Deribit, Valued at $4-5B, Explores Acquisition Opportunities

Hey FinTech Fanatic!

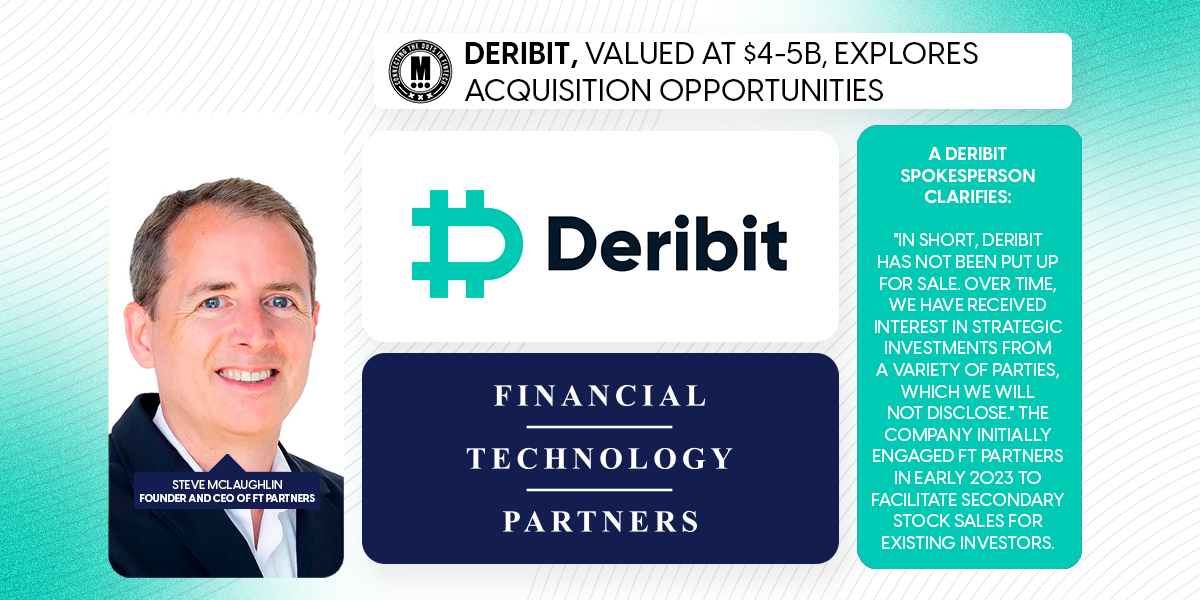

Deribit, the world's largest Bitcoin and Ether options trading platform, is working with Steve McLaughlin and Financial Technology Partners to review potential acquisition opportunities. The platform, valued between $4 billion and $5 billion, has attracted interest from various parties, though crypto exchange Kraken reportedly evaluated but did not proceed with a potential deal.

A Deribit spokesperson clarifies: "In short, Deribit has not been put up for sale. Over time, we have received interest in strategic investments from a variety of parties, which we will not disclose." The company initially engaged FT Partners in early 2023 to facilitate secondary stock sales for existing investors.

The development coincides with increased crypto sector M&A activity, which saw deals worth $1.2 billion in the fourth quarter, up from $400 million the previous year, following the crypto market rally.

If you’re interested in reading a bit about what’s been happening in FinTech, keep scrolling!

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

#FINTECHREPORT

📊 Cross Border Payment Expectations vs Reality. Real-time payments have raised consumers’ expectations for fast and easy cross-border payment experiences. But unfortunately, the complexity of cross-border payments often causes these expectations to not be met. Download Visa’s full report to learn more

FINTECH NEWS

🌎 Airwallex invests in Latin America growth securing a payment institution license from the Banco Central do Brasil, the acquisition of MexPago, and an Institution of Electronic Payment Funds (IFPE) license-holder. It will link its global financial infrastructure to Latin America’s economies to enable support for companies and facilitate international businesses’ entry into the region.

🇺🇸 JPMorgan earns biggest-ever annual profit as investment bankers ride rebound. JPMorgan's strong results bode well for the banking sector, which is seeing a revival in dealmaking and fundraising activities as the U.S. Federal Reserve cuts interest rates to bolster the economy.

