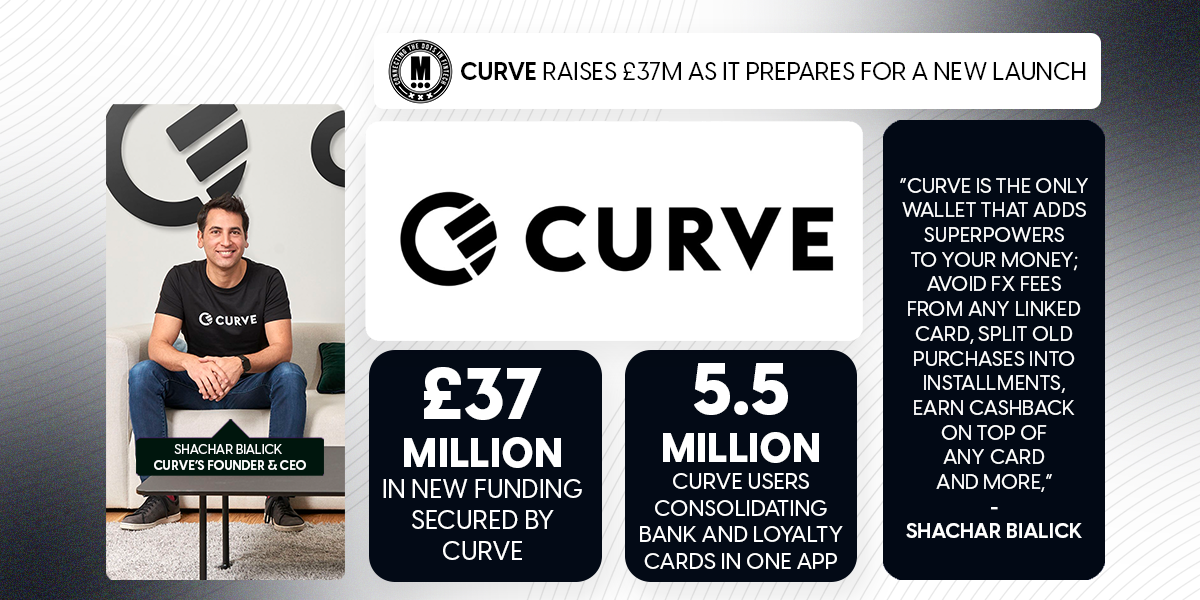

Curve Raises £37M as It Prepares for a New Launch

Hey FinTech Fanatic!

After last week’s news of Curve’s £36 million loss—though an improvement of 48% from the previous year—and its decision to pause US operations, fresh funding of £37 million has landed, bringing a positive turn for the London-based FinTech.

The funding round was led by Hanaco Ventures, marking its first investment in Curve. Hanaco, which focuses on Israeli startups, joins existing investors such as Fuel Ventures, IDC, Outward VC, and Lord Stanley Fink in backing the company’s next phase.

Curve, which enables 5.5 million customers to consolidate their bank and loyalty cards into a single app, sees 2025 as a milestone year. It aims for profitability while expanding its product offerings, including the launch of Curve Pay, its answer to Apple Pay and Google Wallet.

“Curve is the only wallet that adds superpowers to your money; avoid FX fees from any linked card, split old purchases into installments, earn cashback on top of any card and more,” said Shachar Bialick, Curve’s Founder & CEO. “This investment will allow us to invest further in our customer experience, bring new partnerships, and accelerate our path to profitability.”

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

SPONSORED CONTENT

Power your FinTech, bank, or brand with full-service embedded banking—seamless account funding, transfers, payouts, and issuing, all backed by enterprise-grade risk management and compliance. Simplify operations, reduce costs, and launch faster. Find out more today.

BREAKING NEWS

🇺🇸 BNPL lender Klarna files for U.S. IPO, and plans to go public on the New York Stock Exchange under ticker symbol 𝗞𝗟𝗔𝗥. Klarna hasn’t yet disclosed the number of shares to be offered or the expected price range. The decision to go public in the U.S. deals a significant blow to European stock exchanges, which have struggled to retain homegrown tech companies.

