake' in FinTech giant 🤯 Nik Storonsky accounted for between 40% and 60% of the $500m of Revolut stock that was sold at a $45bn valuation last month, Sky News learns, as the billionaire founder climbs the ranks of Europe's wealthiest people.

FINTECH NEWS

🇵🇪 Kuady introduces virtual prepaid Mastercard in Peru. The Kuady Card allows online merchants to pay directly into Kuady accounts, helping them build stronger customer relationships through faster and more efficient payment methods. Read more

🇮🇳 Mastercard Business Cards gain added value with business subscription management tool powered by Nuclei. The tool offers a distinct advantage to subscription providers by motivating companies to make subscription payments by card instead of the slower and less efficient account-to-account (A2A) transfers.

🇺🇸 Walmart Marketplace and Parafin announce a new initiative to provide sellers with capital through the Walmart Marketplace Capital program. Eligible sellers can easily access financing through Parafin, a Walmart Marketplace-approved solution provider, to grow their businesses and prepare for the upcoming holiday season.

🇨🇳 China's Ant Group refinancing $6.5 bln credit line. The refinancing was for an existing syndicated bank credit line from 2019, a spokesperson added. The company plans to allocate $1.5 billion of the borrowing quota for its overseas arm Ant International, Bloomberg News reported.

🇺🇸 Google Wallet debuts digital IDs and enhances commuter features. Starting soon, U.S. users can create digital IDs from their passports for select TSA checkpoints, enhancing domestic travel convenience. The service will also support state-issued IDs and prepaid commuter benefit cards, with plans to add more global transit options.

🇪🇺 Mintos completes its launch in Europe amid the boom in passive investment. 2023 and 2024 were years of strong geographical expansion, where Mintos launched its operations in new European markets. To boost growth, it launched its second crowdfunding campaign with Crowdcube in April 2024, raising 3.1 million euros.

PAYMENTS NEWS

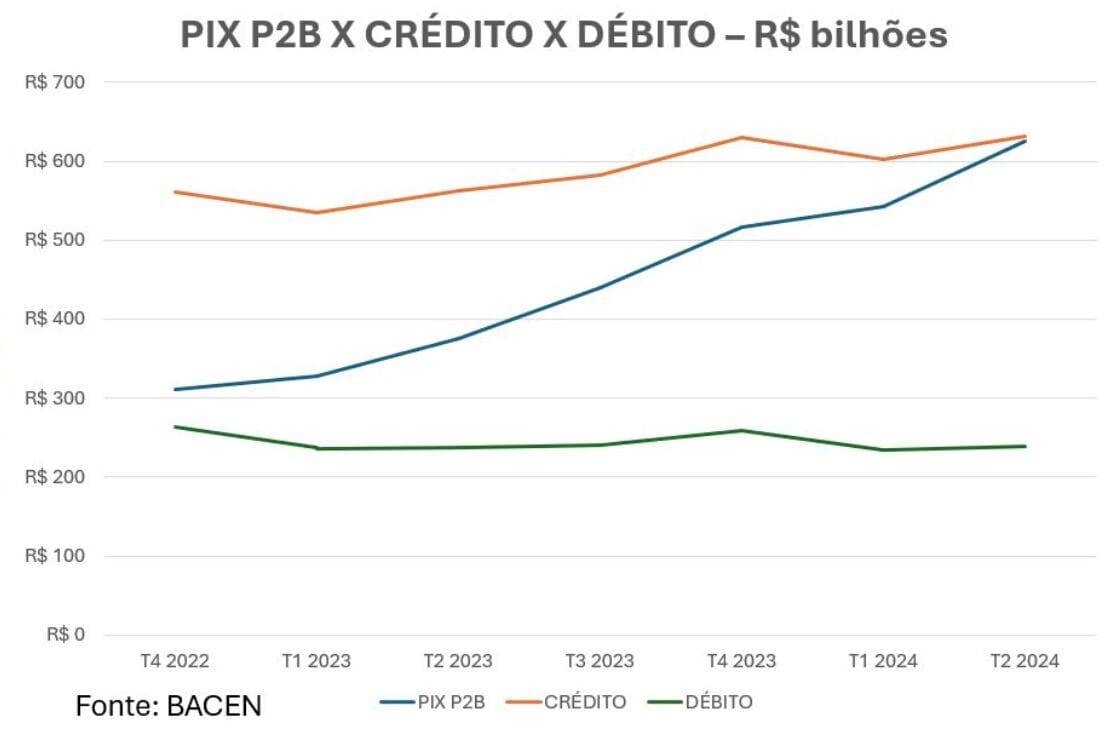

🇧🇷 Data from the Central Bank Brazil indicates that Pix P2B (person-to-business transactions) is very close to surpassing credit cards in quarterly volume (including both in-person and online purchases) 🤯

The use of contactless Pix could further accelerate its growth, impacting debit cards even more (Pix P2B was more than 2.5 times larger than debit card transactions in the second quarter of this year).

🇬🇧 Ant International to supply range of digital payment options for Tottenham Hotspur. The partnership sees Ant International, including its brands Alipay+, Antom and WorldFirst, become the exclusive official global payment solutions and digital wallet partner of Tottenham Hotspur.

🇵🇰 Visa aims for 10-fold rise in Pakistani use of digital payments. The payments giant plans to increase the number of businesses accepting digital payments in Pakistan tenfold over the next three years, the company’s general manager for Pakistan, North Africa and Levant told Reuters.

🇺🇸 Convera selected by Routable for its extensive Global Payments Network. This integrated partnership will enable Routable to leverage Convera’s global network and expertise in foreign exchange and compliance to provide its customers with increased global reach, reliability, and competitive rates.

