Crypto Clash: Binance's Compliance Chiefs Held in Nigeria

Hey FinTech Fanatic,

Tigran Gambaryan, who leads the financial-crime compliance team at Binance, took a trip to Abuja, Nigeria, to address a serious accusation. The Nigerian government had accused the world's leading cryptocurrency exchange, Binance, of negatively impacting the national currency.

Tigran, an American and former IRS special agent, thought he was heading out for a straightforward business trip, leaving his family behind in Georgia with just a small suitcase in hand.

However, things didn't go as planned.

Nigerian officials detained him along with his colleague, Nadeem Anjarwalla, a British-Kenyan who oversees Binance's operations in Africa.

Despite being held in a guarded location, they've not been formally charged with any wrongdoing. This situation unfolded after they were officially invited to Nigeria for discussions, but there's been a lack of public communication from the government regarding their detention.

I highly recommend reading this Wired article for more info and the complete story. And of course, I'll keep you posted about any updates.

Enjoy more FinTech industry updates below, and I'll be back in your inbox tomorrow!

Cheers,

#FINTECHREPORT

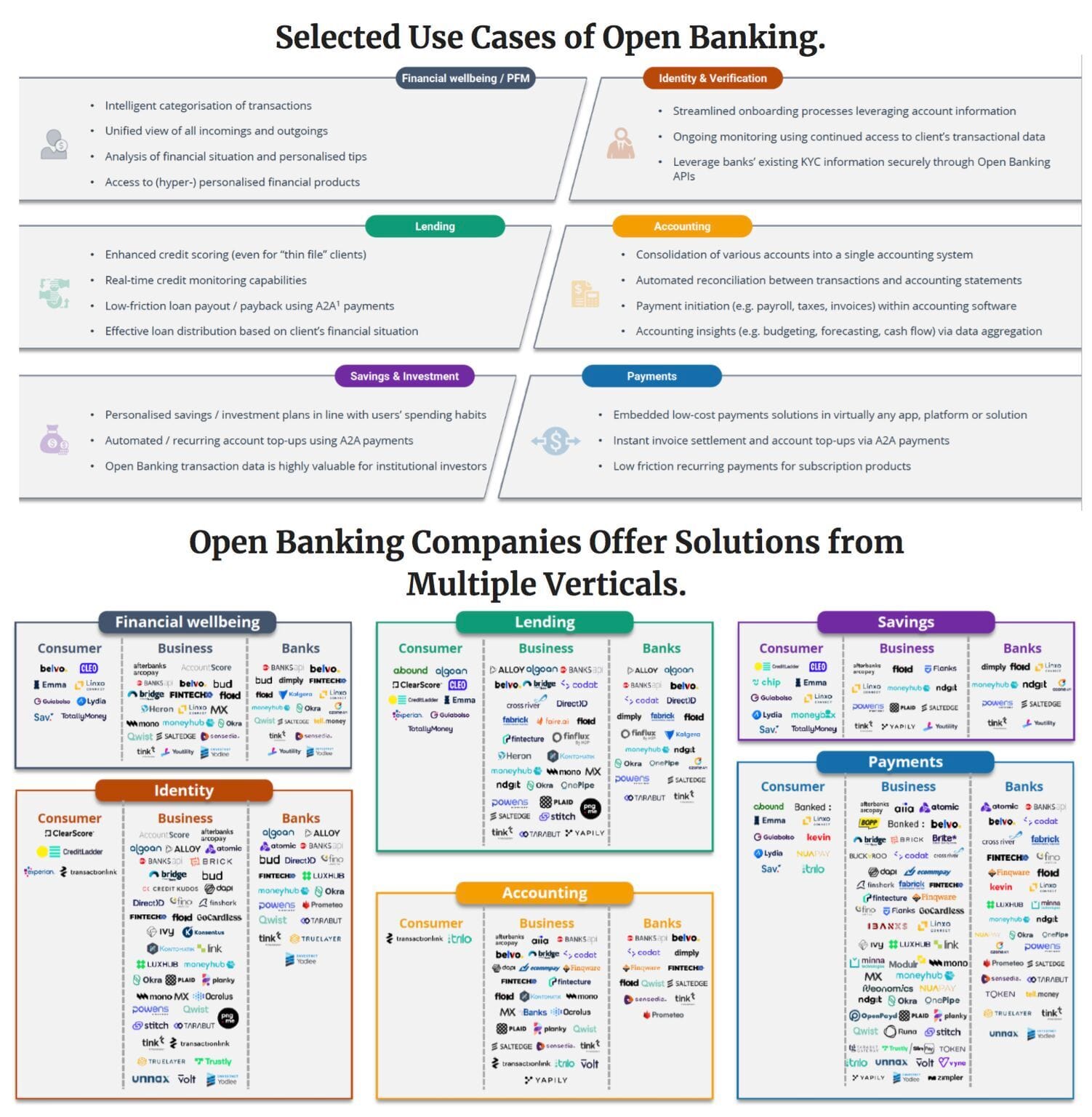

Open Banking FinTechs offer solutions from multiple verticals to various end-user types:

FINTECH NEWS

🇸🇪 Swedish payments group Klarna must pay a fine of 7.5 million crowns ($733,324) for violating the EU's GDPR by not providing sufficient information to its users, a Swedish court of appeal ruled on Monday. The court found Klarna guilty of insufficiently informing users about their data storage practices, stating that the information provided was unclear or hard to access.