FEATURED NEWS

🌍 Trustly partners with Mollie to uncover data-driven insights and actionable strategies to increase sales, build loyalty, and improve business performance. In Mollie's 2025 Playbook, Trustly’s CRO shares his best practices to help merchants boost conversion rates by making their checkout process as friction-free as possible.

🇺🇸 Capital One pulled out as JPMorgan pushed ahead on Javice deal. An executive of the company told a New York jury why his bank withdrew its $125 million bid for Charlie Javice’s student-finance startup on the same day that JPMorgan Chase & Co. offered a price $50 million higher.

INSIGHTS

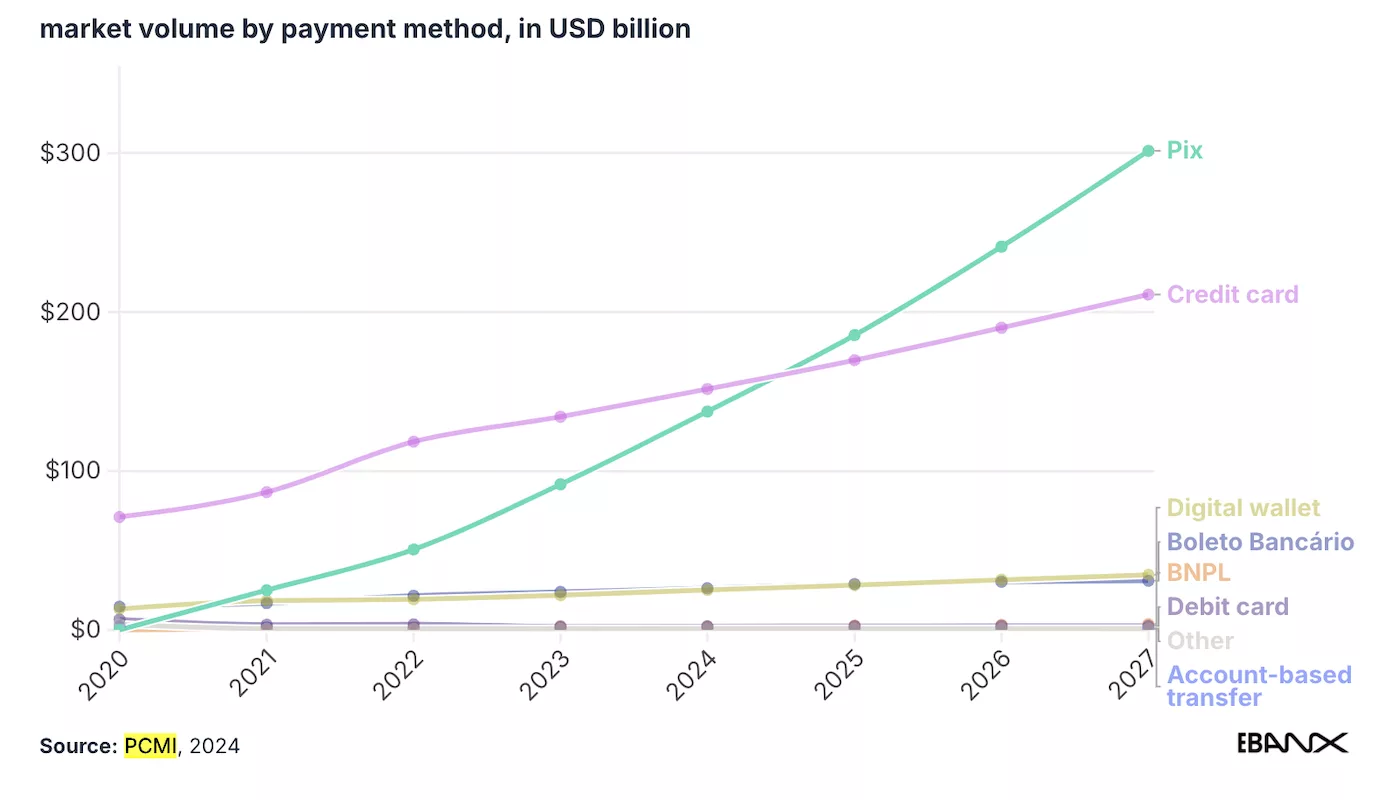

🇧🇷 In 2025, Pix will surpass credit cards as the most used payment method for e-commerce payments in Brazil.

