Deel Secures $300M Investment & Hits $800M Run Rate

Hey FinTech Fanatic!

Deel has just announced new anchor investors, including General Catalyst and a sovereign investor, purchasing nearly $300 million in secondaries from early investors. This milestone highlights Deel’s strong momentum and the confidence investors have in its long-term vision.

The company also hit a remarkable $800 million run rate in December 2024, growing 70% year-over-year—all while staying profitable for over two years. Deel has evolved from a hiring solution into a full-suite global workforce platform, simplifying HR, payroll, and compliance across 150+ countries.

“We are proud to deepen our investment in Deel, a transformative platform that empowers global workforce enablement,” said Jeannette zu Fürstenberg, Managing Director of General Catalyst. CEO Alex Bouaziz added, “2024 was a remarkable year in business growth and product innovation. We’re gearing up for an even bigger 2025.”

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Stay on top of FinTech trends. Subscribe to FOMO now and catch the week’s most important news and updates.

FINTECH NEWS

🇩🇰 Investor slashes value of Pleo stake by 25 per cent year-on-year. The Danish startup, which has raised more than $430 million in funding, provides European businesses with various spend management tools including company cards, employee expense reports, as well as credit products.

🇧🇷 CloudWalk triples profit touting AI deployment. The company reported net income of $63 million in 2024, with revenue per worker doubling to nearly $1 million. Read More

🇮🇳 Yuze expands into India. The company aims to expand its impact by leveraging the nation’s growing FinTech ecosystem. Supported by government initiatives such as Digital India and increasing investments, the Indian market provides fertile ground for Yuze to foster financial inclusion.

🌍 Payment startups battled interest spikes and a funding drought. A combination of increasing compliance requirements, interest rate rises and a funding drought hit the sector hard. And annual VC funding in recent years has yet to crack the $2bn mark as some of its biggest players struggle to reverse losses.

PAYMENTS NEWS

🌍 AFS and Nsano partner to transform Card Payments. The partnership will enable Nsano to expand its offerings by integrating AFS’ state-of-the-art card processing services into its existing mobile money infrastructure. This collaboration is set to transform the payment ecosystem.

🇦🇪 Dubai Duty Free partners with TerraPay. This strategic partnership enables travelers to make purchases using their home-country digital wallets, driving a new era of convenience and accessibility in payment solutions. Read more

OPEN BANKING NEWS

🇬🇧 Money Squirrel partners with Moneyhub for open banking. Moneyhub’s Open Banking-enabled API technology powers Money Squirrel’s platform. It empowers businesses to make the most of their money by automating the saving of future VAT payments into market-leading interest accounts.

REGTECH NEWS

🇺🇸 Encompass Corporation Unveils EC360, the ground-breaking platform designed to transform the banking sector. EC360 seamlessly integrates public and private data, providing a 360-degree view of corporate clients, and enabling fast, flawless, and frictionless identity verification.

🇬🇧 Use of AI in banking to be subject of new inquiry by MPs. The Treasury Committee inquiry will explore how AI is currently used by City firms as well as what opportunities it brings for innovation in the financial services sector. MPs may also consider the potential impact on employment in the sector.

🇬🇧 Nationwide Building Society to train people to think like cybercriminals. The training organisation’s founder and CEO, Andrea Cullen, said the programme helped cyber security professionals understand their adversaries. “To combat threat actors, you must be able to think like one,” she said.

DIGITAL BANKING NEWS

🌍 Viva.com merges e-money and banking licenses across Europe. The company will provide businesses a single value-driven platform for payments acceptance, card issuing, and banking that will accelerate the adoption of the latest technology, with unmatched convenience and efficiency.

🇸🇦 STC Bank launches operations in Saudi Arabia. The bank has completed its pilot phase and received clearance from the Saudi Central Bank to launch digital banking services in the Kingdom. It will leverage the clearance to launch financial solutions that elevate banking services for individuals and the business sector.

🇲🇺 Arie Finance signs with SaaScada. The platform will specialise in cross-border transactions, offering customers a personalised, speedy, and safe account setup. It will embed multi-currency accounts, payments, and access to a best-in-class FinTech partner network across multiple geographies.

🇺🇸 MongoDB collaborates with Lombard Odier. They work together to create customizable generative AI tooling, including scripts and prompts tailored for the bank's unique tech stack, which accelerated the modernization process by automating integration testing and code generation for seamless deployment.

