Elon Musk's Latest Move: Transforming X into a Financial Powerhouse

Elon Musk's recent maneuvers to transform X (formerly Twitter) into an all-encompassing financial platform have been a subject of intense focus. Musk's vision extends beyond social media, aiming to revolutionize the way we handle our financial affairs.

Strategic Expansion Across States

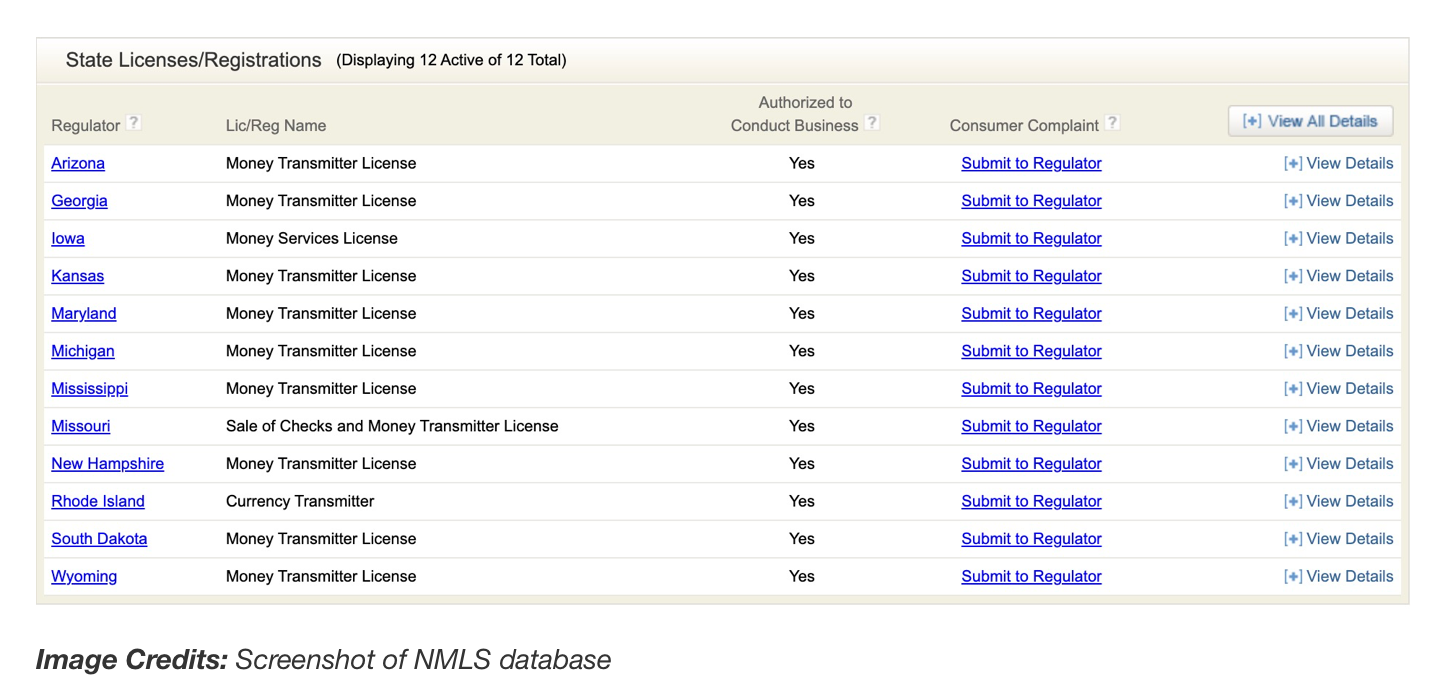

Recent developments have seen X successfully obtaining a payment processing license in 13 US states, including Pennsylvania, a move that signals the company’s commitment to becoming a significant player in the fintech arena.

This approval, as outlined in reports from Reuters and TechCrunch, empowers X to facilitate money transfers in a manner akin to established systems like PayPal's Venmo.

Payments are also tied into X’s broader move into the creator economy, where X users with at least 500 followers and 5 million organic impressions on their posts over the past three months can become eligible for ads revenue sharing.

The licensing journey began with South Dakota, Kansas, and Wyoming, followed by further registrations in Iowa, Mississippi, Georgia, Maryland, Rhode Island, Arizona, Michigan, Missouri, and New Hampshire.

This strategic state-by-state expansion is crucial, as full nationwide coverage is necessary for X to offer comprehensive payment services across the US.

Musk's Vision: A Financial Ecosystem

Elon Musk’s vision, as reported by The Verge and reiterated in his public statements, is to evolve X into a platform where users can manage their “entire financial life.”

In all hand call meeting with employees he recently stated:

‘You won’t need a bank account... it would blow my mind if we don’t have that rolled out by the end of next year.’

This bold ambition suggests a future where traditional banking could be significantly disrupted.

Musk envisions a platform that handles everything from peer-to-peer payments to complex financial transactions, potentially eliminating the need for conventional bank accounts.

The Road Ahead: Regulatory and Trust Challenges

However, this ambitious plan isn’t without its challenges. Regulatory hurdles are significant, as obtaining approval in every state is a complex, time-consuming, and costly affair.

Moreover, Musk's controversial public persona and X's own tumultuous recent history, especially concerning advertising and content moderation controversies, present additional obstacles in earning the trust of both users and financial regulators.

The financial industry, known for its rigorous compliance and regulatory standards, might find Musk’s unconventional and fast-paced approach at odds with its norms.

Winning over regulatory confidence and user trust will be crucial for X’s successful foray into the financial domain.

Potential Implications for the Fintech Sector

Musk’s move could have far-reaching implications for the fintech sector. By integrating financial services into a social media platform, X could potentially offer a more seamless and integrated user experience, challenging traditional banking models and existing fintech services.

Furthermore, this development might spur innovation and competition within the fintech space, as other companies may seek to integrate similar services.

The potential of X incorporating crypto services, hinted at in Musk’s past comments, could further shake up the financial landscape, merging social media, traditional finance, and the burgeoning field of cryptocurrencies.

A Focus on Small Businesses and the Creator Economy

In the wake of losing major advertisers, X has pivoted its focus towards small businesses and the creator economy. This shift could be a strategic move to diversify its revenue streams and build a more robust financial ecosystem within the platform.

By offering advertising revenue sharing to users with substantial followers and engagement, X aims to incentivize content creation and engagement within its platform, potentially driving further adoption of its financial services.

Conclusion: A Bold Step with Uncertain Outcomes

In conclusion, Musk’s latest venture is a bold step into uncharted territory, merging social media with comprehensive financial services. While the potential for innovation and disruption is high, so are the challenges and uncertainties.

The success of this endeavor will hinge not only on regulatory approvals but also on Musk’s ability to build a reliable and trustworthy platform that resonates with users and withstands the scrutiny of the financial industry.

As this story unfolds, it will undoubtedly be a key development to watch in the evolving fintech landscape.

Comments ()