Crypto Surge Drives Revolut to Record £1Bn Profit

Hey FinTech Fanatic!

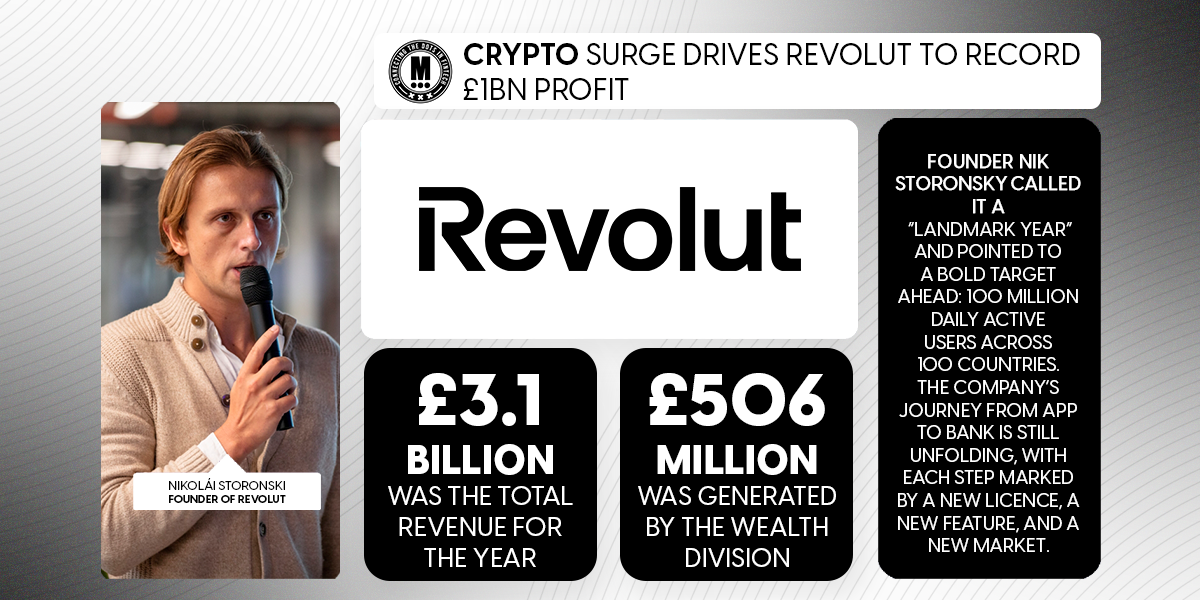

In a year marked by changing consumer habits and a revived interest in digital assets, Revolut posted pre-tax profits exceeding £1 billion for 2024, more than twice its result from the year before. Revenues climbed to £3.1 billion as the company onboarded 15 million new customers, bringing its global user base to 52.5 million.

Much of this growth was driven by a return to crypto trading, as Revolut’s wealth division brought in £506 million, that's about 4x what it earned the year before. The company also expanded its deposit base significantly, with customer balances increasing from £18 billion to £30 billion. Fee income from card transactions and growing interest on deposits remained core pillars.

Revolut’s long wait for a UK banking licence came to an end last summer. With restrictions still in place, it’s now laying the groundwork to offer mortgages and scale its lending products across its home market. Its loan book, which includes credit card and BNPL products, reached £979 million.

The subscription model also showed traction. Premium offerings now contribute £423 million in annual revenue, while Revolut Business accounts for about 15% of the top line. It’s a sign the company is pushing deeper into both consumer and corporate verticals.

Founder Nik Storonsky called it a “landmark year” and pointed to a bold target ahead: 100 million daily active users across 100 countries. The company’s journey from app to bank is still unfolding, with each step marked by a new licence, a new feature, and a new market.

Read more global FinTech industry updates below 👇 and I'll be back with more on Monday!

Cheers,

INSIGHTS

🇬🇧 UK firms secured a third of the top 10 European FinTech deals as funding fell by 26% in Q1.

