Curve to Launch Apple Pay Competitor, Promises Significant Savings for Banks

Hey FinTech Fanatic!

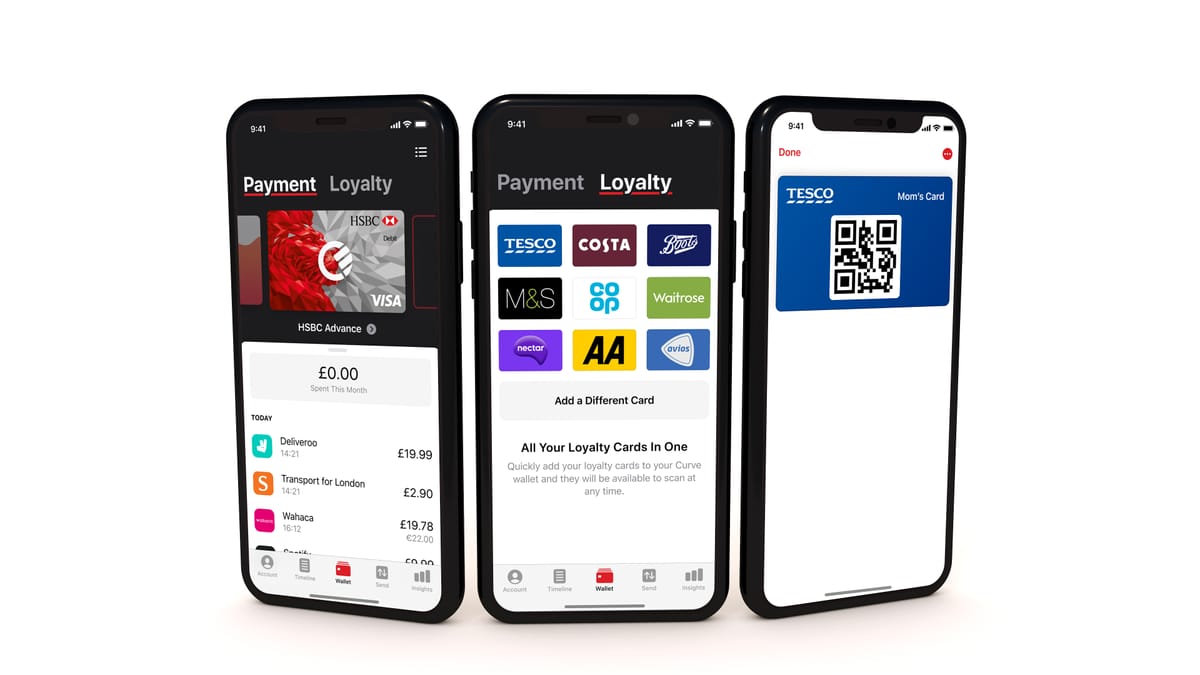

Banks and financial institutions currently face hefty fees for transactions processed through Apple Pay. However, London-based FinTech company Curve is set to launch a new payment service that promises to save banks millions by offering a direct alternative to Apple Wallet.

Curve's upcoming service will allow iPhone users to make contactless payments by double-clicking the side button, just like Apple Pay. This move comes after Apple recently opened access to its near-field communication (NFC) chip to competitors, following an investigation by the European Commission that began in 2020.

Curve's founder, Shachar Bialick, stated, “Curve has long argued, what the European Commission recently confirmed, that Apple Pay has enjoyed market dominance through illegal restriction of competition. This undermines consumer choice and has forced banks to pay high transaction fees. We are delivering Curve Pay to reduce these costs for issuers and enhance the customer experience.”

The launch of Curve Pay is expected once final technical details with Apple’s NFC technology are resolved. This new payment system aims to reduce the "Apple Tax" and provide more options and rewards for consumers, promoting a competitive digital wallet market.

