The Surge and Evolution of Digital Banking in France: Balancing Tradition with FinTech Innovations

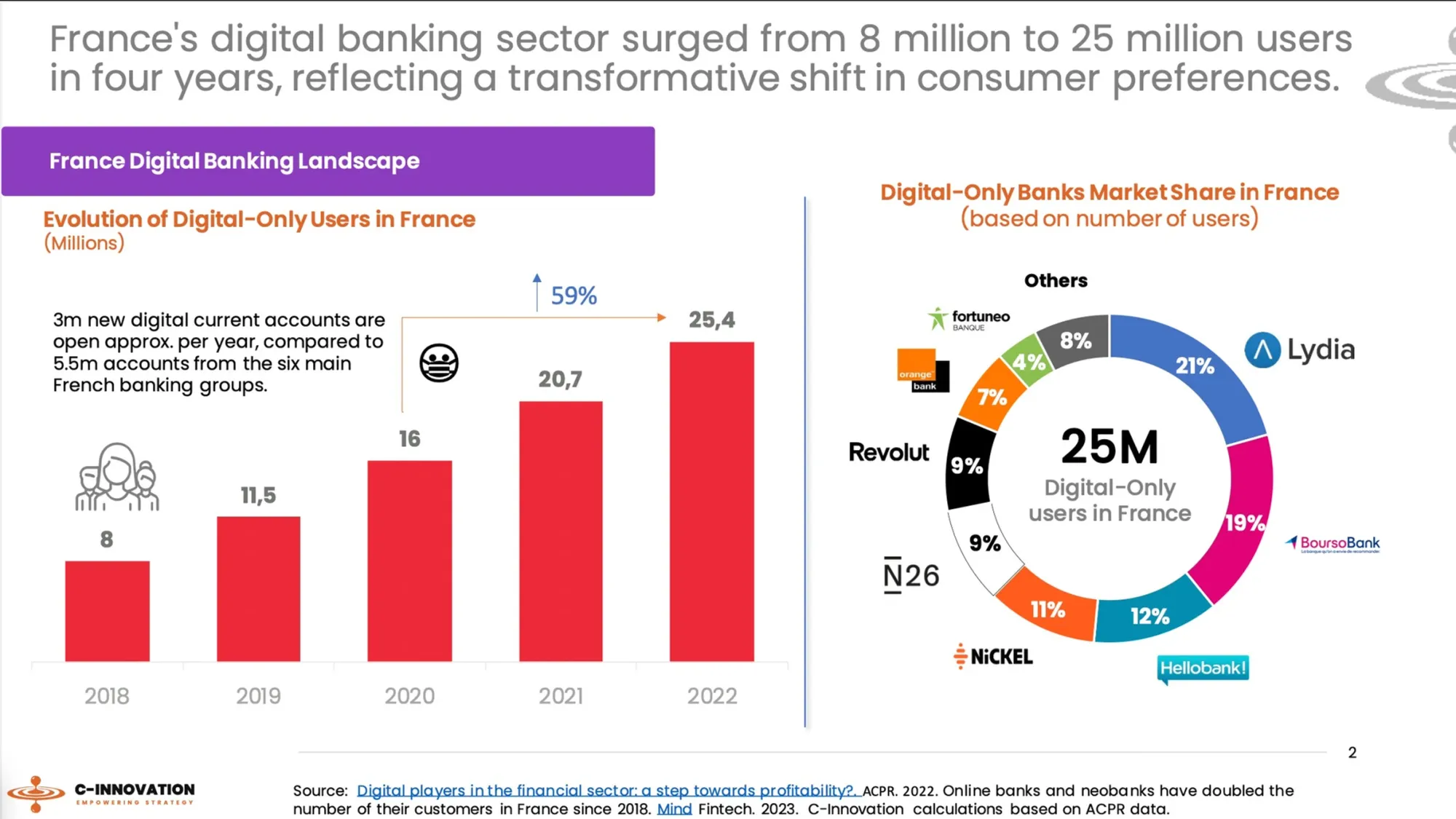

With the digital user base skyrocketing from 8 million to 25 million between 2018 and 2022, it’s clear that the traditional banking framework has metamorphosed to cater to contemporary, digitally-savvy consumers.

In a startling transformation, France's banking industry has remarkably redefined its financial landscape, merging traditional banking practices with FinTech innovations to adapt to the surging trend of digital banking.

With the digital user base skyrocketing from 8 million to 25 million between 2018 and 2022, it’s clear that the traditional banking framework has metamorphosed to cater to contemporary, digitally-savvy consumers.

One of the defining characteristics of the French digital banking landscape is the users' inclination towards a blend of conventional and technological financial services. Unlike the typical European consumer, the French populace seeks the assurance and trust of traditional banks while craving the agility and convenience offered by FinTech innovations.

The result? A distinctive, hybrid banking model that encapsulates the virtues of stability from traditional banking and the expedience of FinTech.

Traditional banking entities have astutely navigated this digital revolution, not just acknowledging but strategically incorporating fintech into their services. By devising hybrid banking that intertwines foundational elements of traditional banking with FinTech's swift, user-friendly solutions, these banks have embraced a new banking paradigm.

It is critical to note the symbiotic relationship observed between traditional banking institutions and digital-only platforms in France.

