Crypto Exchange Kraken Is in Talks for Pre-IPO Fund Raising Round

Hey FinTech Fanatic!

Starting your week with this newsletter is probably the best decision you could make 😉

You can also make my day when you decide to leave a review or recommendation on my LinkedIn page if you truly enjoy the newsletter.

Your feedback would mean a lot to me and would greatly help in reaching more people in the FinTech industry with my daily updates.

Thank you in advance, and enjoy your day!

Cheers,

#FINTECHREPORT

📊 There are now 121 FinTech unicorns 🦄 in Europe. Only 2 FinTech startups achieved unicorn status in 2023, compared with 41 in 2021. 7 of them have lost their unicorn status. Find out more

INSIGHTS

🇫🇷 François Hollande: FinTech investment is key. The former French President, François Hollande, gave a keynote session at Money 20/20 last week, speaking on the current state of French technology investments and about how he turned France into a FinTech hub.

FINTECH NEWS

🇲🇾 Global payments firm Airwallex shared its commitment to expanding its Malaysian operations, with significant inroads already made, including securing licenses from Bank Negara Malaysia. The company’s growing team in Malaysia is a clear indicator of its dedication to further establishing a presence in the region.

🇬🇧 UK-based payments solutions provider allpay Limited has announced a new partnership with issuer processing expert Enfuce. This collaboration aims to integrate secure cloud-based card payment solutions into the heart of public sector services, including local UK councils, impacting communities across the UK.

🇰🇪 Mastercard has announced a US$2.04 million investment in partnership with African influencer marketing platform Wowzi and Masria Digital Payments (MDP), aiming to transform the financial management landscape for content creators through innovative digital card solutions.

🇨🇦 VoPay, in partnership with Avesdo, is set to modernize the pre-sale property market by introducing a fully embedded digital payment solution within Avesdo’s Transaction Management System (TMS). This partnership aims to eliminate the traditional inefficiencies that plague the home-buying process.

🇳🇬 Nigerian FinTech startups could spend over $1 million on KYC address verification. Specifically, OPay might pay ₦563 million ($376,000), PalmPay around ₦500 million ($333,883), and Moniepoint ₦304 million ($196,000). These costs could rise as some FinTech executives have not disclosed their verification expenses.

🇬🇧 Former Barclays CPO Megan Caywood Cooper launches AI wealthtech firm, Caywood. Cooper described the startup as a wealthtech platform and product that uses AI to provide personalised financial guidance in real time. Read on