Curve, founded in 2015, enables users to consolidate multiple bank and loyalty cards into a single app. With over four million customers and £3.2 billion spent via the platform in 2022, Curve is targeting profitability this year. The company generates revenue from card transactions, ATM withdrawals, currency exchanges, and subscription services.

Apple Wallet, exclusive to iPhones and other Apple hardware, stores a variety of sensitive information, including credit cards and airline tickets. The US Department of Justice sued Apple in March for monopolizing the smartphone market, alleging that its ecosystem stifles innovation and discourages the development of alternative digital wallets. Apple has denied these claims and intends to fight the lawsuit vigorously.

You can read more FinTech industry updates below, and have a great start to the week!

Cheers,

POST OF THE DAY

🤔 Digital Wallet Apps: how do they work?

INSIGHTS

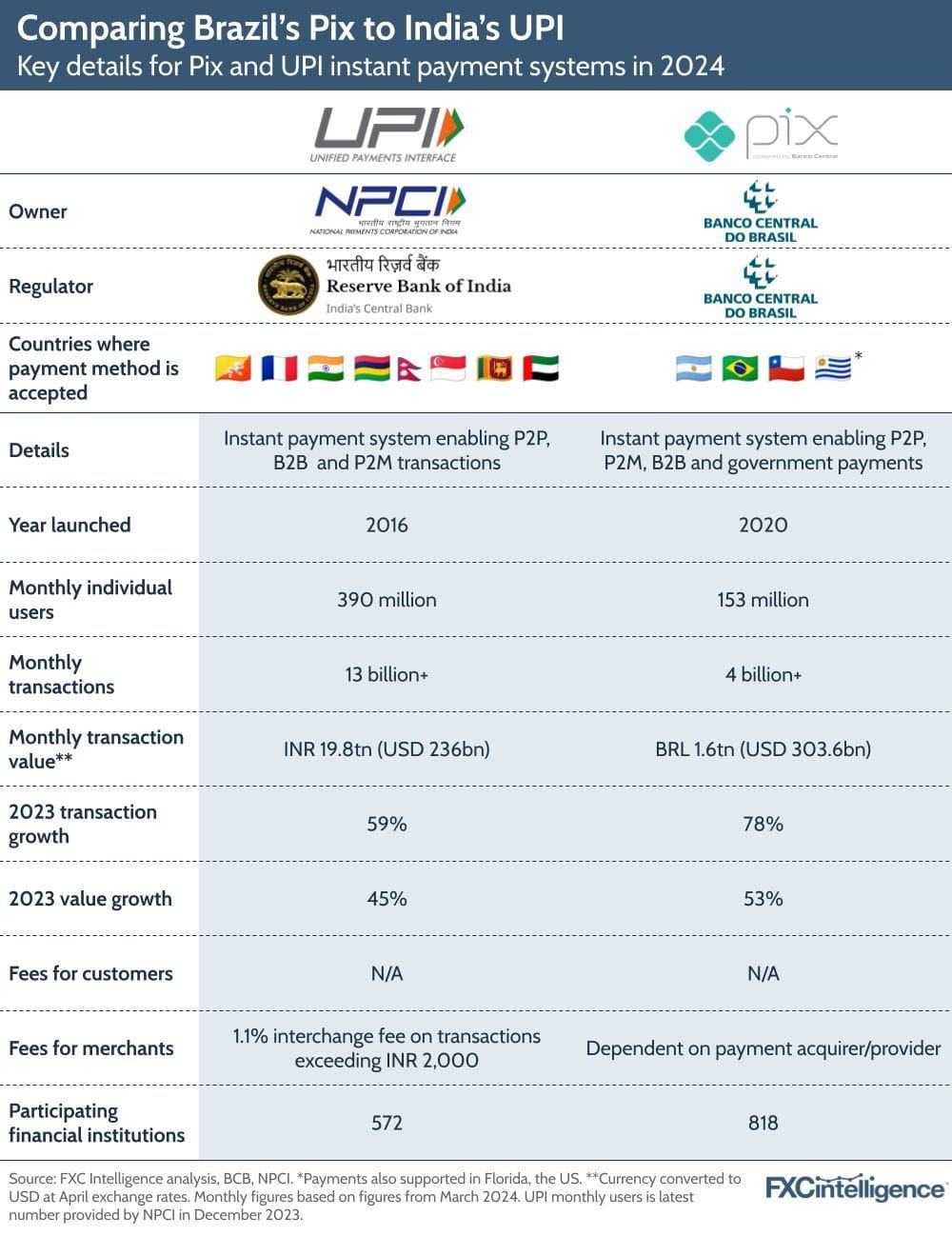

🇧🇷 Brazil’s Pix 🆚 India’s UPI 🇮🇳

Let's dive in (and compare) these two Payments success stories:

FINTECH NEWS

🇻🇳 Grab announced that it will stop offering its e-wallet service in Vietnam, which was launched in 2018 in a strategic partnership with local payments firm Moca. Effective on July 1, the change will affect both the Moca app and Grab's app in the country, which Grab entered in 2014.

🇶🇦 Qatar Central Bank launches Express Sandbox for quicker market entry of FinTech solutions. This announcement is in line with the Third Financial Sector Strategy, the FinTech Strategy and Qatar Central Bank's ongoing efforts to regulate and develop the financial sector.

🇺🇸 US expansion pushes up credit losses at Klarna. Credit losses at Buy Now, Pay Later group Klarna rose in the first quarter as it pursues its aggressive US expansion plans and consumers continue to struggle with high prices. Read more

🇮🇳 JFS launches JioFinance in beta; to build a super app for FinTech. Jio Financial Services has launched ‘JioFinance’ app in beta mode, integrating digital banking, UPI transactions, bill settlements, and insurance advisory to offer a consolidated view of accounts and savings in a single interface.