FINTECH NEWS

🇺🇸 FinTech Beeline Holdings Inc. secures NASDAQ listing after strategic merger. The company merged with Eastside Distilling Inc., and shareholders approved the change of control and company name to Beeline Holdings. To comply with Nasdaq’s requirements, Beeline will implement a 1-for-10 reverse stock split.

🇫🇮 Raisin expands into the Nordics with Finland platform launch. The Finnish platform allows customers to compare and open deposit accounts across Europe seamlessly, all through one login. Users benefit from transparent terms, no fees, and a secure platform that has already facilitated over €70B in deposits.

🇬🇧 Cleo released its 2024 Annual Report, doubling its ARR to $185m. The report showcases Cleo's expansion in user base, improvements in its AI-driven financial assistant, and strategic partnerships, emphasizing Cleo's focus on financial inclusion, offering users better insights into their spending and savings.

🇧🇷 Nubank, Google Pay and Binance are among the most downloaded financial apps in Brazil. A recent report revealed a 27% increase in global financial app installations, with Latin America seeing a 29% rise. Notably, Google Pay moved from 4th to 2nd place, while Nubank shifted to 7th as Binance climbed to 6th.

🇺🇸 Citigroup to ‘hire thousands’ of permanent IT staff and cut contractors. The bank aims to streamline operations and address regulatory failings that led to hefty fines. An internal presentation reveals plans to reduce external IT contractors by 30%.

🇺🇸 Block announces that its industrial bank, Square Financial Services (SFS), received approval from the Federal Deposit Insurance Corp (FDIC) to offer the company’s consumer loan product Cash App Borrow. Continue reading

PAYMENTS NEWS

🇮🇹 The most popular payment methods in Italy, by Ecommpay. Cash remains a popular way to pay, but several factors are driving the swift growth of e-commerce in the region. For example, EU regulations have propelled the adoption of digital payments, like the Payment Services Directive 2 (PSD2), which has made online payments more secure and reduced fraud risks. Click here to learn more

🇬🇧 Avoiding PayPal high-risk status: A guide for subscription businesses, by Solidgate. The only solution is to get ahead of the risk. By reducing disputes, tightening up billing practices, and keeping PayPal’s risk triggers in check, you can protect your revenue—and keep payments running smoothly. Here’s how

🇺🇸 Visa to add tokenization and digital wallet capabilities to Fleet cards. These enhancements will enable issuers and FinTechs to integrate encrypted and tokenized card information into Apple Pay mobile wallets. The new features will be made generally available “soon,” per the article.

🇬🇧 FCA seeks views on removing the £100 contactless limit. This could benefit consumers, merchants, and economic growth in the UK. Making regulation less prescriptive would also give firms greater control and could promote innovative payment methods or fraud prevention solutions.

🇺🇸 Fed Data shows economics of interchange: 86% of fees fund rewards programs. Consumers use general purpose cards across all age and income levels. The data shows that more than 80% of consumers receive rewards offers from their credit cards, and 72% used these rewards in the 90 days leading.

🇷🇴 Click to Pay made available at PayU for all Mastercard and Visa cardholders. Customers and clients will be able to shop online faster and easier through the use of Click to Pay, a new one-click payment option, from any device. Read more

🇵🇹 MB Way is already the payment method most used by the Portuguese when shopping online. The service has over 4 million users, an increase of nearly 500,000. A recent study has also revealed that clothing, footwear, travel, event tickets, and books are the most frequently purchased items online.

🇦🇪 Mastercard and AEP team up to launch debit and prepaid cards in the UAE. The partnership aims to broaden the payment horizon in the region and increase security and convenience. Read the full article

🇰🇷 PXPay Plus 1st Taiwan e-wallet brand to launch in South Korea. Users can access 1.9 million merchants through payment platforms ZeroPay and ICB. Taiwanese travelers can pay by scanning the merchant’s QR code using the PXPay Plus app or their payment barcode.

REGTECH NEWS

🇬🇧 Revolut optimises security features for retail users. This move is a response to the recent rise in phone snatching across big cities and the continued threat of phishing scams, especially in the financial service sector. Learn more

🇦🇷 CNV defined the regulatory framework for crypto exchanges. The regulation aims to ensure transparency, stability, and user protection within the crypto ecosystem. PSAVs will need to register, comply with cybersecurity standards, prevent money laundering, and safeguard assets.