🇯🇵 SoftBank veteran hunts for profits in payments infrastructure plumbing. Akshay Naheta, an executive whose career has been marked by bold wagers on disruption, is making perhaps his most ambitious bet yet: That the world’s payment infrastructure is ripe for reinvention. Read the full piece

PAYMENTS NEWS

🇫🇷 Lemonway unveils online onboarding solution for marketplaces, powered by Entrust identity verification solution. This solution eliminates the need for marketplaces to manage new customer onboarding themselves, allowing them to focus on strategy and business growth while staying competitive in the eyes of their partners.

🇸🇦 Google Pay set to launch in Saudi Arabia in 2025. Google Pay will offer users a secure and seamless way to make purchases in stores, on apps, and online. It will also allow users to conveniently add and manage their cards through Google Wallet, ensuring enhanced convenience and safety.

🇺🇸 JPM to offer payment terminals with biometric authentication. The terminals, a payment tablet, called J.P. Morgan Paypad and a payment pin pad called J.P. Morgan Pinpad, are scheduled to be released in the US in the second half and rolled out internationally after that.

🌍 Adyen powers wamo's latest payment service. The solution allows business owners to accept payments in-store or on the go, simplify cash flow management, consolidate payment and financial tasks and focus on growing their businesses. Continue reading

🇻🇳 Cross-border QR payments now live between Vietnam and Laos. This allows businesses and individuals to conduct transactions in Vietnamese Dong or Lao Kip, reducing reliance on foreign currencies and lowering transaction costs. The initiative aims to boost bilateral trade, investment, and tourism.

🇺🇸 FinTech Klarna’s loan sales suggest it is more Fin than Tech. Klarna is seeking buyers for a pipeline of its future buy-now-pay-later loans is a reminder that for now at least, its underlying business looks more like a financial firm than a tech group.

REGTECH NEWS

🇺🇸 SEC accuses Musk of fleecing Twitter investors. Elon Musk cheated Twitter shareholders out of more than $150 million by waiting too long to disclose his growing stake in the company in 2022 as he prepared a takeover bid, the US SEC said. The complaint was immediately disputed by Musk’s lawyer.

🇨🇦 BMO renews FundApps compliance monitoring contract. “The renewal of our partnership reinforces our commitment to our clients through continued investments in compliance monitoring and risk mitigation,” said Susan White, Chief Information and Operations Officer, BMO Capital Markets and BMO Commercial Bank.

DIGITAL BANKING NEWS

🇮🇪 Bank of Ireland reports record Christmas digital banking usage, as ATM use falls 12%. Tracking customer behaviour from December 14 to 24, the bank recorded a higher login rate than any other peak holiday or shopping period. It also reported an increase of 45 per cent in December 2024 compared to December 2023.

🇬🇧 Banking giant to close office, affecting 500 staff. Lloyds Banking Group plans to close its Liverpool office later this year. A spokesman said the cost-cutting move was part of plans to create "fewer [but] better-equipped, modern and sustainable offices to suit the future of our business".

🇷🇴 Romania’s CEC Bank selects Temenos to power retail and corporate banking. This transformation will enable CEC Bank to drive faster time to market, operational efficiency and business agility as it looks to further strengthen its position in the Romanian banking market.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Solana, XRP ETFs may attract billions in new investment. More investors are betting on the approval of the first spot Solana and spot XRP exchange-traded funds (ETFs) with expectations of a more innovation-friendly regulatory regime in the US after President-elect Donald Trump’s inauguration on Jan. 20

🇮🇹 Italy's Intesa 'tests' bitcoin with 1 mln euro investment. Intesa set up a proprietary trading desk and started handling spot trades with cryptocurrencies. "As a wealth management company that has the ambition to become like UBS, we have very sophisticated clients who may ask for this kind of investment," said the CEO.

🇹🇭 Singapore and Thailand move to block crypto betting site polymarket. Singapore’s Gambling Regulatory Authority blocked access to Polymarket in December as it was deemed to be providing unlawful gambling. In Thailand, law enforcement is preparing to propose a similar ban.

🇺🇸 Coinbase investigates ‘Delayed Sends’ for XRP. “We are aware that some users may be experiencing delayed sends for Ripple (XRP).” “Buys, Sells and Fiat withdrawals/deposits are not affected. We are investigating this issue and will provide an update shortly,” Coinbase said on its status page.