🇩🇪 German BaaS provider Dock Financial files for insolvency (but aims to continue operations) maintaining its search for a strong investor, and did not file for bankruptcy for its regulated entity in Luxembourg. Read the full piece

🇲🇾 Malaysians lead the world in mobile wallet usage, survey reveals. Malaysia is leading the world in mobile wallet usage, with 63 per cent of Malaysians utilising mobile wallets for transactions, said global financial technology platform Adyen.

PAYMENTS NEWS

🇮🇳 Payments Giant Stripe is moving to an invite-only model for new clients in India as it builds up the infrastructure to deal with an evolving regulatory landscape. The firm says it has made the "tough decision" for the temporary switch, telling businesses in India that they now need to request an invite to sign up for its services.

🇺🇸 Jose Fernandez da Ponte of PayPal says Solana is the perfect fit for payments. He also explained that they are bringing Mainstream Crypto use cases with their remittance company called Xoom that moves billions of dollars every year.

🇮🇪 PayPal has recently introduced a new payment solution tailored for small and medium-sized enterprises (SMEs) engaged in online trading in Ireland. The initiative, named PayPal Complete Payments, extends support for various payment methods, including Apple Pay and Google Pay, across more than 20 European markets.

🇮🇳 Razorpay POS, the financial technology company's offline payments unit, has announced 'Q-Zap', a smart payment solution for retailers designed to facilitate quicker checkouts and eliminate queues. By using Q-Zap, Razorpay POS aims to improve the in-store customer experience by cutting billing time by 40% and benefiting retailers by saving up to 20% in annual operating costs.

OPEN BANKING NEWS

🇺🇸 Western Union collaborates with Plaid for faster, more secure payments in Europe. The collaboration provides Western Union’s customers with seamless open banking payments, giving them additional flexibility in how to send money to their families and loved ones.

🇧🇷 Brazil's Banco BRP brings the total number of Open Finance payment initiators to 30. Banco Ribeirão Preto (BRP) has been authorized to operate as a payment transaction initiator via Pix in Open Finance, becoming the 30th institution to do so.

