EMI License vs Banking License, What's The Difference?

Hey FinTech Fanatic,

What's the difference between an EMI License and a Banking License? Let me explain based on an interesting source article made by Transact:

Electronic Money Institutions (EMIs), entities authorized to issue and manage electronic money, operate in a sphere that while similar, is distinct from traditional banks.

E-Money & EMIs Explained:

E-money, essentially digitized cash, is appreciated for its multipurpose convenience, enabling transactions via digital records, prepaid cards, and e-wallets.

EMIs, regulated entities licensed to manage e-money, engage in various financial activities such as:

✔️ Issuance, distribution, and redemption of e-money

✔️ Provision of services that enable transactions with e-money, such as withdrawing cash from a payment account, transferring funds to third parties, and remittance delivery

✔️ Issuance of payment cards that allow withdrawing and depositing cash.

✔️ Providing information about accounts

Key products offered by EMIs include:

☑️ Virtual IBAN accounts (personal and business)

☑️ Merchant accounts

☑️ Physical or virtual payment cards (debit, prepaid, corporate, travel, gift)

☑️ E-wallets

☑️ Cryptocurrency services

☑️ Money transfers and foreign currency exchange services

☑️ BIN sponsorship

There are currently 550+ authorised EMIs in Europe.

Contrastingly, traditional banks, facilitated by banking licenses, offer a broader array of services:

► Manage client deposits

► Offer payment cards

► Offer credit, for example overdrafts, loans, and mortgages

► Deliver payment-related servicing, such as bill payments and money transfers

► Issue other financial products, for example insurance

Stringent regulations, comprehensive compliance, and risk management characterize their operational framework.

Key Differences between EMIs and Banks:

EMIs, often erroneously synonymous with banks, differ primarily in lending capabilities - a service banks provide but EMIs are prohibited from offering.

EMIs can potentially offer operational and technological efficiencies, swifter services, enhanced safety due to non-lending practices, and face fewer regulatory hurdles.

The differences in regulation between banks and EMIs are often due to the fact that banks operate and handle money on a much larger scale than EMIs do.

In Europe, banks typically need a large capital base of at least €5 million, whereas EMIs are smaller businesses and can operate with as little as €350,000.

Let me know in the comments if there is anything you like to ad to this!

Have a great weekend and I'll be back in your inbox soon!