🇬🇧 Aldermore Bank selects Temenos to launch new small business savings notice accounts. Commercial Director for Aldermore Bank, said: “This strategic technology investment will help us to rapidly expand our offering, providing more customer-centric solutions and exceptional experiences for the underserved small business market.”

🇵🇪 Revolut is finalizing the details of its official entry into Peru. The neobank has already hired an executive to lead its expansion and is now fine-tuning legal details to comply with regulatory requirements, including the formal application for an operating license from the Superintendency of Banking, Insurance, and AFP.

🇬🇧 Would a UK exit help make sense of Santander’s sprawling empire? The bank is exploring a number of strategic options for its UK business, one of which is potentially exiting the British retail market where it has had a presence since 2004. Continue reading

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Telcoin received approval for its Digital Asset Depository Bank Charter. This approval marks a significant milestone in the integration of digital assets into the traditional banking framework. It will issue US dollar-backed stablecoins to facilitate its safekeeping and seamless integration into mainstream financial systems using independent node verification networks.

🇪🇺 Kraken Digital Asset Exchange secures EU MiFID license. It was obtained through the acquisition of a Cypriot Investment Firm. The license allows it to offer fully compliant and regulated derivatives products to advanced crypto traders across selected EU markets.

🇸🇬 Bybit opens physical Web3 store. At the exclusive opening event on Jan. 17 at the Bybit headquarters, the brand new space was unveiled to the global crypto community. The guests were treated to an evening of inspiring conversations and crypto innovations.

PARTNERSHIPS

🇨🇳 Deutsche Bank & Yonyou help Chinese enterprises to go global. This collaboration will help enterprises optimise financial resources, reduce costs, and enhance risk control. The partnership aims to deliver efficient domestic and cross-border payment solutions.