PAYMENTS NEWS

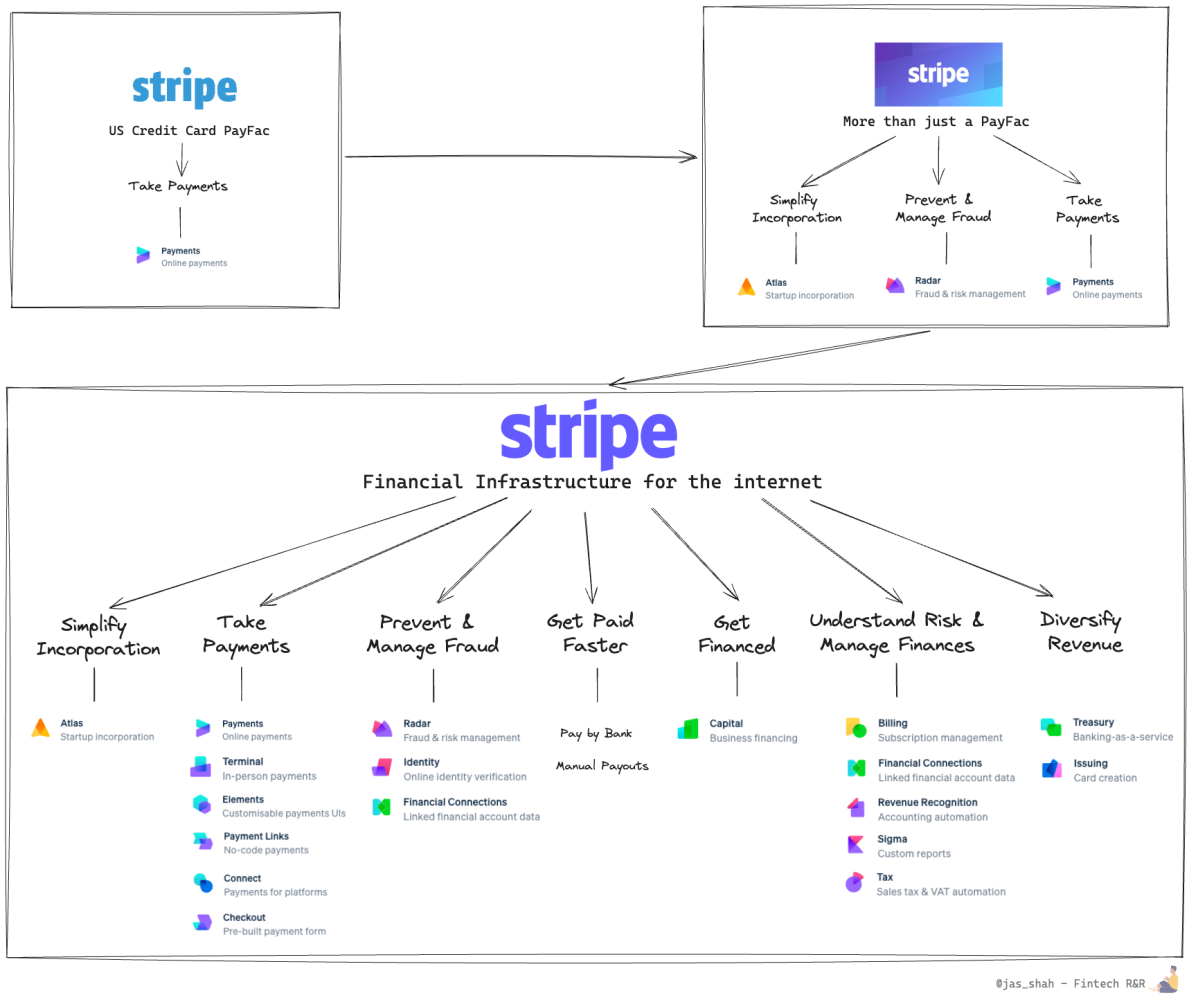

🇺🇸 Stripe, more than a PayFac. Founded in 2010 by Patrick and John Collison, Stripe has transformed from a basic payments facilitator into a multifaceted financial infrastructure platform, demonstrating strategic product development and market adaptation. Read this deep dive article by Jas Shah

🇬🇧 Sainsbury's agrees BNPL deal with Klarna to offer its payment methods at the online checkouts of three iconic brands: Argos, Habitat, and TU. Shoppers will be able to choose from Klarna's payment options: Pay Now, Pay Later in 30 days, or Pay in 3 equal installments.

🇸🇦 Saudi Arabia’s central bank has joined the Bank for International Settlements’ (BIS) cross-border central bank digital currency (CBDC) project, mBridge, as a participant, after being an observing member.

🇺🇸 BNPL Company Zip Co. announces WNBA superstar Kelsey Plum as First Brand Ambassador. Together, they will spotlight Zip's commitment to providing accessible payment options that open doors to new experiences, events, and possibilities for customers across all economic backgrounds.

🇺🇸 Till Payments – a subsidiary of Nuvei, partnered with BigCommerce to elevate online business payments. The partnership offers BigCommerce customers a feature-rich eCommerce payment solution, enabling seamless payment experiences for both online and in-store merchants through a single processing partner.

🇬🇧 A UK tribunal has ruled that interchange fee lawsuits against Visa and Mastercard can proceed. The two US giants are being sued on behalf of hundreds of merchants over the multilateral interchange fees charged for accepting card payments. Read more

Debt markets are fueling Buy Now, Pay Later resurgence. Companies offering buy now, pay later services like PayPal and Klarna are selling debt backed by consumer loans, as they find new ways to fund their business in a higher-rate environment.