🇬🇧 WealthOS, the cloud-native operating system for digital wealth management products, has launched its new solutionfor providers of Self-Invested Personal Pension accounts (SIPPs) in the U.K. Its technology delivers immediate end-to-end benefits from an operating model that is 40% cheaper to run than existing systems and enables three times faster product innovation.

🇧🇷 Banco do Brasil is to work with German firm Giesecke+Devrient (G+D) to test offline payments as part of pilot trials of its central banking digital currency, Drex. The tests will explore payment use cases using the Brazilian digital currencyin situations where there is no internet connection or electricity grid.

PAYMENTS NEWS

ACI Worldwide and comforte AG Pave the Way for Payment Modernization with PCI DSS v4.0 Compliance. Under this partnership, ACI will use comforte’s data-centric security solutions, which ACI has rigorously tested to be compatible with ACI’s solutions. Read the full piece here

🇬🇧 Hotel guest experience management platform Eleanor chooses Mangopay to provide fully embedded payments solution. Eleanor’s new integration with Mangopay elevates its suite of apps, providing its clients with a frictionless, secure and compliant way of handling payments from within the platform.

🇦🇺 The head of Australia’s Commonwealth Bank says Apple’s in-country payments operations need greater oversight. “They should be subjected to a lot more scrutiny in Australia,” said Matt Comyn, whose comments at a conference in Sydney Monday March 11, were reported by Bloomberg News.

Tranglo turns to Inpay for Instant Sepa payouts. Starting with 12 key SEPA countries at launch, the partnership provides Tranglo with the technical and regulatory infrastructure to scale its cross-border payouts offering across a further 24 European countries through a single integration.

🇳🇱 iDEAL has launched new functionalities in collaboration with Rabobank. During a trial period, members of the bank's online Rabo-Labs community will be the first to create an iDEAL profile and enjoy easier payments at selected online stores. Following the pilot's conclusion in April, the new iDEAL profile will be available to customers of all banks affiliated with iDEAL.

OPEN BANKING NEWS

🇲🇽 Prometeo launches its "account-to-account payments" product for Mexico, a major advancement in FinTech. Integrated into clients' digital platforms, it enables real-time bank transfers, bypassing intermediaries with a single API integration, revolutionizing payment reception for businesses.

REGTECH NEWS

ID fraud may account for 50% of all bank-reported fraud by 2025. Analysis of the UK’s largest database of syndicated risk intelligence shows ID fraud is the top fraud type reported by banks and other financial service providers, accounting for 45% of all adverse contributions made in 2023. This could reach 50% by the end of the year.

DIGITAL BANKING NEWS

🇬🇧 Cashplus: Digital challenger to rebrand as Zempler Bank this summer to reflect its new range of digital products and authorisation as a bank. The bank said the new name reflected its commitment “to providing exemplary levels of service”. Read full article

🇬🇧 Bristol, U.K.-based ClearBank has applied for a license to expand its services to Europe in search of growth. ClearBank officials are hopeful for approval from the European Central Bank in the second quarter, Paul Staples, group head of embedded banking, told Bank Automation News.

Zeebu, the Web3 Neobank tailor-made for the telecom carrier industry, announced processing over $1 billion in invoice settlement on its platform. The platform's journey to this milestone has been marked by relentless innovation at the crossroads of blockchain technology and financial services, redefining the settlement processes in the telecom sector.

🇺🇸 US neobank Oxygen switches focus from banking to health in new strategy. In a statement on the company’s website, Oxygen says it officially commenced the “account closure process” on 8 March, with both consumers and business users being informed that their accounts will be closed on 29 March.

🇬🇧 Core banking engine SaaScada announced it was selected by Electronic Money Institution (EMI). The Payment Firm’s easy-to-use, customer-centric solutions will cover the full span of payment services, initially providing accounts with virtual IBANs, before expanding into multi currency accounts, cross border payments, card issuing, and accounts with virtual SWIFT.

🇩🇪 Tide is to launch in Germany, with the country becoming Tide’s second market outside of the UK, following the successful start of its operations in India in 2022. In the UK, Tide offers small businesses that don’t have a finance function, highly connected finance and admin solutions that save members (customers) time and money.

🇬🇧 Allica Bank integrates with Sage and Xero accounting platforms. Allica Bank's direct integrations enable its business current account customers using Sage and Xero to automate transaction feeds into their accounting software. This streamlines processes, saves time, and minimizes errors by sharing crucial transaction details seamlessly between platforms.

