Crypto.com Joins Deutsche Bank in Banking Milestone + Black or White? Pick Your Card

Hey FinTech Fanatic!

Deutsche Bank has stepped forward to provide corporate banking services for Crypto.com across Singapore, Australia, and Hong Kong, establishing a significant banking partnership in the region. This collaboration aims to enhance operational efficiency and create a robust banking foundation for Crypto.com's continued expansion.

Karl Mohan, General Manager APAC and MEA and Global Head of Banking Partnerships for Crypto.com emphasized: "This is a momentous relationship for us and further highlights our commitment to security and compliance."

While Kriti Jain, Head of New Economy Corporate Coverage for APAC & Cash Sales for APAC & MEA for Deutsche Bank added: "Our strong track record with serving global new economy clients, combined with our commitment to innovation and broad global network position us strongly to help Crypto.com with its long-term growth ambitions."

Talking about milestones, Revolut is celebrating its 50 million customers worldwide with exclusive limited edition card designs. The special 50M card will be available in both Black and White versions, distributed on a first-come, first-served basis while supplies last.

And I want to know... Black or White? - Which special edition of the Revolut card design would you choose? Share your pick in the comments!

Read more global FinTech industry updates below 👇 and I'll be back tomorrow!

Cheers,

P.S. 👉 Follow Marcel van Oost - The Card Collection for more cool Card Designs!

#FINTECHREPORT

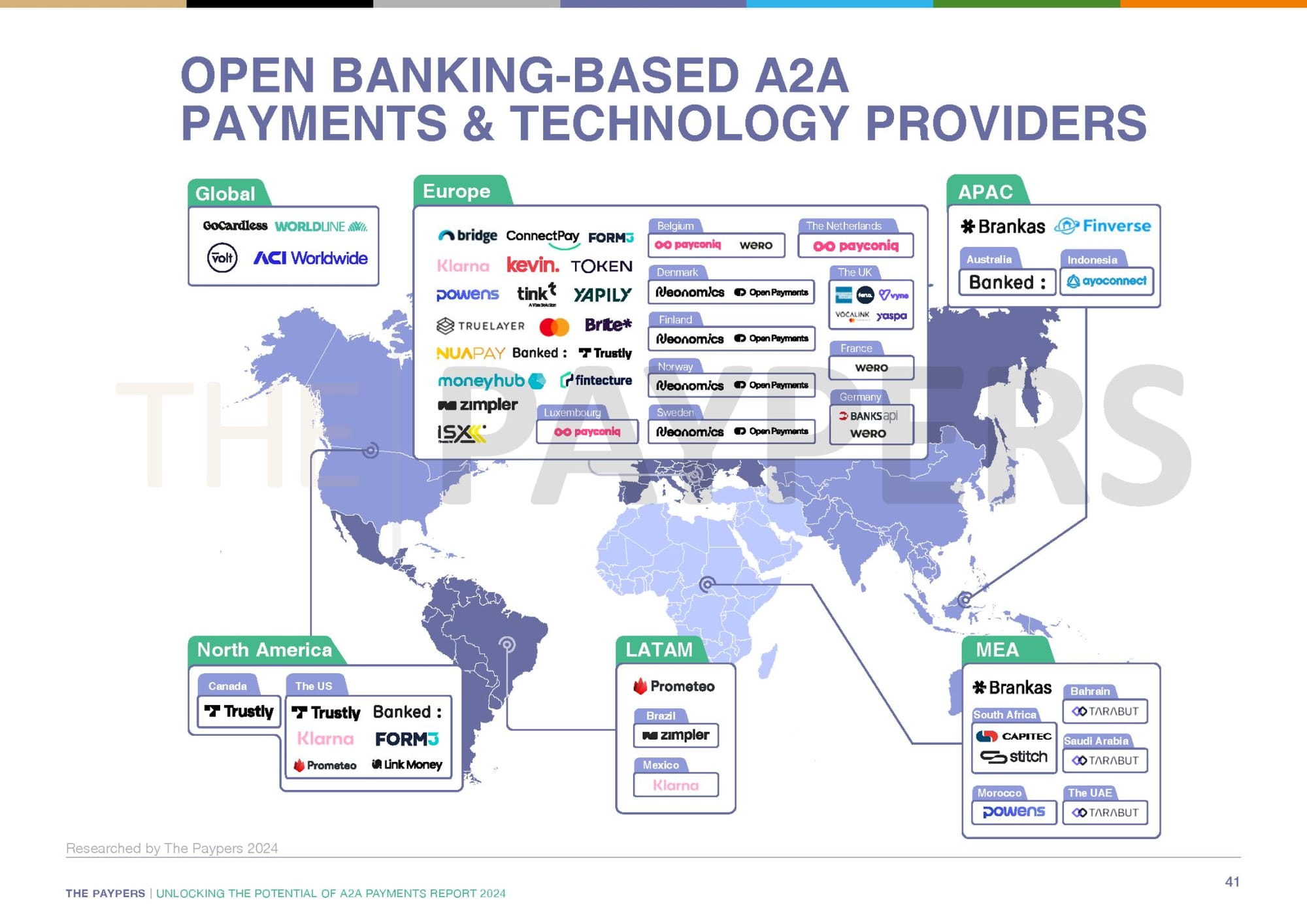

📊 The Paypers' global overview of A2A Payment Providers 👇

Any missing in this overview?