🇺🇸 Utah-based healthcare payments software company Waystar envisions $20B healthcare payments market. The software provider is attempting to build its software business by simplifying a complex web of payments for healthcare providers and patients.

🇲🇾 Malaysians will soon be able to make QR payments in South Korea using the Paybooc app, thanks to a collaboration between Korea’s BC Card and Malaysia’s PayNet. Starting this month (June), the first phase of this collaboration enables South Koreans to make QR payments in Malaysia using the BC Card e-wallet app.

🇵🇰 1LINK, in partnership with Raast, an initiative by the State Bank of Pakistan (SBP), and 13 merchant aggregators, has launched the 1GO Raast Person to Merchant (P2M) service. The 1GO Raast P2M service aims to transform the landscape of interoperable P2M payment services in Pakistan. The service includes a range of features such as Dynamic QR Code, Static QR Code, Request to Payment Now & Later, and Bulk Request to Payment Later Processing.

🇲🇳 Khan Bank partners with Alipay+ for cross-border mobile payments in Mongolia, integrating 12 international e-wallets from eight countries and regions for seamless digital transactions. Read more

OPEN BANKING NEWS

🇺🇸 Mastercard announced the integration of Deposit Switch and Bill Pay Switch with Mastercard’s Open Banking platform, enabling consumers to automatically switch their direct deposits and update their recurring bill payments, both when opening a digital account or when updating information on an existing account. The solutions will be delivered in partnership with Atomic.

🇬🇧 Moneyhub, a data and payments platform, has announced the introduction of its account verification service. Powered by Open Banking, Moneyhub Account Verification enables better payment security utilising bank level security controls (including PSD2 SCA) and biometrics.

REGTECH NEWS

🇬🇧 Global full-cycle verification platform Sumsub has announced that it entered the Mastercard Engage Partner Program to mitigate fraudulent activities. Through this, the company aims to secure customers’ onboarding and ongoing compliance journey.

DIGITAL BANKING NEWS

🇺🇸 The FDIC has issued a new warning to consumers about using neobanks and FinTech companies for banking. Specifically referring to third-party banking apps and nonbank companies that offer banking services, the FDIC says “you may want to be particularly careful about where you place your funds, especially money you rely on to meet your regular day-to-day living expenses.”

This warning comes as a FinTech banking crisis has left millions of Americans unable to access their funds due to the shutdown of a software provider that acted as a bridge between banking services and real banks. Click here for a deeper dive

🇺🇸 U.S. Bank and Greenlight partner to bring financial empowerment to families. Eligible U.S. Bank clients will now have complimentary access to Greenlight’s award-winning debit card and money app, helping more families teach their kids and teens critical financial skills.

🇧🇷 SoftBank-backed Brazilian online lender Inter & Co is hoping to replicate its home market success in the US, where it is targeting visitors from Latin America's largest country in two of Florida's biggest cities, the firm's chief executive said.

🇿🇦 TymeBank expands digital footprint as South Africa’s online-only lender. This year, with operations also running in the Philippines and Vietnam under the Tyme Group umbrella, the challenger bank hopes to raise at least $100mn to expand further, says CEO.