Cheers,

#FINTECHREPORT

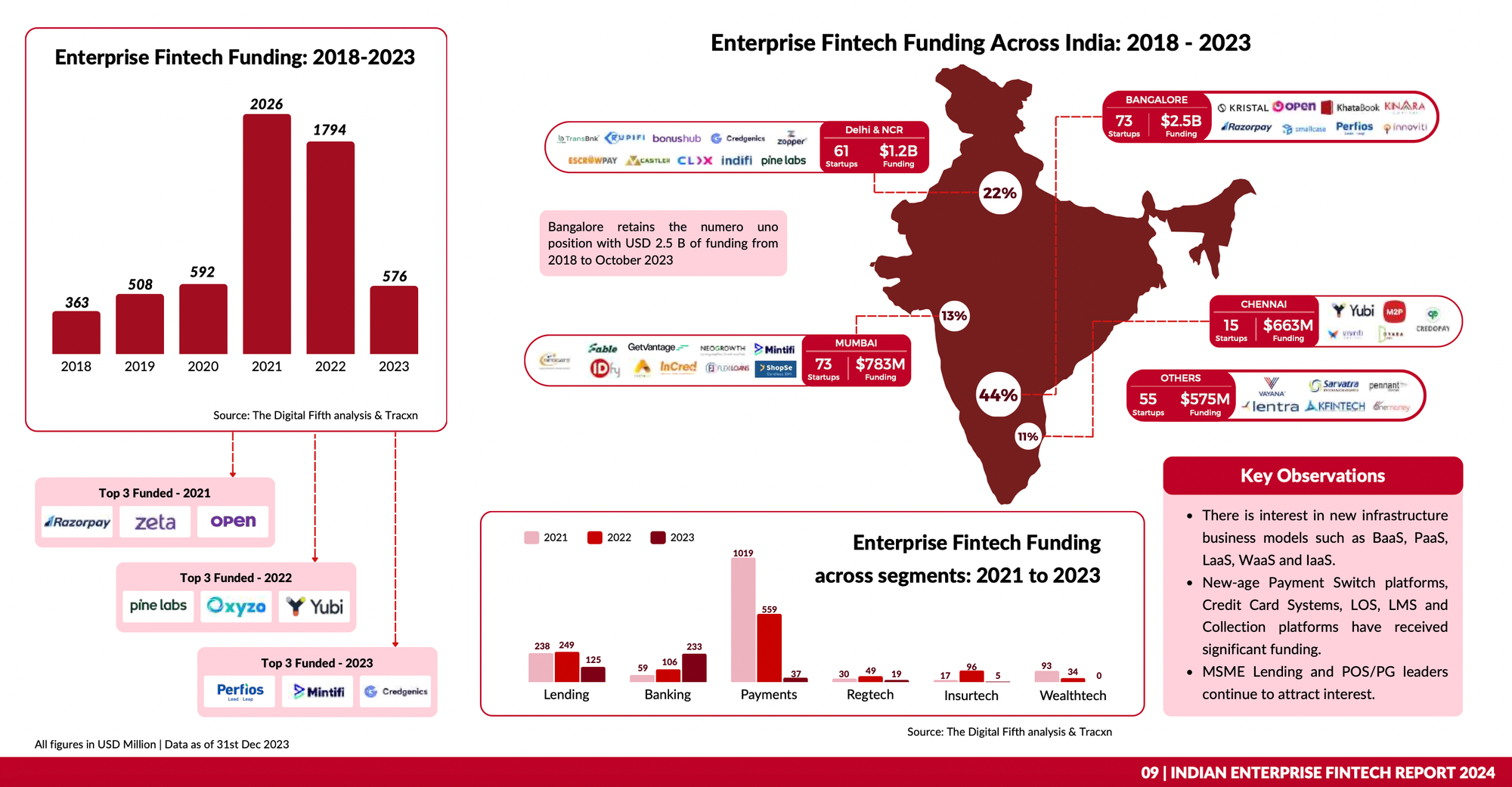

Unlocking Indian Enterprise FinTech Market Report 2023 showcases Chiratae Ventures’ focus and confidence in India’s FinTech sector and deep dives into the nuances of the massive opportunity that Enterprise FinTechs present. Download the complete report.

FINTECH NEWS

🇺🇸 Green Check grows its leading cannabis business and financial services marketplace to more than 60 providers. Green Check (GC), a FinTech connector, and technology and insights provider in the emerging cannabis market, announced that Advocharge, Flex Payment Solutions, BitX and Distru have joined Green Check Connect – a first-of-its-kind cannabis business marketplace launched in January 2023.

🇧🇷 Ebury and Nium expand partnership to power cross-border payments in Brazil. Together, the firms will enable businesses to send or receive fast, reliable, and affordable cross-border payments to and from Brazil. This builds on the duo’s existing partnership in Europe, in which Ebury leverages Nium’s global payments infrastructure to send international supplier and payroll payments around the world.

🇬🇧 Manchester FinTech company BankiFi is partnering with financier Praetura on a new lending-as-a-service solution that will boost SMEs’ access to growth funding. BankiFi and Praetura’s solution empowers traditional lenders to meet the diverse financing needs of the UK’s small businesses, with Praetura adopting the risk of the initial investment.

PAYMENTS NEWS

F1’s payments sponsorships: Why is Formula 1 key to the industry?

FXC Intelligence explains:

North American 🇺🇸🇨🇦 🆚 European 🇪🇺🇬🇧 PayFacs. Here is a deep dive comparison by Flagship Advisory Partners: In North America, 16% of the payfacs registered today are new since Mar ’23. However, 5% of the payfacs from Mar ’23 were unregistered by Jan ’24, a 6% annual attrition rate. Learn more

🇷🇺 Payment services used by Russians to transfer money overseas were knocked offline on Wednesday after the central bank revoked digital bank Qiwi's licence, sending its Moscow-listed shares plummeting almost 50% to a record low. The central bank said Qiwi Bank had engaged in high-risk operations, systematically violating requirements on AML and terrorism financing legislation.

🇬🇧 UK buy now, pay later firm Zilch has expanded its consumer credit offering with the launch of a longer-duration zero-interest payment option designed for bigger ticket purchases abaove £75. The new product will sit alongside the shorter-tenor ‘Pay over 6 Weeks’ or, for day-to-day purchases, Zilch's 5% interest-bearing ‘Pay Now’ debit product.

🇸🇪 Tink has entered the official register to become one of the first participants of the European Payments Council’s newly launched SEPA Payment Account Access (SPAA) scheme. Tink has been a founding member of the SPAA Multi-stakeholder Group (SPAA MSG) since 2019.

🇫🇷 Numeral, the payment technology provider, announced the support of Swift payments, enabling companies and financial institutions to automate cross-border payments with their partner banks to more than 200 countries, in addition to local European SEPA as well as UK Bacs, FPS, and CHAPS payments, from a single platform.

Buy Now, Pay Early: 97% of Klarna Black Friday purchases paid off on time or early, an increase of 2% compared with last year. The data comes as Bank of England boss Andrew Bailey declared that the UK’s recession may already be over. Over half (51%) of purchases were paid off early, ahead of their due date.