This is manifested through acquisitions of successful fintech startups and developing in-house digital solutions to compete with new, innovative players in the sector. Traditional banks, therefore, position themselves to offer an amalgam of reliability and technological advancements, ensuring their resilience amidst digital disruptions.

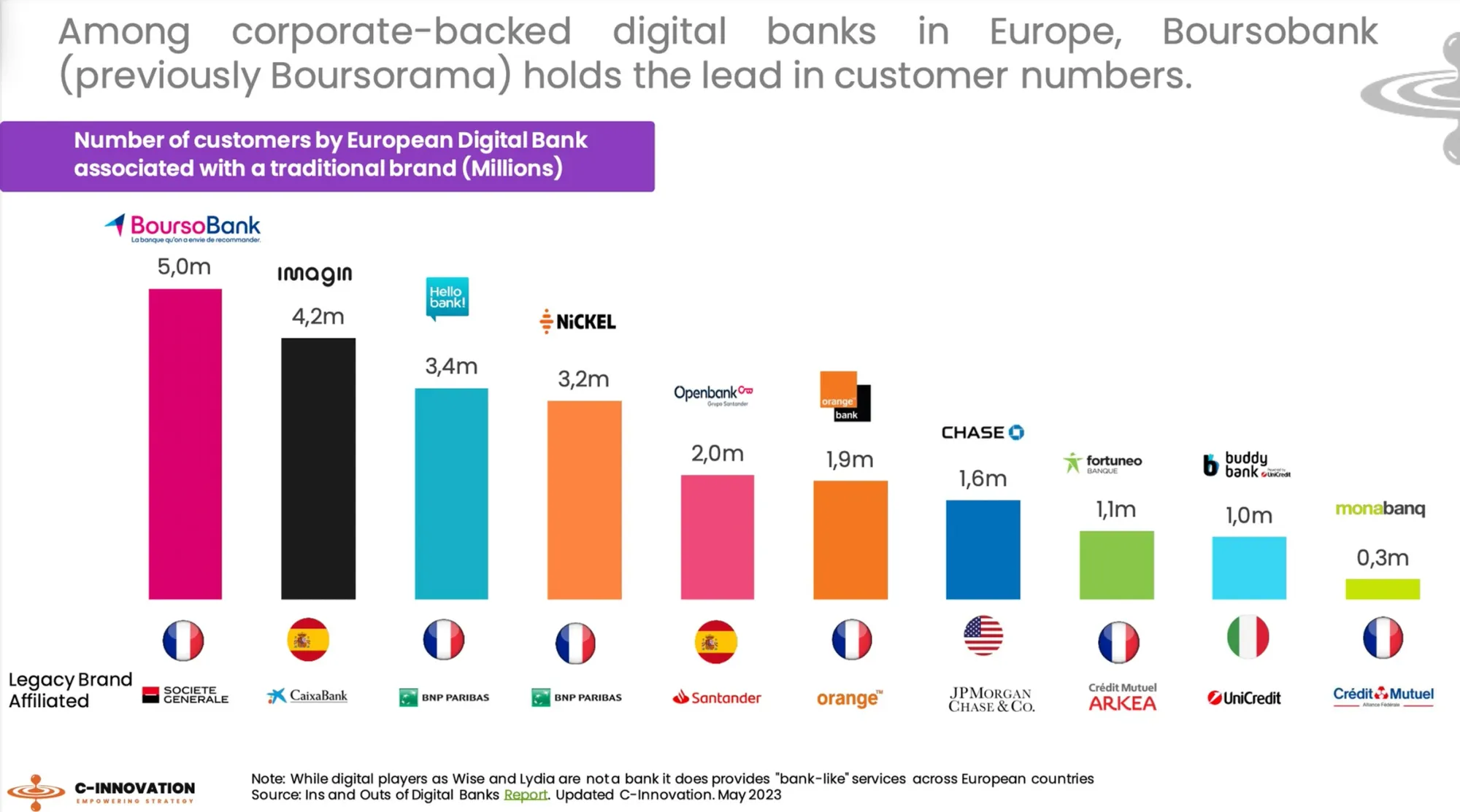

Boursobank, rebranded from Boursorama Banque, is a paragon of blending technological dexterity with a robust reputation in the French digital banking scene.

From its roots as an online broker in 1995, it has burgeoned into a leading digital bank, offering a spectrum of financial products while maintaining a steadfast commitment to innovation and customer financial health. With a revamped brand identity and a strategy to accumulate over 8 million clients by 2026, Boursobank underscores its journey with a dedication to simplicity, cost-effectiveness, and elevated customer experience.

As the boundaries of traditional banking practices are continually redefined in France, this blend of trust and innovation moulds a future-ready financial ecosystem that not only meets but anticipates the evolving demands of a digital, convenience-driven society.

Traditional banks and digital-only players are, therefore, not at an impasse but seemingly on parallel tracks, both adapting and aligning with changing consumer preferences and technological advancements in the digital age.

In summary, France’s foray into digitizing its banking industry is not merely a transition but a holistic evolution, offering a glimpse into the future of global banking, where tradition and technology coalesce seamlessly to serve the varied needs of the modern consumer.

For a deeper dive into the evolution and expansion of France's banking industry, read the full C-innovation source article and report.

Comments ()