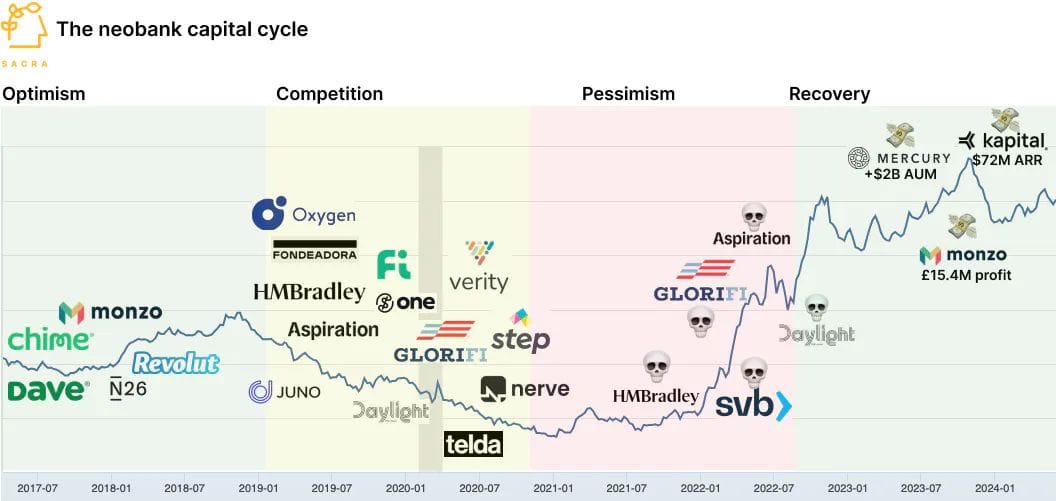

🏦 The higher interest rate environment of the last few years forced underperforming neobanks to shut down, but the top players are doing better than ever. Neobanks that weathered the post-ZIRP storm are growing 100% YoY, getting profitable, and building financial super apps.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Kraken, one the oldest cryptocurrency exchanges, is considering raising a final funding round ahead of a possible initial public offering after receiving inquiries from potential investors during the current digital-asset market rally, according to people familiar with the matter.

📈 Binance marks 200m global users in spite of leadership change, fines and setbacks. At the end of 2023, the exchange said it had added 40 million users to bring its total to 170 million, which means that it has gained about 30 million in the first half of this year.

🇳🇬 100+ Federal Prosecutors Demand Binance Exec Gambaryan’s Freedom in Nigeria. Around 100 former federal prosecutors and agents have united to send a letter to Secretary of State Tony Blinken, emphasizing the urgency of addressing Gambaryan’s situation and also highlighting Gambaryan’s contributions to significant investigations.

DONEDEAL FUNDING NEWS

🇳🇱 Amsterdam’s FinTech innovator Prêts raises €1M to boost access to sustainable home technologies. The company focuses on simplifying the financing process, offering embedded financial solutions, and promoting healthy household finances.

🇨🇭 Kaspar&, a Zurich, Switzerland-based software and wealth management company, raised CHF 2.5M in Seed funding. The company entered into a strategic partnership with Avaloq, a leader in wealth management technology based in Zurich. Click here to learn more

M&A

🇬🇧 Payhawk, a $1 billion corporate card startup, plans M&A shopping spree after 86% sales growth. Payhawk said it is looking to acquire a company or companies at the series A stage of their development, referring to early-stage startups that have already raised a significant round of funding.

MOVERS & SHAKERS

🇺🇸 Curve strengthens US leadership by appointing Nancy Yaffa as USA CEO and Reeta K. Holmes as Board Member. Nancy brings the calibre and credentials to lead Curve’s ambitious next phase of growth, and Reeta joins Curve as a Board Member, bringing over 25 years of senior investment experience to the team. Read more

🇺🇸 Elon Musk is hiring FinTech engineers at his new AI startup. A recent recruit back in February was Nathan Ziebart; he spent the last six years at FinTech unicorn Robinhood, where he was promoted three times from senior engineer up to principal. Prior to that, he was a tech lead for infrastructure at Palantir Technologies.

🇨🇦 FinTech firm Adyen has opened a new office in Toronto to anchor its Canadian operations and appointed Ilona Fagyas as Head of Sales. At Adyen, Ilona will focus on expanding the company's footprint in Canada and enhancing its commerce business.

🇺🇸 US-based digital banking solutions provider Alkami Technology has appointed industry veteran Gagan Kanjlia as its new chief product officer (CPO). Speaking on his decision to join Alkami, Kanjlia explains that the firm is “uniquely positioned to help regional and community financial institutions compete against megabanks’ digital capabilities”.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()