FINTECH NEWS

🇳🇬 CBN fines Moniepoint and OPay ₦1 Billion each as Nigeria tightens FinTech regulation. The penalties followed a routine CBN audit of the FinTech sector, which revealed compliance issues. According to two sources familiar with the process, these regulatory checks are a standard procedure for banks and financial institutions under CBN oversight.

🇪🇺 Scalapay boosts BNPL fraud prevention with Trustfull. The collaboration will strengthen fraud prevention operations across Scalapay’s extensive network of European markets, leveraging Trustfull’s platform to proactively identify fraudsters and prevent first payment defaults.

🇬🇧 Warwick Business School launches FinTech Innovation Lab following £4.2m funding. The new facility will advance research and innovation in the UK’s FinTech and AI sectors. It is open to visiting academics, students and businesses and is fully equipped with high-specification computers, digital screens, strategic AI tools, and more.

🇦🇷 MercadoLibre races into FinTech turf war with rival Nubank. The companies’ leaders, friendly rivals from the startup scene, downplay competition. However, MercadoLibre's vast user base for shopping and transactions enables data-driven offerings like loans and insurance, placing it in direct competition with Nubank.

PAYMENTS NEWS

🇬🇧 Airwallex celebrates end of Formula 1 season with ‘podium finish’ for brand and partnership metrics. The leading global payments and financial platform for modern businesses, recently announced the impact of its first year of partnership with the McLaren Racing Formula 1 team, to demonstrate that winning off-track is a prerequisite for winning on-track. Discover more

🇦🇪 Apple's Tap to Pay on iPhone is now live in the UAE. Retailers in the UAE can now accept these contactless payments using an iPhone after Adyen, and the UAE payment platforms Magnati and Network International brought out the Tap to Pay feature. Merchants can process payments from cards, Apple Pay, and digital wallets.

🇳🇴 Vipps MobilePay launches the world’s first alternative to Apple Pay on iPhone. From now on, Vipps users in Norway can tap their phones to pay in stores using Vipps. With this launch, Vipps MobilePay becomes the first company globally to offer a solution competing with Apple Pay on iPhone.

🇦🇪 Worldline empowers global online businesses to succeed in the strategically important United Arab Emirates. Worldline has joined forces with Telr to launch an advanced e-commerce payment solution aimed to simplify online transactions and enable global businesses to access the dynamic market, reinforcing the UAE's role as a strategic hub for commerce in the Middle East and Africa.

🇮🇱 Nayax enables Discover® Global Network cardholders to use their preferred payment method across EMEA. This collaboration boosts growth for Nayax and Discover Global Network, enabling Nayax customers to serve 345 million Discover Global Network cardholders and access automated payment devices worldwide.

🇬🇧 SumUp to offer cash advance product, available in several European countries including Germany, France, Ireland, and the Netherlands. The service allows merchants to tap into funding of up to £20,000. Typically, the funds are available in just two days.

🇺🇸 Lithic announces Commercial Revolving Credit API, bringing enhanced flexibility to business credit card programs. The new offering enables card programs to quickly launch and scale commercial credit card programs with unmatched flexibility and control.

🇺🇸 Ibanera leverages FIS Innovation to launch comprehensive prepaid card program, supported by Visa’s global network, offering users the flexibility to make payments wherever Visa is accepted, ensuring both convenience and security. Keep reading

Asian cross-border payment framework to launch in '2 or 3 years.' A payment framework that enables immediate money transfer between five Asian nations is expected to launch in two to three years, according to a senior official at the central bank in Thailand, one of the participating countries.

OPEN BANKING NEWS

🇸🇪 Kameo chooses Neonomics' NelloPay for Open Banking services. By connecting Kameo users to their bank accounts, Neonomics’ Nello Pay will enable faster and more efficient payments that reduce costs while optimising conversion. Read more

REGTECH NEWS

🇰🇿 Kaspi-Led FinTech lending draws Kazakh watchdog’s scrutiny. Kazakhstan's booming online marketplaces are thriving, partly due to a popular financing offer now under scrutiny over inflation and rising consumer debt. This short-term financing is a profitable revenue source for lenders like Kaspi.kz and Halyk Savings Bank. Explore more

DIGITAL BANKING NEWS

🇺🇸 Marygold launches newest feature of mobile FinTech banking app—Cash Management Account with up To 6% return. The launch of this new feature represents an important step in Marygold’s mission to streamline and organize clients’ financial lives, in one user-friendly mobile app.

