eToro Files for $5Bn IPO on NASDAQ

Hey FinTech Fanatic!

eToro is making another push toward the public markets. The retail trading platform has filed for an IPO on NASDAQ under the ticker symbol “ETOR.” The company hasn’t yet revealed the size or pricing details, but reports suggest a potential valuation of around $5 billion.

This isn’t eToro’s first attempt at going public. Back in 2021, it planned to list through a SPAC merger at a $10.4 billion valuation, but that deal ultimately fell through. Now, with Goldman Sachs, Jefferies, UBS, and Citigroup backing the IPO, the company is taking a more traditional route to the stock market.

With over 30 million customers, eToro has built its reputation on social trading—allowing users to invest in stocks, crypto, and other assets while following experienced investors.

The company reported $12.6 billion in revenue for 2024, a sharp increase from $3.89 billion the year before. Net income also saw a jump, reaching $192 million.

Crypto has been the main engine behind this growth, making up about 96% of eToro’s revenue last year. The surge in digital assets came at a time when U.S. politics shifted back toward a more crypto-friendly stance under Donald Trump’s presidency.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

SPONSORED CONTENT

FEATURED NEWS

🇺🇸 Retail trading platform eToro filed for an initial public offering (IPO) in the United States on NASDAQ under the symbol “ETOR”. The proposed size and price range for the share sale will be disclosed in a later filing when EToro is ready to begin marketing the offering.

#FINTECHREPORT

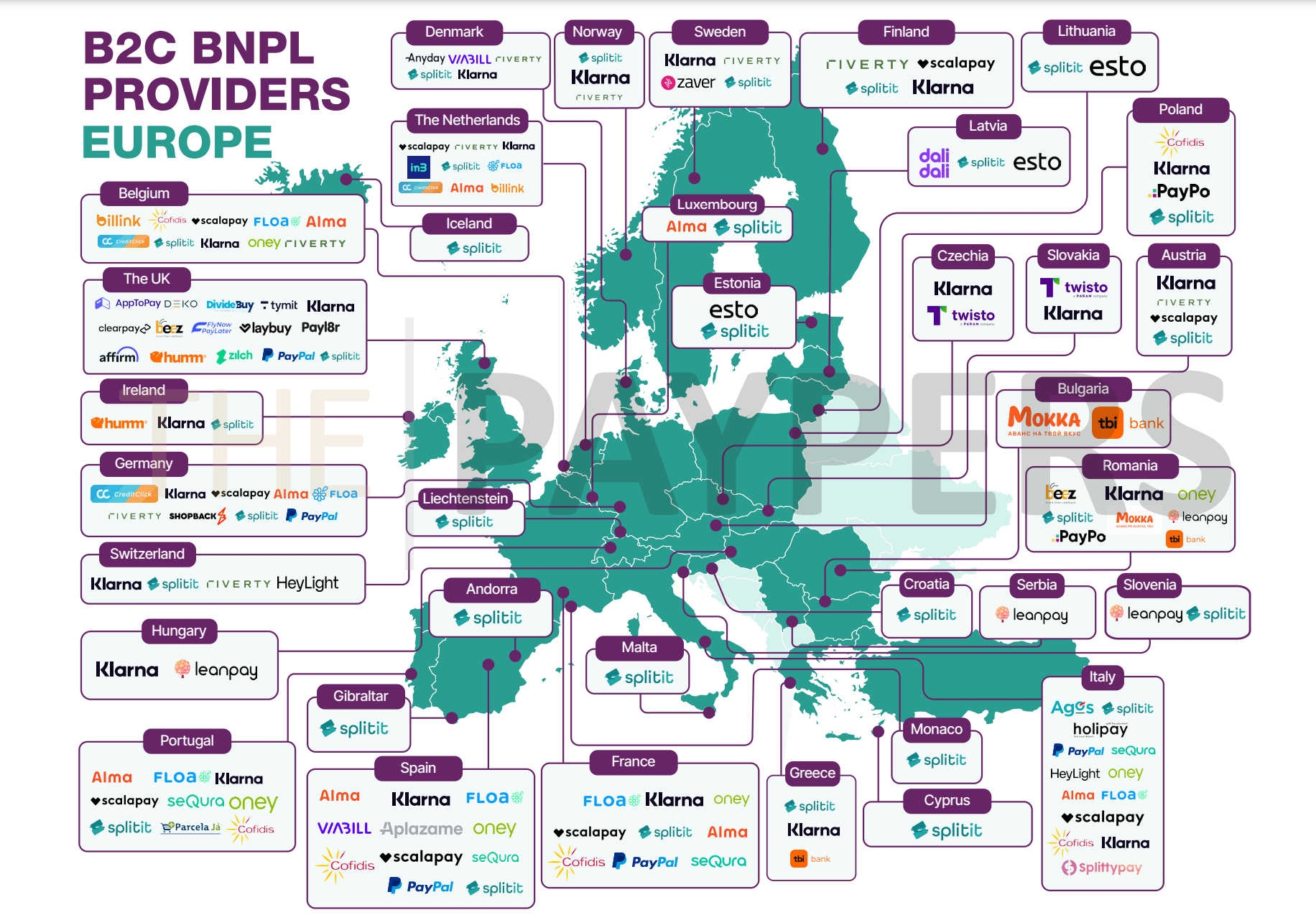

🌍 Buy Now Pay Later (BNPL) Market Map Europe

Any missing in this overview?👇

INSIGHTS

🇺🇸 Klarna's claim of AI-driven efficiency contradicts workforce data, which shows a 36% reduction in headcount since May 2022, long before AI could have had a significant impact. This suggests the workforce cutbacks were part of a planned pre-IPO strategy, not the result of AI efficiencies.