🇨🇳 Unlimit partners with Shoplazza to boost cross-border payments for Chinese e-commerce. The collaboration will help to enhance cross-border payments for Shoplazza’s 500,000+ merchants, improve payment success rates, and support the growth of the e-commerce industry in the APAC region.

OPEN BANKING NEWS

🇧🇷 B3 and Rendimento join over 30 payment initiators. The list of institutions authorized to operate as a payment transaction initiator (ITP) via Pix in Open Finance in Brazil continues to grow. Last Friday (09/06), B3 and Banco Rendimento joined the group, which now consists of 35 institutions.

🇪🇺 Ebury partners with Salt Edge in order to expand its Open Baking presence in the regions of the EU and the UK. The collaboration is expected to enable both financial institutions to optimise visibility and attract new clients and customers, while also offering already existing users Open Banking services.

DIGITAL BANKING NEWS

🇨🇴 Revolut set to enter Colombia in 2025. As Colombia’s digital banking sector experiences rapid growth, Revolut is gearing up for its 2025 entry, poised to disrupt the market and challenge the established players. Continue reading

🇪🇸 Revolut Spain announced the integration of Bizum, the popular Spanish peer-to-peer payment service, and reaches 𝟯.𝟱 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 customers 🤯 With this move, it aims to continue increasing its customer base, which has just reached 3.5 million users in the country, according to figures revealed by the company.

🇳🇱 Dutch neobank Bunq goes on hiring spree, targeting digital nomads, as other FinTechs slash jobs. The bank told CNBC that it plans to grow its global headcount by 70% this year to over 700 employees, even as other financial technology startups have decided to cut jobs.

🇲🇼 Flutterwave's Send App launches in Malawi. “This marks the beginning of an exciting journey of endless possibilities in Malawi, and we’ll continue innovating to make Send App available to as many people as possible who need it across the African continent." Olugbenga ‘GB’ Agboola, Founder and CEO of Flutterwave said.

🇮🇹 UniCredit's CEO approached Commerzbank about exploring merger talks, a source with knowledge of the matter said, after Italy's second-largest bank bought a 9% stake in the German lender and signalled it was open to buying more. The raid on Commerzbank by UniCredit CEO has reignited speculation of consolidation in Europe's fragmented bank sector.

🇺🇸 Keybank launches revenue cycle management capabilities with Zentist for dental service organizations. KeyBank will introduce Zentist's Remit AI software to its extensive network of DSOs, providing them with access to a transformative tool that enhances their dental insurance revenue cycle management operations.

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Nubank has announced its decision to cease operations with its cryptocurrency, Nucoin. This announcement comes just over a year after the launch of the Nucoin ecosystem, which debuted in late 2022. The platform announced that buying and selling the token will be permanently suspended within 15 days.

🇬🇧 EToro to shut down nearly all crypto trading in settlement with US SEC. The firm also agreed to pay a penalty of $1.5 million to settle charges that it operated as an unregistered broker and unregistered clearing agency in connection with its cryptocurrency offerings.

🇨🇭 BBVA incorporates USDC, a leading stablecoin, into its crypto asset service in Switzerland. This addition will enable BBVA’s institutional clients to speed up their trading operations by enabling them to transfer value more efficiently with blockchain and secure their stablecoins into BBVA’s vault.

🇬🇧 UK Government moves to clarify crypto's legal status. The UK's new Labour government is introducing a bill that will ensure that Bitcoin and other digital assets can be considered personal property, boosting legal protection for owners.

🇨🇦 Blockchain firm Coincover teams up with Netcoins and VirgoCX. The collaboration’s goal is to give client assets the best possible security. The modern security solution from Coincover, tailored particularly for the cryptocurrency business, will help VirgoCX and Netcoins.

PARTNERSHIPS

🇺🇸 Velera has begun providing card processing solutions to BrightStar Credit Union, which services about 60,000 members in South Florida. It started providing credit card processing support to the credit union in June and will add debit card processing services by the end of September, Velera said in a press release emailed to PYMNTS.

DONEDEAL FUNDING NEWS

🇭🇺 B2B BNPL player PastPay secures €12 million Series A. The financing will be spent on investment in product development and the expansion of its digital services and infrastructure for both online and offline transactions.

🇬🇧 Huma raises $38M to hyper-scale its Payment Financing (PayFi) Network. PayFi aims to address this giant liquidity gap by bringing trillions of dollars of real world payment volume over to blockchains and stablecoins. Read on

M&A

🇺🇸 Mastercard bolsters threat intelligence capabilities with $2.65 billion deal for Recorded Future. The acquisition will bring expanded threat intelligence capabilities to the payments firm, which recorded $9 trillion in gross dollar volumes last year, a metric that represents the total dollar value of all transactions processed.

MOVERS & SHAKERS

🇺🇸 Grasshopper grows digital banking team with four strategic hires. Grasshopper has strengthened its team with these new appointments: Rob Burnett as Director of Startup Banking, Vince Peterson as Vice President of Embedded Finance, Nate Gruendemann as Product Manager, and Vince Magpayo as SMB/SBA Digital Loan Specialist.

🇺🇸 ComplyAdvantage hires Paul Kizakevich as chief revenue officer. He will lead the global commercial organization to increase market penetration, invest in the partner ecosystem, and drive success for 1,600 customers. His appointment also reflects the company’s momentum in the U.S. market.

🇺🇸 Stratyfy names distinguished AI Executive Vicki Moeller-Chan, PhD, and esteemed payments and fraud leader Brandon Timmone to its Board of Advisors. Both leaders will leverage their deep expertise to advance more ethical, equitable and inclusive financial decisioning. The announcement builds on a series of company milestones for Stratyfy.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()