🇺🇸 BofA’s CashPro App hits $1 trillion milestone, spotlighting treasury’s digital evolution. By the end of 2024, Bank of America expects its corporate clients to approve over $1 trillion in payments on its CashPro App, they said. The announcement shows businesses embracing secure, streamlined digital finance solutions.

🇬🇧 HSBC raised fraud alarm leading to collapse of FinTech Stenn, whose UK units, valued at $900 million in 2022, entered administration on Dec. 4 after HSBC flagged potential transaction irregularities, sources said. Continue reading

🇬🇧 Monzo takes its “mission into Europe in 2025.” In Monzo’s 2024 annual report TS Anil, Monzo CEO, said: “We believe every part of the world needs a Monzo so we’re focused on expanding our offering, building strategies to disrupt the US with a first-class leadership team in place."

🇬🇧 Monzo’s power players: the leadership team behind the neobank. Monzo serves over 10 million customers and holds £11.2bn in deposits. Starting as a prepaid card in 2015, it has expanded into stocks, buy-now-pay-later, and pensions. Click to explore the visionaries driving Monzo’s growth, its cultural evolution, and its global expansion efforts!

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 Crypto.com is teaming up with Deutsche Bank in banking milestone. Deutsche Bank will provide corporate banking services for Crypto. com in Singapore, Australia and Hong Kong, with a commitment to working closely to provide additional banking support and country coverage in Europe and the Middle East as the relationship progresses.

Binance still to choose location for global headquarters, CEO Teng says. Binance has long said a decision on a global HQ would come soon. Revealing the location of a head office is seen as part of its push to improve transparency in the wake of criminal charges against its former CEO Changpeng Zhao.

🇦🇪 First Abu Dhabi Bank partners tokenization Firm Libre for blockchain collateralized lending. The collaboration aims to transform collateralized lending by using real-world asset (RWA) tokens as collateral. The MoU sets the stage for FAB to pilot a credit line for stablecoin lending secured by these tokenized assets.

PARTNERSHIPS

🇺🇸 Amazon is bringing Intuit QuickBooks software to its millions of third-party sellers. “Together with Intuit, we’re working to equip our selling partners with additional financial tools and access to capital to help them scale efficiently,” said Dharmesh Mehta, Amazon’s VP of worldwide selling partner services.

🇬🇧 118 118 Money partners with D•One for open banking services. 118 118 Money, specializing in loans and credit cards for the near-prime market, will use open banking data from D•One to assess borrower affordability on its site and through the ClearScore marketplace.

DONEDEAL FUNDING NEWS

🇳🇱 Amsterdam’s Next Sense secures €11.5M to decarbonise real estate. The funding will help the company enhance its platform, which combines real-time monitoring, AI-driven controls, and advanced building simulations to optimise energy use, meet ESG standards, and improve occupant experiences.

🇺🇸 Curql Fund II makes history, surpasses $200 million in investment commitments. Nick Evens, President and CEO of Curql Collective said, "Crossing $200 million shows the collective impact of our credit unions. But we’re not done yet. The investment window is still open for those ready to join; it's not too late."

M&A

🇺🇸 Gen extends its financial wellness offerings with the acquisition of MoneyLion for $82.00 per share in cash payable at closing, representing a cash value of approximately $𝟭 𝗯𝗶𝗹𝗹𝗶𝗼𝗻. With the addition of MoneyLion, Gen builds upon its mission, now empowering people to grow, manage, and secure their digital and financial lives.

🇺🇸 LexisNexis Risk Solutions announces definitive agreement to acquire IDVerse. The acquisition will integrate IDVerse's capabilities across solutions and will enhance customer readiness for future fraud threats through advanced AI-powered solutions. Read on

MOVERS & SHAKERS

🇬🇧 Curve appoints ethical consumer lending experts Robert Pasco and Ash Woolf to drive rorward credit innovation. Their arrival brings extensive expertise in credit innovation and risk management to Curve, strengthening the company’s mission to transform credit accessibility and pioneer cutting-edge products across the UK and Europe.

🇬🇧 PPRO names Nicole Asling as new SVP of Commercial Europe. Nicole joins PPRO to lead the European Commercial team, where she will focus on forging partnerships that fuel growth and innovation across the region.

🇲🇽 Kueski welcomes Andreas Waldmann as Chief Marketing Officer. In this role, Waldmann will lead strategic marketing initiatives, reinforcing market leadership, unifying brand identity, and leveraging his expertise in the Mexican market to drive product adoption.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()