DIGITAL BANKING NEWS

🇺🇸 Visa and Mastercard have agreed to pay $197 million to settle a long-running class action lawsuit accusing them of keeping ATM fees artificially high. According to court documents, reported by Reuters, Visa has agreed to pay $104.6 million and Mastercard $92.8 million to settle. The deal awaits court approval.

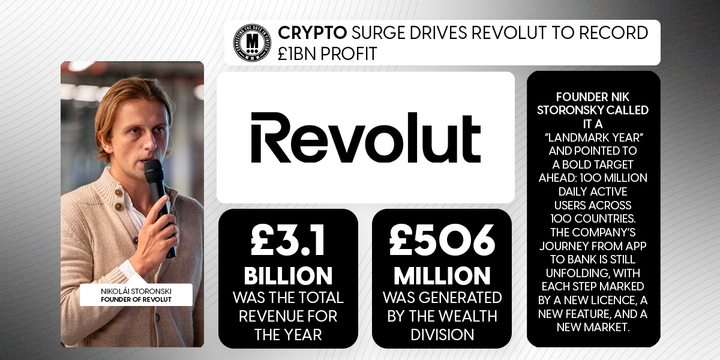

🇦🇺 Revolut views Asia Pacific as key for expansion. The APAC region is one of the keys for global expansion at London-based Revolut, including markets such as Australia, New Zealand and Singapore, according to the FinTech company’s head of growth.

🇬🇧 CMA to investigate £2.9bn takeover of Virgin Money by Nationwide. The CMA said it had opened the first stage of its merger process to look at whether the deal – one of the largest transactions in the banking sector since the 2008 financial crisis – would lead to substantial lessening of competition.

🇬🇧 The Bank of London announces a strategic partnership with payments specialists, allpay Limited, to simplify and expedite payments for everyone, whether they have a bank account or not, through easily manageable prepaid cards. Read on

🇻🇳 Southeast Asia Commercial Joint Stock Bank, SeABank and Visa further tightens their comprehensive cooperative partnership by a strategic cooperation agreement on developing digital payments. With the support of Visa, SeABank has created a revolution on its card services and launched various new card lines.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase argues SEC is trying to crush crypto industry. Coinbase argued in a brief filed with the US Court of Appeals for the Third Circuit that the Securities and Exchange Commission is trying to crush the crypto industry in a “Catch-22″ conundrum.

DONEDEAL FUNDING NEWS

🇸🇪 Swedish climate FinTech Doconomy bags €34m in Series B funding. Doconomy states the newly obtained funds will be utilised to fuel the company’s expansion in North America, drive “broader engagement and adoption of its tools”, and support the further development of its product suite.

🇺🇸 FinTech startup Forward grabs $16M to take on Stripe, lead future of integrated payments. Lloyd intends to use the new funding to expand the company’s capacity in terms of customers and on technology development, including machine learning and artificial intelligence.

🇺🇸 Novel closes $15m round to propel the FinTech’s expansion of their groundbreaking Capital Intelligence™ platform. This injection of capital catapults Novel’s total funding to over $130M, fueling its mission to transform how tech founders fund and grow their business.

🇺🇸 Light Frame, a Providence, RI-based private banking and wealth management technology company, raised $1.7M in Pre-Seed funding. The company intends to use the funds to accelerate its innovation and growth. Read more

MOVERS & SHAKERS

🇸🇬 After three years as CFO at Funding Societies, Frank Stevenaar moved to VC firm Antler. His replacement is Junxiong Ho, formerly of Brankas and Stripe. Despite slow growth, Funding Societies focuses on long-term success and has 80 open positions.

🇬🇧 Saxo UK appoints Andrew Bresler as CEO. Andrew, with significant experience in the financial sector, including leadership roles at Saxo from 2016 to 2018, brings a deep understanding of the bank’s products and services, especially in APAC.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()