FINTECH NEWS

🇧🇷 Fiserv to acquire Brazilian financing engine Money Money. Fiserv plans to expand the range of payment, management, and cash flow solutions Fiserv’s Clover offers Brazilian small to medium-sized businesses. Money Money’s financing engine is connected to the receivables registry infrastructure regulated by the Central Bank of Brazil.

🇬🇧 Revolut profits surge above £1bn on crypto trading boom. In an annual report published on Thursday, Revolut said its pre-tax profits had increased from £438mn a year earlier. Revenues rose to £3.1bn, from £1.8bn. A surge in crypto trading also helped the FinTech last year.

PAYMENTS NEWS

🇺🇸 How to streamline banks’ payments as pathways proliferate. Payments orchestration centralizes traffic in a bank and sends it down the best path. As real-time payments and cross-border payments increase, setting up hubs will help banks keep up. Read the full article by Erich Litch from ACI Worldwide to learn more.

🇺🇸 eBay and Klarna deepen global strategic partnership to empower flexible shopping in the U.S. The expanded partnership reflects eBay’s continued investment in bringing more choice, flexibility, and control to buyers while enhancing affordability across key categories.

🇨🇦 VoPay launches embedded cross-border solution – A “Shopify" for Global Payments. Built for software platforms and financial institutions, the white-label technology enables organizations to move money globally with full transparency, compliance, and real-time FX, without building their cross-border infrastructure.

🇺🇸 RTP® and FedNow transaction limit increase fuel instant payments surge. 84% of US banks say the new $10 million RTP® limit boosts their attractiveness, and 84% believe raising FedNow’s $500,000 cap will have the same effect. The results suggest larger transaction limits are helping to boost instant payment demand.

🇧🇷 Pix by Proximity payment method has reached 1 million users, according to the Central Bank of Brazil. The process enables users to make instant payments by simply tapping their smartphones or other NFC-enabled devices against a payment terminal, without opening a banking app or logging in.

OPEN BANKING

🇸🇦 American Express Saudi Arabia and Tarabut pioneer a first-of-its-kind open banking experience to expand credit access. By partnering with Tarabut, AmEx Saudi Arabia is contributing to the Kingdom’s broader objectives of financial inclusion, while also offering a faster, more seamless, and secure credit journey.

DIGITAL BANKING NEWS

🇸🇬 Aspire partners with Episode Six to launch corporate card offering to SMBs in Hong Kong and Singapore. This collaboration strengthens Aspire’s financial solutions suite, providing its 50,000 SMB customers with powerful tools to optimize spending, improve security, and seamlessly manage international payments.

🇬🇧 Zopa Bank doubles full-year profit to £34.2 million. Its success has allowed the bank to reinvest profits at scale, fuelling a flywheel of sustained growth and innovation. By offering even greater customer value combined with seamless experiences, it drove deeper customer engagement and increased product adoption.

🇬🇧 Tandem posts 40% profit growth, underlining its status as the UK’s Greener Digital Bank. Tandem is now strongly positioned as one of the UK’s leading FinTechs, with award-winning savings products that offer consumers great rates designed to help homeowners and car buyers transition to a greener lifestyle.

🇬🇧 Revolut introduces Karma, a points-based system that tracks staff behavior and impacts bonuses, creating a feedback loop to encourage good practices. Meanwhile, Irish users have deposited nearly €1 billion in savings, with Revolut’s loan book in Ireland growing 54% in 2024 compared to 2023.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Brale and Spark have partnered to enable the issuance and transfer of stablecoins natively on the Bitcoin network. This collaboration integrates Brale's fiat-backed stablecoin issuance platform with Spark's infrastructure, allowing developers to create and manage stablecoins on Bitcoin through a single API.

🇹🇭 KuCoin launches SEC-licensed exchange in Thailand with ERX, offering secure crypto services tailored for local users. This new platform combines KuCoin’s global trading experience with local operations. It has a financial base with 351 million baht in paid-up capital.

🇺🇸 Coinbase waives fees on PayPal’s stablecoin in crypto payments push. This allows users to redeem the token directly for U.S. dollars. Coinbase will allow merchants on its network to settle directly in PYUSD instead of traditional financial rails.