FINTECH NEWS

🇺🇸 Affirm announces JPMorgan Chase merchants can soon offer installment loans at checkout. US retailers using Chase’s platform can soon offer Affirm installment loans for purchases ranging from $35 to $30,000. They will also have access to loans ranging from 30 days to 60 months, according to Affirm.

🌍 Incore Invest raises €25 million to fund high growth FinTechs. The new fund will support businesses with proven revenue models and strong growth potential, particularly in the Nordic and Northern European markets, including the UK. The company will provide long-term capital to businesses.

🇬🇧 Curve eschews AI with recruitment drive for human CX experts. The new hires will focus on critical areas such as payments support, proactive fraud prevention and ensuring Curve’s products meet customer expectations. Read more

PAYMENTS NEWS

🇮🇳 Paytm to discontinue Juspay-routed transactions from April. The move aligns with PPSL’s commitment to offering a more seamless and reliable payment infrastructure to its merchant base. Keep reading

🇨🇳 No. of Kakaopay’s overseas payment service users doubles in China. According to the platform, the number of its app users increased by 94.5% YoY between November and February. It also reported a rise in the number of transactions 82.3% and transaction volume 56.2% during that period.

🇬🇧 Noda launches QR code payments for offline merchants in the UK. With a fixed transaction fee of just £0.20, this Pay-by-Bank service offers a faster and more affordable way to accept payments compared to traditional card transactions.

🇫🇷 Apple Pay is now available at Qonto. This means that users can add their Qonto card to Apple Wallet and use it for secure, fast, and convenient payments. With this integration, users can make in-store and online payments using their iPhone or Apple Watch, making transactions seamless and easily accessible.

🇰🇪 dLocal expands mobile money payments with Airtel for google play users in Kenya. By enabling Airtel Mobile Money as a payment method, dLocal is supporting Google to provide a localized solution that meets the needs of users. Keep reading

🇺🇸 Splitit launches embedded Shopify app. This new app provides merchants with an all-in-one service, including credit card processing, while delivering a seamless one-click installment payment experience for consumers, without any redirects or applications.

OPEN BANKING NEWS

🇬🇧 Experian launches Cashflow score to signal new era of Open Banking - Powered Lending. This solution can easily integrate into existing workflows alongside traditional credit scores providing lenders with a clearer view of an applicant’s financial behavior, including income, expenses, cash reserves and more.

REGTECH NEWS

🇬🇧 Sumsub introduces Reusable Digital Identity Product Suite. The product includes two products, Sumsub ID and Reusable KYC. Both enable end-users to skip cumbersome verification steps such as document uploads, while ensuring that all checks required for regulatory adherence for businesses still take place.

🇨🇦 Trulioo upgrades its proprietary models for improved verification rates. The company is committed to continuing to refine these solutions while remaining compliant with the regulation requirements and laws of the industry. Trulioo built its proprietary machine learning models to respond faster to emerging threats and its customers’ evolving needs.

DIGITAL BANKING NEWS

🇦🇺 Westpac to enable consumers to block accounts when suspecting fraud. SafeBlock feature, which will be added in the coming months, is meant to be used by customers when they suspect they are being scammed. When activated, the feature will block digital and card payments, transfers and ATM withdrawals.

🇵🇭 Tonik hits 1 million loans milestone in the Philippines. This achievement underscores Tonik’s commitment to consumer lending, a key driver in the country’s expanding digital banking sector. Continue reading

🇺🇸 Revolut U.S. CFO Max Lapin can sum up the FinTech’s ambitions in one line: “Revolut wants to become a bank in the United States.” Now the company is focusing its attention on growth in the U.S., with CEO and co-founder Nik Storonsky highlighting Revolut’s plans to pursue a U.S. banking license in November.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 BlackRock launches first bitcoin product in Europe called the iShares Bitcoin ETP, to meet growing demand for cryptocurrency exposure. The product is domiciled in Switzerland and listed on exchanges in Paris, Amsterdam, and Frankfurt, following its success in the U.S., where it attracted over $50 billion in similar products.

🇺🇸 Binance probes insider trading, suspends staff. Binance has suspended an employee for allegedly using insider information to benefit from a cryptocurrency project. The employee reportedly purchased a large amount of tokens from a project before its Token Generation Event, then sold part of these tokens for profit.