OPEN BANKING NEWS

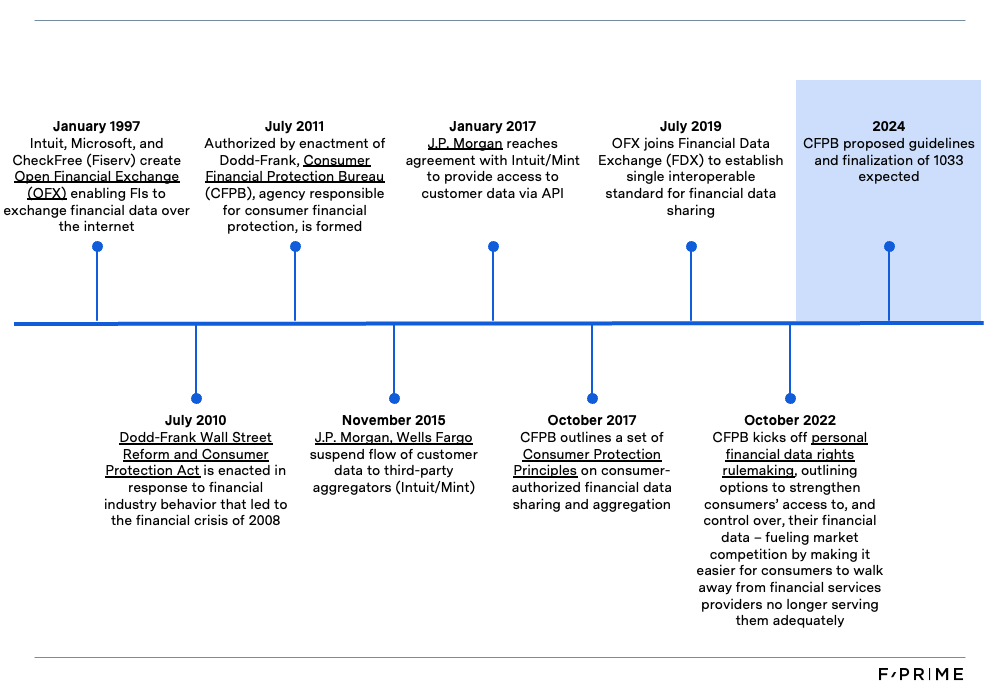

A Brief History of Open Finance.

DIGITAL BANKING NEWS

🇩🇪 Solaris Bank ends months of trepidation with ADAC deal. At the Berlin FinTech bank Solaris, many managers should be able to sleep more peacefully again – the most important deal in the company’s history is about to be concluded. The accounts of 1.3 million credit card customers from the ADAC portfolio are to be transferred to Solaris this year, as the “ Handelsblatt ” first reported.

🇬🇧 Griffin launches Foundations, an early access programme for UK companies to embed banking products. This comes after a successful pilot programme for its first set of customers. Foundations participants will receive access to Griffin’s platform, along with dedicated support from a team of banking and tech experts.

🇸🇬 Revolut says it’s gross profitable in Singapore for 2nd year running. The company more than doubled its revenue in Singapore between 2022 and 2023. In an interview with Tech in Asia, Revolut Singapore CEO Raymond Ng said the growth was driven by the post-pandemic travel rebound.

🇺🇸 Green Dot forms BaaS partnership with Dayforce. With this new partnership, Green Dot will facilitate banking services for Dayforce Wallet users in the United States, continuing to free up access to earned wages for employees who have access to this benefit.

🇧🇷 Nubank launches IPCA CDB as new investment option: Starting this week, the CDB IPCA (Certificate of Deposit tied to the Consumer Price Index) will be gradually available to users on the app. With this addition, customers will have another fixed-rate investment option to diversify their portfolio and protect their assets against inflation, as CDB is linked to IPCA.

🇬🇧 British SMEs lost £2.8 billion in 2023 to "rip off" bank FX fees says Wise. The firm says that the expensive, complicated and slow services that currently dominate the market are made worse by poor regulation, due to a ‘corporate opt out’ which means that banks don’t have to apply existing, albeit patchy, payments transparency regulation to SMEs.

🇸🇪 Finnish digital neobank Saldo Bank opens in Sweden. The bank will start operating in Sweden in February and offers interest rates of up to 5% on one year’s fixed-term accounts. According to the comparison website Compricer, the next highest offer is 4.4 per cent.

Combined French 🇫🇷 banking app downloads reached a total of 73m downloads by the end of 2023, that’s 24% higher than Germany’s 🇩🇪 total banking app downloads.

DONEDEAL FUNDING NEWS

🇩🇰 Januar raises Seed extension and launches B2B crypto services platform. This latest round highlights Januar's compelling status as a compliance-first licensed payment institution dedicated to servicing crypto and web3 native businesses, with investors recognizing the potential of its one-stop platform for seamless fiat-to-crypto money flows.

SEI invests $10m in Tifin. The two firms are also forming a partnership to use SEI's scale and distribution to push Tifin's AI technology to the wealth management sector. More on that here

🇸🇪 The European Investment Fund (EIF) has signed a guarantee transaction worth SEK 114 million with Swedish SME lender DBT Capital. The transaction, which covers two distinct investment areas, will allow DBT to make available a new portfolio of SME-lending of up to SEK 285 million to further support innovation-driven Swedish companies.

🇨🇴 Goldman Sachs bets on Simetrik’s automation tech for CFOs. Nearly two years after securing $20 million in Series A capital, Simetrik is back with additional investment to the tune of $55 million in Series B funding. The Colombia-based company is developing financial automation technology around record centralization, reconciliations, controls, reporting and accounting.

Zūm Rails raises $10.5M as it brings together Open Banking and Instant Payments capabilities in the U.S. The firm will use the funding to further expand its payments offerings, including the introduction of new Banking-as-a-Service features for merchants. Read the full article here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()