🇺🇸 Ether.fi pivots to become a neobank and rolls out cash cards in the U.S. The ether.fi app will give users the experience of a traditional FinTech app, allowing them to spend, save, and earn money through linked crypto features, including restaking. The app will allow bill payments and payroll services using fiat money.

PARTNERSHIPS

🇬🇧 Standard Chartered joins the Temenos partner programme. Through the integration, financial institutions on the Temenos platform will benefit from a faster go-to-market in accessing StanChart’s extensive currency offering, allowing them to price services across more than 130 currencies and 5,000 currency pairs while managing exposure risks to FX market volatility.

🇬🇧 WooCommerce partners with Affirm to expand BNPL checkout payment options. With the move, UK-based merchants using the WooCommerce platform will be able to integrate Affirm and offer their customers a wider range of customisable payment options at checkout.

🇬🇧 RiseUp partners with Yapily to bridge the gap between financial insights and payments, offering financial institutions and their customers a powerful tool to achieve their financial goals. RiseUp’s partners can now turn these strategies into impact in the form of payments.

🇬🇧 PayPoint partners with Uber and Deliveroo to expand digital voucher services for retailers. The new partnerships allow retail partners to maximise opportunities for spontaneous purchases, attracting new customers and offering new gifting options with a wider range of digital gift card services.

DONEDEAL FUNDING NEWS

🇲🇳 FinTech LendMN raises USD 20 million to drive tech-led financial inclusion for MSMEs in Mongolia. For Lendable, investing in the Mongolian FinTech represents a strategic move and aligns with the company’s overall mission of bridging the financial inclusion gap by boosting accessible and inclusive financial services for all.

🇺🇸 WealthTech custodian Altruist secures $152m Series F to scale RIA platform. Its solution enables advisors to build and manage client portfolios more efficiently, with capabilities including fractional share trading, automated rebalancing, and performance tracking via a modern mobile app.

🌍 BitradeX raises $15.9m Series A. These hubs will allow developers and institutions to access and customize the ARK model through open APIs under a “Strategy-as-a-Service” framework, opening the door to fully modular and programmable crypto trading systems.

🇺🇸 US climate FinTech GreenFi launches with $17m seed funding. The capital injection will support the rollout of new financial products in "the coming months", including climate-conscious credit cards, green loans, expanded impact investment options, and higher-yield savings accounts.

🇺🇸 Embedded FinTech Alternative Payments raises $ 22 M. The company aims to utilize this capital to enhance its platform, offering features such as automated invoicing, customer financing options, and improved payment security. Keep reading

🌍 European crypto firm RockawayX closes $125m fund amid renewed interest in digital assets. The firm plans to invest around 50% of its capital into blockchain startups in Europe. Regulatory changes in Europe and friendly policies pursued by Donald Trump have provided respite for those interested in the asset class.

🌎 Western Union: migration slowdown reduces growth of remittances business. The provider of cross-border, cross-currency money movement, payments, and digital financial services saw its volume of Consumer Money Transfer transactions in the Americas decline by 2% in the first quarter, while its CMT business in the rest of the world, excluding Iraq, rose by 10%.

MOVERS AND SHAKERS

🇧🇪 Mastercard appoints Kelly Devine as President, Europe. Devine will report to Ling Hai, President, APEMEA, and will join Mastercard’s Management Committee, effective 1 September 2025. She will be based in the company’s European Headquarters in Waterloo, Belgium.

🇺🇸 Payments processor Stripe to open Atlanta office, seeks state banking charter. The company plans to open an office in Old Fourth Ward this fall that could hold dozens of employees, and it has applied for a special-purpose state banking charter.

🌍 Worldline makes senior hires. The company welcomes three new leaders: Candice Dillon, Joachim Goyvaerts, and Tim Minall. With their exceptional leadership expertise, the fresh energy, and the cultural diversity they bring, the company is raising the bar to make Worldline robust, efficient, and offensive in supporting merchants and financial institutions in addressing their payment needs with the best possible customer experience.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()