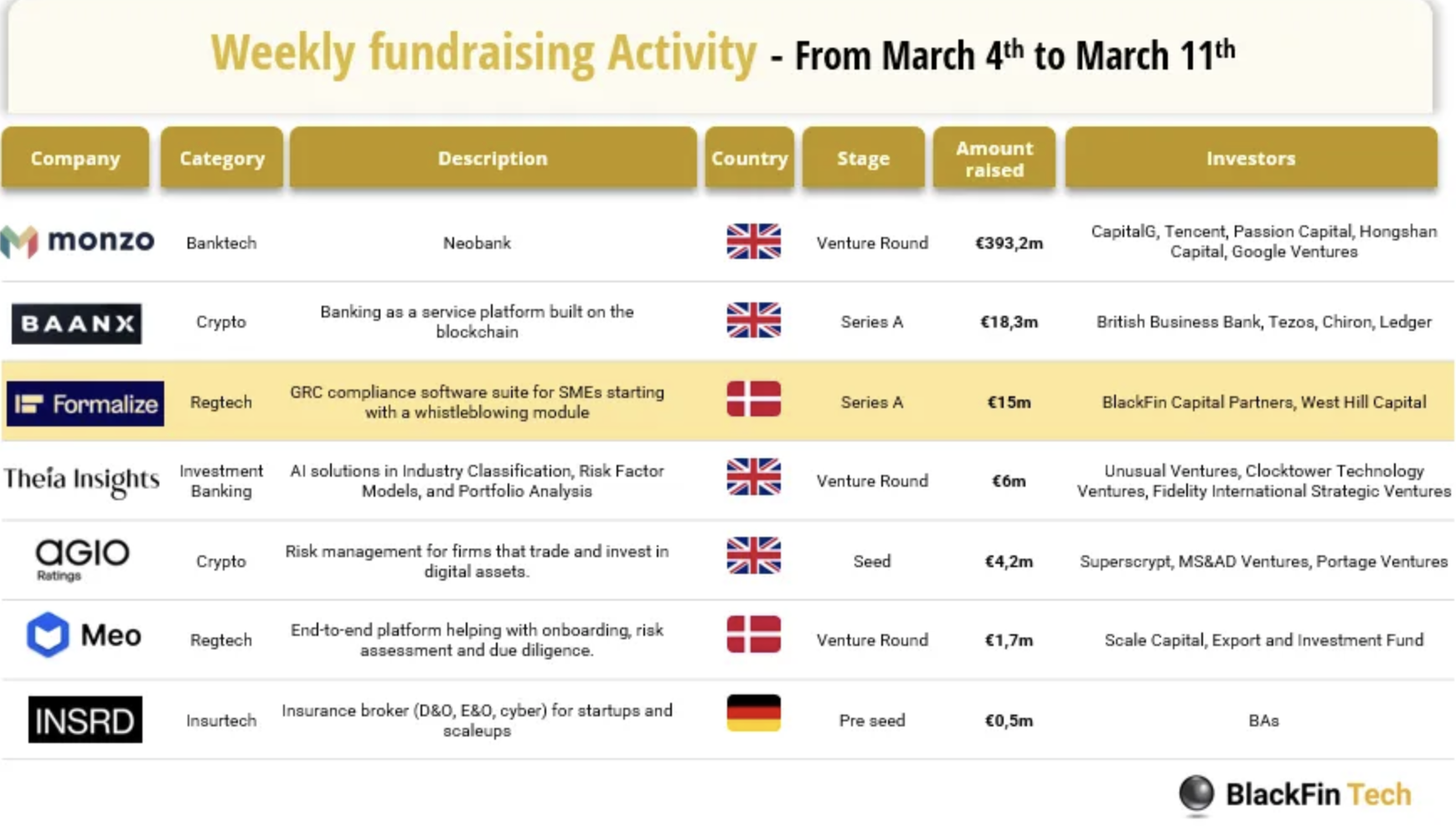

DONEDEAL FUNDING NEWS

Last week we saw 7 official FinTech deals in Europe for a total amount of 438,9m€ raised with 4 deals in the UK, 2 in Denmark, and 1 in Germany. Read the complete Blackfin Tech article here

🇳🇱 JPMorgan invests in Dutch cybersecurity firm Eye Security, which provides 24/7 monitoring, attack response and cyber insurance to hundreds of mid-market businesses. With the new funding, Eye Security plans to strengthen its position in its existing markets, such as the Netherlands, Germany, and Belgium, while also expanding into new European countries.

M&A

🇪🇸 Amadeus acquires travel payments expert Voxel. This acquisition will enhance the payments experience between a range of different players across the travel ecosystem. With this deal Amadeus continues to expand into areas that are complementary for its existing customers.

MOVERS & SHAKERS

🇺🇸 HSBC is planning to recruit about 50 more bankers in its US commercial bank to lend to start-up companies, mainly in the technology and healthcare sectors, according to a senior executive. The London-headquartered bank hired about 40 people from Silicon Valley Bank after the latter lender failed a year ago.

🇬🇧 Miranda McLean joins Ecommpay as Chief Marketing Officer. Strengthening the representation of women in its senior leadership team, she will support the company’s continued investment in innovation and its differentiated merchant proposition. More on that here

🇬🇧 Starling Bank has appointed Raman Bhatia, the chief executive of energy retailer OVO and former HSBC digital banking lead, as it new CEO. Bhatia will take over from John Mountain, who has been acting as interim CEO since founder Anne Boden retired from the role last year.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()