🇬🇧 Atoa Payments receives FCA approval. The approval will now enable the company to extend its payment services to larger businesses across the UK, including payment initiation, virtual account, and payment account information services.

🇺🇸 MoonPay gets Wisconsin Money Transmitter License. Wisconsin residents can enjoy full functionality to top up their MoonPay Balance, which lets users deposit funds to their account for zero MoonPay fee purchases. This type of License authorizes a company to provide money transmission services in a state.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Landmark Stablecoin Bill advances in senate banking committee bill with an 18-6 vote. The bipartisan legislation focuses on regulating privately issued, dollar-backed stablecoins, aiming to enable cheaper and faster global transactions. The bill is now on a fast track for full Senate approval.

🇦🇪 Crypto.com licenced in the UAE to offer derivatives. With the limited license, Crypto.com plans to introduce various derivatives products, such as futures, perpetual swap contracts, and CFDs, which will be initially available to eligible global institutions, with qualified investors to follow.

🇹🇷 Turkey introduces stricter crypto rules. The Capital Markets Board of Turkey has taken full regulatory control over crypto platforms, managing their licensing, operations, and compliance standards. Keep reading

PARTNERSHIPS

🇺🇸 Copper and Figment partner to expand institutional staking. The collaboration enables Copper’s clients to stake assets securely while earning rewards across multiple blockchain networks, including Ethereum (ETH), Solana (SOL), and Polkadot (DOT).

🇧🇷 XTransfer and Ouribank join forces to empower businesses and boost cross-border trade in Brazil. This collaboration aims to reduce the cost and processing time of cross-border payments for XTransfer’s clients, particularly benefiting Chinese and global traders with significant markets in Latin America.

DONEDEAL FUNDING NEWS

🇸🇰 Slovak Vestberry closed an investment of 2.2M EUR from Seed Starter České & Slovenské spořitelny, Venture to Future Fund and Zero One Hundred. The new investment will help Vestberry to further expand, especially into the American market.

🇸🇬 RedotPay secures $40 million series A funding to accelerate global crypto payment solutions. With the new funds, it plans to accelerate its product roadmap, enhance its payment ecosystem, reinforce regulatory compliance frameworks, and expand its licensing footprint across multiple jurisdictions.

🇬🇧 Curve lands £37M in funding led by a VC firm that invests in early and growth stage startups. The company said its latest funding will help it on the road to make a full-year profit and new product launches. Keep reading

🇺🇸 Tomo secures $20M in funding as it scales AI-powered mortgage solutions. The new funding will support Tomo’s expansion across the United States, including hiring loan officers and mortgage professionals for its offices in Detroit, Seattle, and New York.

🇺🇸 Disputed.ai raises $1.1m to revolutionise AI-powered chargeback management. The investment will enable the company to accelerate its mission of redefining chargeback management for large-scale merchants through AI-driven solutions.

M&A

🇮🇹 UniCredit secures ECB's approval for Commerzbank stake. ECB approval was expected given UniCredit's strong balance sheet and the banking supervisor's supportive stance on consolidation efforts. Read more

🇺🇸 EquiLend secures minority investment from The Bank of New York Mellon Corporation. BNY's investment represents a significant commitment to EquiLend and its suite of technology solutions. It will also advise the company on enabling further innovation and efficiency across the securities finance ecosystem.

🇺🇸 AvidXchange said to weigh sale after takeover interest. The company has been working with adviser Financial Technology Partners to consider options after being approached in recent months by potential buyers including private equity firms.

MOVERS AND SHAKERS

🇦🇺 Digital bank Up lands new CTO Meera Shanaaz Aneez. Her role as CTO includes overseeing Up’s technical strategy, ensuring the platform continues to scale, and delivering innovative solutions to enhance the banking experience for customers.

🇺🇸 Momnt has bolstered its leadership team. Ryan Brennan has joined as CBO, bringing over 20 years of experience. Cara Rivera has been promoted to COO, responsible for compliance, IT, security, and project management. Lindsay McAndrew has been promoted to CPO, with a background in product roles at Momnt and other companies.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()