DONEDEAL FUNDING NEWS

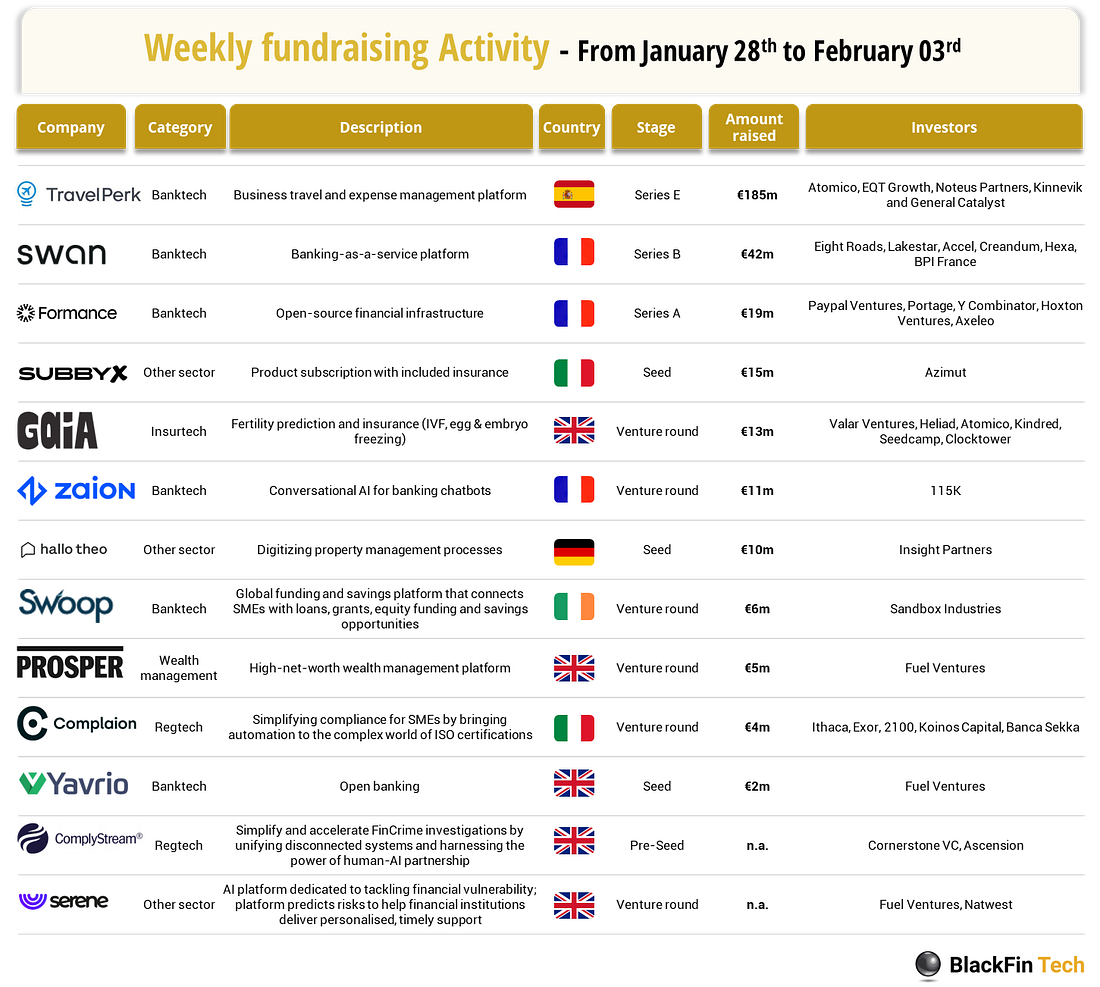

💰 Over the last week, there were 13 FinTech deals in Europe, raising a total of €311 million, with 5 deals in the UK, 3 deals in France, 2 deals in Italy and 1 deal each in Ireland, Germany and Spain.

🇮🇳 SoftBank-backed billionaire to invest $230M AI startup Krutrim. Bhavish Aggarwal is financing the investment in Krutrim. The initiative comes as India seeks to establish itself in an artificial intelligence landscape dominated by US and Chinese companies.

🇬🇧 Fimple accelerates global expansion with $12m Series A funding. The funding round will accelerate Fimple’s product development and fuel its international expansion, particularly into the MENA and CIS regions. Continue reading

🇳🇴 DNB Ventures invests in FinTech startup Receipts. Investment Manager at DNB Ventures, says, “Through active ownership, DNB Ventures will be a driver of mutual learning and insight between DNB and the portfolio companies, while also contributing to the companies’ development.”

🇸🇦 Egypt’s Khazna banks $16M for its financial super app and expansion. The investment will support its expansion plans as it prepares to apply for a digital banking license in Egypt and expand into Saudi Arabia. Read More

🇺🇸 Deel is welcoming General Catalyst as an anchor investor. The company aims to leverage its expertise and resources to further its mission of transforming the HR and FinTech landscapes. This strategic move is part of Deel's efforts to strengthen its financial position and expand its network of anchor investors.

M&A

🇳🇴 United FinTech acquires Commercial Banking Applications. This enhances its ability to support financial institutions in their digital transformation. The acquisition strengthens automation, efficiency, and security for commercial banks worldwide, ensuring they can seamlessly integrate innovative FinTech solutions.

🇵🇰 ABHI joins forces with TPL to acquire FINCA Microfinance Bank. This acquisition aims to expand access to financial solutions and accelerate financial inclusion across Pakistan, also, enables ABHI to introduce a range of services, such as gold-backed loans, salary advances, savings accounts, and value-added offerings like bill payments.

🇿🇦 Paycorp acquires Pilot Software. This strategic move strengthens Paycorp's market presence and enhances its product offering, enabling businesses to benefit from a diverse range of payment solutions. The acquisition reaffirms its commitment to delivering innovative, cost-effective and a collaborative payment offering.

MOVERS AND SHAKERS

🇦🇺 Ishan Agrawal joins Airwallex as Head of Engineering. Ishan is joining Airwallex with a mission to drive innovation in AI, Data Platforms, and Growth. He cited the company’s business impact, technical ambition, and strong engineering culture as key motivators for his decision.

🇺🇸 Stripe brings aboard new head of ‘startup and VC partnerships’. Asya Bradley, a former FinTech founder and investor, has joined payments giant Stripe as its new head of Startup & Venture Capital Partnerships. Read more

🇬🇧 Monument Technology appoints Simon Featherstone as Chair. Simon will lead the Board and work closely with the Executive Team to build the company into a market-leading tech platform business. He will also play a vital role in shaping the company’s strategic direction, strengthening relationships with potential clients and investors.

🇬🇧 Monument Bank hired a McKinsey alum as its CTO. Shaun Bohannon joins with the goal of providing high net-worth individuals a "private bank-like experience." He joined from Virgin Media O2, where he spent the last two years as digital CTO serving as a Senior Director of Software and cloud engineering at the consultancy.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()