🇬🇧 Revolut is coming for crypto rivals with a new trading app called 𝗥𝗲𝘃𝗼𝗹𝘂𝘁 𝗫. The app will expand to include retail traders and be available on mobile phones as the neobank amps up efforts to compete with native crypto firms. It is another testament to how the growing crypto boom has encouraged FinTech firms to muscle into the market.

🇧🇷 Nubank expands cryptocurrency platform portfolio. Customers now have access to Cardano, NEAR Protocol, Cosmos, and Algorand, complementing the 16 cryptocurrencies already available. Nubank aims to diversify its crypto offerings to meet customer needs and will continue expanding its selection throughout the year.

🇺🇸 Trump’s crypto project plans to offer dollar-tracking stablecoin. The USD1 token will be 100% backed by short-term Treasuries, dollar deposits and other cash equivalents. BitGo Inc. will serve as custodian and the USD1 tokens will be initially minted on the Ethereum and Binance Smart Chain blockchains.

🇺🇸 Crypto-native bank Custodia partners with Vantage on 'first bank-issued stablecoin' backed by tokenized customer deposits. The companies have partnered on a new tokenization project that uses customer deposits to issue Avit stablecoins.

PARTNERSHIPS

🇬🇧 ACI Worldwide and Co-op extend strategic technology partnership. The agreement will see Co-op continue to use the full range of solutions offered by ACI’s Payments Orchestration Platform, including in-store, online and mobile payment processing as well as end-to-end payments and fraud management.

🇺🇸 Walmart partners with JPMorgan to speed payments to online sellers. The pairing will allow merchants on Walmart's marketplace platform to accept and make payments, while managing cash flow using JPMorgan's systems, said Lia Cao, head of embedded finance and solutions at U.S. bank.

🇺🇸 Leverate integrates TradingView charts to enrich its brokerage solution. Through this collaboration, brokerages and prop trading firms using Leverate’s solutions will now have access to TradingView’s advanced charting tools, at no additional cost.

🌍 Scalapay and Lendismart: a new way to offer financing at the point of sale. This collaboration will allow establishments associated with Lendismart to easily integrate Scalapay among the payment methods available to their customers, facilitating access to short-term installment payments.

🇬🇧 Vanquis Banking Group chooses FinScan to help optimize AML processes and strengthen financial crime risk management. FinScan helps banks centralize AML processes through a unified platform for real-time and retrospective name screening, enhancing operational efficiency and customer visibility.

🇻🇳 Fundiin teams up with Visa to enhance credit-scoring model. The partnership’s aim is to enhance Fundiin’s risk management capabilities, reduce costs, and expand credit opportunities for Vietnamese consumers, especially the unbanked and underbanked.

🇺🇸 Upside and Marqeta form partnership. This collaboration enables Marqeta’s customers to leverage Upside’s always-on cash-back offers within their consumer card programs, helping them drive more transactions, increase retention and engagement, and strengthen their top-of-wallet positioning.

DONEDEAL FUNDING NEWS

🇬🇧 Burbank secures GBP 5M in series seed funding to launch card-present over internet. The funding round was led by Mouro Capital with participation from Anthemis (supported by Foxe Capital), Portfolio Ventures and others. These funds will accelerate the global roll out of Burbank's platform.

🇺🇸 Advent nears $3 billion-plus continuation fund for Xplor. The fund is designed to support Xplor’s continued growth and expansion. Advent's strategy involves the use funds to extend its investment horizon and provide additional capital for portfolio companies, allowing them to further develop their business.

🇬🇧 Loyalty platform Squid closes €1.7 million crowdfunding round. The funds raised will be deployed to accelerate the rollout of Wave, SQUID’s next-generation universal points system, designed to streamline loyalty rewards across its growing network of over 2,000 business clients in Ireland and the UK.

M&A

🇯🇵 Solaris investor SBI completes ownership process. The acquisition of the majority stake was announced as part of Solaris’s EUR 140 million Series G funding round, secured in February which will help lay the foundations for sustainable growth and accelerate the company's path to profitability.

MOVERS AND SHAKERS

🇺🇸 Ashye Marcus departs Amazon and takes on Global GTM Industry Lead for Retail role at Stripe. She stated that Stripe has always been a company she admired for its bold mission, its impressive scale, and the high intellectual standards set by its founders and leadership. When the opportunity arose, accepting it felt natural and timely.

🇺🇸 Robinhood adds Meta CRO John Hegeman to its Board. John holds a degree in mathematics and economics from Stanford University. In addition to his new role at Robinhood, he serves on the Board of Directors for Jio Platforms Limited and the Center for Election Science.

🇬🇧 Zodia Custody COO Samuel Howe has left the crypto custodian for traditional finance. "Sam has left the company to go back to traditional finance, this shows the oscillation of roles and skills between crypto and TradFi," CEO Julian Sawyer said. "He is replaced by Sam Hill who has worked with us for the last 18 months."

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()