PARTNERSHIPS

🇪🇸 Unicaja and Fiserv sign a strategic payments agreement. Both companies will work together to create new tools that enhance the omnichannel processing of all payment methods, optimising development times to offer enhanced customer experience.

🇸🇪 StepLadder partners with Swedish FinTech start-up Cirkly to empower community-based savings. This cooperation will leverage StepLadder’s extensive expertise in running Saving Circles, to support Cirkly’s mission of building and growing their community of collective savers and borrowers in Sweden.

🇬🇧 Lyca Mobile and Revolut Pay launch first MVNO partnership in the UK. The alliance aims to revolutionise payment experiences for customers by simplifying and enhancing payment processes and gain access to automated subscription and bill payments, real-time payment notifications, and one-click top-ups.

DONEDEAL FUNDING NEWS

🇬🇧 Klearly snatches €6 million for in-person payments and to support SMBs across Europe. With this fresh injection of capital, Klearly looks to lead a transformation in the €7.9 trillion European point-of-sale market, reshaping how payments are processed and integrated into merchant operations.

🇺🇸 Deal execution platform Sydecar raises $11 Million in Oversubscribed Series A. Sydecar’s funding will be used to expand the company’s product suite, reach new customers and scale distribution through new channel partners. Continue Reading

M&A

🇵🇦 Crypto options Venue Deribit draws interest from buyers. The company (valuation $𝟰 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 to $𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻), the world’s largest trading platform for Bitcoin and Ether options, has drawn interest from potential acquirers and is working with a financial adviser to review opportunities.

🇺🇾 Payment services provider dLocal is analyzing whether to buy a smaller FinTech rival this year after the company itself was the target of takeover proposals, and claims it's NOT FOR SALE 🤯 This is what Chief Executive Officer Pedro Arnt said in an interview.

🇬🇧 Ebury to acquire Lithuanian international payments provider ArcaPay amid strong growth and continued profitability momentum. The acquisition will enable Ebury to expand in the Baltics, help existing clients grow in the region and further strengthen and complement its core capabilities in international payments.

🇺🇸 IPC Systems expands trading tech with Intracom deal. “This acquisition enables IPC to deepen its value proposition, providing communication solutions that extend from traders on the front lines to compliance teams and middle- and back-office operations, all through a secure, scalable SaaS model,” said the CEO of IPC.

MOVERS AND SHAKERS

🇺🇸 ACI Worldwide announces the appointment of Philip Bruno as Chief Strategy and Growth Officer. “The addition of Phil to our already strong executive leadership team is critical to further enhancing our corporate strategy and increasing our growth opportunities. He brings the strong vision and business expertise.” said Thomas Warsop, president and CEO of ACI Worldwide.

🇬🇧 Bank of England and NYDFS swap staff with expertise in emerging payments and digital assets. The transAtlantic regulatory exchange will open secondment positions to staff with demonstrated expertise in digital payments, distributed ledger technology, virtual currency, or digital assets.

🇹🇷 Garanti BBVA Crypto names new CEO. Korcan Abalı will be stepping down as CEO and Onur Güven will replace him. Güven has been a senior manager at a variety of renowned financial technology companies. He has more than 20 years of experience in digital assets, and crypto/blockchain.

🇿🇦 Aaron Foo steps up as CPO at Tyme Group. In his new role, Aaron will oversee product development for Tyme Group, covering both the digital banks. Aaron, who joined the group in 2019, has been instrumental in shaping Tyme’s strategy and product innovation, contributing to its growth and expansion into new markets.

🇬🇧 Wealth manager GSB hires COO. Hugh Johnson will support the company’s expansion and growth across all GSB operations. He has previously held roles senior roles at the Fry Group and global financial services firm Sanlam. Continue reading

🇺🇸 Warner Bros Discovery adds SoFi CEO, ex-IAC chief to board. The company has appointed Anthony Noto and Joey Levin. "Both Anthony and Joey are accomplished leaders with considerable experience in relevant industries and exceptional track records of driving growth, innovation and shareholder value," said CEO of Warner Bros Discovery.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()